Intel (Nasdaq: INTC) was flying high before Q3 earning report on 2nd October, 2021. It was trading between $53 to $54. Intel has just recovered from disappointment from the Q2 earning report debacle when it revealed that it has delayed much anticipated 7nm based processors by six months or more. It's stock dropped whopping 21% (i.e. $61 to $48) though it beat both EPS and revenue handsomely. Few weeks later, INTC announced a $10B buy back program and stock recovered steadily up to the last Q3 earning report.

Intel's Data Center Group (DCG) revenue in Q3 declined by 7% to $5.9 billion that incurred a whopping 39% drop in operating income for DCG due to lower average selling prices (ASPs). It means that Intel was selling more low cost hardware and lost its leverage on high margin profit.

It is obvious that the enterprise and government have either stalled new procurements or inclined to lower cost hardware due to uncertainty caused by the COVID-19 pandemic. It is no wonder that Intel's enterprise and government sales plunged by 47%. However, the bright side in DCG's income came from the cloud service was up 15%.

Interestingly, Intel is quite optimistic about earnings for 2021 and raised it year to year guidance. It now expects sales of $75.3B and GAAP earnings of $4.55 per share. It also raised its Q4 revenue to around $17.4 billion, with per-share earnings coming in at $1.10 which are slightly above average analyst forecasts ($17.36 billion and $1.07, respectively).

Though Intel has beaten both EPS and revenue handsomely investors are looking for clues about its weakness. Intel has recently lost market share in processor business to AMD due to delay in its 7nm process technology due to foundry problem and AMD's surge in its own technologies.

The drop in DCG's income made investors nervous about its main bread and butter since both AMD and NVDA is clawing back to take more shares. For example, NVIDIA (NASDAQ:NVDA) is making inroads in the data center. NVIDIA's data center revenue skyrocket by 167% to $1.75 billion last quarter, although that includes results from Mellanox. NVIDIA has recently completed its acquisition of Mellanox in April. Mellanox currently included approximately 30% of NVIDIA's data center business in the Q2. Moreover, NVIDIA has recently acquired ARM which will be a direct competitor to Intel's data center processor business with leadership help from the NVIDIA.

Now, the million dollar question is whether Intel a buy after disappointing Data center income. Moreover, Intel's lagging in 7nm process technology which has devastated its Q2 report will hang on its head.

However, Intel is making significant progress with its 7nm process as CEO Bob Swan said in the last earning conference call on 22nd October "Since the last time we spoke, our 7nm process is doing very well, now we deployed the fix and made wonderful progress."

Earlier, Intel announced that if it sees further delay in its own foundry problem, it may move to third party foundry such as TSMC which is widely used by Intel's competitor AMD.

I personally believed that current drop of 11% is overreaction from the Investors. Competition from AMD and NVIDIA is overblown. Yes, AMD has taken some market shares from Intel's consumer processor business but overall processor market is getting bigger due to surge in technology usage due to the ongoing pandemic. Moreover, Intel is still way ahead in Data center processor technology which ARM and AMD was trying to make inroads for years without major success.

