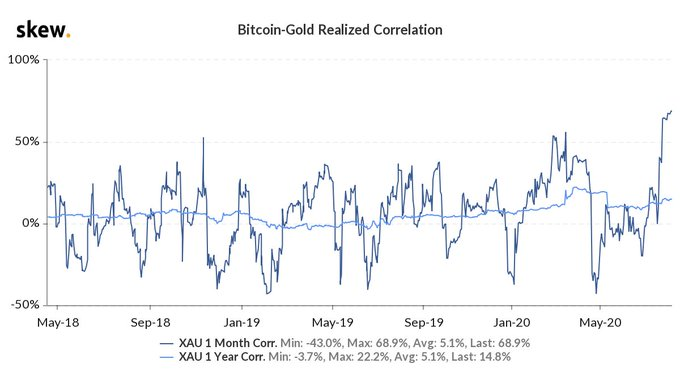

Bitcoin is again strongly correlated to gold, currently seeing record high correlations

Ever since the pandemic really started back in February/March, stocks and bitcoin had been trading pretty much in lockstep.

The correlations between stocks and bitcoin were at record highs, causing some to question the store of value narrative surround bitcoin.

More about that can be seen here btw:

Well we are currently starting to see those correlations between stocks and bitcoin break down.

As I type, stocks are up significantly while bitcoin gold and silver are all down significantly.

This shouldn't be that surprising to those of you that have been around bitcoin for some time, but even then, the positive correlation between bitcoin and gold is actually at an all time high.

Check it out:

(Source: ~~~ embed:1292763517360189440) twitter metadata:c2tld2RvdGNvbXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9za2V3ZG90Y29tL3N0YXR1cy8xMjkyNzYzNTE3MzYwMTg5NDQwKXw= ~~~

As you can see, the bitcoin/gold correlation 1 month correlation is at an all time high.

Buy Bitcoin Gold and Silver when the money printers go brrrrr

This again gives credence to the store of value narrative of bitcoin and the idea that it should do well when central banks are printing money.

Speaking of which, that is likely a big part of the reason that bitcoin gold and silver are all down significantly today.

A week ago it looked like we would have a new stimulus bill approved by the end of last week.

Not only did we not get a new stimulus bill passed, but it sounds like both sides are still far apart, meaning we may not get one this week either.

I imagine at some point they will come together and pass something that the economy and American people badly need, but it may not be for another couple of weeks.

Which is not what the markets (bitcoin gold and silver) wanted to see.

There is a lot of damage done to the economy that will not be remedied any time soon which means we are still likely very much in an easy money environment and will be for some time.

For that reason, big dips in bitcoin gold and silver are likely buying opportunities as we go forward.

Stay informed my friends.

-Doc

Posted Using LeoFinance

I've never understood the obsession with trying to correlate Bitcoin to other assets. It's all short-term nonsense; only day-traders should care. On the macro side of things Bitcoin is correlated to nothing because it's a unicorn asset making exponential gains every year.

Money flows like water. Everything is correlated, until it's not. I find the obsession with all the assumptions made about Bitcoin's short-term correlations more fascinating than the actual correlations themselves.

So much noise.

Do people even remember they thought the opposite thing the day before?

They certainly won't admit it!

It's kinda mind-blowing at times.

It's not about thinking anything per say, it's a fact. At times bitcoin is correlated to gold, and at times the stock market and other times neither. It matters to macro funds that are trying to put together the best long term risk-adjusted portfolio they can. If bitcoin often moves along with stocks, there isn't much of a reason to own it. If it mostly moves on its own accord or along with gold, it offers diversification away from one's stock holdings. It's not just about labeling it something, it's about deciding whether it actually makes sense as a long term hedge in a well diversified portfolio.

I will say it's fun to be correlated with gold because people call it Gold 2.0, but that just opens another can of worms trying to compare a digital asset with a physical one. It's just more misinformation. Gold 2.0 should make Gold obsolete by definition, but that again is an impossibility because the two products don't even appear on the same plane of existence.

Ha yes, that is a good point. That would be fine by me if gold just became another "jewelry metal" and bitcoin takes the majority of its $10 trillion dollar market. :)

Gold is also used in electronics.

I guess you probably already knew that though... although I didn't know the estimates given.

And it's used to reflect space radiation apparently? So we might use it more if we do more space exploration.

Also if gold loses market cap to Bitcoin that will make many mining operations less profitable, thus reducing the supply and maintaining equilibrium at a lower level. It's not like its value can just get wiped out by Bitcoin SOV. I'm actually more worried about property SOV tanking because of Bitcoin more than gold, because buying property is a huge commitment with a lot of overhead, while anyone can buy any amount of Bitcoin or Gold without taking out a loan because it's Fungible.

If property stops being the goto means of storing value for citizens that will be hugely disruptive to the economy and change the entire game. Imagine going from wanting a house with a white picket fence... to wanting to own one Bitcoin :D Crazy thought.

Yes though people do need places to live and the population is ever increasing while land is staying static... And remember, it is often the land that the home is built upon that you are investing in, rather than the house itself. Though people love to talk like it is actually the house. Yes kitchens and number of bathrooms matter, but in general a house is a deteriorating/depreciating asset while the land it's built upon is not.

True, but I feel like that just opens up another can of worms. The only way to truly own land is if you can stop someone from taking it by force (military). It is arguably the government that owns all the land and they simply rent it out to the population in the form of property taxes.

Meanwhile, you can actually own Bitcoin and the government can't take it away from you if you take the proper precautions. In fact, they wouldn't even know how much one controls if one played the game very well.

It sounds like such a nonsensical dystopia thought-experiment not based in reality but I get the feeling it will become more legitimate over time.

We could see a property death-spiral, especially if crypto city-states start popping up that allow citizens to own property without paying any taxes on them.

And that is interesting regarding the amount of gold in electronics. I knew it was of course, but I had no idea the actual dollar amount. $.50 per is higher than I expected.

Yeah but from my perspective Bitcoin has done nothing but go x2 every year so from my point of view all these conclusions being drawn are just flat out silly. Bitcoin can decouple for a week and go 10x and it's like no one's paying attention to that. Feels like I'm taking crazy pills over here.

True, but not everyone has your perspective and/or expects history to keep repeating. Past performance doesn't guarantee future results and all that...

Yes, but the aggravating thing is going to be when history DOES repeat itself and everyone just continues on like they were never wrong. Happens all the time.

The only plus side to that is that if people keep making the same mistakes over and over again I can profit off of that using zero-sum game-theory, but that's not why I'm here so it's disappointing. Silver lining.