Hi everyone!

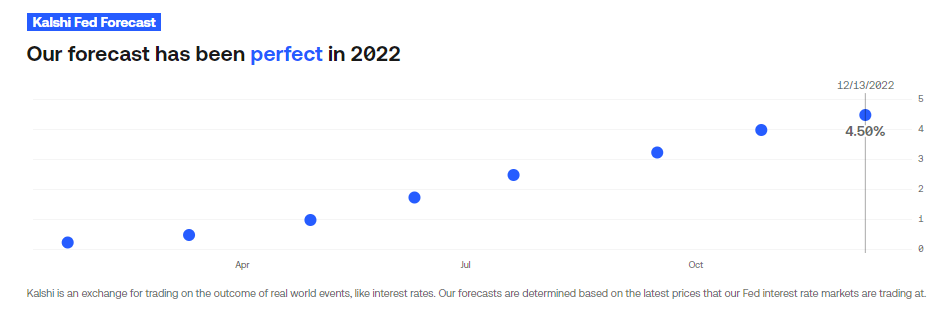

I was doing a monthly series called 'Not Financial Advice' for a while there, but it kind of dropped off, because, well, it seemed like the US Fed was being super predictable so there was less to write about.

I wanted to write a special edition focused specifically on the US Fed and why I think they might be leading the US, and the world into ruin.

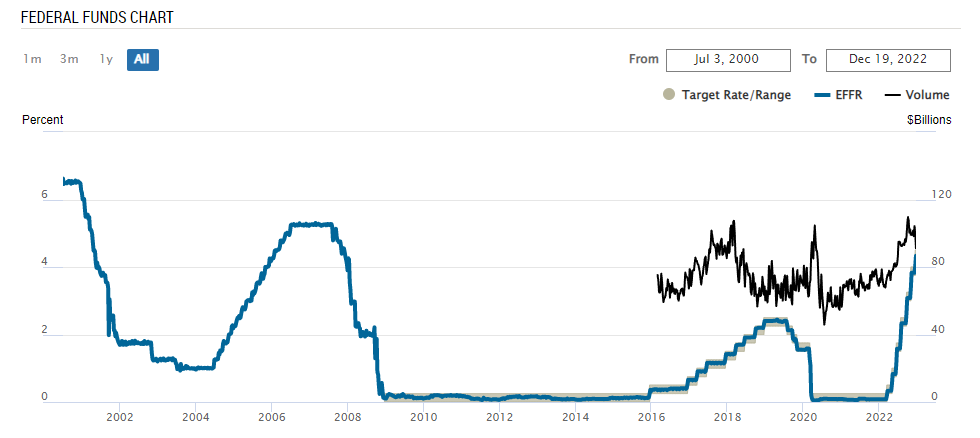

I was not at all surprised to see the US Fed continue to raise interest rates by 0.50% (50 Basis points) at their meeting last week (13th/14th December 2022).

Haha, at Kalshi patting themselves on the back here... but they've influenced my estimates a lot:

I've seen lots of chatter about a US Fed pivot, but I personally don't think that's going to happen anytime in the next few months.

A US Fed pivot is where the US Fed would announce that they are going to lower interest rates. These are the rates that the US Treasury loans out to Commercial banks who then add on their own interest rates in their loans to businesses.

The US Fed's main job is to keep inflation in the 2% range.

Their main tools they have at their disposal are:

- Raising interest rates (lowers inflation)

- Lowering interest rates (raises inflation : deflation and stagnation are also really bad)

- Selling assets off the US Fed Balance sheet (lowers inflation)

- Buying assets to put on the US Fed Balance sheet (raises inflation)

The reason the US Fed is so uptight about inflation is that you get caught in a circle that easily spirals out of control:

1.) Costs for a business go up, so they raise the price of their products.

2.) Products become more expensive so employees require higher wages to survive.

3.) Wages go up which increases costs for businesses, so they raise the price of the products more.

Once you get stuck in that loop, it's really hard to get out of.

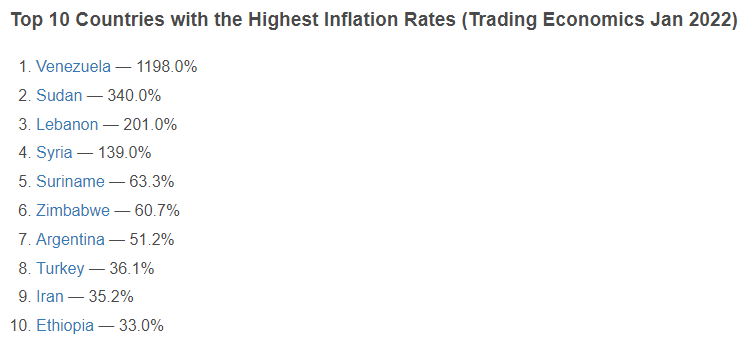

Our friends in Venezuela know the pain of having the price of products change daily...