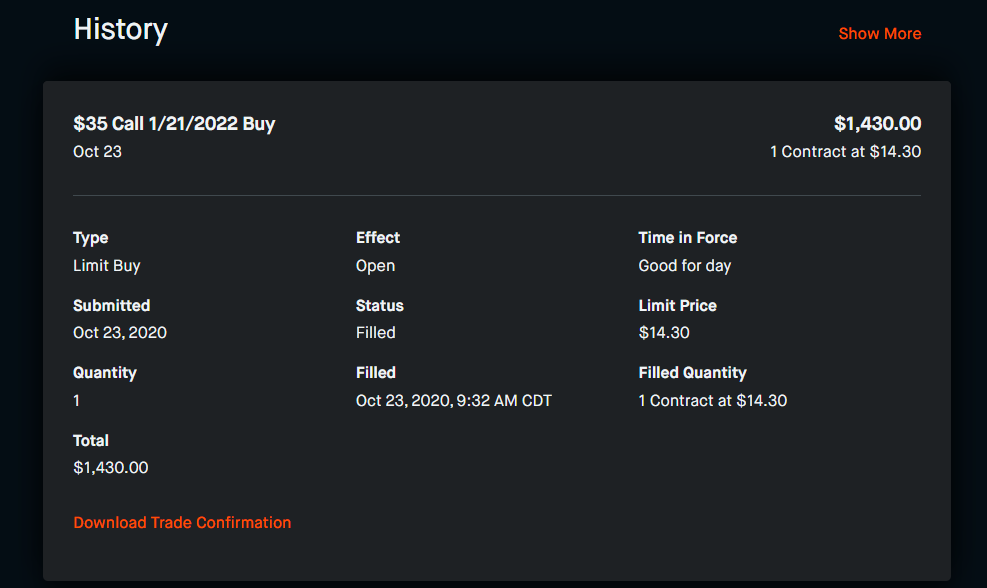

Interestingly, I bought a 15th January, 2022 Long-Term Equity Anticipation Securities (LEAPS) call at strike price of $35 for $14.30. My plan is to sell some covered calls against it. Basically, I will use a poor man covered call strategy which I will discuss in my future blogs.

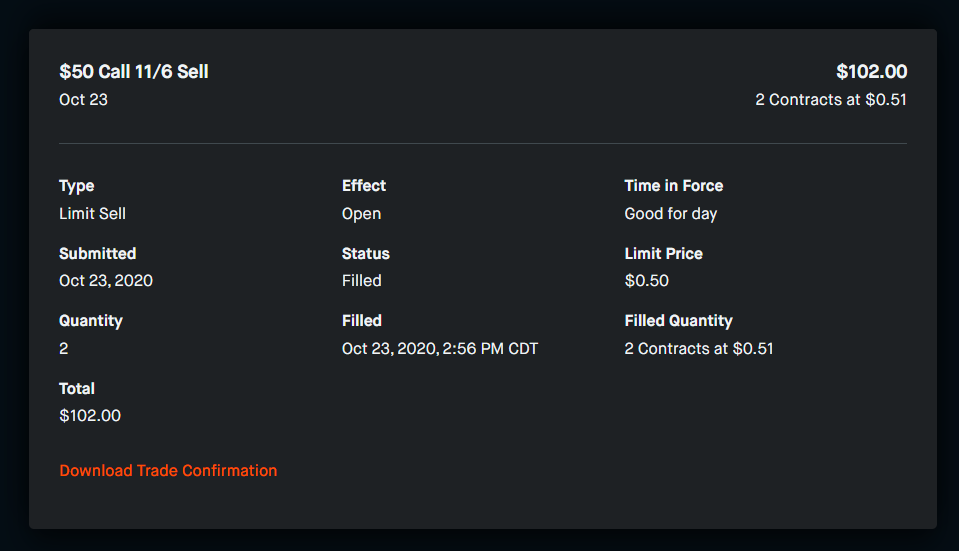

At current market dynamics in next few months, Intel will move sideways between $48 to $52 until it delivers any processors based on 7nm process. Moreover, I already had a LEAPS call for same date and sold two covered calls for $102.

Recently, I am trading some poor man covered calls extensively and love to share my experience with #leofinance community.

It feels good to be back!

Disclaimer: This opinion is not a financial advice, it my personal perspective and opinion. Please seek professionals for financial decisions. This opinion is only for educational purpose.

Image sources: Most images are open sourced (e.g. Pixabay, Wikimedia etc.) with Creative common license. Some images are used with due courtesy to respected owners.

Thanks for reading.

@dtrade

Cryptominer , occasional trader and tech/finance blogger

Posted Using LeoFinance Beta

Are you ok?

It's good to have you back @dtrade!

I really don't know much about Intel but I do know that after a dump comes a pump. So, if Intel has dumped by 11%, wouldn't be a bad idea to buy long!

Posted Using LeoFinance Beta

Interestingly, Intel dropped another 3.5% today ($46.5). However, goal is take call premiums weekly. I will continue to write about the proceedings. Thanks for visiting by ;)

Posted Using LeoFinance Beta

Pleasure is mine

Posted Using LeoFinance Beta

Welcome back!

This is the sort of outward facing content that the LeoFinance community is crying out for.

Looking forward to seeing more of your work on my feed :)

Posted Using LeoFinance Beta

LeoFinance will be there, thanks for passing by ;)

Posted Using LeoFinance Beta

Intel is probably a safer play than some of their competitors in that so much of their production is in the United States. Geopolitical risks are higher for the companies more reliant on China or Taiwan.

Posted Using LeoFinance Beta

Congratulations @dtrade! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: