HBD is the best crypto investment out there.

Weird claim, right?

The best investment is some not-so stable-coin near the #3000 rank on the market cap? But there is some truth to the statement. The ability to earn 20% yield in the savings account is a better return than professionals make year over year in the stock market. Think about that a tick. All that's required is that the HBD be worth the same or more (in terms of USD) than you paid for it.

We've already seen that HBD has a robust history of staying alive (even if the peg hasn't been so great over the years). Several upgrades have come into play as well such as the HBD stabilizer and Hive >> HBD conversions.

I was actually going to write this post a couple of days ago, but now I have to now that Hive and HBD have spiked up so hard. We haven't seen HBD break it's peg to the upside like this since before conversions from HIVE >> HBD came into play. Now I'm realizing from my talks in Discord that I actually have no idea how this conversion mechanic works.

I thought it was the same as HBD >> Hive conversions

In this contract, HBD is destroyed, and then 3.5 days later Hive is created using the new average price of Hive. You might destroy HBD because it's worth 90 cents, but in 3.5 days this could end up being a loss or a gain depending on what the average price of Hive did. If Hive goes up you'll get less of it from a conversion, and if it goes down you get more.

I assumed that HIVE >> HBD conversions were just the opposite of this plus a 5% conversion fee to prevent arbitrage exploitation. This is absolutely not the case. Hive >> HBD conversions are extremely convoluted and a bit ridiculous (but have some interesting advantages). The documentation on this contract is also terrible.

Where to begin?

Oh I know, let's try the documentation found at Hivesql...

https://docs.hivesql.io/technical-informations/operations/txcollateralizedconverts-hf25

- let's say the current HIVE price is $0.10

- the user issues a collateralized_convert operation with 2000 HIVE (worth $200)

- 2000 HIVE are temporarily removed from the user wallet.

- the user gets 100 HBD (half of 2000 HIVE => 1000 HIVE converted to HBD) immediately.

Yeah no...

The fee is taken before the HBD is issued... so no, you wouldn't get 100 HBD. This example is wrong. Also this:

- the remaining 1000 HIVE are put on hold as collateral

- At the end of 3.5 days, if the price of HIVE hasn't changed, the user gets 950 HIVE back, that is 1000 HIVE - 50 HIVE (the 5% fee on the 1000 HIVE collateral)

AND THEN THEN DOCUMENTATION ENDS

lol what the fuck. If the price of Hive hasn't changed? Show me a single time that the price of Hive hasn't changed and is EXACTLY the same after 3.5 days. Way to explain what happens in the scenario that literally never happens. And then the doc just ends as if it was explained correctly. Mindblowing.

So I've been chatting a lot in LEO Discord about how this all actually works, and it's surprising complicated. Even if one figures out how the conversion works... good luck trying to parse how the contract interacts with the DHF and the stabilizer.

Long story short.

When a user does a Hive >> HBD conversion, they get the HBD instantly upfront. However, only half of it is converted. The other half is stored as collateral (plus a 5% fee is taken away right at the start). Obviously, minting the HBD instantly makes it a lot easier to stop HBD from pumping. But also an HBD pump inevitably pumps Hive because Hive is getting destroyed to mint the HBD. Because the HBD is minted instantly it can be dumped for Hive immediately and that Hive can again be converted in an arbitrage loop with 50% diminishing returns (because half of the Hive is stored as collateral).

Then, after 3.5 days, the collateral is returned to the user. How much collateral depends on how much the price of Hive has shifted in the 3.5 day period. I'll spare the details because I still don't fully understand it, but apparently there is a "lowest median price" blah blah blah. Trust me it's more complicated than it needs to be.

For arbitragers, by arbitragers.

Our lead dev, Blocktrades, runs an exchange. All exchanges are inherently arbitrage factories. Smooth runs the stabilizer. The stabilizer is an arbitrage factory. Thus it makes perfect sense as to why these conversions would be so complex and ridiculous. It fuels the arbitrage factories of the people who created the system. More conversation on this topic by Blocktrades and Smooth themselves can be seen here on Gitlab:

https://gitlab.syncad.com/hive/hive/-/issues/129#note_47514

Here's how I think it works:

This is not exactly how it works

- Right now Hive has a 3.5 day average of 43 cents.

