I learned how to become self-conscious of my spending and budget an allowance when I was only 14 years old. My parents decided to part ways. My mother then left me with a task that I didn't understand. I have no idea too why she chose ME! She just left a note assigning me to do the family's budget and take charge of everything. I was shocked! At that time, I was confused and bewildered. I was only 14. How could she have thought I could take on such a big responsibility? Anyway, I just turned this impossible task into an opportunity to improve myself.

Since then, budgeting has been my specialty. It is one of the special skills I have that I am really proud of. When I turned 18, I started using credit cards. My mother assigned me a supplementary card and it's a WOW for me at that time. pirma pirma na lang ako in front of my classmate. I remember the time that having a credit card is a status symbol. It's a sign that you are either well-off, earning a lot of money or rich. But change me (ibahin mo ko), I didn't think like that because I know deep inside that we are not rich.

Here, I will tell you how I manage my Credit Cards. I will show you my technique (based on my experience) and various behavior that a credit cardholder must possess. Hope I could help those who are struggling using Credit Cards.

Behaviors to practice when using credit cards

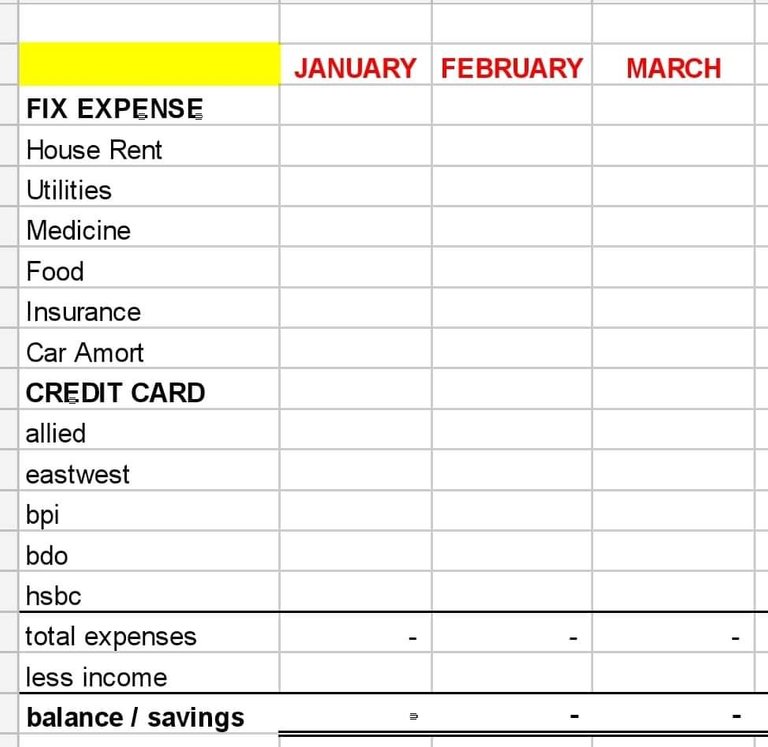

a. Make it a habit to record and monitor all of your expenses. I have been using this template so I won't forget any of my transaction.

It's up to you if you want to use the same format or you may modify the entries :) Also, it is better If you can project your 6 months expenses! This is to monitor your Buy Now Pay Later transaction.

b. Self Discipline: you must know when to stop spending. Learn to say NO if you can't afford one thing. You'll become default if you have these financial habit: EXPENSE > INCOME or INCOME = EXPENSES

K-Y-C or Know Your Card

As a cardholder, it is important to know the characteristic of your Credit Cards.

Make an effort to research and understand the following:

a. Transaction Cut-off: this is different from the due date. Usually, it is 20 days before the statement due date. It is important to learn this so you know when or where to encode your expenses in the spreadsheet.

b. Annual Fee: once you received advice regarding annual fee, you may call your card issuer to reverse it. They will give you options on how to waive it, you just need to make sure you comply with the terms. :)

c. Finance Charges: get to know the different Credit Card charges such as interest for late payment fees, interest for paying below the amount due, etc. Once it is reflected, pay the whole interest plus the next due amount so it won't earn interest again. Otherwise, your account will blow up with huge interest charges

My suggestion is to record all your expenses correctly and try to pay the Total Amount Due on time so they won't charge more interest

d. Know the current promo or offers: For you to encourage to buy something using Credit Cards, these companies are offering various promo for them to earn interest. Please check the following:

- 0% interest installment: you need to pay it monthly plus any of your straight charges to avoid interest charges.

FYI, this is not literally 0% interest because the supposed interest charge (which is the profit of the company) was already subsidized by the proponent of the promo.

Buy Now Pay Later: make sure to encode it in your spreadsheet for projection of your expenses. From this, you will know if there's still remaining balance on your budget.

Balance Transfer: this is the key if you can't pay your total amount due. You may transfer it to your other Credit Card with a sufficient Credit Balance. Of course, it will charge you monthly interest (.70 to 1%). Get this option than paying 2.5% monthly interest when you can't pay the whole amount. Again, make sure to encode it in your spreadsheet :)

Convert to Installment: You may use this promo if you want to buy something that is not offered in installment. You just need to compare the interest rate if you want to avail it vs. Balance Transfer to other card.

Reward Points this is the perk if you are a regular credit card user. You may convert your points to rebate, gift certificte or travel incentive via Mabuhay Miles.

Cash Advance over ATM or Convert to Cash If you need an emergency money, you may get it in your credit card using Cash Advance facility (high interest rate plus handling fee) via ATM ( you need the MPIN) or Convert your Credit Limit to Cash (recommended, low interest rate) processing time is 7 to 10 working days.

Enroll your Credit Cards to Online Banking and keep your Transaction Slip

It is okay not to encode right after your purchase. You can do it 2 to 3 days after by accessing your transaction through online banking or keeping your transaction slip.

This sums up my experience using different Credit Card. You should spend wisely, always compute & record your expenses.

Also, you may earn higher Credit Score if you'll pay your total bill and on time. The higher the Credit Score the Higher the Credit Limit. You will also get loan approval easily

PS:

Please note that the information in this article is all based on my personal experience and observation and is not in any way financial advice.

Don't forget to track your online transactions.

All images are acquired from Canva Premium.

Posted Using LeoFinance Beta

When I use my credit card, I immediately pay off the balance, if I can't do that, I can't afford the purchase.

Yes, payoff the balance immediately. Otherwise, interest will hit you back multiple times :)

What a fantastic vote of confidence to be assigned that at 14!

I was just reading one of those centralized social media memes asking everyone to say one thing they would like to see taught in school that it not. This is it! Budgeting!

Fantastic advice as so many people appear to be rich but are just broke at a higher level. Credit IS there for you to leverage but you will mortgage your future if you don't have both hands on the wheel today.

Love it! I think I may ReHive this.

Indeed, the event really taught me a lot. Budgeting is important. I also believe that it needs to be taught in school so they would know the importance of money :)

This is true Fantastic advice as so many people appear to be rich but are just broke at a higher level. Thank you for reading my story :)

Congratulations @mutedgeek! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 900 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!