The decisions on the spot Ethereum ETFs are still pending, with final deadlines for the SEC today and tomorrow for two of them.

There is a pretty comfortable majority thinking they will approve them, given the change in approach. VanVick and Fidelity already have tickers listed on the DTCC but inactive, waiting for the approval (something that happened exactly the same way prior to the approval of the spot Bitcoin ETFs in January, except they were temporarily active, probably by mistake).

I also believe they will be approved, but it's not much time until we'll have the official answer.

In the meantime, I read what was the amendment required by the SEC for the spot Ethereum ETF applications. Their requirement was that the underlying Ether coins of the ETF will not be staked, thus not participating in the Ethereum governance, I add.

That's obviously a great provision that makes taking over control of the Ethereum governance unlikely through the spot Ethereum ETFs.

However, even if Ether from ETFs isn't staked, it is still kind of locked into the ETFs, subject to operations with the shares into the funds. But I believe governance concerns were not what prompted this requirement. It's a great one, nonetheless.

If we expect these funds to grow - and we do - on top of the staked Ether, there will be another category of Ether in the ETFs which may create liquidity issues on Ethereum.

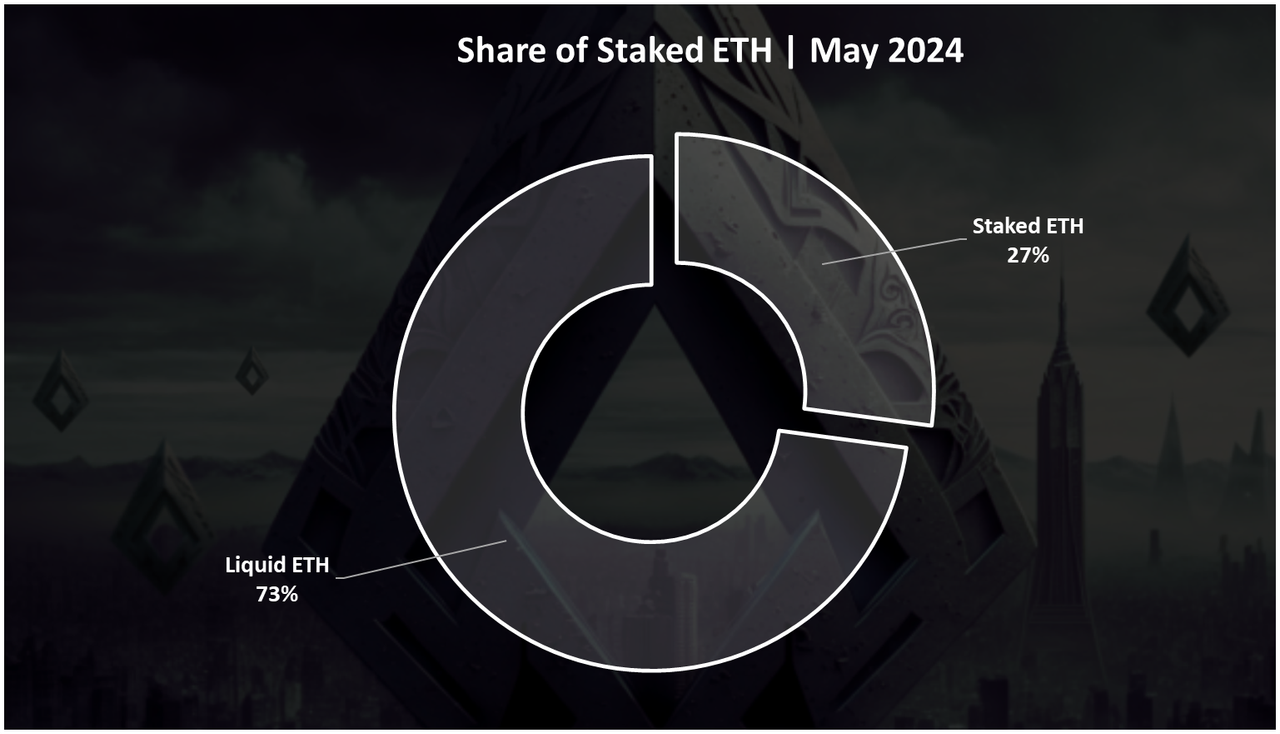

If we check @dalz's report on Ethereum staking levels from about a week ago, we see 27% of all Ether is staked, as in this chart I borrowed from his post:

What this chart doesn't say, but other charts say on dalz's post, is the trend of growing staked ETH compared to liquid ETH.

From another useful post of dalz from the beginning of the year, we learn that after switching from POW to POS, Ethereum became deflationary for the first time in 2023, a trend that is likely to continue, if nothing changes.

That means that the supply of ETH is shrinking as time goes by, instead of expanding. Couple that with an increase in staking, the likely large chunks of ETH that will be swallowed by the spot ETFs, and Ethereum may turn from a liquid coin to one with liquidity issues. And that is an issue for spot ETFs because they need liquidity to operate without creating serious volatility when they go in or out. I believe a similar discussion can be made on spot Bitcoin ETFs at some point.