- Anyone can convert Hive into HBD somewhere around this price point.

- However, because Hive has pumped from these conversions it is selling on exchanges for 53 cents currently, the chance that the conversion is not worth it at this point is high because a conversion will sell the hive at 43 cents instead of 53 cents.

- However... again... after 3.5 days has passed the collateral needs to be returned to the user, and this collateral that gets returned uses the newer price point of Hive.

- To reiterate, if you converted 2000 Hive at 50 cents, 1000 of that gets converted into Hive instantly. That's 475 HBD (after factoring in the 5% fee). Now we have something like 1900 Hive sitting in collateral for this "loan" that will be liquidated 3.5 days later.

- After 3.5 days has passed, say Hive is now worth 60 cents due to all the pumping. The 1900 Hive collateral is now worth more money ($1140 instead of $900). The HBD "loan" was for 475 HBD. The user will get back something like $1140 - $475 = $665. At 60 cents a token that's a return of 1108 Hive. After everything was said and done 892 Hive was converted into 475 HBD (53 'cents' per hive; but this becomes much more worth it when HBD breaks the peg to the upside). It's also worth noting it required an upfront deposit of 2000 Hive to convert less than 900 of them by the end of the 3.5 day period.

Again, I have no idea if this is how it works.

It works something like this, but the details are convoluted as shit and the documentation is hammered dogshit (as is most documentation on Hive). Again, this is what happens when your lead devs run an arbitrage factory. Not saying it's a bad solution... it's actually pretty cool that we can get HBD on demand instantly. I'm just saying it's very complex, which makes sense given who programmed it and what their business is. Context matters.

5,546,763 HIVE in total were converted so far.

Pretty wild, eh? The Discord conversations we've had about this in LEO general have been extremely enlightening. Kudos to @engrave for being such a good sport and providing so much valuable data. I voted his witness today with my last remaining vote (currently #24 in rankings).

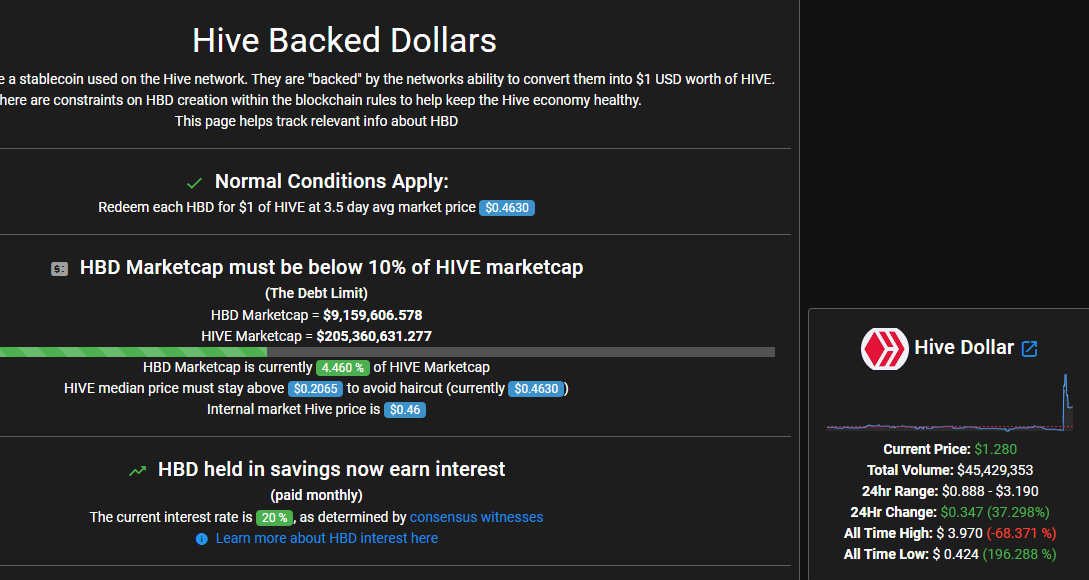

$0.437 (3.5 day) average

Hive's average price is way lower than the listed price. Someone on UPBIT apparently made a limit order for $60M dollars worth of HBD at a price point of $3 per HBD. What a jack ass. The Korean whales must be up to something.

