Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

Oh my goodness, I have overslept by a few hours so this report is a little later than normal. It's been a while since I slept for 12 hours. Been working 6 days a week for maybe 8 months now and just pure wrecked all the time.

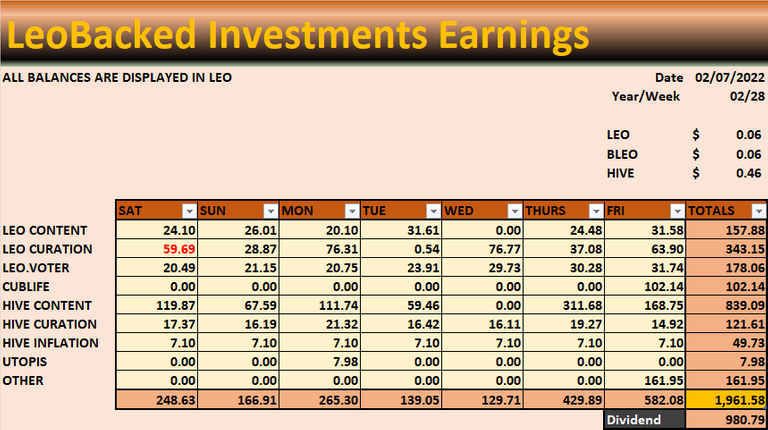

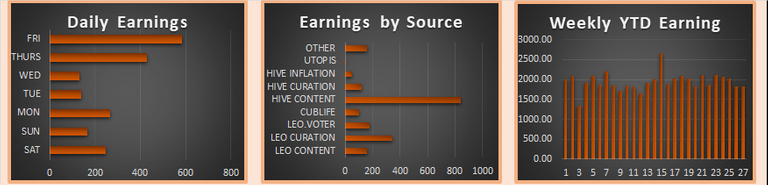

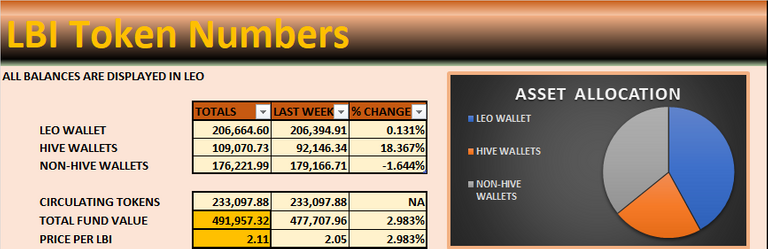

This weeks earnings are on par with what they have been for the past month are so and floating it just under 2000 LEO. LEO curation rewards have really dropped off because of the LEO power-up days. I had hoped that more LEO being staked on the platform would result in maybe a small increase in LEO content rewards because people would have bigger staked LEO balances but it seems to not be the case as LEO rewards have declined.

CUBlife had a good week and this increased by 30% for us, UTOPIS paid out this week but I learnt that the project is now as good as dead as its operator is pulling funds off HIVE and sitting up very cheap buy-back walls.

HIVE content rewards have mooned this week and it's our top earner. It's going to be interesting to see how the bear market will affect the LEO to HIVE ratio over the next 6-18 months. LEO has to be closer to it's bottom compared to HIVE. All in all, we ended with just under 2000 LEO again this week, not bad.

