It's been a long time.

I haven't commented on Hive mechanics outside of HBD in forever. It's one of those things everybody does once and then you're kinda like, "Been there done that," while moving on to all the other stuff there is to talk about. But I have seen this conversation popping up here and there recently and it seems like there are a still a decent amount of users around here that don't know the basic facts about how money is printed on this network.

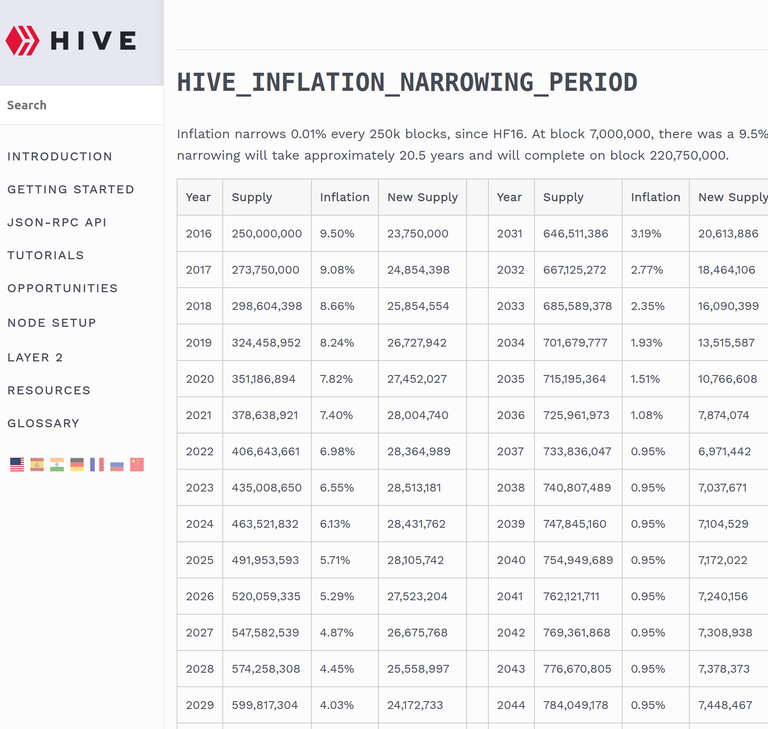

You'll notice from this chart that total network inflation started out just below 10% in the beginning. A respectable number considering the absurd rates that came later from other tokens (especially in DEFI 2020). From there we see it drops around 0.42% a year, with 2025 listing inflation at 5.71%. Crazy because the last time I checked up on this number officially I remember it being just under 8%, so again that would have been back in 2020 during all that ridiculous DEFI shitcoinery.

Once the inflation rate drops to around 1% in 2036 it just sits there and doesn't get any lower to insure everyone can still get paid. That might be x5 less percentage than we're doing today, but the hope is that price going up from less supply would more than make up for the difference. That's how it works on Bitcoin anyway, assuming that was even a comparable technology.

It's interesting to see from this chart that 2026 is the first year where Hive will actually start printing less tokens than the year before. This is due to the exponential nature of inflation; inflation creates more inflation creates more inflation. Notice how in 2021, 2022, 2023, 2024, and 2025 the network expected to produce just over 25M new Hive each year even though the percentage was going down.

To better clarify this phenomenon for those who might not understand compound interest: 2022 has more raw inflation than 2021 because even though 2022 has a 0.42% lower rate there are still 28M new coins from the year before that also generate inflation to account for. So the inflation of the inflation for 2022 creates about 2M new coins, but the 0.42% reduction on inflation only saves around 1.7M, leaving us with about 300k more static tokens minted in 2022 vs 2021 due to the compound interest mechanic.

As stated earlier, we see that 2026 is the first year where this static inflation number actually goes down (by 600k Hive in that year alone). That number will then continue to deflate until we reach the 0.95% floor in 2037 down to 7M tokens per year. Then compound interest kicks back in and the number will slowly go up again. Of course all this assumes that we don't hardfork the chain to modify these numbers, which is a real possibility (unlike BTC).

Pop quiz:

At 1% inflation rate how many coins would we mint after 100 years? If we do the math additively we'd get +100% more tokens, but because even a 1% inflation rate is still exponential growth the real number is more like +170%. Food for thought.