We need to be very careful at this point.

The bearish new moon cycle is starting and the FED meeting is in two days. If you guys recall... I planned to sell crypto on July 25th. That's today. This HBD/HIVE pump was the best possible outcome. I dumped everything liquid I had into stable coins when I woke up. Now I can pay bills and buy the dip if and when it should happen. It almost certainly will happen if the FED announces another rate hike, which I expect to happen because it seems like the insider traders are already dumping the news. I guess we'll see.

2.4M HBD printed?

If 5.5M Hive was converted to HBD at a price point of 44 cents, then surely 2.4M HBD was just printed? Although, like I said, it might be half that because only half gets printed upfront as HBD. Still, seeing as there is only...

There's only 9.1M HBD in circulation... wut?

So even if we only printed 1.2M HBD today, that's still 13% of all HBD in circulation. That's a 15% increase from where we were at yesterday. Pretty wild.

debt ratio

This is what makes HBD such a good deal.

Not only do we offer 20%, but that amazing deal isn't even being scooped up. When considering our debt ratio is still less than 5%, we can see that HBD is incredibly sustainable at the moment. Especially true when looking at the haircut, which wouldn't kick in until a Hive price of 20 cents. Essentially all we have to count on is that Hive won't crash to zero and HBD instantly becomes one of the most valuable assets out there that seemingly nobody wants. Stable-coins aren't exciting. I have $0 in the savings account just like many of my peers. Hopefully that will change one day.

Conclusion

This post is a bit raw and unchecked. I gotta say I was pretty frazzled when I found out (sort of) how Hive to HBD conversions work. Still, it's nice finding out something new about Hive. Just when you think you know it all a curve ball pops up like this.

Hive and HBD are always being upgraded. The yield on HBD is better than professional brokers make trading the stock market. These pumps are always exciting but I've used this one for exit liquidity, as that was always the plan anyway. Now I'll easily be able to make it through a new bottom if we happen to get one. If not... no complaints either way. Balanced positions are key.

Posted Using LeoFinance Beta

It was done that way because @blocktrades wanted the HBD to be received right away, as you say to sell into pumps. I would have been perfectly happy to have it work the same as the other conversions. Yes it would be less effective short term on pumps but I think it would have been sufficiently effective over time and simpler. In reality, we have no way to know if this is correct.

Anyway, the way it works is the HIVE you "convert" is actually posted as collateral for a loan of HBD. The amount of the loan is determined using the MINIMUM feed price with a 2:1 collateral ratio (i.e. you get half as much HBD). Then after 3.5 days the conversion actually happens at the MEDIAN feed price, converting whatever portion of the HIVE collateral is needed to repay the loan, and you get a refund for the rest. With 5% fee deducted of course.

The 5% fee seems to be applied to the whole 2x collateral, meaning its a 10% fee.

I'll look at the code but I don't think so. It may be applied to the collateral when calculating the amount of the loan, but ultimately it is the conversion and return of extra collateral at the end that matters.

Hi @smooth, is anything going on with @hbdstabilizer? The last 4-5 hours it seems to be just letting Hive collect in the account.

There is some glitch in the code where it freezes up very occasionally like once every few months or so. I have looked for the bug but never found it. Anyway, all gets corrected once it is restarted. Maybe I'll script something to autorestart it.

Ok I wonder sometimes if I am interpreting it right, but it seems a lot like a 10% fee at the end to me. I will do a post in 2 days when the dust from yesterday settles.

Thanks for answering.

I looked at the code. It applies the fee to the

converted_amountwhich is the amount of HBD received at the beginning of the request. This is then subtracted from the total collateral to determine the collateral to return. This appears correct to me (5%).Thank you for looking! This seems exactly right.

I think there should be a way to scale the demand of HBD on time.

