Due to the recent drop in the HIVE price, the LSTR initial sale sell wall is trading at 21.5% below our mNav

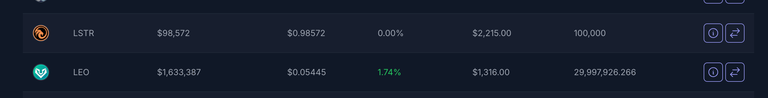

What does this mean? Each LSTR is worth ~22 LEO right now. 22 LEO is worth about $1.20

- Our LEO per share is worth 22 LEO or $1.20 USD

- Our LSTR initial sale is selling for 4.25 HIVE or $0.985 USD

- This is a 21.5% discount from fund value

The only reason this mNav discount exists is because of the initial sale of LSTR tokens. This creates a fixed 4.25 HIVE/LSTR price for early entrants to the LeoStrategy fund

The sell wall is limited to what is currently for sale. Once it runs out, it is completely gone

Then, an LSTR:LEO pool will be created. This pool will be priced at an mNav of 1. All else being equal, this means LSTR will be priced at $1.20 when this pool is released (an instant 21.5% profit for anyone who buys LSTR right now)

Bullish!

Two question:

who will provide liquidity in that pool? As Strategy will perma stake all $LEO.

Will there be liquidity provider rewards? (Independent of volume)?

good news indeed

I strongly believe in $LSTR