Crypto is slightly in the green today.

Bitcoin is once again approaching that $44k resistance point and Solana flipped XRP on the market cap claiming the #5 ranked position. Of course most people round these parts refuse to touch SOL with a ten foot pole due to the premine and VC nature of the chain, but it's still fun to watch it go with some popcorn. Avalanche also made it into the top 10 today after going over x4 over the last few months. Impressive.

Unfortunately Hive is about to drop below the #300 rank which is kind of a gut punch but whatever. Hive do be like that sometimes. We often lag behind and then one day pump out of nowhere, which honestly is good for any type of volatility trading. I'm personally ready to make a big buy at 400 sats should the opportunity arise.

15 second commercials eh?

On the heels of Google changing their terms of service to allow BTC ETFs to be advertised on the platform we see that commercials are already being leaked for just this purpose. Notice how these are not 30 second commercials. AKA not made for TV and much more likely to popup on YouTube or where ever else. What a shock that YouTube just aggressively changed their ad policy to make them much harder to block and skip. What a surprise. Seems like all these things are just lining up perfectly all at the same time.

At this point the consensus strongly leans toward the idea that multiple spot ETFs are going to be approved around January 8th through the 10th. All the signals line up for this to be true, but the idea that the SEC is going to play fair is also a little bit ridiculous considering their track record.

We can clearly see that all the other final deadlines are in mid March (ides of March), so all it would take to push it back two months would be to deny or delay the ARK application, and we've all seen how much respect ARK has been given over the past few years (basically zero).

At this point the most conniving way this situation could play out is a flash-crash panic in January with a V-shaped recovery in March. The only certainty is that massive volatility is still 100% in the cards. Everything hinges on the ETF decision at this point. Volume is still in the gutter and most big players in the game are refusing the sell, but more importantly they are also refusing to buy as well, as this pushes up the price too fast when there are no sellers available.

Market cap doesn't move based on money flowing in and out.

This is a concept most people don't seem to understand. If someone sells a billion dollars worth of Bitcoin, the market cap doesn't change as long as there are buyers at the current spot price. Conversely, if there are no buyers at the current spot price then dumping that billion dollars worth of Bitcoin can move the market cap by a hundred billion dollars (like a 12% loss at current valuations).

We are not going to figure out where equilibrium is until people are actually willing to sell their Bitcoin. That means we need to see high volume on exchanges: x5 to x10 times higher than what we are seeing now. Only then can we start to get an idea of how much wealth is about to be transferred into new hands from old ones.

It's pretty much guaranteed that if the ETF gets approved then Bitcoin will will almost instantly be trading above all time highs again. That's already less than an x2 from here, which is honestly pretty hard to believe when taken out of context but here we are. The bull run will likely be kicked off early based on this greed play.

Many also wrongfully assume that the market is literally incapable of pricing in or frontrunning the ETF news. The idea being that an EFT will bring in so much money that it's impossible for the current market to absorb it. This is preposterous sentiment for the exact reason I just mentioned.

The market cap ratio could easily spike to 1000:1 just from the SEC confirming that the ETF is allowed. Meaning $1B of actual dollars entering the market would push Bitcoin's MC up instantly by a trillion dollars. That's a +117% gain from here. The Bitcoin ecosystem can pick and choose whatever price it wants before the ETF launches simply based on market sentiment.

What about altmarket?

I think it's almost guaranteed that Hive will lag behind if and when the ETF gets approved, which is why I'm so bullish on buying Hive at 400 or even 200 sats per coin. Hive can easily trade flat while Bitcoin goes x4 just like it did in Q4 2020.

Other alts are likely in a similar boat, just on different timelines. Usually in these situations Bitcoin has to dip a little and then crabwalk before traders are willing to gamble gamble on the rest of the market. It's going to be a crazy time to be sure.

Conclusion

These leaked interwebs commercials have more hype behind them then Super Bowl commercials. Speaking of the Super Bowl... that happens in February so we will likely see ads for the ETF there as well if approval happens in January like everyone thinks. Gonna be FTX levels of ridiculousness all over again.

We've reached the point in the crypto cycle where all we can do is hold on for dear life as the price goes up without selling out too early. Two more years of bull market to go, and Bitcoin will almost certainly lead the way as is often the case.

Since retiring, I’m past the phase of converting fiat to crypto, so just trying to juggle switching among BTC, HBD, and HIVE.

And then there’s the retirement accounts. My own is all-in on GBTC, for better or worse. My wife has three retirement accounts, two of them “professionally managed” but the third that I run. That one is crypto-centric. It’s only quarter of the other two. I’m hoping that a series of god candles lets her retire in 2025. 😎

What groups are you dabbling in with those? I’ve got some funds not allocated that I want to try and do some playing with. I got some assets in Riot bitcoin mining but I haven’t dabbled beyond that. Riot has matured nicely since I got the shares which is nice!

I have a game you can play. Send them over to me.

Hahaha sure, let me hook up my carrier pigeon!

