Money is an interesting concept. It is by far the most popular hallucination in our world. I mean, when you see two kids fighting with sticks, and pretending to be chevaliers, you obviously smile. But when you give away a day of work in exchange of a piece of paper, you're not. At their core, these two activities are identical: people engaging in them are pretending, are doing some sort of role playing, are projecting their imagination onto outside props.

The money hallucination is getting even weirder when you start thinking how that piece of paper is created.

If that banknote will be a contract between me and my employer, its value will remain constant for as long as there will be trust between me and my employer - or, to continue the metaphor, for as long as we both accept the same hallucination. We will both know, and enforce, the limits of our trust.

But the banknote is printed by somebody else. We don't have a direct contract with that entity. We don't even agree on all the components of the hallucination, like how many notes should be printed, when, etc.

So, what's happening with this rogue printing is that we get a gap between the trust and the value. Because we're not sharing the same hallucination, trust is not catching up with the value on the paper. The trust is shrinking, while the paper supply is increasing.

One way to solve this problem will be to bring back the paper supply to the trust level. Or, in layman terms, to burn some notes. In geek terms, that will be to "send them to the /dev/null". But we have a problem. There is no /dev/null for the USD.

And that is a BIG problem. It's not the printing itself that is dangerous, but the fact that it's not balanced with the burning. If there is enough trust, let them print. It's the same trust that allows people in crypto to print their own coins. They can do that because they establish a trust relationship, and that relationship is balanced with limiting mechanisms. Bitcoin, as we all know, has a limited supply, there won't be any satoshi left after we finish the 21 millions. Cub Finance, a project you most likely know about, since you're reading this, has a very transparent burning strategy.

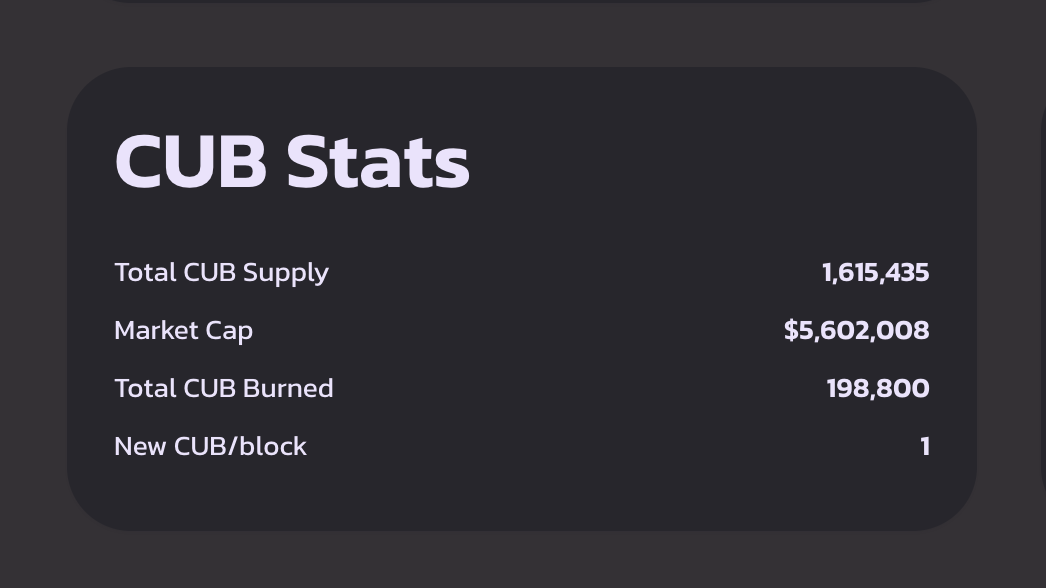

As you can see from the screenshot above, 12.30% from the entire CUB supply was burned. This was announced from the beginning of the project and it is enforced. This burning mechanism is a preventive measure, one that aims to keep the trust invested in the project, and the value of the coins, in sync. There are, obviously, other ways to enforce trust, like "diamond hands", use cases for the token, etc, but the burning is just as important.

And the fact that there is no /dev/null for the USD, or for any other state-owned currency, is, like I said, a BIG problem.

And a strong case in favor of currencies which have this mechanism in place.

There is an ongoing funding proposal for two of my Hive-related projects, which will allow me to support some of the costs involved. If you want to support this proposal, all you have to do is to vote it using any of the two links below:

Sign this proposal with Hivesigner

Peakd: https://peakd.com/me/proposals/165

I'm a geek, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Hive you may stay updated by following me @dragosroua.

Wanna know when you're getting paid?

| I know the feeling. That's why I created hive.supply, an easy to use and accurate tool for calculating your HIVE rewards | |

It's free to use, but if you think this is a useful addition, I'd appreciate your witness vote.

Thank you!

Posted Using LeoFinance Beta

cub is the top most name that discussed around every cryto page or finance, and someone prediction is that it will be famous like btc, though it is in a low price. investment here will be a wise decision.

Some people tried to do this themselves.

Good one! I enjoyed watching this, but then again, it's a rogue call. The trust should be enforced at both ends.

Posted Using LeoFinance Beta

Interesting thoughts ! Would be fun to see the US or Chinese Givernements building a dev/bull account for their digital currencies 😆.

