As "luck" would have it...

The first bank closure of 2024 happens to be located in my state of Pennsylvania. As is the standard with these types of foreclosures the feds have moved in to capture the bank and bail it out with FDIC insurance. Republic First Bank was a relatively small bank so this should not be that big of a deal, but it definitely could point to foreshadowing of even bigger bank failures later this year.

If we recall last time this was all going down in 2023 these bank failures seemed to be good for Bitcoin... even though many conspiracy theorists were claiming that Bitcoin and crypto at large were the targets (as the biggest three were all banks that handled crypto operations and the bleeding was backstopped right after they seemingly allowed at least one to fail on purpose). This was called "Operation Choke Point 2.0" in reference to another time they illegally targeted a particular type of bank user (sex work). Will crypto continue to be a target? The current events all shout a resounding 'yes'.

Of course the reason why banks are so screwed is because the FED hiked rates so hard and fast and that didn't give a lot of time for everyone else to rebalance their positions accordingly. The liquidity issues within the economy still exists as the battle with "inflation" continues. We crypto degenerates seem to want rates to come back down to create a climate of easy money and number go up antics. Perhaps this is a sign that the FED will be forced to lower rates soon™.

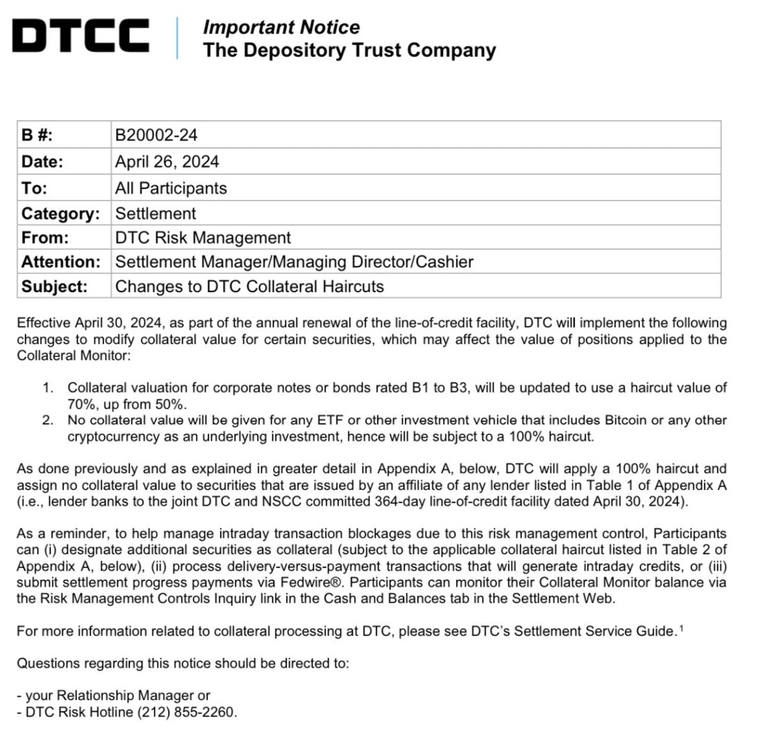

Yesterday there was some very sharp dumping in the market so I immediately checked Twitter to see if anything crazy had just happened. It just so happened that a very big thing did happen. The Depository Trust & Clearing Corporation (whatever that is!) declared that Bitcoin has no collateral value and jacked up the haircut to 100%, giving Bitcoin derivatives a $0 value starting April 30th... which just so happens to be the same day that the Hong Kong in-kind spot BTC ETF launches.

Secondly, any ETF or other investment tool that includes Bitcoin or any other cryptocurrency as an underlying investment will not be given a collateral value and will therefore be subject to a 100% deduction.

This likely throws a wrench in the plans of agencies like Blackrock in terms of being able to collateralize the ETF shares to play games like create a futures market and allow users to draw loans from their position. Can't draw a loan from a position worth $0. I have no idea how much power the DTCC has... maybe they don't have authority over Blackrock and this is just a bank thing... so banks that hold BTC derivatives have a higher chance of going under? Unclear. I'm sure we'll find out more about this later. Maybe @taskmaster4450 can provide some insight.

No matter what the situation is it's clear that the banks are in trouble and the ones that deal in Bitcoin are not going to have a fun time going forward.

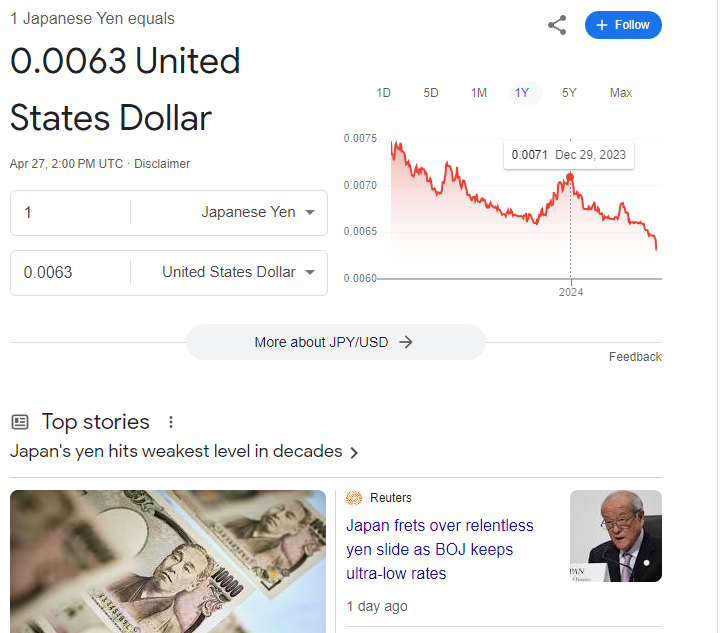

So Japan is screwed...

This is nothing new as Japan has been screwed for a long time. The Ponzinomics of fiat is rearing its ugly head. Fiat and debt-based economies only work given a state of cancerous growth with a new sucker being born every minute. Japan was one of the first countries to experience an inverted curve in their demographics with less and less debt-slaves being born to propagate the scam.

So what will Japan do? Who knows. People are saying they need to dump treasuries. Sounds like a bandaid solution to me. It's a shame none of these failing entities seem to want to embrace crypto because I don't see any other way out except to slowly abandon the debt-based ponzi.

child sexual abuse material (CSAM)

Elizabeth Warren coming in hot with claims that crypto funds pedophilia in a letter to the Department of "Justice". Is anyone gonna tell this bitch she's like 10 years too late for that? That was the narrative being peddled long before 2017 when crypto was nothing but a fringe whisper in the background.

The central banking playbook has always been DRUG DEALERS TERRORISTS CHILD MOLESTERS when they can get away with that hogwash. For some reason they think this narrative is going to stick after all this time. It won't. They need to go back to "Bitcoin wastes energy" except that can't because Blackrock has already slapped that one down now that they're in the game. So now they try to go retro. Hm! Good luck with that.

Conclusion

This is the THIRD DAY IN A ROW where I was able to just spew highly relevant crypto related news. It's got to be some kind of record I don't remember if there's ever been this many current events to cover in rapid succession like this. And what has Bitcoin done in the face of this rampant stream of FUD? Absolutely nothing. Still trading in a tight wedge near all time highs. We are still in the, "Bad news has zero affect on the market," phase. Bull market vibes for sure, even if we have to wait till the end of the year to see some real fireworks. Hunker down and weather the storm.

The best part of the sham crime excuse is that BTC is like the exact opposite of good crime money. You can literally follow the trail. I read some articles about how BTC actually helped police catch a few crime rings. I guess that wouldn't make the news though.

Here's what banks are facing. This is the real inflation rate. Who can EVER rebalance their assets to manage this inflation?

This chart reveals that fractional reserve banks are all insolvent. They cannot keep up with inflation. Fiat isn't dying. It's being killed, so that CBDCs can replace it. 20% on HBD isn't keeping up with inflation. Stocks aren't keeping up with inflation. The prices of these things may go up, but inflation goes up faster. That's the reality of money today.

However, there are investments besides money, such as production tooling. A garden will keep up with inflation because it doesn't produce money as a return, but the things people buy with money. Invest in production tooling, means of creating products that are purchased with money, to stay ahead of inflation.

Thanks!

Not with that attitude! (jk)

I agree with the production tooling. Greed has made many forget that production is way more incredibly important than cost.

Particularly now. Just days ago I read that a way to make graphene a semiconductor had been developed. This is astounding news, because graphene inks can be printed with ordinary inkjet printers. IOW, we should be able to print our own chips. The era of Open Source Hardware is about to begin. I don't need 4nm chips to run my household computer. I can live with something 100 times as large, so within the range of inkjet printing. Also, graphene semiconductors are reported to take a fraction of the power and produce ~20% of the heat that silicon chips do, and with larger chips there's easier ways to cool them as well. Then there's the already amazing panoply of table top tech for making stuff that has advented recently, such as 3D printers. Only last year the first 3D printed space rocket, Terran 1, was launched in March. Since then multiple space manufacturers have moved to adopt 3D printing in a big way. The last craft that landed on the moon, Odysseus, used a 3D printed rocket motor. Space manufacturing uses aluminum, so my guess is that 3D printers capable of printing aluminum are about to become available much more inexpensively than they were last year, and with increasing adoption prices can be expected to plummet - as usual for new tech being mass adopted.

I am super optimistic about decentralizing production of most of the goods and services we need to create the blessings of civilization. I don't want to buy radios I can't change the batteries in, or keep Google apps off of. I want to print my own radios that also create a mesh network so that people can speak freely and forthrightly amongst ourselves without being censored by ISPs, and can trade crypto even when they ban it to replace it with CBDCs. I not only want these things, I NEED them, and, lo and behold, here they come.

It's about time we got rid of mass production and adopted bespoke local production of exactly the products we need, and got rid of the parasites that suck our life's blood out of every hour we work for them, out of every product we buy from them, and keep that in our red-blooded American veins where it belongs.

I'm super stoked about the coming redistribution of wealth that will come with redistributing who makes the products we use, and that being us, instead of vile psychopaths like Gates, Soros, and Rockefellers that happily destroy the environment to make a few more pfennigs, or add bugs to our food to make us more miserable.

They are just trying to blast crypto to hide their failures. Fuck then we will win!!!

After this news, people will once again lose faith in banks and we will see people once again believe in crypto and invest all their money in it, so we will see prices go up.

It's pretty sad that both sides have been using the whole child porn thing as a smoke screen since 2020 now. I truly believe it's a serious issue that needs attention, but now with this news it's clear that both sides are weaponizing it and using it as a smoke screen to detract from other issues that need attention.

If this pedophilia story is already seven years old, perhaps, Warren could not think of any crime this time that she can associate with cryptocurrency.