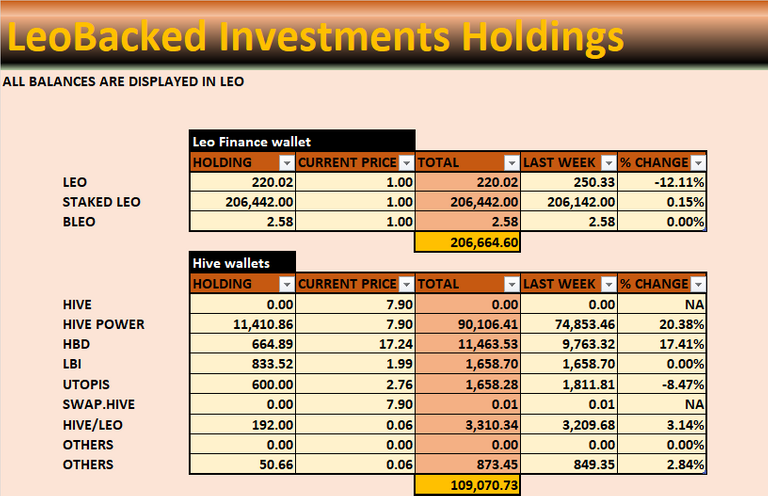

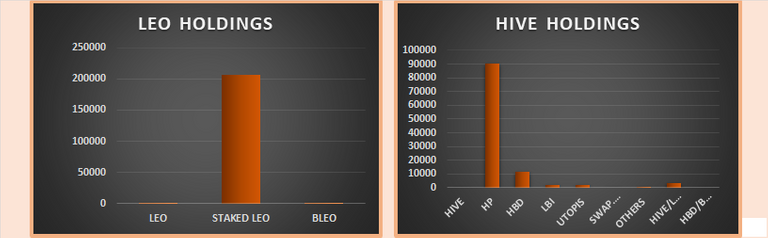

This week i took out 100 HIVE power down, convert x amount in 20 HBD to bring us to an HBD balance of 50 and then added that to the savings wallet. I took the remaining HIVE, converted it into 460 LEO and stacked 300 of that. I notice that our HP balance is not decreasing that much as we power down so we might be able to maintain a 100 HIVE weekly power down for a few cycles, depending really on the HIVE to HBD ratio. As for UTOPIS, i might try and dump it, i need to look into it more and decide what's best long term.

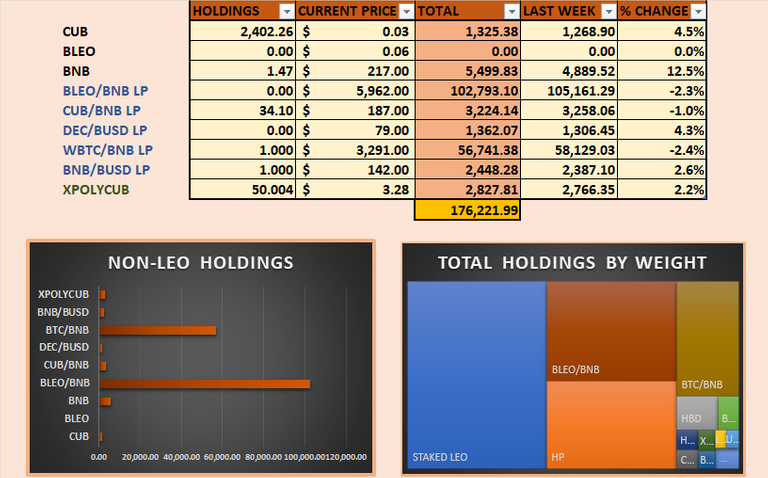

DEFI and non HIVE holdings

Not much change here this week in terms of LEO valuation, we end the week with most things moving 2-3% up are down. BNB is up 12% because CUB that was CUB harvests have been collected. Tempted to convert these into BUSD and wait for further drops and then go bargain hunting but we''re already doing that with HBD sort of. Anyways, we continue to harvest.

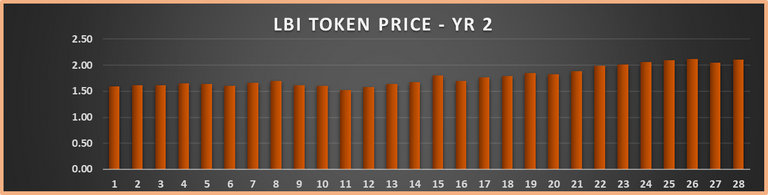

Not to surprising to to see that we finish this week with an increase in the LBI token price. With LEO going sideways with the rest of the market and HIVE increasing a bunch, our 11k HIVE is worth more LEO. It's hard to guess what will happen next week as i would guess the price of HIVE will decline and LEO will continue to go sideways. I would guess the LBI price will maybe drop to 2.07-2.09 for next week. Mostly importantly, i dont see it dropping to under 2 LEO again in the near future.

We all see the decline in LEO curation rewards so something has to be done if LBI is to continue growing at an average of 20% per year. We dont earn anywhere close to 20% of LEO curation, even compounded would not yield 20%, not that we can compound anyways. HIVE earnings have been good to us as LEO has declined over the past year but that will not last forever either. We would need to explore the idea to creating more sub projects under LBI like CUBlife. In my mind, i did CUBlife as an example to show that a project that pays out decent divs (26% APY this week) could be ran in around 60-90 minutes per week thinking that others would see how easy and little time it took with the hope others would step up and run other simple projects but maybe that was naive thinking on my part that investors would gonna be active in growing there investment. I guess thats not much of an incentive to small token holders.

We end the week strong and will see what happens over the next week.

Sorry for the late report, have a great weekend everyone.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Posted Using LeoFinance Beta

He hasn't made it clear what he wants his investors to do.

Look into it and do what you think is best.

Posted Using LeoFinance Beta

Not sure about UTOPIS from what you are saying it might be time to sell, sad Iliked that token

Well, Chrono responded to my comment and it does look like he is planning on building a buy wall but dividends should still go out for now though. So I am guessing the project will be retired eventually.

Posted Using LeoFinance Beta

!HBIT

Posted Using LeoFinance Beta

Success! You mined .9 HBIT & the user you replied to received .1 HBIT on your behalf. mine | wallet | market | tools | discord | subscribe | <>< daily

Great report. Utopis looks like its over. Big shame as I loved that token.

Posted Using LeoFinance Beta