I know that is a dream hehe 😉

I guess you wanted to write /dev/null, not /dev/bull, but I like how yu think :)

Posted Using LeoFinance Beta

CUB has some serious room for growth and I think over time we will see that. I just hope the burn happens fast enough and we don't get carried away with the printing of new CUB. Do you know of any break downs that show CUB printed / CUB burned on a daily basis by chance?

The roadmap should be your friend here, I know there is a certain ratio from the fees, both in Leo and Cub that gets burned, but I don't remember the exact amount just now.

To add to your theme trust can take years to create but only take an instant to break. In USD terms it won’t take long now to lose all off its trust. Sad fact.

Thanks for bringing this up, because it's often a theme for me. How is trust created? How is it maintained in time? What role inertia plays in this and how long some cultural biases can be prolonged, until the shit hits the fan, so to speak? I think right now the trust in fiat is mainly a cultural thing, intertwined with other identity myths, and it is somehow inherited, not constantly verified. Because trust in fiat is more of a cultural thing, it may take longer to be completely wiped out, because people tend to cling to their identities (being them physical or cultural), but the good news is that when this trust is wiped out, it will also carry out a cultural shakeout as well.

In simpler words, once people will no longer trust fiat currencies, they will no longer trust governments and current forms of leadership as well.

It will be interesting to see how much traction they can get for their bridge which will also create a burn on supply. If they start earning a nice amount in fees the token will move upwards very fast.

Yeah, the CUB project is a very interesting experiment. I see it as a learning playground, where you also get paid a little to experiment various iterations, DeFi, LeoBridge, automated DeFi, etc.

Posted Using LeoFinance Beta

As far as I know central banks pull damaged banknotes from circulation effectively "burning" them, I don't know if the numbers are available to the public so transparency might be an issue but I think the burning mechanism exists

That's not a burning mechanism, it's a safeguard for making sure all the paper notes in circulation are correct, from a technical point of view. A real burning mechanism will have to take into account macro-economics processes, and maintain, for instance, a decent inflation (among other parameters). As far as I know, there wasn't any burning made with this goal, at least until now.

Posted Using LeoFinance Beta

Banknotes and coins represent a very small part of the total money supply. Without going into further into the many ways of how money is created and the multi-faceted nature of money, an common example of dev null for money is what happens when a loan taken from a bank is repaid. The bank is left with the interest payments to cover their operational expenses and to pay for its shareholders but the principal is removed from circulation. That's the main money sink.

Posted Using LeoFinance Beta

I'm not sure I understand how a repaid loan burns money.

So, a customer takes a loan, and with that money pays for a house. The house owner gets that money (usually from the bank, directly, although that money passes briefly through your pockets as well). That's actual money that is in circulation.

Now, you have to pay back to the bank what you took from it, over 30 years, with interest. The bank indeed keeps the interest, but the money you pay to it is going back into their reserve - from where they took what they gave to the house owner.

I know how fractional reserve works, and how banks can offer more money than they actually have (or can back up), and my point is that in this process, no money gets burned in any way. On the contrary, more artificial money is created (fractional reserve) and customer has to generate more value than the actual loan, to pay for bank's risk.

Posted Using LeoFinance Beta

So far correct.

No. That money does not go into the reserve. It ceases to exist.

When a loan is created, the money does not come from any reserve. It is created out of thin air. When the principal, which was created when the loan was issued, is paid back, it is removed from circulation. It goes to the equivalent of dev/null.

The reserve exists for the purpose of covering bad loans that do not get paid back. I'm not exactly sure where the bank gets that money but the important part is that they're required to maintain a minimum ratio of reserves to loans issued.

What this means is that the part of the money supply that get created by commercial banks by issuing loans, can grow or shrink depending on the ratio of new loans issued to old loans paid back.

Posted Using LeoFinance Beta

I think I understand what you mean, but I still think this is not a burn, at least not in the sense that I understand it.

When the entire loan is paid, the debt that you created with the bank is settled, and the bank remains with the interest. But all the money you added in the principal are already in the pocket of the house owner. What was exchanged was some sort of a promise between you, the bank and the house owner. But no money was burned in this process. There was some promise made, that you kept for 20-30 years, to pay, and the bank got paid some interest because it supervised this payment process.

No money was actually burned. Which, like I said, is a problem.

Posted Using LeoFinance Beta

I understand burning as a reduction of supply.

Yes, the bank gets the interest and remains with it.

When a mortgage is created the principal is created from thin air. The buyer transfers that money to the seller of the house. He has to pay the mortgage back, usually in monthly installments. It is now his obligation to get money from elsewhere to be paid to the bank after which the principal portion is removed from circulation. The bank keeps the interest portion of the installment and only that, the rest is destroyed. Money is fungible. It makes zero difference that the money used to pay back the mortgage does not come from the seller of the house but somewhere else.

Yes, money was burned = removed from circulation. What the bank keeping the interest causes, however, is that for no one to become insolvent, the money supply will have to grow continuously for all of the interest to be able to be paid. Yet, the total supply of money issued by commercial banks using this mechanism can decrease. If that happens, there will be defaults, which will be covered by the reserves held by the banks. But that even that is a separate issue from money being burned or not burned when a mortgage is paid back.

With that I agree. And when that principal is "removed" from circulation, nothing actually gets removed from circulation, because it was created from thin air, it was a promise.

Posted Using LeoFinance Beta

That's a philosophical notion, not a technical one. Technically, when a mortgage is paid back, parts of the principal get removed from circulation on installment at a time. The money supply shrinks a tiny bit as a result each time.