Personally I do not believe that a 1% floor is high enough and we should freeze the floor at a higher level, but that's not really something we have to worry about for another decade so why argue about it now? Still, that drop from 16M/year to 7M/year from 2033-2036 could be extremely brutal and cause volatility/liquidity problems. Something to think about.

Inflation Schedule:

- 10% Witnesses

- 10% Decentralized @hive.fund

- 15% HP Dividend

- 65% Reward Pool

- 32.5% Discussion Rewards

- 32.5% Curation Rewards

I came to this network before the DHF even existed, so it used be 75% to the reward pool (plus curation rewards were also half as much as well). At one point author rewards were quite high on a relative scale (56% of all network inflation), but 32.5% is still pretty decent when considering it much easier to get upvotes from a curator with greater monetary incentive.

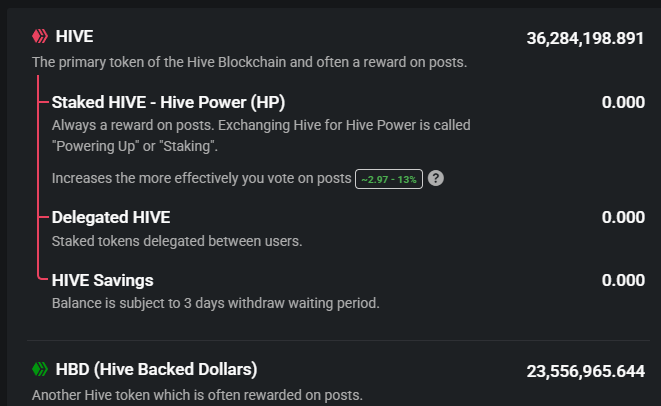

15% HP Dividend

Out of all inflation on Hive this is definitely the weirdest one. It's also one which I've suggested could be removed on a couple of different occasions, but it has the advantage of providing a little yield (~3%) to accounts that delegate their stake to others, so it just hangs around being weird and potentially redundant.

What makes it even weirder is that HP isn't actually HP. Hive Power is not the Hive token, and exists as a different asset called VESTS on-chain. The 15% doesn't increase the amount of Hive you have, but rather the amount of VESTS you have... but then when you powerdown convert those VESTS back into Hive it can appear as though it was Hive the entire time on most of the frontends we have available (for simplicity and to lower newbie confusion).

Separate HBD inflation

Pre 2021 HBD inflation was 0% to the savings accounts. Since then we've seen numbers ranging from 3% to 7% to 10% to 12% to 20% and now back down to 15%. The amount of "Hive" created here is completely separate from all the other inflation we've talked about thus far. The "total inflation" amount earlier does not include HBD minted in the savings accounts, which can be seen as either a good or bad thing depending on perspective. Personally I'm more pro-inflation than most people in crypto so I see it as a very good thing.

Ninjamine

At the very beginning of the network OG accounts got their stake from POW mining. The biggest chunk of these coins is referred to as the "ninjamine" or "premine" which now sits in the @hive.fund account "for development". I for one will be happy when this number gets a lot closer to zero so it stops being an existential threat to the community that creates needless volatility and drama. But that's just like, my opinion, man. I'm trying quite hard to just stick to the facts and steer clear of my opinions... or the size of this post would surely balloon to a 3000 word juggernaut.

Conclusion

Well I think that pretty much covers all sources of Hive inflation.

Again, it's been a long time since I've covered this topic, so it's nice to do a little rehash every once and a while so I can look back and see what I've learned or how my stance on these topics has changed over the years. It's easy to get lost in the weeds on Hive and see certain accounts "exploiting the reward pool" and whatnot but in the grand scheme of things a couple thousand dollars here or there is a tiny drop in the bucket for a network with a market cap in the nine-figure range. Hive inflation looks a lot worse and daunting when you try to measure it by static numbers and the feeling of "that's a lot of money" vs just looking at the actual macro percentages in play.

