It's been a month since the last time I touched DeFi and I am glad to do it on time this every month. I saw a post mentioning how much CUB was burned and there are constant posts mentioning the returns from the platform. Overall, I believe in the LEO community and that CUB can rebound. So I use some of my earnings here to fund my Defi adds.

CUB

It looks like the roadmap documentation page is blank after an update 11 days ago. I liked to look at this to see what is planned to the platform so I hope they do fix this page.

518k CUB was burned from March 2021 to August 2022.

523k CUB was burned from August 1st 2022 to September 30th 2022.

On the other hand, the multi-token bridge is burning a lot of tokens. It managed to burn more tokens in the past two months compared to the 18 months before it. I think the new HBD and Hive farms are doing a great job generating income to buy back CUB.

PolyCUB

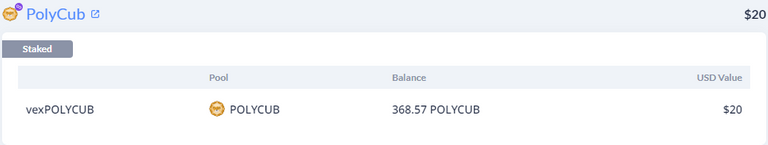

There have been no changes in the PolyCUB roadmap. I haven't really seen anything talked about for Polygon so this is still on the sidelines.

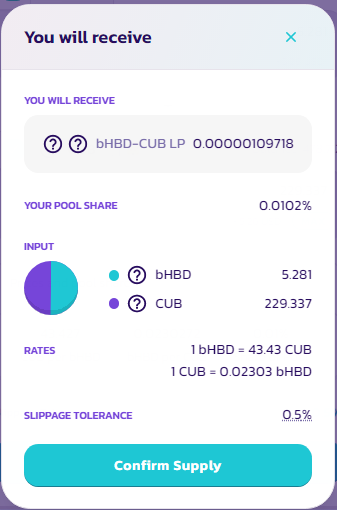

Monthly Add

I sent 201 LEO tokens over to my metamask wallet using the the wLEO bridge. After removing the 1 LEO token fee, I was left with 200 LEO tokens. Of which, I changed half into CUB and the other half into bHBD. It's the same plan I did last month but it looks like I got a lot less LP for the same amount of LEO and I didn't get nearly as much bHBD or CUB from this. So it looks like the drop in price for LEO isn't looking that great.

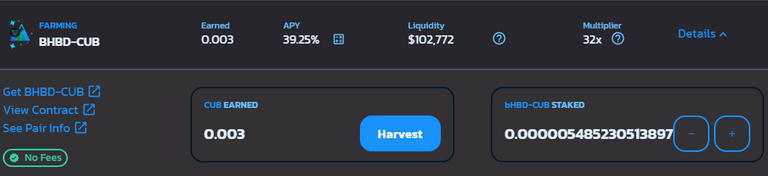

The APR is down from last month but there is also more liquidity in the pool now. So it means that my share is lower now that there are more funds in this pool.

It looks like the price of CUB hasn't changed much but the multiplier has dropped from 33x to 20x in the kingdom. I am not sure if I will bother investing as much into this kingdom starting next month. Maybe I will consider collecting some more BNB instead to pay for fees and if prices dip further.

My portfolio last month is above and my current portfolio is below. I decided to start tracking my PolyCUB position even if it's only vexPolyCUB. I don't have the value from last month so I will start tracking this going forward.

It looks like CUB price has gone up in price and bLEO/BNB has dropped in price. So my total value in Defi has gone up slightly from last month. However, it's a bit too sad to see that my Defi position used to be closer to $1k (with my DEC position that I removed last month).

Please make sure to invest only what you can afford to lose and nothing I said is financial advice. Feel free to leave a comment if you read my post. If you have any questions, feel free to ask and I will do my best to answer.

Posted Using LeoFinance Beta

I still have my CUB staked in Kingdoms. Am yet to get back into DeFI. Good to see you are doing good.

Posted Using LeoFinance Beta

The multiplier on Kingdoms has dropped so I am wondering if I should just stock up on some BNB instead of putting them into the kingdom.

Posted Using LeoFinance Beta

I’d stick with hive itself. Just me

It's not a bad choice and I am thinking I might start taking some profits off of CUB. For now, I think I might take the harvested CUB and get some BNB. I can always convert that into Hive or HBD when I want later.

Posted Using LeoFinance Beta

Is it really DeFi though? Anything run here as a tribe token isn’t a decentralized blockchain

Well, I do think CUB is Defi and I know that not everything is full decentralized. I do think it's getting there and HE has it's own witnesses now. I tend to believe that more as I trust the team behind LEO more than some random project online.

Posted Using LeoFinance Beta

It’s called DeFi but is is really decentralized I mean. Like how is it “getting there” ?

Cub as far as I know isn’t decentralized. Might still be a ok project but I don’t see how it’s not centralized. These tribe tokens are ultra centralized. I just see the De-Fi label being used everywhere and there some of the most centralized projects around.