Hey Jesstock traders

The stock market in the US has been on a 40-year bull run of sorts, headed up by the FAANG or technology stocks. These names can do no wrong and have become the darlings of many investment portfolios. The "can't lose narrative" of the stock market continues to sucker in larger swaths retail investors who have no idea what they are getting themselves into and are totally besotted by the number going up.

The Japanese stock market has been in a lull for over 30 years, and the European stock market has been sedated for the last decade, so the US stock market has become the casino of choice. The Fed and the US government stop at nothing to maintain the stock market and ready to step in big time for any big correction.

As long as there is confidence in the stock market, it's seen as confidence in the economy, even when the fundamentals are totally out of whack, and the real economy is pretty much in shambles.

The idea of number go up and avoiding a crush down at all costs is making the chances of a crash up all the more likely, the longer the markets are artificially propped up.

Not about access to capital but a store of value

Traditionally stocks are an investment based on accessing either the free cash flows of the business and tapping into those dividends, or you're betting on the future growth of the company.

In today's market, it's me of an alternate store of value where investors want to hold anything but a currency that is losing its purchasing power as they try to beat the hurdle rate of debasement.

The more dependant the economy becomes on the stock market to store their value, the more a crash up becomes a real possibility.

What exactly is a crash up?

A stock market crash up is when the rate of return of the stock market cannot outpace the rate of inflation. While the figures go up, the purchasing power goes down.

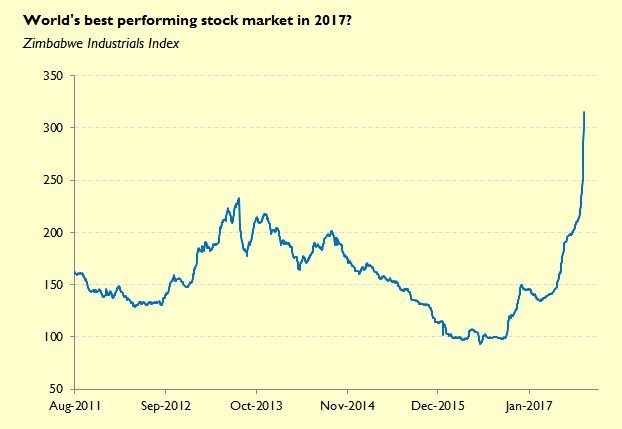

If you want to see an example of a crash up we can look at what happened to the Venezulean and Zimbabwean stock market where the currency was used to try and paper over the cracks.

Even with investors gains increasing in the stock market it wasn't enough to outpace inflation and they ended up with stocks worth very little in terms of purchasing power but the value measured in the currency was astronomical.

Image source: - frontera.net

Image source: - jpkoning.blogspot.com

A crash down can trigger a crash up

The crash up can be gradual, as each year stock market gains reduce and inflation increases, this can be a slow process that takes years. However, it can also be triggered by a crash down, as fear takes over the market and net buyers become net sellers pushing the stock market down violently.

Central banks may overreact and pull the trigger on a level that runaway inflation occurs.

I am not saying a crash up is in our future, but this stock market frenzy is delicately poised. For those who may think it's always up, all-time high after all-time high based only on inflation could sucker in more investors and destroy many peoples investments.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

Posted Using LeoFinance Beta

Last week the Indian Stock market touch the 50 year high.. some of the stock are shooting this maybbe because of the budget parliament session in coming week....

Damn a 50 year high thats nuts, it seems like most of the worlds stock markets are becoming casinos and a place to store your value or make gains when you cant go out and work

and how much will we see, 20-30% dip?

¯_(ツ)_/¯

Lol I tackle that in my next post, but to spoil it for you a 55% drop would be fair value for the stock market, but it would drop even lower because of all teh fraud, fear and mal-investment before it can rebuild if it were to crash in the old sense of a crash

I think you are very right and the crash getting closer by the day

Either way crash down or crash up it has to come correct eventually and the party has to end sometime. Who knows when that will happen but it sure is fun to watch in the mean time

In Myanmar, stock trading is just beginning.

Due to Stock traders couldn't able to know about Stock market and Stock sharing Companies exactly, It's a gamble.

Posted Using LeoFinance Beta

So are people trading stocks now? You can also trade stocks via some crypto exchanges I see

It's a big similarity to Casinos, looking at the bets you'd feel a green, but on the next Blink you'd watch your investment flew with a red coat. I totally keep my head where it's simple, stock is a no interest zone for me.

Posted Using LeoFinance Beta

It absolutely a casino, its been that way for a while but now it's just sucking in more capital and more people with promises of easy riches and now that cash flowing around makes big news and bringing in more people and so the casino gets crazier

Gotta to keep the business going, that's how the unfortunate ones get played over and over

Posted Using LeoFinance Beta

The public always become the suckers bet, if retail is stuck with the bag it's their own fault, if hedge funds and banks are stuck with the bag, they get a bailout and the taxpayer pays it so, either way, same people lose

So it's basically a circular shit, it all meets back to one point, real suckish

Posted Using LeoFinance Beta

Wouldn't you take unlimited bets if you knew you never had to pay for it? Thats the moral hazard we live in when people don;t have ownership of their money

Most of the people invest in stock market by looking at the trend, more people are investing so this is the best time so let me invest as well. Which could be wrong. We need to look at all factors.

Same with crypto, many of these alt coins don't even have a working product and those that do, the product doesn't work well or doesn't solve any problem but hey blockchain and people go nuts, lol

I remember when I started to invest in stocks early 2017, it was all about market crashing soon and I was considering an entry or to wait for the crash.

It's been 4 years now and market crash is still all over the discussions, sure it will happen but good luck to time it.

Back then USD was not in the printing frenzy it is now, but now what you're saying is a lot different and makes a lot of sense.

Crash up looks way more like a possibility as it seems they won't allow a crash down that easily.

Posted Using LeoFinance Beta

LOL, I feel you I've also been hearing the stock market is going to crash this year for YEARS now and it just keeps going up, 40 years of this has people so bullish they forgot what a real downturn is like.

If we do go for the crash up, it's going to take even longer to close the gap between currency inflation and stock market gains. I think it's at 7% a year the stock market increases and they say inflation is at 2% so there's still a 5% margin to blow up first and then run past significantly before people notice a crash up

!BEER

Sorry, out of BEER, please retry later...