Short, sweet, to-the-point analysis.

1...Silver and Gold are highly correlated, meaning that if Gold goes up, Silver goes up as well. And Silver tends to outperform Gold during bull markets.

2...As global central banks try to print their way out of a crisis, the value of their currency starts to decrease. This is the ideal environment for assets like Gold and Silver (considered "real money") starts to rise.

From a technical perspective (relative to the 2011 highs), it is still extremely cheap.

Gold, on the other hand is almost at all-time-highs:

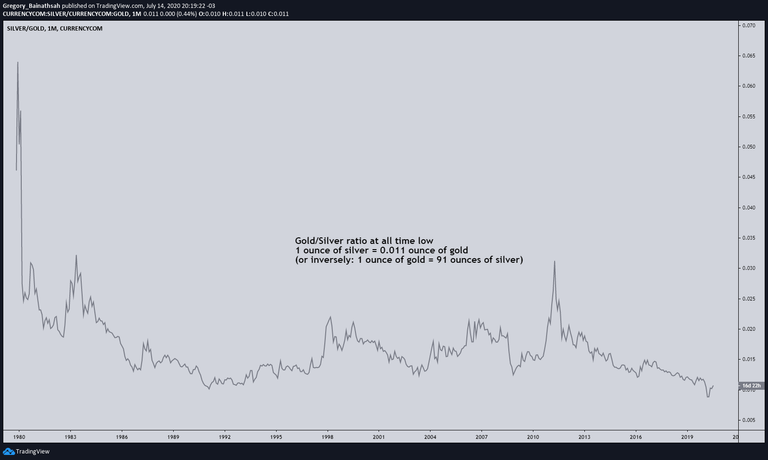

3...With Gold clearly in a VERY strong trend and with Gold and Silver being very strongly correlated, Silver is – measured by the Gold/Silver ratio – historically the cheapest it's ever been, relative to Gold (at least since the available data).

Keep in mind, this is just an educated opinion. What to buy and how much to buy should depend on your individual risk-tolerance and goals, not my opinion.

Also; there are plenty of factors that might go unexpected. Nobody can predict the future every time, so we manage risk all the time.

Congratulations @gregg0! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!