SHIT!

shit shit shit shit shit

Binance caves to regulators once again!

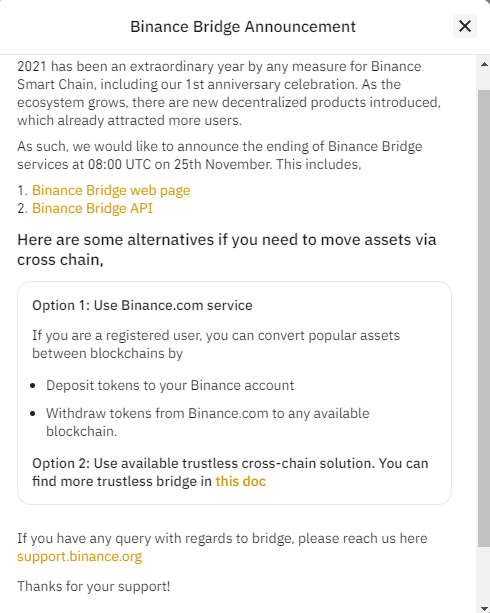

Sad day, as this was how I was importing value into BSC. After I got kicked off Binance I rebooted my Huobi account and was buying Litecoin and using this bridge to wrap the LTC into a BSC pegged version. Then I'd dump the LTC for BNB on BSC. Looks like that's no longer an option.

Huobi: the poor man's Binance.

Huobi is very annoying for several reasons. The site operates almost identically to Binance with a few slight alterations. However, those slight variances add up to a very annoying user experience.

Annoyance #1: Huobi is not connected to BSC.

Not only can you not withdraw to BSC from Huobi, but they don't even list BNB or BUSD as an option for trade. We can of course attribute this to competition and perhaps even regulation, but it doesn't matter. Not connecting to the world's biggest and best exchange or their EVM chain is a huge mistake. Crypto does not compete, so when competition is forced onto the space it makes those players look really incompetent and bad. Strike 1, Huobi.

Annoyance #2: Huobi is not up to date.

I can not transfer LTC or BCH from Huobi to the new wallets.

Just in case you don't know what I'm talking about...

New wallets look like this: ltcquzx0ft5048vchjq3kruzgfl3...

Old wallets look like this: MPmnjpyZFT72EAVrFwRuuUV...

If you try to withdraw to obvious LTC wallets that even begin with "ltc" Huobi says those are not valid wallets. It's comes off as very very very unprofessional and annoying.

Annoyance #3: Fees are double.

Binance charges 0.1% trading fees, and will even give you a discount if you hold BNB. Meanwhile, Huobi charges 0.2%. That's a huge markup. Of course 0.2% is still competitive with platforms like Coinbase Pro that charge 0.5%, but whatever. I want the 0.1% fee. Consumers demand the lowest price. #capitalism.

So I finally decided to take a look into Mandala.

This is something I should have done instantly right when I got kicked off Binance in the first place.

https://trade.mandala.exchange/account/signin

The weirdest thing about signing up with Mandala is that you don't type your password in twice! I was kinda floored by that. Everyone has users verify their password in a repeat field. Not Mandala exchange! lol. Get it right the first time or pay the price. I actually immediately logged out of my account and logged back in with my password just to make sure I didn't mess it up. Call me paranoid.

Is Mandala Exchange safe?

From what I can tell from the internets, Mandala was basically a fledging exchange that decided to abandon their old business model and adopt something called "Binance Cloud". All their security is enforced via Binance protocol. All their liquidity pools are Binance liquidity pools. From everything I can tell: Mandala basically IS Binance, or at least it's a very very accurate clone.

Referral link.

Mandala does have an interesting referral system. It is dynamic, in that you can allocate 10% of the commission to either yourself or the person you're signing up. Meaning you can give yourself the entire 10% commission using a dynamic link or you can split it 50/50 and give the person you signed up a 5% discount on their own trades. This is good incentive to get someone to sign up with your link.

Of course because there is no KYC on Mandala the smartest thing to do is just set up one account without a referral link and simply never use that account to trade. Then with that dummy account you refer yourself on the real account and scoop the entire 10% discount. Referral link hacks are easy when there is no KYC.

Test deposit

So I sent a test amount of 50 Hive to my Mandala account. It works EXACTLY the same as Binance, right down to sending the money to @deepcrypto8. The only thing different is that the user-identifying memo has two or three more digits than the ones given directly on Binance.

I then took this 50 Hive and dumped it for BNB, and cashed out the BNB directly to my BSC wallet. Success... it worked... too easy.

So basically I've gotten my Binance account back. Feels nice. Not only that, the withdraw limit is still 2 BTC daily, there is no KYC, and Mandala is connected directly to BSC with access to all of Binannce's liquidity. For all intents and purposes, Mandala is just an underground version of Binance.

This is quite surprising to me.

Funny how easy it is for these crypto companies to just continually sidestep regulations like this. I'm sure the regulators will figure it out eventually, but it's obvious they have their hands full. Who knows when they'll actually get around to it. By the time they do there will probably be ten new on/off ramps in/out of BSC and other EVM chains.