Inflation is particularly bad for people on a fixed income... it just means they have to survive on less and less.

The US economy is doing okay, I think technically it's in a recession but in the US it doesn't feel like a recession. Not yet anyway.

The problem for the US Fed, is that while there are plenty of indicators that the US is technically in recession, the labor numbers are still very strong:

Total nonfarm payroll employment increased by 263,000 in November, and the unemployment

rate was unchanged at 3.7 percent.

Crypto is going down, shares are going down, commodities are going down, the economy doesn't look great, but unemployment is still the same.

The US Fed wants much higher unemployment... because the more people unemployed means companies have more choices while hiring and they can hire people for lower wages (since the job market is more competitive).

Higher unemployment means lower wages. Lower wages means lower costs for businesses. Lower costs means product prices are cheaper. Inflation is halted.

The problem is...

US Fed Jerome Powell states the problem himself in the Q&A at the last FOMC meeting:

"...despite very high wages and an incredibly tight labor market, we don't see participation moving up, which is contrary to what we thought. So the upshot of all that is the labor market is actually -- it should -- it's 3 1/2 million people at least smaller than it should have been based on pre-pandemic."

Not only did lots of working people die in the last couple years, but lots of people in their 50s decided to take retirement early.

The US workforce hasn't recovered from the pandemic.

The thing is, I don't see this issue getting better anytime soon.

The people who retired earlier are unlikely to step back into the US workforce.

The current 'tripledemic' (Flu, RSV, Covid) is taking out workers in the short-term as people themselves are getting sick or parents are looking after sick kids... and in the long-term, things like LongCovid might take people out of the workforce completely.

I have no idea if people dropping out of the workforce because they got sick is greater than young people entering the US workforce, but it's also not a 1:1 swap. Someone with no experience cannot be as immediately productive as someone with 15-20 years of experience, especially if people are dropping out of the workforce without the ability to hand over their knowledge to others.

I believe that the US Fed is going to keep rising interest rates while the job numbers and wages are increasing... even if it sends the US deep into recession. The main tool of a central bank is their credibility. The US Fed moves markets globally... but if no one believes they'll do what they say they'll do, then they cannot move markets and they lose a huge chunk of their power and ability to try and keep inflation around 2%.

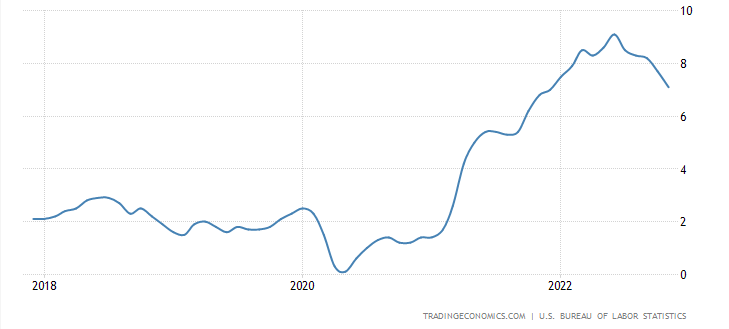

Inflation is currently at 7.1% which is still really high.

I expect CPI to go down (as do others).... but....

.... with China now facing it's own pandemic after abandoning ZeroCovid, the US may very well get further supply chain issues. Which will increase prices and inflation around the world, including the US.

Inflation has been going down because companies sorted through their supply chain issues, ended up with too much inventory and had to sell their products at a discount to save storage costs.

I don't know how the effect of China's pandemic will affect inflation, and it may take a few months to start to affect prices in the US.

This table holds what I think is the most important data for the US Fed:

You can see the Average Hourly Earnings rising 0.10% (from 0.05 to 0.06) from October to November, and this is exactly the trend that the US Fed wants to stop.

Automation is inherently deflationary, and with so many people getting sick and dropping out of the workforce in both the short and long term, the push for automation will be stronger than ever... but that takes time and high-level technical skills.

Basically, I still think we're in for a lot of pain.

I imagine everyone reading this is only interested in how it affects crypto, which, agreed, it's the whole reason I'm researching it.

I just don't see crypto bull markets any time soon. 6 months or longer.

Crypto does well when there is lots of money sloshing around the US economy. Bitcoin's highest price was when stimulus cheques were free-flowing. For the 2 years before the pandemic, BTC played at a price between $5K and $10K.

Part of me thinks that the US economy has changed permanently from the pandemic, and I don't truly know what that means for shares, crypto, real estate, etc. I'll be looking to develop some kind of idea, but for the moment I'm stumped.