5% for the current system (3,5 days) and if someone wants to create more over a longer time period the fee becomes reduced.

like 30 days = 1% and 90 days = 0,1%.

Why? because it would increase supply and would work like an DCA out of Hive.

But it is overall way too confusing. Like alchemy.

Thanks for the comment.

I still don't understand it.

Mostly just the median price thing.

Median of what dataset?

A snapshot every hour?

It's the same median that's used for the other conversion. One snapshot every hour for 3.5 days.

Way too complicated and intransparent, I always use the internal market. You will see what you get, plain and simple.

with enough energy the HBD is gameable. But that's something nobody cares about. On the scale, it can cause massive damage.

💯 correct. This HBD story is not gonna end well for those banking on 20% for life. It makes no sense to me the push of a not even stable coin. Hive should be the focus and I wish we’d fork HBD outta existence honestly

I always do the same, instantly done, simple as « a + b » :)

Confusing as hell? Yes.

But the reality is most should not be using the conversion mechanism. Many think that is how to arbitrage. People need to use the internal exchange for their swaps and leave the conversions to the bigger fish. Of course, having better documentation could really help out.

For those who understand (and are willing to take the risk), have at the conversion feature. For everyone else, sell or buy on the internal market. It is the best approach.

Of course, for those who like to get a bit fancy, can also arbitrage using pHBD.

Posted Using LeoFinance Beta

It's a super advanced feature for arbitragers, true.

Yeah and the time delay makes it impossible to see if a move is profitable or not. Isnt arbitrage designed to take advantage of pricing inefficiencies and move if profitable? How can you do it when the prices can change by 20% in 3.5 days?

Posted Using LeoFinance Beta

I would love a rinse and repeat tutorial post on how small stake accounts should approach this. I just sat there and watched the pump with no clue. I would have liked to have been able to grow my stack by $10 or $20.

Posted Using LeoFinance Beta

This actually explains a lot about the HBD process so thank you for doing it in such an artistic way :)

The one thing that worries me is doesn't that open Hive and HBD to a money force attack. Where someone could manipulate the market in such a way to pump one or the other trigger a conversion and suck the other pretty much dry?

Granted I still don't understand how it works other than it still doesn't work very well for keeping HBD stable. That things flies around at random from $0.90 to $1.05 during normal times and in extreme cases we have seen $0.80 and last night over $2 for a while.

What worries me is trying to take out a decent amount of HBD and having to take a cut because it's not holding the peg.

Posted Using LeoFinance Beta

It does.

Well the Hive purchases that resulted from the HBD pump were good, so I start to see the benefit in the 2 way conversations, but leave the swapping up to the experts!

Posted Using LeoFinance Beta

“Weird claim, right?

The best investment is some not-so stable-coin near the #3000 rank on the market cap? But there is some truth to the statement. The ability to earn 20% yield in the savings account is a better return than professionals make year “

The 20% isn’t permanent. The dollar is garbage and taxes alone eat a third of this profit plus inflation is over 15% (real level but even fake CPI at 9% plus).. I’d rather be in something that will double after the Fed reverses. Anyway I’ve made my opinion clear b4 so no point in repeating same point but I seriously think it’s insanity Antibes claiming the 20% is safe. It’s not and it’s a bad idea to tell people otherwise in my humble opinion.

It’s all love and respect

Cheers 🍻

The 20% has nothing to do with whether it is safe or not. What matters is the debt ratio and how sustainable our demand to hold debt is. Inflation is not 15%... like seriously talk about unsustainability. Inflation spikes and it's never going to come back down? It literally can't stay this high mathematically. People don't have the money to even pay the new cost. We already see leading indicators of a snapback.

You have basically just claimed that it's impossible for even professionals to make money on the stock market. You know that, right? You basically said the only way to successfully invest in this atmosphere is to put money in crypto and hope for a massive return.

I appreciate the sentiment. The economy is not doing well. 20% doesn't make sense in any other context but crypto, but it is 100% safe and sustainable while our debt ratio is below 5%. We've been at 10% ratio for years with 0% interest.