Another site I was directed to was https://anyswap.exchange/#/router

This one is connected to all the EVM chains I'm familiar with like ETH, BSC, and Polygon. It's also connected to a dozen other chains that I'm totally unfamiliar with. I'll circle back around to this one when the time comes.

ThorChain.

This is also another way to connect value from chain to chain, but it's been down for days. Not a good sign, especially when we consider that downtime in the future could be even worse. Just goes to show that this tech is complicated and no one truly knows how it works and what the problems of the future will be.

That being said I'm still hugely bullish on ThorChain (RUNE) after using it just one time, even though the experience was very clunky and somewhat complicated (noobs will have a very hard time). Still, it feels like magic being able to connect multiple wallets and trade any asset for any other asset without any pegged tokens being used. Every token being linked to main-chain security is a huge deal. There are no centralized attack vectors for trading: only if you decide to provide liquidity. And even then I'm not sure how big of a risk this is. The network seems to be playing it very safe in this regard, which a double hack that crashed the network down near $3 but was able to recover in no time.

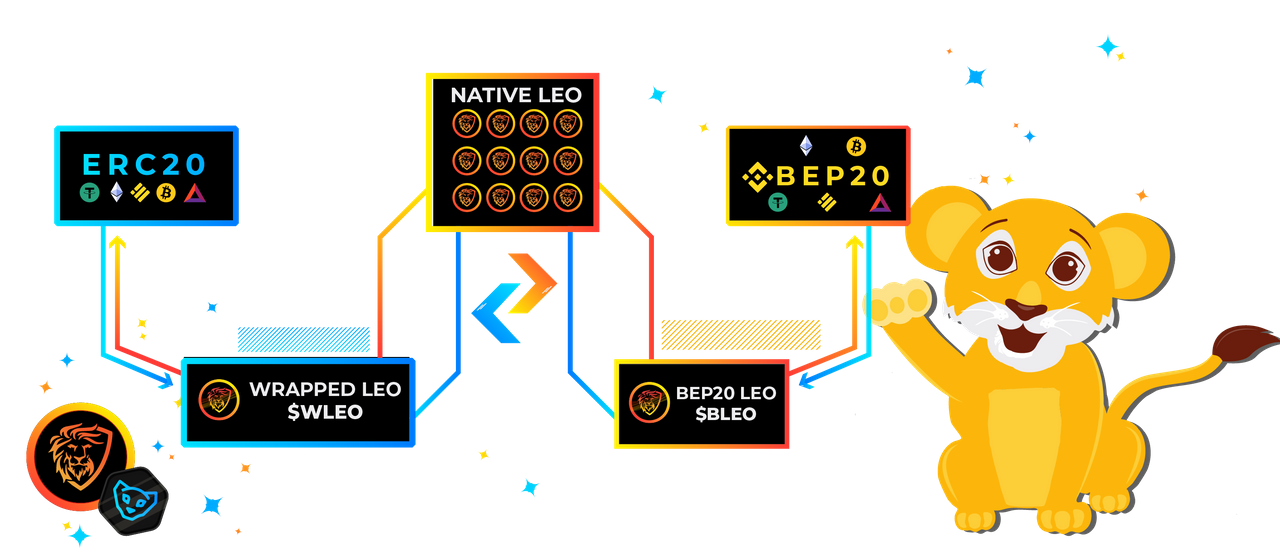

LEO Bridge

I have never used LEO Bridge because ETH is too expensive. However once PolyCUB launches it will be totally worth it to use the bridge to transfer value to/from BSC/Polygon. This is yet another example of how these regulators are shit out of luck and don't even realize it yet. The tech is evolving ten times faster than they plug the holes or regulate the bottlenecks.

When it really comes down to it crypto is just going to keep getting bigger and bigger, and these regulatory agencies are going to stay the same size. Their complete and utter pointlessness will be displayed in an embarrassingly transparent light within the next ten years.

The key to all of this is creating jobs.

Once crypto becomes non-speculative and anyone can sign on and earn real money for real jobs, this will mark the beginning of the end for the legacy system. Once users can work and spend their money within the system, capturing all the value created, well, that's probably when the war starts. The dying legacy economy will crack down as hard as they can, and they are guaranteed to lose, but casualties will be devastating on both sides I assure you. Stay safe out there!

Conclusion

I got my Binance account back.

Pretty sweet deal.

Crypto is moving at the speed of light and regulators are playing a ridiculous game of cat and mouse. Spoiler alert: Tom never eats Jerry.

Posted Using LeoFinance Beta

Well... They want to be legit and to get a piece of the US and European markets. The sad thing is that they will be kicked out. The US never let any competitor in thriving industry.

So many examle:

So no hope for this Asian company to ever be accepted. They should just acknowledge it hehe

Posted Using LeoFinance Beta

US regulators are so backward.

This doesn't help you.

It doesn't protect you.

All it does is force you to look at shady, offshore alternatives that don't give a fuck.

By choosing to ban exchanges instead of actually educating their citizens and allowing them to make informed choices, all regulators are doing is speeding up the offshore, decentralised web.

