Hello Lions,

I hope you're all doing well and I send my best wishes to those participating in the ongoing Leofinance adoption campaign. In our previous discussions, we covered a range of interesting blockchain topics including Bitcoin, Ethereum, Hive, and Leofinance and in my post from Yesterday, we also explored the Ethereum Virtual Machine (EVM) and the Polygon blockchain that utilizes EVM technology. However, today I'm excited to introduce a new focus on a particular blockchain for our conversation.

Introduction

Today, we'll be shifting our attention to a blockchain technology that operates differently from being the EVM-based system that I discussed in our last post. Yes, today I will be talking about a specific blockchain Ripple or XRP and will also be providing a general overview and introduction on a broader scale. I will try to explore various aspects of this blockchain technology including its core principles, unique features, advantages it offers to its users and potential use cases. By understanding this alternative approach, we can easily gain and learn about valuable insights into the diverse landscape of blockchain technologies. So, get ready for an enlightening journey as we explore this fascinating realm of Ripple aka XRP to grasp the fundamental concepts, unravel complexities and to uncover the potential benefits this blockchain technology offers.

Should a blockchain must use EVM?

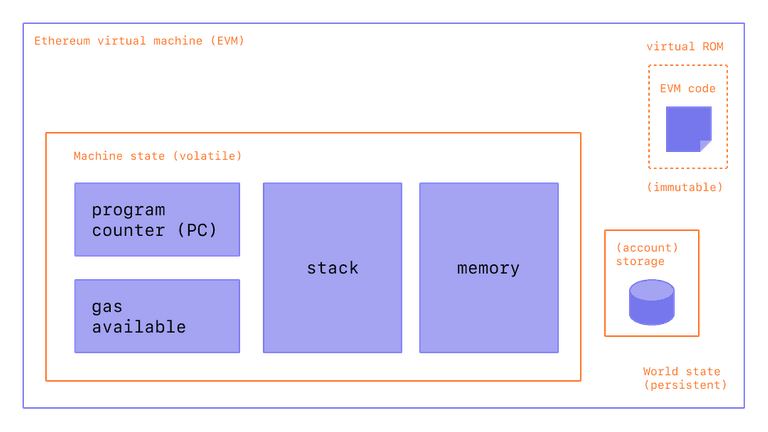

The EVM is a component specific to the Ethereum blockchain which later got adopted by some other chains as well and this component is mainly responsible for executing smart contracts. However, a blockchain does not necessarily need to use the Ethereum Virtual Machine (EVM) in order to run itself successfully. While EVM has gained significant popularity and is widely used in today's world for decentralized applications (dApps) on Ethereum and other chains, there are other blockchain platforms as well that don't use EVM in their system and offer alternative approaches to smart contract execution.

To understand what EVM actually provides to a blockchain, let us follow through the advantages and disadvantages of EVM below:

Advantages of EVM-based Blockchains

Developer-FriendlyNo doubt that the EVM provides a fast, efficient and comprehensive development environment for developing and deploying smart contracts. It supports a Turing-complete programming language called Solidity which allows devs to build flexible contract logic.Wide AdoptionEthereum has one of the largest active developer communities in crypto with many tools, libraries and frameworks those got built around the EVM component. This vast and extensive ecosystem makes it comparatively easier to find resources and collaborate and develop projects.InteroperabilityEVM-based blockchains can interact with each other and send and use of data through standardized protocols like ERC-20 (token standard) and ERC-721 (non-fungible token standard). This particular characteristic enables it for the exchange of assets and data between different dApps.

Disadvantages of EVM-based Blockchains

ScalabilityEVM-based blockchains like Ethereum have faced challenges with scalability due to the limitations in their consensus mechanisms. As a result, we have seen them struggling to handle a high volume of transactions and often experiencing network congestion.Gas FeesAnother big challenge for EVM-based blockchains is the usage of gas fees as a mechanism for transactions and to prevent spam attacks. However, these fees can be seen to fluctuate significantly depending on network demand at some times and can be expensive for users.

Examples of Non-EVM Blockchains

Now, let me provide some examples of well-known and popular blockchain systems that don't use EVM technology and run with their own scripts and consensus algorithms below.

BitcoinBitcoin is the first ever created and also the most well-known blockchain and you may get surprised to know that it operates on its own scripting language and not EVM. BTC focuses primarily on peer-to-peer transactions and digital currency transfers and people accept it as digital gold for its limited supply and scarcity.RippleRipple is a blockchain-based payment protocol system used by banks and many other international financial institutions and it aims to facilitate a fast and low-cost platform for money transfers. It also has its own consensus algorithm and does not rely on the EVM like Bitcoin.Hyperledger FabricHyperledger Fabric is another open-source blockchain framework developed by the world-famous Linux Foundation. It is designed for enterprise applications and allows organizations to build their own private blockchains as per requirement. It does not use the EVM and instead provides a modular architecture that supports various programming languages for smart contracts and thus a better environment for devs to work in this chain.CordaCorda is a blockchain platform developed by the R3 consortium and it is primarily used by financial institutions. It enables secure and private transactions and like others above, it also does not utilize the EVM.EOSIOEOSIO is well-known for its high scalability and high-powered performance. It uses the delegated proof-of-stake (DPoS) consensus mechanism and offers a great smart contract development model as an alternative to the EVM.