Are u seriously saying prices haven’t gone up year to date at least 15%? Groceries and gas it’s more frankly. The CPI is garbage but if u take the 10% instead and count the taxes owed on the profit from the ARP it’s not as great as advertised, at least with the risk.

Second I agree with u on the 20% not being factor in safe or not. But it is reason more funds have gone into HBD.

“but it is 100% safe“. I wouldn’t be saying this. Nothing is 100%. The dollar isn’t 100% safe the next few years and that’s what it’s based on. Like I always say I like and respect u, not arguing just making points I see as important. The tax authorities will want there cut and it’s not going to be taxed like interest. IRS is going to tax it as income. This is coming.

They definitely haven't increased due to an expanding money supply.

That is a provable fact.

Also one year of data is pretty irrelevant.

Watch what happens next.

Prices will come down.

That doesn't happen with actual inflation.

CPI is irrelevant and measuring supply shock.

USD hasn't lost any value; it's gaining value.

No, that's not what it's based on.

It's based on Hive in combination with an oracle price feed and these interest rates.

If USD loses 50% of it's value we can just jack up the interest rate to 50% to make up for it.

In fact, the debt ratio would go down and we'd be in an even better spot than now.

This wouldn't even increase the debt ratio because Hive would spike x2 from the USD devaluation.

So no, a failing USD does not destroy HBD because "it's based off it".

See that? HBD does not depend on USD in any way. You only understand half of this issue.

This is leading you to come to some very incorrect conclusions.

HBD can be pegged to the price of anything.

We choose the USD price peg because it's the most stable asset in the world.

It still is, and there's no evidence to suggest this is going to change anytime soon.

jack up interest to 50% to make up for it? Come on are u serious? That wouldn’t work. You’d destroy it.

I couldn’t disagree with u more then this comment above. Respectfully of course. It’s just wild to me ur serious

can be pegged to anything? So overnight just totally change what it is? Seriously?

I respect you and don’t mean to come off disrespectful. But dude “ HBD does not depend on USD in any way.“

This sounds moronic to me.

Wanna make a friendly wager?

If you change the peg overnight U honestly don’t think there would be issues? that means it’s worthless or will be. I am certain now HBD will fail. Hive is the gold here not HBD. You take USD “peg” away get ready for total failure

Think of a good metric to bet on. We can lock up funds into a smart contract

Destroy what? What is 'it'? I'll assume you mean HBD price valuation because that is the thing we are printing. Except wait... what is HBD priced in again? Oh, yeah... it's priced in USD... the thing that nobody wants because it just lost 50%. But wait, there's more. The price valuation CANT be destroyed because it is Hive itself that maintains the peg. So it's Hive that we'd be destroying? Again, no. The 50% APR bump only occurred because nobody wants to hold HBD because USD tanked. In that case our debt ratio is less than 1%. We need to increase the APR so that people actually want to hold HBD/debt. It's not destroying anything it's bringing balance to the system. You don't fully understand these mechanics but you think you do.

Again, you're saying the system would be destroyed if we increase APR to 50%.

Wrong, the system is destroyed if we DONT increase APR to 50% in this situation.

The interest rate exists to provide elasticity to the supply and demand of the debt.

Hive is the central bank; HBD is our debt instrument.

When there is no demand for debt we have to stimulate demand for debt just like the FED would.

As in stimulus. As in drastically higher yields (in the FED's case lower rates because it's a debt-based system which is the opposite of crypto).

I couldn’t disagree more. That said it’s all respect ✊

But it’s clear to me we just disagree and we won’t agree.

Let’s bet! U down?

Did someone say something about changing the peg overnight?

Why would be it overnight?

Changing the peg would only happen given the systemic failure of USD stability.

Which means there is some exponentially more stable asset we could peg it to.

Which asset would that even be?

Like I said, even in the case of USD instability, the yield can be modified to make the value proposition of HBD more stable than USD. USD is losing too much value too fast? Just increase the yield to HBD. Now HBD is more stable than USD.

We can't bet on something that's never going to happen, so I won't be locking money into a contract to rot.