What do you think?

Thanks for reading so many words!

Posted Using LeoFinance Beta

Somebody Should tell me that crypto is not about to have a bad months ahead

Okay.... crypto is going to have some great months ahead!

(Not financial advice and the exact opposite to what I predict).

I think the economy is definitely not the same after all of the lockdowns. The supply chain doesn't seem fixed and the economy is going to shit. I don't know when the economy will look better but I don't think it will for a while and the Fed will probably continue to raise rates until things start to break.

Posted Using LeoFinance Beta

It's not the same... and, honestly, I don't think it's going to get back to 2019 levels for years... especially if people continue to get sicker and sicker. I'm so curious to how China's pandemic will go with US supply chains... it might be another bump in the road that shows everyone how un-resilient US companies are.

I absolutely agree that the Fed will continue to raise rates until things are well and truly broken... being hyper-focused on wages in a scenario where the demand for workers is way, way higher than supply, could break everything.

I don't really think China is the main threat as China has been losing part of its base due to the alternatives coming out but they will still be a huge factor in the next few years at least. I think the US companies are very un-resilient. This was apparent when they started asking the government for bail-out money during the lockdowns. So I just don't think many companies are ready for this recession without being bailed out.

Posted Using LeoFinance Beta

i remember my subjects economics, it took a long year to study and passed it and now i realized we are controlled by one entity haha, its not us people who run the economy or crypto sort of things but the entity that has the control over the loop

I don't believe that. It really is the people who control the economy... we can bring entire industries down just by boycotting their goods and services - we just need to be organised and act together (which is incredibly difficult).

yeah haha that is why i cant say we have the control because its really hard to do that in the first place unless theirs someone who can influence everyone

That's true... but you can see the protests in Iran can come from the people if enough people have had enough. Don't stand in the way of the people!

somehow but protesting cant really help and it will only resulted to violence we have also that history in the end we people lost our stand because even in the street their are still entity who control it..

The current inflation is not caused by too much money being created by the government, it is by corporations raising their prices. Corporation have been making record profits in the last few years, if inflation was caused by too much money creation, corporations would not be earning record profits...

Sorry @dksart - I either didn't mean to imply that that inflation is caused by governments, or miscommunicated my message somehow. The stimulus cheques alongside the US Fed buying up assets did avert financial disaster in the first year of the pandemic but I don't think either contributed to inflation in any real meaningful way. The cheques were too small and infrequent and the QE affected asset prices but not much else.

Corporations in many industries have made record profits and have used the pandemic and Russian invasion as excuses to drive up prices unnecessarily, particularly the Oil industry.

As inflation gets higher though, people stop spending and try to start saving (if they can) which *should *eventually force corporations start to compete on price again and drop their prices or risk losing market share and profits. Inflation itself is somewhat deflationary.

This is why I think the US Fed is so focused on wages more than anything else... because if workers are earning more then they don't need to start to save when inflation gets too high. Of course this entire ignores the prospect that inflation is high so people are getting multiple jobs just to survive.

you left me pensive and a little scared, the short-term future does not look bright for cryptocurrencies, it is very likely that prices will continue to fall...

On the other hand, I have NEVER seen inflation in a country go down... have you?

Yeah, I've had a couple of people tell me that prices never go down.. and while it's true that obviously $100 in the 1970s bought way more than $100 does today, prices do go down in the short term as companies compete on price. In the US prices got real, real high in 2008 in the Global Financial Crisis but prices and inflation did go down in 2009.

Even recently, prices for so many things went crazy in March 2020 and inflation was hardcore, and then with the US Fed giving stimulus cheques, both prices and inflation came down in May 2020.

Currently the US CPI inflation is 7.1% compared to 9.1% in June... I'm not sure that I can say I've noticed changes in prices for me... but I'm honestly cutting spending as much as possible because, um, I'm also pensive and a little scared for the short-term future.

I only found this Twitter thread now... but I think it has a lot of great information/opinion on what's going to happen the next couple of years:

I really need to figure out what this sentence means:

"So I want to own high-margin, FCF producing businesses that are capital light"

I think it's talking about businesses that are profitable (make money after all expenses) for FCF. So I think he is talking about profitable companies without any trouble surviving the recession.

Posted Using LeoFinance Beta

Yeah, I think you're right... I did a couple of minutes of research and basically found out that companies with a lot of cash reserves and have kind of essential products fit this bill. So companies like Walmart or Apple or Microsoft are good ones to invest in for the next couple of years until the S&P starts to turn around...

The rewards earned on this comment will go directly to the people( @aussieninja ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @aussieninja! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 27000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: