Crypto be weird like that.

Every four years our bags get huge and everyone collectively loses their minds, but very rarely do we ever sell anything. There are no rules, number can always go higher, and it's essentially impossible to sell the pico top, leading to financial pain either way.

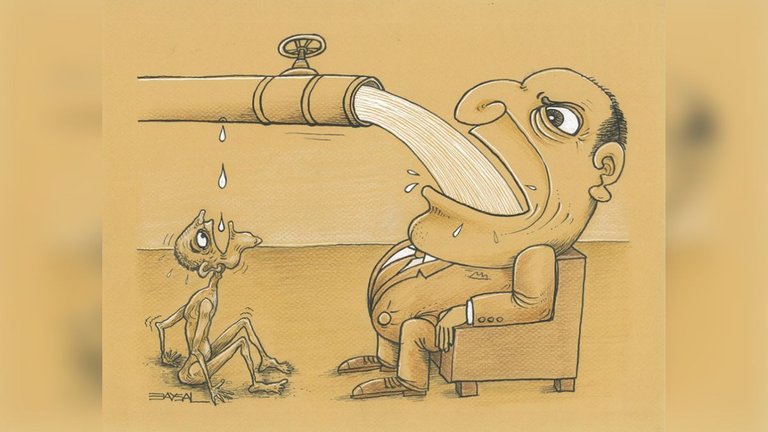

Surprisingly the story of doing a full round-trip on the gains is the common one, while tales of Lambo and Generational Wealth are much more rare, but also go more viral, leading to extreme survivorship bias. This type of behavior greatly inhibits the ability to tell what is real and what is not. If we only listened to the hype everyone would assume that we're all multi-millionaires by now. It's such a popular concept by now there are dozens of social media memes that reflect it.

So why aren't you rich though

Ironically a lot of us aren't filthy rich because we tried to be rich. Crypto provided us with plenty of money, but rather than rebalance our positions responsibly we just let 100% of our money ride into the next bet. After all if it came this far it can easily pull another 10x, right? Nobody wants to swing early and be the one to miss out on those sweet gains during peak FOMO.

FOMO creates a collective delusional state in which everyone convinces each other to bask in financial irresponsibility. After all, even if the price were to collapse 50%, we're all pretty rich so who cares? Except the huge problem here is that when it does end up crashing 50% nobody wants to capitulate as the survivorship bias transitions into sunk-cost fallacy. In for a penny, in for a Pound, as they say. Why sell here when a recovery is "imminent"?

Of course then everything is down 75%-90%... and shockingly often we see people ride their bags down a full 99% in lost value... which is just insane when you think about it. Memecoins are not going to have fun next bear market, just like NFTs, DEFI, and the ICOs that came before them. And of course that's when people sell because "it's so over". And for a lot of assets it actually is completely over as they bleed out to zero, but anything that's already survived a bear market tends to stick around.

So how do we tame our own greed?

If greed is the problem, do we fight against it or lean into it somehow in a less toxic way? Crypto is not a zero-sum game in which someone has to lose in order for another person to win, but it often gets framed this way by vulture capitalists that don't know any other way. This ship rises and falls together with the tide.

Selling as a way to defend the current price point.

There are many psychological tricks at our disposal that can be used to rationalize the decisions we should be making anyway. If our favorite coin is already up 10x... wouldn't we like to defend that price point in the future? Seeing as our unit of measurement for everything is USD, that's what you'd need to sell for to defend that price.

There are also the "moonbag" longshot assets that can go x100 or more due to high volatility and low market cap. My experience with those ones is that you'll never be mad long term if you sell around x80 (like everything... not DCA or any of that type of nonsense). Nothing has ever spiked that hard and been able to also maintain a floor that high. What goes up must come down.

There is also a lot more infrastructure available to help us manage our finances in a more safe and productive way. Pairing an asset to USD in a liquidity pool forces us to sell half of the bag into USD just to enter the pool. We can then earn yield on top of that to sweeten the deal. This doesn't take into account the systemic risk of using wrapped tokens but it's actually been a long time since we've see in any big failures; for the most part the kinks in defi have been completely ironed out.

HBD also still has 15% yield, which I imagine will be pretty valuable when everyone's bags are huge again. HBD is a little known asset to the cryptosphere at large, which actually seems to be a huge benefit for those who actually use it. The trade is very uncrowded, making the debt ratio low, manageable, and more importantly safe and guaranteed to be pegged to the dollar down to a price point of 5-cent Hive.

Very few of us actually capitalized on HBD even when the yield was 20% and the 4-year cycle was telling us it was bear market time. Denial is a helluva thing. IMO HBD is a killer asset and way safer than an LP, which suffers from both impermanent losses (buying the dip) and centrally wrapped assets.

Conclusion

Don't be greedy. Much easier said than done, but my experience is that greed is punished in crypto one way or another, be it losing 99% of your net worth or being jailed for 30 years degen gambling when customer funds like FTX. Best to avoid such happenstances. Point being: when you feel like you've finally made it... don't just sit there and ride it back to zero. Maybe this is something everyone needs to do at least once, or maybe we can pave this path we've forged through the jungle so it's not such a harsh journey for the ones that come later.

Whilst the chances of HBD de-pegging are very low with the debt limit removed, it is still a very risky bet with the low market cap of Hive and the huge size of the Hive DAO compared to HP holders. The old addage of where does the yield come from could be answered unless the Hive price picks up somewhat and gets back to over $0.30 and therefore a more healthier market cap.

This. HBD is a lot more risky than most ppl on here make it out to be, at least for positions of any meaningful size.

I mean Hive has to drop under 5 cents for the haircut to even start haircutting at the current debt ratio.

Probably more like 4 cents... maybe 3.5 depending on the conversions done up to that point. Then price has to drop even more from that level before actual conversion rate is lost. The current 30% debt ratio is greatly in the favor of HBD holders... which is good because it's a confidence game and we don't want people who hold HBD to suddenly all lose confidence and perform a bank run.

That was the entire point of bumping it from 10% to 30%, because if we hadn't of done that we'd of hit the haircut again this cycle and there would have been yet another confidence crisis for literally no reason other than 10% is too low to account for the volatility.

I'm somewhat confused by this statement.

Our debt ratio is right where it's always been.

Are you saying we need a debt ratio below 5%?

The ratio is the ratio is the ratio.

We've been in crypto long enough to know that higher market cap does not equate to less volatility.

In fact it is the higher market caps during the bull run that CREATE the volatility you are claiming we need to avoid. So I would argue that some of what you're saying/implying here is contradictory.

I'm saying the debt ratio doesnt exist anymore that's why it's always within tolerance even at 5 cents..

My point was only that at this low Hive price, the DAO makes up more.than half the real market cap, so being over $0,30 is a more safer area that can maintain the status quo and less risk because the DAO % is not so overwhelming. Higher is obviously better. Nothing to do with volatility imo.

Right but the DAO doesn't take up more than half the MC.

This would operate under the assumption that the DAO is liquid.

The DAO is a drip that can be shut off at any time.

On a philosophical level: locked tokens are the same as non-existent tokens.

It's just as easy to print tokens out of thin air and claim that all networks are under threat.

Which is exactly the main theme of all Bitcoin maximalists.

Best example here is if the entire ninjamine was destroyed when Hive was created and we just decided to print money in real time to fund the DAO instead. Logistically both of these solutions produce the exact same outcome and inflation rate. And in fact the threat we are discussing here has already been shown not to exist when the entire DAO was defunded just recently.

I didn't calculate since November last year and Hive was a similar price too. Then it was 41%, which is crazy high. As the price falls from here, that % increases rapidly cos the DAO is mostly held in liquid HBD pegged to $1 and as you said, the coded debt limit doesn't kick in even at 5 cents.

This in theory should make HBD safer as they are prioritised over HP holders, but it doesnt take account of long term incentives and the risk it could spiral out of control rapidly like Terra Luna. Once people lose confidence, its over.

I agree with all your other points.

If I'm interpreting you correctly one of us might be a little confused as to how this works.

The 5 cent price point doesn't include DHF money, nor does the debt ratio.

https://www.hbdstats.com/

https://hive.ausbit.dev/hbd

The coded debt limit kicks in at 30% debt ratio, which can happen at any price point.

It can happen at $5, in fact that's how Luna actually collapsed; UST leverage becoming more popular than the base governance token in the eyes of big money players. Luna collapsed because UST overleverage pumped it x100.

It's just super ironic to me because it's very clear that Hive is in a stable state.

It's when we get pumped that the network becomes unstable and risky.

And also we are supposed to be discussing the risk to HBD holders,

in terms of the 15% yield and $1 peg being sustainable.

Immediately bringing up the DHF is quite off topic.

An argument can be made that it's risky to the Hive network.

An argument can't be made that it's risky to HBD holders.

The biggest risk to HBD holders is if witnesses change the rules, which isn't even a risk because it requires a hardfork and gives everyone months to accept the new rules and pivot accordingly.

I can relate to your post entirely. Perhaps, I'm just one of the many who are waiting and waiting for years, without selling a cent, because of whether not knowing when it's right, or just dreaming bigger.

We have greedy whales in front Hive world too, who have mega bot pages and who have 100 and 100 fake pages .. they never buy HP up , who have used this mega lot pages to make mega liquid wallets in exchange pages 🤫 .. also I still wonder this days how they even got justin suny's steem into their hands... ☕ and how it under the HIVE has been moved to the exchange pages and never come on HP 🙈 funny world we have .

But it was good post to read ☕👍👍🦊

You're basically implying that self-upvoting and vote-selling is the downfall of the network.

It's not.

That's a very meager amount of money in the grand scheme of the percentages.

like with most things its good to have goals

when crypto hit certain thresholds its best to just follow along with what you have had planned

You wrote this for me dude... selling is always the hardest thing ever.

I set some soft targets for myself this cycle so that I could take advantage of some smaller gains before things really got into gear. I thought I was being pretty conservative with my smaller goals, but we haven't even hit any of them yet, so I have a feeling I totally misjudged.

I can totally relate to this. Its so hard not to get caught up in the optimism of bull markets, and to admit to yourself when things start to turn. Unfortunately, I feel swings can happen fast, and you can easily start to lie to yourself that things will start picking up again, when in reality they may just keep dropping and you're left with the bag.

you must keep in mind that the money soon or late is done but you can use a few of your HDB o HIVE to put it in saves and earn 15% although others think that doesnt work hive will be bigger in a few years :D

FOMO and greed is really one of the struggles we deal with as people in the crypto world. Your suggested strategies to manage greed is workable and am definitely exploring that earning yields on HBD