I've always wondered how the fuck Hive conversion worked, and... I'm still basically where I was in understanding now lol. What a complex system!

it's weird :D

First edicted's post that I don't understand much.. I'm probably not smart :)

Wait, does that mean HBD can dump below 90 cents?

If yes, It's not good news

HBD can go under 90 cents but that has nothing to do with Hive to HBD conversions and everything to do with HBD to hive conversions combined with the 10% debt ratio haircut.

I prefer the internal market, which can yield small profits at more or less regular intervals regardless of HBD and HIVE prices. 😁

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP~~~ embed:1551641933168234498 twitter metadata:WWFuUGF0cmlja198fGh0dHBzOi8vdHdpdHRlci5jb20vWWFuUGF0cmlja18vc3RhdHVzLzE1NTE2NDE5MzMxNjgyMzQ0OTh8 ~~~

The rewards earned on this comment will go directly to the people( @aschatria, @shiftrox ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Hmm... A litlle bit confused

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

@arthursiq5(1/5) tipped @edicted (x1)

Join us in Discord!

Here is how a pro is doing it :) @demoturk

I have only 10 in the process and with smaller amounts :)

I just created this account in case anyone ever makes the same typo when they intended to transfer to me...

lol :)

Sorry for the typo, but again might be useful :)

Price difference between different exchanges. Inside Hive, it was sold for 0.3200 USD and inside Binance it was 0.5074 USD

it's for experienced users you know? :D haha

I guess some stuff are better left untouched . Understanding the Hive/ Hbd conversion mechanism is such an uphill task .

It shouldn’t be, should be simple and easy to understand. The HBD story isn’t going to end well. I wish we’d push Hive not HBD. Just my take

Still can’t get enough of these internal hive economics.

The documentation can really be improved.

While everyone is mostly skeptical about the sustainability of 20% Apr, I’m here thinking when will witnesses increase interest rates to 25%? Lol. People will loose their shit and scream doom even when there isn’t one.

Of course 20% is sustainable.

It's the debt ratios that become unsustainable.

Market cap of Hive has to go up just as much as people want to hold the stable coin for it to work.

Hive and other crypto's can't expand 20% year over year?

obviously they can.

Bitcoin is doing 100% a year.

DEBT... RATIO

Look it up.

You're uninformed.

People aren't even taking the deal; of course it's sustainable if no one is even taking the deal.

Duh.

I dont know nuffing, but im scared. You cant assume anything, like if there is an assumption that nobody has 2 billion dollars or a malicious heart to break something, think again. If its theoretically possible to break, it will be broken. What ever is happening is because some entity spotted a way to collect free money and abuse a system. Maybe something more sinister. The debt ratio might be a thing, but 20 percent infaltion does not seem sustainable, unless Hive is growing. It isn't.

Having said that, iv been waiting for people to see the 20 percent and start buying HBD and locking up hive. It will push the price of hive up and keep it locked up, i like this but iv no idea if it is sustainable or not.

The most obvious flaw in the logic that it is unsustainable is the implied assumption that this 20% yield is static and can't be changed. Witnesses can lower it to 0% if they wanted to in an instant. It's a dynamic variable that improves monetary elasticity and stability.

If Hive spikes x10 because everyone is buying HBD and burning Hive and increasing the debt ratio and creating massive leveraged risk... then yeah... lower the yield because it's unsustainable. What we are seeing right now is the opposite of that. The 20% yield gets better and better as the price of Hive crashes. Don't even need to consider lowering it while debt ratio is below 5%.

ok, so it makes it seem easier to understand knowing that only if Prices are rising its risky and it can be altered, this is good news. Im still not comfortable with systems like these though only because i like things that just run themselves, they are so beautiful. I dont like governments or banks so the Hive system just doesn't seem decentralised enough for me personally. Might be a while but i think at some point it will be evident.

If the debt ratio is rising it's risky. Unless our higher demand for debt is sustainable. For example if the ratio is going up simply because we are offering 20%, that's bad. But if it's going up because someone built a successful business on Hive, that's fine. These things can't be run by an algorithm. They require a lot more analysis than plugging some numbers on a screen into an equation.