As seasoned bitcoiners would know, once the next halving starts to take effect, as fewer coins hit the market from mining operations. The majestic price rise of bitcoin through its programmatic quantitative tightening is a marvel to behold, and I think we've become numb to it.

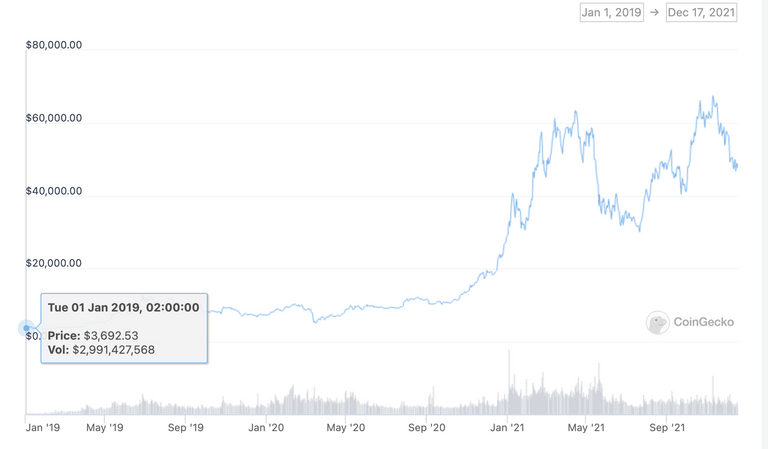

It's easy to forget that in January 2019, the price was hovering below $4000, well below its previous all-time high of $20 000 at the peak of the last bull run.

Bitcoin broke that $20 000 barrier in December of 2020 and has surged on the 20k mark that lasted less than a month, and we have not seen since. Bitcoin has made the push above $60 000 four times in this latest run, first in April of 2021, and while it has settled in the $40 000 range now.

I do not see this as the end of the bull market.

Bitcoin's next leg up.I know many have been holding on to PlanB's stock-to-flow model, hoping for $100 000–$288 000 at the end of this cycle and who knows, we could still hit those heights.

Bitcoin Price - @ CoinGecko

Bitcoin trending down of late

Bitcoin has been trending downwards since its highs of November this year, and you can actively see morale dropping based on online chatter. Retail traders who thought that this was the final break out were proven wrong, and billions in leveraged longs have been liquidated in the past few weeks.

It seems hilarious to say that Bitcoin has "crashed" to $45 000, but that's the narrative we have going around now as bitcoins price volatility gets the better of retail sentiment. When there is blood in the street, and when morale is low, people tend to avoid looking at the underlying data.

They either move into riskier plays like the shitcoin market, or they get out and into cash waiting on the sidelines for the next momentum trade.

A consolidation into cash

Looking at the data, we can see that there has been a consolidation into cash. This could be through people liquidating shitcoin gains, bitcoin or adding more cash to exchanges to gobble up coins during this side-ways trend.

According to Santiment Content, they've reported that exchanges have seen the highest level of USDT in the last 6 months as traders prepare to accumulate supply and what seems to be fair value for bitcoin. The coin has spent very little time below the $40 000 range, with less than three months of the year being below that price point.

If we consider that the US inflation numbers have had mainstream attention with numbers not seen in 40 years, trying to beat the 6.8% rate may be on a lot of retail traders minds at the moment.

So while they are sitting in cash, they're waiting for someone to make the next move before that mountain of stablecoins flows into Bitcoin.

The ratio of #Tether stablecoins on exchanges has risen to 22.5%, which is the highest level in over 6 months. This amount of supply converts to $8.99B, indicating a rising level of buying power accumulating on exchanges. https://t.co/Ew9XWwqO2N pic.twitter.com/EjTwvQXOE2

— Santiment (@santimentfeed) December 17, 2021

The ratio of #Tether stablecoins on exchanges has risen to 22.5%, which is the highest level in over 6 months. This amount of supply converts to $8.99B, indicating a rising level of buying power accumulating on exchanges. https://t.co/Ew9XWwqO2N pic.twitter.com/EjTwvQXOE2

— Santiment (@santimentfeed) December 17, 2021Miners' BTC outflow hitting new lows.