That's not how it works. There is price of VESTS composed of two values held in

dynamic_global_property_object:total_vesting_shareswhich is a sum of all VESTS from individualvesting_sharesbalances, which is close to all VESTS in the system (with exception of pending rewards, that have separate counter)total_vesting_fund_hivewhich is a balance holding actual HIVE used to buy those VESTSThat price is used by front-ends to convert VESTS amount into HP.

Whenever user does power up, they transfer HIVE to

total_vesting_fund_hive, while they get newly minted VESTS on theirvesting_sharesbalance. Similarly when power down is executed, VESTS are burned, while adequate amount of HIVE is transferred to user balance. Both ways use above mentioned price of VESTS current at the moment of execution. Again - VESTS are minted and burned, but HIVE stays intact, just trades places.Part of inflation is added to

total_vesting_fund_hivethus increasing price of VESTS. The amount of VESTS is not affected by inflation, just existing VESTS are paired with increased amount of HIVE.lol boo!

Try to make me learn things I'll show you what for!

Way to take a confusing issue and clear it right up 😅

I will say I have yet to hear a convincing argument for why vests exist in the first place.

It seems like complete nonsense every time I see it explained.

Which is likely why muh brain refuses to remember how they actually work.

I'm sure you probably don't subscribe to traditional economic models. But, I think I remember reading somewhere that the magic number for inflation is around 2% or so. This would be the goldilocks zone to create velocity of money, and thus generate economic strength in a system.

I often wonder if we could speed up the process, lower the inflation before the scheduled time. Now, I realize to you and I, that would be "bad", because we've been here grinding for a while, and thus if we keep it up, we are likely to grow a lot faster now. But, in theory, it would help Hive's price solidify a lot more.

The fact that our inflation is still so high just means anyone who joins today is still quite early.

2% is the inflation rate that central banks say is good.

That does not apply to crypto at all.

The 2% inflation on a central bank is the amount of theft they can get away with without crashing the economy and ruining the party for everyone. Inflation on Hive is not theft or debt, it is new money owned by the entities that issue/receive it. This is a great discussion to have though and probably worth a separate post at some point.

I am with you in the DHF being close to zero or just burn that shit out.

I definitely think there are two economies regarding Hive. There is all the activity that happens onchain, which includes accounts "exploiting the reward pool" (which will always be annoying) and then there is the Hive price itself determined by all the buying and selling on the exchanges and whatnot, that, as far as I can tell does not seem to be influenced by much, if anything, that happens onchain.

It's a nice place to be in, honestly, but potentially also means there isn't a lot we can do to affect the Hive price in our favour.

When you talk about the Ninjamine, you're specifically talking about the early Steem days yeah? I assume there was no ninjamine of Hive because almost everyone (excluding Sun et all) just got their Steem tokens replicated on Hive... is that right?

The ninjamine on Hive is the @hive.fund

All that money was "reallocated" from Steemit Incorporated to the fund.

Sun's stake should have been destroyed but it was transferred here instead.

Keeping the threat alive and well, just under new management of a DAO.

Ahhhhhh, I either didn't know that or totally forgot. Thanks!

Let's do an experiment, the Posting Key for this account is revealed as below, so anyone can login to this account and post/upvote/downvote/reblog anything they like.

Let's see how this account will evolve, i.e., who will login to it, what will they post, what posts will they upvote/downvote & reblog and etc..

5K4qnzQxbiMWKcFG3woEHq8bfNBwDEmp8zEKLiqhUQZ37FDLa1m

HI

Thanks for the explanation. It has cleared a few things up for me.

Thanks for the insights.

Do you know what happens to HBD savings inflation if the haircut is triggered? Does it go to 0, or will the blockchain still print HBD to pay people who have HBD in savings?

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Totally with you on that one, especially given the lacking accountability of some (all?) of that "development"

From time to time I see "burn" posts. Do we know how many hive tokens have been burned and whether this has offset the inflation in supply?

!PIZZA

$PIZZA slices delivered:

@danzocal(3/10) tipped @edicted

Come get MOONed!

I learned something new today. I didn't know that HIVE inflation dropped in steps until a floor is reached. This is fascinating, especially with compounding interest involved. Thank you for this. 😁 🙏 💚 ✨ 🤙

Had forgotten that the next year is when new hive tokens actually drop, nice reminder there.

nvm it actually dropped this year and last year too slightly? lol