With the success of the LeoFinance token we are starting to see some movements for the other Hive Engine tokens as well. The prices can vary a lot and with the different supply for each of the tribes tokens it nice to have a look at the market cap.

I have made a post like this before Ranking The Hive Engine Tribes By Market Cap!, but there has been some movements in the last period. Also that one was more tribe focused, here we will take a broader look at all the Hive Engine tokens.

The market cap is a standard metric for ranking tokens. All the coins aggregators like coinmarketcap, coingecko etc. are doing it this way. The thing with the Hive Engine tokens is that they are extremely small, some of them can’t even be considered as a real project but more or less just playing around.

In a lot of the cases there is a large funder share. Because of this its challenging to determine the marketcap. Another extremely important metric is the trading volume. Hive Engine tokens are lagging behind here as well with very low trading volume and liquidity.

It is important to note that we are seeing some growth on Hive Engine as for the price of the tokens and in the liquidity as well. It is still far from managing some large volumes but in the past few moths there is an uptrend.

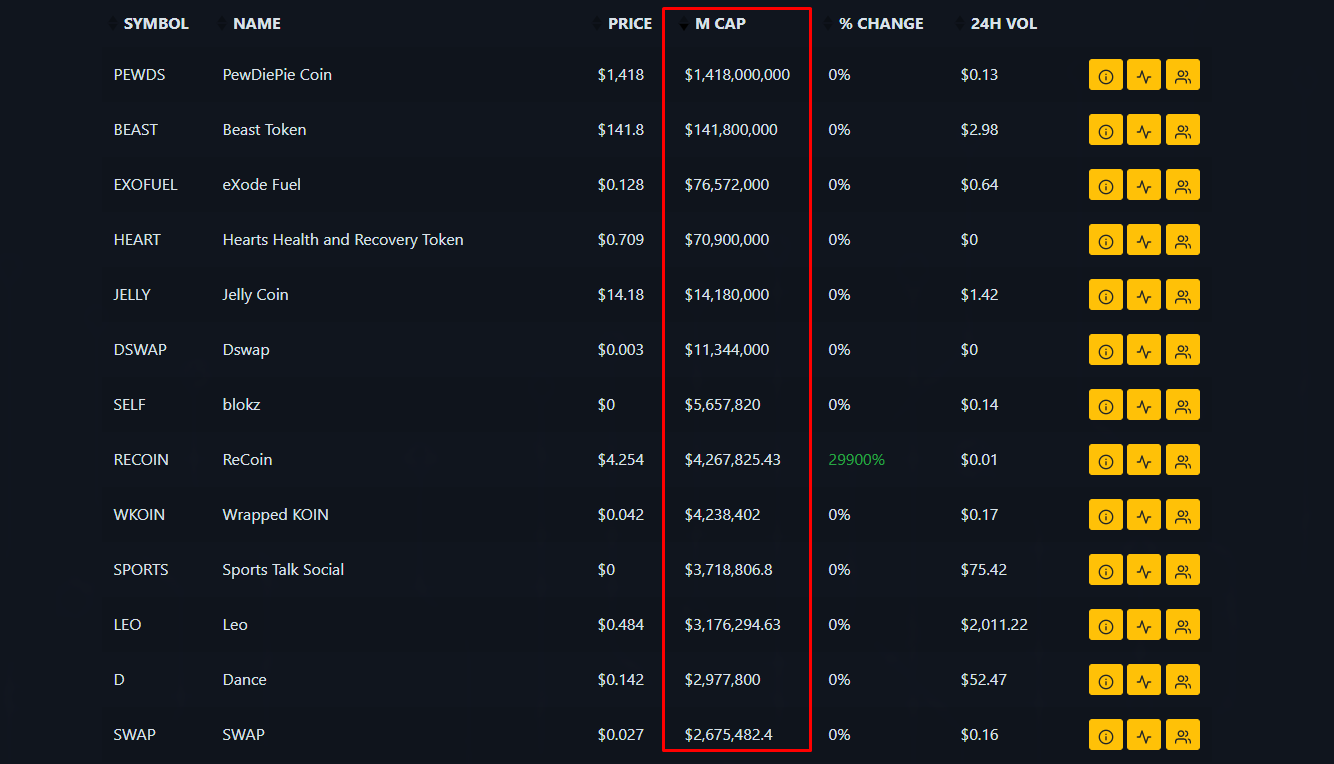

If we sort out the tokens by market cap on Hive Engine we will get this at the moment.

Not a lot of know tokens above. The main reason again, a lot of team tokens and no trading volume. Almost all the tokens above don’t have any trading volume or a volume in few dollars. The one exception on the list above is LEO and the SPORTS token, with SPORTS having a large amount of team tokens that inflate the market cap.

The Real Market Cap

To get the real market cap we will be doing the following:

- Adjust the supply of the tokens (exclude team tokens etc.)

- Calculate 30 days average prices

- Calculate the market cap from the adjusted supply and the average price

We will use price averages to estimate the market cap for the tokens. Because of the low volume and the high volatility, we can’t use just a momentary price for the tokens. We will be using 30 days average.

Tokens that we will be looking at are the following:

- LEO

- DEC

- SIM

- EPC

- BEE

- PAL

- BRO

- SPORTS

- SPT

- WEED

- STEM

- NEOXAG

- CTP

- LBI

These are some of the tokens that have volume and market cap. Overall having activities. They have been around for a year as well. There are some others than the above, but we will be looking into these for now.

Tokens Supply

As mentioned already in some cases there is a lot of team/projects tokens. This can offset the market cap by a lot. Also, there are burned tokens in the null account that need to be excluded.

Because of this we need to adjust the tokens supply.

Here is the table for the initial and adjusted supply.

| Token | Starting Supply | Adjusted Supply |

|---|---|---|

| LEO | 6,568,778 | 6,169,105 |

| DEC | 630,004,851 | 630,004,851 |

| SIM | 89,999,776 | 77,771,876 |

| EPC | 974,322,096 | 367,817,721 |

| BEE | 1,499,882 | 228,726 |

| PAL | 7,704,445 | 6,885,431 |

| BRO | 69,220 | 69,220 |

| SPORTS | 101,257,599,882 | 912,567,921 |

| SPT | 67,545,120 | 66,619,613 |

| WEED | 42,418,247 | 2,536,640 |

| STEM | 3,720,147 | 1,393,205 |

| NEOXAG | 35,287,026 | 26,896,152 |

| CTP | 2,706,304 | 2,366,789 |

| LBI | 250,000 | 212,577 |

All the tokens to null have been excluded from the adjusted supply. The team and projects tokens as well. For example, for SPORTS the first two accounts from the richlist are excluded https://leodex.io/richlist/SPORTS, and the null account.

Average Price

The price of these tokens can vary a lot. For this purpose, we will be calculating the average price for the last 30 days.

Here is the table:

| Token | 30 Days Average Price [HIVE] |

|---|---|

| LEO | 3.35 |

| DEC | 0.0066 |

| SIM | 0.0044 |

| EPC | 0.00011 |

| BEE | 0.7 |

| PAL | 0.044 |

| BRO | 8.32 |

| SPORTS | 0.00027 |

| SPT | 0.0012 |

| WEED | 0.14 |

| STEM | 0.17 |

| NEOXAG | 0.0044 |

| CTP | 0.084 |

| LBI | 2.23 |

| GAMER | 0.00023 |

The prices are in HIVE for better context. Although when calculating the Market Cap, we will convert these prices in dollar value.

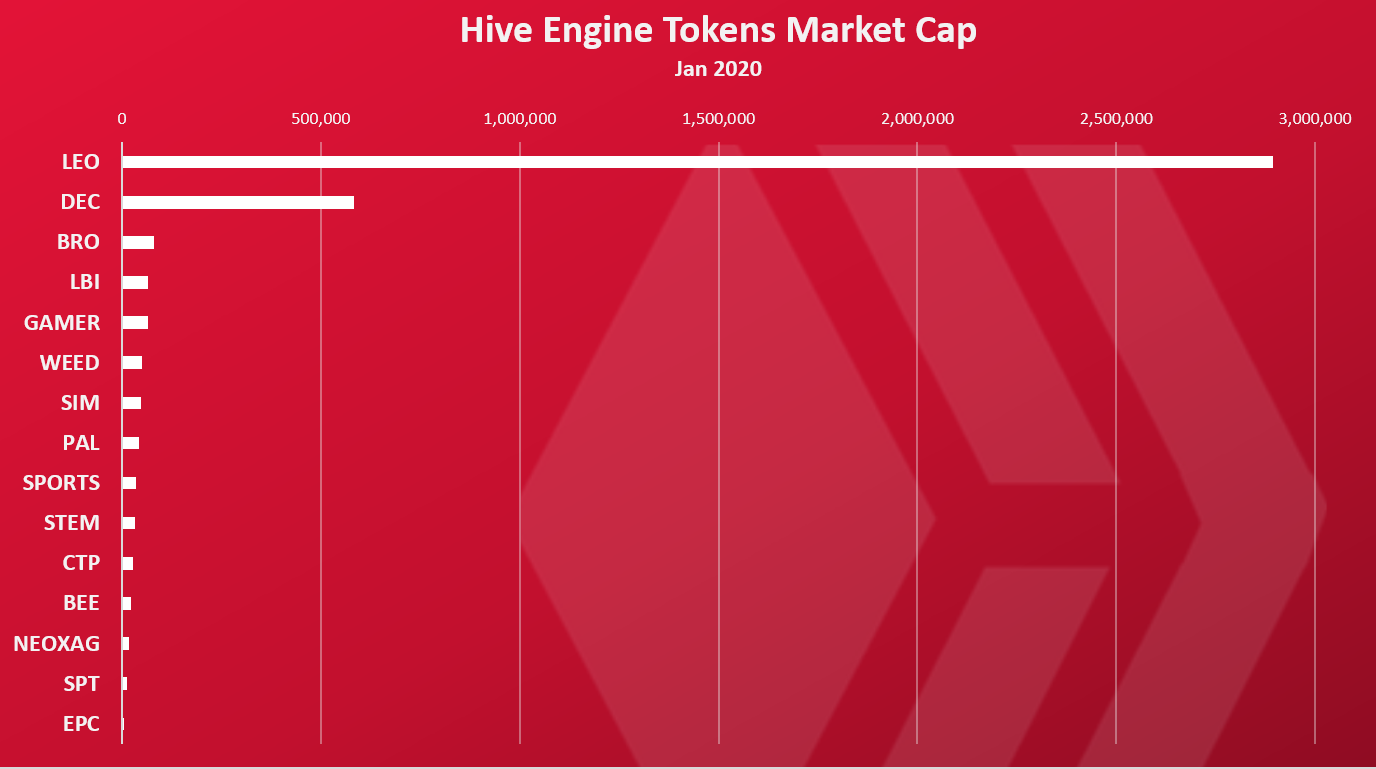

Market Cap

Now that we have the adjusted supply and average prices, we can calculate the market cap.

| Token | Market Cap [$] |

|---|---|

| LEO | 2,893,310 |

| DEC | 582,124 |

| BRO | 80,627 |

| LBI | 66,366 |

| GAMER | 65,907 |

| WEED | 49,718 |

| SIM | 47,907 |

| PAL | 42,414 |

| SPORTS | 34,495 |

| STEM | 33,158 |

| CTP | 27,833 |

| BEE | 22,415 |

| NEOXAG | 16,568 |

| SPT | 11,192 |

| EPC | 5,664 |

LEO is obviously dominant on the top with almost 3M USD market cap.

On the second place is DEC, with more than half a million MC, followed by the BRO token on the third place.

The next tokens are in the range of 5k to 66k USD market cap. These are almost nonexistent market caps. Even for an experimentational tokens at least a 100k in MC is needed. A 1M market cap for a project to be taken a bit more seriously. If even one of the above, except LEO is about to get to a 1M market cap that will be a 20X to 50X move in price. A move to 200k market cap is still a multiple increase in the price for these tokens. Hope some of them find the way there 😊 and stay on those levels.