Now, to understand more about these blockchains that doesnt rely on EVM, let us discuss about the Ripple chain below.

Introduction to Ripple Network

Ripple is an innovative blockchain-based payment protocol and remittance network developed by Ripple Labs Inc. that facilitates real-time gross settlement (RTGS), currency exchange and performs secure cross-border transactions. With its open-source and decentralized protocol, Ripple targets to revolutionize the traditional banking system by offering a fast, secure and cost-effective solution for worldwide financial transactions. At the core of Ripple is its distributed network and decentralized digital ledger, which certainly eliminates the need for any central authorities or intermediaries through decentralization. This enables Ripple to operate faster and more efficiently compared to the procedural and traditional banking systems. Transactions executed on the Ripple blockchain can only take as little as four seconds which clearly provides its users with almost instant transfers of value and assets.

The Ripple network also introduces a versatile token system that represents various forms of value - including fiat money, cryptocurrencies, commodities and even some unique non-traditional assets like frequent flyer miles or cell minutes. This tokenization feature on this chain expands the possibilities of Ripple and certainly makes it a flexible platform for transferring and exchanging different types of value across borders. Ripple's native cryptocurrency, XRP also plays an important role in its blockchain network. It serves as a bridge currency and facilitates rapid and seamless currency exchange between different fiat currencies. With XRP, many international financial institutions and other payment providers can offer their customers enhanced liquidity and efficient cross-border payment solutions.

Furthermore, being an effective chain, the Ripple blockchain also supports smart contracts and decentralized applications (dApps) and provides an efficient platform for financial institutions and payment providers to offer fast and non-traditional financial services. By leveraging the capabilities of the Ripple network, many international institutions effectively deliver secure and transparent transactions, faster settlement times and a wide range of financial solutions to their users and customers. This is why some Major financial institutions which include Santander and MoneyGram have already recognized the potential of Ripple's network and also using its groundbreaking technology in their operations.

Founders and History of Ripple

Ripple, a pioneering blockchain-based payment protocol and remittance network was founded by a team of visionary individuals who wanted to revolutionize existing international trade processes and cross-border transactions. The concept of Ripple originated with Ryan Fugger, who developed the initial decentralized digital currency system called RipplePay. In 2012, a technology executive named Chris Larsen and another cryptocurrency entrepreneur Jed McCaleb joined together and built a team with Fugger to further develop and enhance the Ripple chain. Together, they established the initial company named OpenCoin which later got rebranded as Ripple Labs Inc., the company that is responsible for Ripple's development and enhancement. Both Chris Larsen and Jed McCaleb had a clear vision to create a faster, more reliable and more affordable payment mechanism for international trade. In order to achieve this goal, Ripple Labs launched the Ripple payment protocol back in 2012 and it was dedicatedly designed to offer financial institutions and banks with a more secure and efficient platform for transferring funds globally.

Building upon its initial vision and after getting recognized and adopted by several institutions, Ripple Labs later introduced its popular XRP token in 2013. XRP, also known as RippleNet soon became the driving force behind Ripple's network. As promised, The XRP token facilitated seamless transactions and acted as a bridge currency and efficiently enabled swift currency exchanges across different fiat currencies which helped it to get recognized and used globally.

Over the years, Ripple has forged a large no of partnerships and collaborations with many industry-leading financial institutions and international payment providers. These strategic alliances have helped them a lot to achieve the process of sending and receiving money across borders and also made it more cost-effective for customers. But despite its great achievements, Ripple has also faced a number of challenges and regulatory-related issues. In the past, several important concerns have been raised against the centralization of the Ripple blockchain network and the durability of XRP as a security. But somehow, Ripple has remained resilient and emerged as one of the top blockchain-based services for international payments at the current time.

Currently, Ripple is valued as one of the largest crypto based on its market capitalization. Its presence in the global financial industry is clearly visible through its partnerships with major international banks and global financial institutions like Santander, National Bank of Abu Dhabi (NBAD), ReiseBank, CIBC and UBS helped it to secure its position as a leading player in international transaction provider sector.