Short-sighted and overall a MASSIVE negative for the US.

...Yes I know the reality is that they're not there to 'protect' their citizens, but simply to increase the government's bottom line in the cheapest, easiest way possible.

Posted Using LeoFinance Beta

You've touched on the most important thing:

Which is how frustrating it is that so many gullible people think the government protects them.

This is why we can't have nice things.

That is awesome, I am going to have to check that out.

I had honestly never heard of it before. You are in the US right? So there are no issues with that?

Posted Using LeoFinance Beta

I didn't risk it and just logged into Switzerland with my VPN like I always do.

Yeah, I tried to sign up and they flagged my IP address. I will have to try again with my VPN on.

Yes, there are issues with that. One can get around them with a VPN, if they so choose ...

Posted Using LeoFinance Beta

Yeah, I noticed that. I tried to sign up and I got the message that I was in a restricted region.

BSCBridge.

https://bscbridge.deathwing.me

tips fedora.

lol @ fedora

I remember seeing a mention of this once then recently when I tried to find out which it was as I had forgotten I couldn't find a trace so cheers for this!

Man the world's gonna be a different place when Thorchain and its competitors are fully developed. Frictionless trading across all blockchains 😌

For realz.

It's hard to even imagine.

Regulators gonna lose their shit.

Congrats! I am hoping to use rune for such in the future. I shifted a bit out of CUB to buy rune. That day or the next Thorchain went down :-(

It came back up today and am waiting to swap into RUNE through a site called Thorswap. Thorchain should be nice because you can do BTC, LTC, BCH, BNB, ETH. More to come supposedly in the future. On top of that, you can do pooling as you said.

There is a beta wallet for Thorchain called xdefi. It is beta and therefore risky (much like Thorchain is risky), but I have used it and it is very nice :-) so far. You may have already looked at xdefi, but if not, take a gander. Lots of potential as a possible metamask competitor. Feels nice to see all of my things in one wallet on one screen and be able to swap between them (theoretically anyway -- if the chain is not down ;-))

I realize I am probably preaching to the choir, who probably knows more than I do about all this. Just wanted to get it out of my system :-)

Posted Using LeoFinance Beta

Binance Bridge closing isn't a surprise. At least there's a ton of other bridges we can use.

Posted Using LeoFinance Beta

They have also the Mandala Exchange Token (MDX). It took a hard hit in the recent months but is doing quite well now. If many people switch to Mandala similarly like you, it could become a next BNB - who knows?

That sounds like a nice system. The referral link hack is also quite nice. For Binance, you made an account but no KYC right? So this means you can transfer in and out of BSC without any issues?

Posted Using LeoFinance Beta

Yeah no KYC.

I forgot to mention I use a VPN so that my IP address is from Switzerland.

Interesting. I am going to have to try Mandala. I had been trying to sign up for Rune, but I couldn't understand it. I love the idea, but they need to make that easier. Anyway, interesting info. Thanks! Will go to Mandala now.

Yeah when I did Rune it was a huge pain in the ass.

I got it working but I was like hot damn that's going to mess up a lot of ppl.

I have been using Changelly to do most of my cross chain action lately since they have added Hive as well as using Tribaldex. I am sure I may be losing some to fees here and there, but I have gotten used to that. Been mainly going from BSC into Hive though so the both methods work well for me. Was trying to use Simpleswap for a while, but they have high minimums, and I am usually not sending that much money.

I somehow hoped the exchanges wouldn't bow to regulatory pressure without a fight, I can see that they've choosen a very smart one

I like how you explain this mandala,is easy to understand. Thank you.

But just hearing about this mandala now.

Posted Using LeoFinance Beta

Hi @edicted

I am very sad to hear this news, as Binance Bridge is a great portal in or out of BSC. Plus their Eth fees are very low, almost nothing to move money in and 20-30 USD in Eth to move Dai out. Which is very reasonable for any Eth transaction. If you try this on Uniswap Exchanging $500 in Eth for $500 of WLEO costs nearly $USD, then moving WLEO to Bleo across Leobridge costs more in Eth fees. High Carumba!

I guess I will use my Binance account, I am told it’s easy to trade bsc BNB for regular BNB, then Dai people, except for people from North Korean, Iran and the USA.

Thanks for sharing your experience on Mandalay exchange. I should open an account with them, because it’s always good to have a Plan B, when it comes to crypto.

Now that I am active with Splinterlands I can buy SPS there and send it to Splinterlands directly, the bridge is hidden in the user interface and there’s no fees. Then I can send SPS to Hive-Engine, to trade SPS for Hive, and the sell Hive on an exchange or stack it.

Posted Using LeoFinance Beta

Reblogging this one for later when I need it!

Posted Using LeoFinance Beta

use @deathwing swap tool. Hive to BSC and back.

GM!

When????

Wao after Binance, I was out of centralized exchanges for good. Thanks for pulling me back in... lolzzz

Posted Using LeoFinance Beta

The tom and jerry analogy is dope. I see it the same way. Crypto is inevitably evolving too fast for them to catch up with horses, buggy's and carriage.