All the best

@dalz

Posted Using LeoFinance Beta

Great analysis, and it's unfortunate how few significant projects there are on Hive Engine so far. It would be good if the HE website used similar metrics for calculating market cap so it's not littered with nothing projects that show huge caps.

I want to add some additional details about DEC. The DEC tokens on Hive Engine are only the liquid tokens and I don't think they accurately reflect the full market cap. Since every Splinterlands card can be burned for a set amount of DEC, I consider the total supply of DEC to also include the burn value of all of the cards in the game. The DEC held in cards can be thought of as "staked".

There are roughly 2.5 billion DEC currently staked in cards in the game, so if we add that to the ~630M liquid DEC shown on Hive Engine then that would put the market cap at around $2.9M USD...almost the same as LEO!

The one solution to this, and just about every problem on Hive is more users. My own tribe STEMGeeks suffers from the lack of authors writing about STEM related topics.

Almost every issue we have on Hive will be made better by having more users.

We just haven't figured out how to do this, sure marketing will help but it is expensive af and a very low success process so it takes time or even more money. Most of the time it is done extremely poorly with almost no efficiency. We are already burning tons of money via the DHF on projects that are doing nothing to get Hive exposure or make it better in any significant way.

I frequently refer to my fictitious RC/Cars community, if I did in fact create one I'd be lucky to get 1-2 users in it, I certainly wouldn't get an answer to what gear ratio I should use when upgrading the size of my rear tires on an Traxxas Rustler. On Reddit, I'd get 10 responses to that very specific problem. We need users so we can have tons of thriving niche communities and dapps.

You see these massive market caps and you and I know we don't have the users here that have the money to pay that bill.

more users

more users

more users

Thanks!

DEC was a bit special and I was not sure jow to go about it, so I iust left it as it is .... if I excluded the official account tokens it would be even lower.

Probably something similar can be said for SIM as well.

Your comment helped :)

Happy to help. All this makes me appreciate how much work sites like CoinGecko have to go through to properly show the details for thousands of tokens!

It totally looks easier than it actually is!

Posted Using LeoFinance Beta

Yep, quite the chalange...They do have some mistakes, especialy with the burned tokens on eth or bsc, that are not removed from circulation, but transfered to this 00000000...x account .... the null account on Hive does a proper job when it comes to burning :)

These low valuations just don't make any sense!

Posted Using LeoFinance Beta

Why?

Because some of these projects are too good to have such low valuations. I think they just need a lot more exposure.

Posted Using LeoFinance Beta

I think one of the communities you'll see slowly climbing this list over the coming year is Natural Medicine (LOTUS) which has a growing user base, good leadership and focus and is starting to poke at external recruitment of new users.

A recently formed community I wish would tokenize is HivePets, BIG user base there with lots of potential, and pet owners get rather silly about buying into pet-related things.

Great. Those stats on Engine looks pretty bad when someone want to checkout a project. Great Work.

I was looking for some EPC token dividends stats, just saw your post from 2019. Is there any recent post. That would be helpful. I was thinking to buy some for daily dividends.

Thanks again.

Thanks .... I was thinking to do a post on Hive gambling apps in general for a while now.... should come up soon :)

Excellent work man!

Thanks!

Good job!

Thanks!

Capitalization is worth little if there is no movement behind each project.

Many tokens are left to fend for themselves and I would perhaps start to eliminate those who no longer have any activity

Posted Using LeoFinance Beta

!BEER

Great work and graph to facilitate our understanding

of the second layer tokens.

Posted Using LeoFinance Beta

Thanks!

I notice that Blurt is usually in the Top 10... sometimes in the Top 3.

Yes, so and steem, btc, ltc ... but those are not a hive engine tokens, but just pegged version of tokens from other chains.

I love these posts from you. Im starting to wonder about DEC and If I should have a few even if i'm not playing

Posted Using LeoFinance Beta

DEC is almost acting as a stablecoim, becouse of the peg, 2000 dec = 2$.

Usualy it trades in the range 0.007 to 0.009

View or trade

BEER.Hey @dalz, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Thanks a lot! Very useful post! I always have a hard time finding this information. I mean that this information about the HIVE ecosystem tokens cannot be easily found.