Mostly BITQ, BITX, GBTC, and OBTC. BITX is by far the most aggressive/risky of them.

Cool thanks dude I will look into those! I have “managed” funds that I can’t do much with but do have some on my own that I’ve been trying to figure out what to do with haha

YMMV. 😉

My humble opinion is that the peak of this bull market will come sooner. Mostly because the majority is so tied to the four years cycle pattern.

Yeah, timing is a big question mark. For Bitcoin, the RHODL ratio seems to have a pretty good record. Altcoins are much harder to time though. Meh, if it were easy, we’d all be filthy rich.

Definitely has been a wild ride since I started paying attention.

I was pondering over the BTC daily chart a couple days ago and looking back at the last long slide, only to realize it was a year and a half ago! That is a bear market for sure. The daily charts ups and downs have obviously looked good the last few weeks and, though the weekly one scares me a little for the short term, I have sold at a couple peaks.

Getting a touch of FOMO thinking I may have sold too early but it is only in increments and I am ready to buy again lower.

Remember when an episode of Big Bang Theory was enough to pump? ;)

Looking forward to swing trading in a nice bull run again as things have been too stable too long for it to be anything much more than hurry up and wait. ETF time?

I have never doubted the bull market, I just know that there would be some consolidation along the way.

Cheers

Its already too late. There is no more corn left.

I would love a little pull back from where we are now before it goes wild. Unlikely to happen but I can dream! Lol. 38k doesn’t seem unreasonable?

The “leaked” commercials are anything but. It’s just testing the waters and trolling by these companies. Dangling the carrot in front of the crypto bros.

My go-long number is more like $33k-$35k.

I wouldn't mind that lol I put in a couple long shot buys at those mid 30's to see if any trigger

Somehow they managed to crush Binance, take all of the remaining FTX funds, sue Kraken 500 times and scare Bittrex to death before lowering rates and green lighting an BTC ETF.

Such coincidences, much wow for sure.

This post touches on the exciting momentum in the crypto market, from Bitcoin's approaching resistance to the rise of Solana and Avalanche in the market cap ranks. It speculates on the potential impact of the SEC's decision on ETF approval, highlighting how the market might respond and the complexities around pricing in such news. The anticipation of commercials, the potential flash-crash scenario, and the dynamics of market cap are all skillfully discussed. This post delves into the intricacies of market sentiment, forecasting potential impacts on altcoins like Hive, offering a comprehensive analysis of the present crypto landscape and its potential trajectories.

You talked about you having some funds that you can use to play a game

Why not play Splinterlands

It's all happening now! Jan is going to be epic

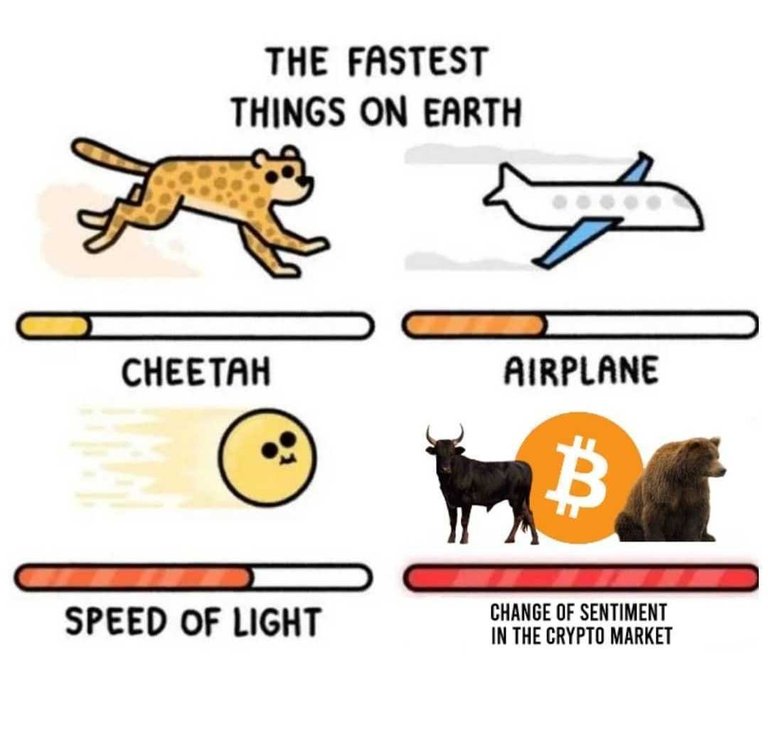

that's sure the fastest thing in the world.

I could see a crash happening. The big hands are going to want a chance to buy in cheap again before the pump actually happens. I don't put it past the government to manipulate the market at all.

Ho Ho Ho! @edicted, one of your Hive friends wishes you a Merry Christmas and asked us to give you a new badge!

The HiveBuzz team wish you a Merry Christmas!

May you have good health, abundance and everlasting joy in your life.

To find out who wanted you to receive this special gift, click here!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: