Moscow exchange has had years of experience in offering trading solutions to institutional investors and running self-developed applications for the traditional finance market. With much impact made in the traditional market sector and much experience garnered, the Moscow Stock exchange has channeled efforts into the emerging and booming cryptocurrency sector. One clear goal, to deliver cryptocurrency trading solutions to institutional clients and subsequently to individual and independent investors.

MOMEX, a subsidiary of the Moscow Stock Exchange was created as the lead entity for this goal. MOMEX has since channeled its efforts towards developing arbitrage trading solutions for traditional markets and cryptocurrency institutions like cryptocurrency exchanges. Operating under the umbrella of MOSDEX; MOMEX has made plausible progress, especially where it concerns developing centralized trading solutions.

The MOSDEX arbitrage trading protocol was developed as part of this drive. The Arbitrage protocol collates the trading prices of an asset across different exchanges and compares them. It detects the difference between the prices of the asset on these trading platforms and swiftly trades the arbitrage by buying on the cheaper exchange and selling on the costlier exchange. It is built to seamlessly traverse between exchanges and employs profit management strategies to ensure that every trade is completed with a net profit.

MOSDEX’s arbitrage protocol is deployed on multiple centralized exchanges to check the prices at which an asset trades on these exchanges and compare presiding prices to evaluate an arbitrage opportunity. The Arbitrage protocol gains access to the exchange’s orderbook through the exchange’s API and conducts trades through empirically developed strategies.

The MOSDEX arbitrage protocol is designed with conditional shifts to serve different market conditions and also different market architectures. The protocol can trade arbitrage on centralized markets (as described earlier) and also on decentralized exchanges.

The ability of MOSDEX’s arbitrage protocol to traverse decentralized financial systems is impressive. The aggressive technology it offers to the decentralized market is set to serve a sector of the crypto space that is becoming even more important.

With the recent wave of tragic events rocking centralized cryptocurrency institutions, most resulting from dishonesty from major role players in centralized cryptocurrency institutions; cryptocurrency investors are seeking a more secure approach to cryptocurrency engagements. The solution lies in self-custody applications. Self-custody applications include decentralized lending and exchange applications, cold wallets, decentralized leverage trading platforms, and the relatively less pronounced decentralized arbitrage trading applications that MOSDEX is pioneering.

Cryptocurrency arbitrage trading is gaining ground and decentralized arbitrage trading solutions are emerging. MOSDEX hopes to play a leading role in both areas. Here’s how it is working towards achieving this goal;

Plausible transitory technologies

With a solid technology introduced to exploit arbitrage on centralized exchanges, MOSDEX’s arbitrage protocol also works on decentralized markets. The decentralized arbitrage protocol identifies crypto assets listed on decentralized exchanges using their smart contract addresses. The prices of these assets across different decentralized are evaluated for arbitrage opportunities.

The arbitrage protocol can trade arbitrages across decentralized exchanges on different blockchain networks and also between centralized and decentralized exchanges in case a more profitable arbitrage occurs between these two platforms.

Crypto assets on decentralized markets can be identified using their smart contract addresses. DEX aggregators use a similar technology to detect the trading price of an asset across different exchanges and offer users the best sale price. MOSDEX’s decentralized arbitrage trading solution uses a related technology but in a more advanced way. Instead of just detecting the price differences; it goes even further to execute trades on the various decentralized exchanges in a way that generates profits for investors who committed their funds to the arbitrage trading protocol.

Like orderbooks on centralized exchanges; price development on decentralized exchanges also experiences lags and spikes depending on the liquidity and trading activity on the platform. MOSDEX arbitrage protocol’s ability to transition from API connections (for centralized exchanges) to snipping smart contract addresses (for decentralized exchanges) is a unique ability. One that sets it apart

Stock exchange history

The stock market might share a lot of differences with the cryptocurrency market, but both markets are championed by people with an undue ability to create market strategies through empirical studies. Experienced players in any of these spaces can easily transition to the other and depending on the experience they gained from their former engagements and their understanding of the asset market, they can quickly become pacesetters.

MOSDEX enters the crypto space with members from the same team that made exploits in the traditional finance sphere. The drums roll quicker in the crypto space thanks to outspoken volatility, but the MOSDEX team is aware of market changes and how to manage them. If there is an obvious reason why they should master the murky waters of the crypto market, this is certainly on top of the list.

Mouth-watering incentivization schemes

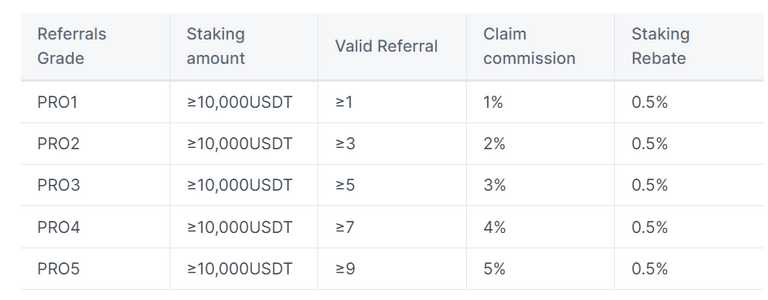

MOSDEX rewards its users in various lucrative ways. Through its referral program, MOSDEX gives back in many ways to users for spreading the word about their favorite arbitrage income platform. Through this program, incentives are given to existing users who invite even more users to the platform. Users can earn up to 5% of the referee’s profits for as long as they both stay active on the platform.

The arbitrage protocol itself is a huge passive income opportunity. You can earn handsome returns by staking your low-volatility asset to the protocol and watching your rewards accumulate in real-time. MOSDEX’s arbitrage protocol offers a daily return on investment of up to 0.5% depending on the state of the market. Minimal actions are required from the user while the protocol works on their behalf to return maximum income.

Through the Profit Sharing Model (PSM) MOSDEX also distributes a fraction of the revenue it generates to its users. Users will through this scheme, benefit from the overall success of the project as they automatically are shareholders of the platform.

Asset security

Committing your assets to a computing protocol could be daunting and considering the events in the crypto space in the past, this fear is quite understandable. MOSDEX is aware of its duty to protect users’ deposits, not just by being honest about their custody, but also by ensuring that external parties don’t tamper with the funds under their guard.

To carry out its duty, MOSDEX claims to have developed special asset management systems and technologies that keep users’ deposits beyond the reach of external parties and also limit their reach on users’ deposits. This ensures that deposited funds are readily available to their owners on request. With this in place, it opines that users rest assured of their funds’ security. It is also advised to apply personal risk management principles in this aspect.

Future expansions

MOSDEX is developing, with every new commit, it gains more technology, and with every administrational breakthrough, the team edges closer to achieving more goals. MOSDEX is evolving into a democratic and open system. First built to serve institutions, it is now opening up to individual investors. with Bitcoin and USDT already integrated into the protocol and working well, the team will hope to add even more assets and enlarge users’ asset options while introducing its technology to more cryptocurrency communities.

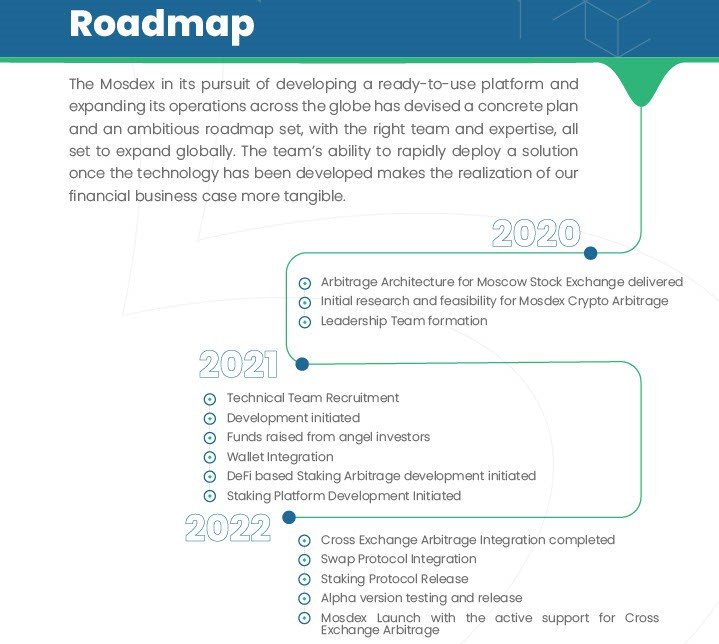

MOSDEX’s roadmap gives a hint of what the project hopes to achieve in the future. The published roadmap dates from 2020 to 2022 and from the records, the team has stayed up to time with their projections. The arbitrage protocol was scheduled to launch in 2022 and rightly went live in the third quarter of 2022. MOSDEX will be hoping to publish the roadmap for subsequent years and work towards the deliverables and maintain their timeliness.

Conclusion

It’s many things to love about MOSDEX. In addition to having a drive for authentic technologies, it is managed with a system that roots organic and exponential growth. As the crypto space advance to decentralized alternatives, MOSDEX is advancing towards this route as well and even setting the pace for similar projects. the systemic approach to trading, profit management, risk management, and fund security can be applied to more vast financial spheres and still maintain its potency.

We are seeing an era of advanced tools emerging into the crypto space and being propagated through the crypto winter as the market looks towards shrugging off the harsh crashes seen in recent months and reclaiming generalized profitability. MOSDEX will hope to continue its development as it welcomes new users. Yet to get a MOSDEX account? Click Here to create one.

As a standard, always conduct proper research before investing in a cryptocurrency project and apply caution while interacting with high-level computing protocols. Once again, get a MOSDEX account today!

Posted Using LeoFinance Beta

Congratulations @joelagbo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 99000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!