In addition to a growing stockpile of USDT sitting on the sidelines, Glass Node has also released data regarding miner outflows. In their latest report, they've stated that Bitcoin sent by miners to exchanges has dropped sharply.

The Miners to Exchange Flow Index (seven-day MA) has hit a five-year low, totalling 2.655 BTC. Beyond that, Miner Outflow Multiple (seven-day MA) is facing a four-month low of 0.772.

As a lack of new supply hitting exchanges thins out the order book, and a large amount of cash starts to look for a place to deploy itself to earn a yield, it could be a recipe for some bullish action.

Another positive coming out of the bitcoin mining sector is the news that hash rate hit its highest point at the time in May during the first bull run. Hashrate had run up to a high of 180.82 EH/s on a seven-day moving average scale.

The subsequent drop had been the most significant recorded drop in hash rate as numbers hit as low as 84.79 EH/s. However, the network has adjusted post-China mining ban, and in December, the hash rate now sits at a new record high of 181.99 EH/s on a seven-day moving average.

That means more miners are coming in to compete for supply and also to secure the growing network.

data by glassnode

Bitcoin whales are buying up.

If we look at more data released by Santiment we can also see there has been considerable accumulation by large BTC holders known as whales. These whales have been adding more to their holdings.

According to figures shared by Glassnode, the number of whale addresses that store from 100 to 1,000 Bitcoins has soared by 193 wallets compared to only 2.5 months ago.

So far, Bitcoin has surged 153.9% year-to-date.

Strong signs of a second leg

If we consider the three factors above, they all seem like bullish signs. Whales are gobbling up coins and increasing positions as they try to pick up anything close to the $40 000 range, which seems to be the new floor.

If we consider the increase in stable coins hitting exchanges, not only USDT but other stable coins like USDC are following the same trend.

If we consider that there is an ever decreasing portion of new coins hitting the open market, then all these trends combined could mean we are in for another leg up, and the bull market is not yet over.

Economics!! Economics!! Economics

This is why I read your posts a lot.

I miss those days of you writing a lot of financial posts.

Anyways, I will keep on stacking. I started late but I hope I can catch up slow and steadily.

I do still post regularly just on my own site I don’t see my content really getting much traction here and I’m getting far better reach on my own so gotta focus on the incentives

I’ll drop a post now and then if I feel it’s something that may be intersting to the crowd here

There’s no need to “catch up” your bitcoin is your time locked and preserved to be accessed when you need it or when you find great opportunities to deploy it

As for the now me personally I can’t see anything that beats it long term and that’s why I’m laser focused

I remember the day BTC dropped to 4000 and I bought some shares and holding it till now. I could not buy much as it was end of month and there was no more money left 😂

Posted using LeoFinance Mobile

Well then you still 10x'd your money already so it can't have been a bad trade

I tend to lean on BTC being more bullish towards the end of the year due to the money on the line for options/futures markets. Although I didn't know that the miners were decreasing their outflows. It would make sense if they they have the funds available and can wait until later to cash out.

Posted Using LeoFinance Beta

Not just that unlike gold miners, bitcoin miners actually want to keep what they mine rather than sell it so they are using the bitcoin they mine as backing to raise debt and then run their operations on debt pushing out the need to sell

That way they sell less bitcoin to cover their debt or even just refinance and roll over the loan at a different LTV ratio

Yay! 🤗

Your content has been boosted with Ecency Points, by @chekohler.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @chekohler! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 61000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Source of plagiarism 1

Source of plagiarism 2

There is reasonable evidence that this article has been spun, rewritten, or reworded. Posting such content is considered plagiarism and/or fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

Guide: Why and How People Abuse and Plagiarise

If you believe this comment is in error, please contact us in #appeals in Discord.