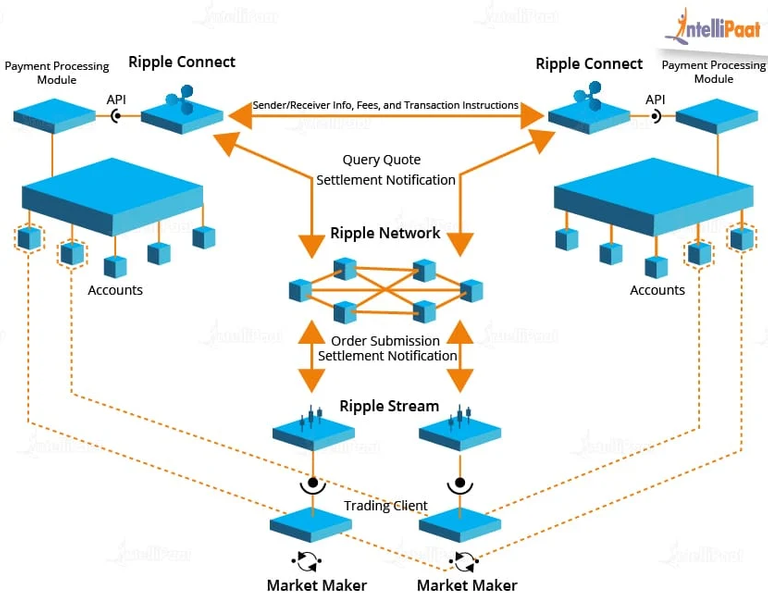

How Ripple's Blockchain Works

Ripple's blockchain also known as the XRP Ledger (XRPL) operates on a unique consensus algorithm which is called the Ripple Protocol Consensus Algorithm (RPCA). Unlike many other blockchain networks out there that utilize proof-of-work or proof-of-stake mechanisms, Ripple stands upon a unique variant of the Byzantine fault-tolerant consensus algorithm. The XRPL network consists of a distributed network of a large number of validator nodes that maintain a shared ledger that includes all the transactions. When a user performs a transaction, it is first broadcasted to the network and then, these validators work together to execute and validate the order and authenticity of the transactions.

This consensus process ensures that the ledger remains consistent, tamper-proof and well-protected from any malicious activities or getting hacked. To perform fast and low-cost transactions, Ripple also employs a unique concept which is called the Interledger Protocol (ILP). It enables a secure environment for value transfer across different ledgers, both blockchain-based and traditional and thus facilitates a seamless exchange of assets between participants.

XRP Tokenomics

Value Proposition of Ripple:

Ripple offers several important proposals that set it apart from other blockchain networks, let us look at them below.

Fast and Low-Cost TransactionsRipple's blockchain technology enables almost instant execution of transactions which typically are done within a few seconds. This speed is significantly faster than the existing traditional banking systems and as well as many other blockchain networks. Moreover, Ripple's network fees are considerably lower compared to those of traditional and blockchain services which undoubtedly makes it a lucrative option for cross-border payments.Enhanced LiquidityXRP, Ripple's native cryptocurrency also plays a vital role in the network's operations. It acts as a bridge currency that facilitates the exchange between different fiat currencies and enables its users with instant liquidity. This feature makes Ripple an attractive option for financial institutions.Interoperability and IntegrationRipple's payment protocol is designed to seamlessly integrate with existing financial systems and infrastructure. It supports interoperability between different currencies, enabling efficient currency exchange without the need for multiple intermediaries. This feature simplifies the process of integrating Ripple into existing banking and payment systems.Security and TrustRipple utilizes a decentralized blockchain, similar to other cryptocurrencies, ensuring the immutability and security of transactions. The network's consensus algorithm, called the XRP Ledger (XRPL), relies on a group of trusted validators to validate and confirm transactions, providing a high level of security and integrity.

Conclusion

In conclusion, Ripple is a blockchain-based payment protocol designed to revolutionize cross-border transactions by offering fast, low-cost, and secure international money transfers. Founded by Ryan Fugger, Jed McCaleb, and Chris Larsen, Ripple's value proposition lies in its ability to provide rapid settlement times, enhanced liquidity, interoperability with existing financial systems, and a high level of security. Through the XRP Ledger (XRPL) and the Interledger Protocol (ILP), Ripple has made significant strides in transforming the traditional remittance industry and enabling innovative use cases in areas such as cross-border payments, remittances, DeFi, and micropayments.

Ripple Whitepaper - https://whitepaper.io/coin/ripple

Resources I used to gather information

- https://www.coindesk.com

- https://www.publish0x.com

- https://www.geeksforgeeks.org

- https://www.digitaltrends.com

- https://coinguides.org

- https://intellipaat.com

- https://coinmarketcap.com/currencies/xrp

I hope you liked reading my post about non-EVM blockchains and Ripple (XRP) and if you have learned something new today, I will be very happy to acknowledge it. Let me know your thoughts and feeling in the comment below and I will be seeing you all in my next post!

Posted Using LeoFinance Alpha

https://leofinance.io/threads/mango-juice/re-leothreads-2foy5o5mb

The rewards earned on this comment will go directly to the people ( mango-juice ) sharing the post on LeoThreads,LikeTu,dBuzz.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

!PGM

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

$PIZZA slices delivered:

@torran(1/10) tipped @mango-juice