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha

That's a great point and I am curious how it will develop. Would it make sense to buy the ETF with no staking income? I do think we could see selling pressure from Greyscale once again though.

I have picked this post on behalf of the @OurPick project! Check out our Reading Suggestions posts!

Please consider voting for our Liotes HIVE Witness. Thank you!

That's a good question. It makes sense for people who have no idea about crypto and don't want to learn about it. Just use fiat as a proxy for crypto.

I don't know what are the details of the Grayscale application for the spot Ethereum ETF, but I suppose a migration of funds to other ETFs is possible here as well.

That is a nice analysis. I do not follow the discussion and what is happening, so getting updated on things from the authors that I follow is really awesome. There seems to be a lot of ETH still liquid, and there are still more being created, is the risk of low liquidity already a concern this early on?

Ethereum became deflationary last year for the first time (after switching to POS), which means they burn more ETH than they issue. There is still a significant amount of ETH liquid, but that can change seriously over time, with all mechanics converging toward less liquid ETH right now.

That is what I was unfamiliar with. How are they burning ETH; is it required for staking? And wouldn't the introduction of ETFs lessen this burning since they are just going to be idle in the exchanges?

I'll need to check myself further. Since it's POS, I suppose they might have like us, a null account. In fact, I'm almost certain of that, since there is one of BSC and Polygon, and they are EVMs. Now, I don't know if there is some sort of automated mechanism that burns ETH, or it's purely voluntary.

Gotcha. A null account would be the logical solution.

Just a while ago it was announced that ETFs have been approved so it will be a very happy news for all of us for the time to come.

Yes, I read about that. It's a half measure, from what I read, which is even better, in my opinion. I'll write about it in today's crypto weekly update.

Oh, that is an interesting decision but I think it makes sense. If they stake the ETH, they will affect governance and taking out that ETH could be troublesome.

That is the second part of why staking ETH is troublesome. Unstaking ETH takes time, as far as I know, so it becomes iliquid, which is highly unrecommended in case of an ETF, where they need to serve massive withdrawals if that is necessary.

The SEC's approval of the ETF will leave them with many problems in the coming years. There are many projects similar to ETH and the SEC wants to put them in a different category and ban them.

By the way, I think the ETH staking rate is very low. Even in Hive, this rate should be around 40-45%.

You may forget they recently switched to POS, so staking level slowly grew over time. And there is another "issue" with staking on Ethereum. There is a 32 ETH minimum staking requirement, which pretty much makes staking a whale game or done via staking pools. But there may be ETH holders who don't want to give control of their ETH to a pool, in return for the staking rewards.

On something like Hive, you can stake even 0.001 HIVE, so no lower limit (or upper one, for that matter). If we disregard the liquid HIVE on Upbit which seem to never move out from that exchange, the staking ratio is much higher, which yes, I believe can be an issue at some point. Despite all that, HIVE seems to be one of the most active coins on the markets when it comes to daily volume, which is an interesting aspect to remark.

It seems like an impending problem that's looking to happen, and it's probably wise to stall on that spot ETF for Ethereum

Yes, it probably is. I've noticed that when there is strong enough pressure, potential issues are ignored. But they won't go away.

They surely won't go away, but I guess a lot of people just want the spot ETF for eth to happen, howbeit. The market is precarious at the moment and it's most just the pumps for many people

We can see that from how popular meme coins are...

Maaaaaaan,It's fascinating when unexpected alliances emerge. Can't wait to delve deeper into this topic with you buddy

I'm pretty sure we'll have some good news today...

Hopefully my good friend hopefully 💯💯💯💯

Maybe there will be a news to make crypto lovers happy later today

I’m watching out😁

I'll have to check out in the morning... Too late for me already.

Congratulations @gadrian! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 19000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPHello @gadrian. Thank you for your post on "I Can Finally Agree on Something with the SEC." I'm glad the SEC doesn't want to take control over the governance of Ethereum. Is that right when I said the SEC doesn't want to take control over the governance of Ethereum? I want to make sure I'm understanding this all correctly. Did the SEC take control over staked BTC?

No, it was about the ETF fund management firms that could have had a major say in the governance of Ethereum if the Ether they will buy for their clients would be staked and voting.

OK @gadrian so how did this make you agree with the SEC? I got kind of lost reading.

They asked the applicants to revise their applications to not allow staking of the ETH they buy for the ETFs, which otherwise could have been staked and used in governance decisions.

Oh OK so is this good? Sorry I can't seem to read lol, so no one could take over?

Ethereum ETFs couldn't. But others could, if they buy or hold ETH directly and stake it, and hold a controlling stake.

OK, @gadrian thank you. All of this is sure complicated because I can't remember all of rules and things.