We are all no doubt pretty excited about the upcoming ETH merge, a move on which high hopes are attached to improve Ethereum scalability and efficiency, and thus, it has been heralded as one of the most monumental events of crypto history. However, nothing is perfect after all, and wherever there is a pivot coming, there must be side effects included. Of course, Ethereum's transition from proof-of-work to proof-of-stake is no exception here!

And if you've been following Ethereum news for the last few months, you certainly know that one of the major risks that could be posed after the merge is the potential centralization. Something that could trigger much bigger risks, not the least of which is compromising the censorship resistance nature of Ethereum...

As known, Proof of stake is not a new consensus mechanism, and it is already being used by multiple "Ethereum competitors" such as Cardano, Solana, Polkadot, and others. But the thing is that none of those "competitors" is even close to Ethereum capitalization or popularity. You know, A project the size and vogue of Ethereum is one hell of an attractive object for regulators to hit, and being very much centralized makes it both more attractive and easily accessible for them...This is where all the "centralization concerns" come from, so let's take an objective look to see if they are legit...

Where is decentralization? I can't see it, can you?

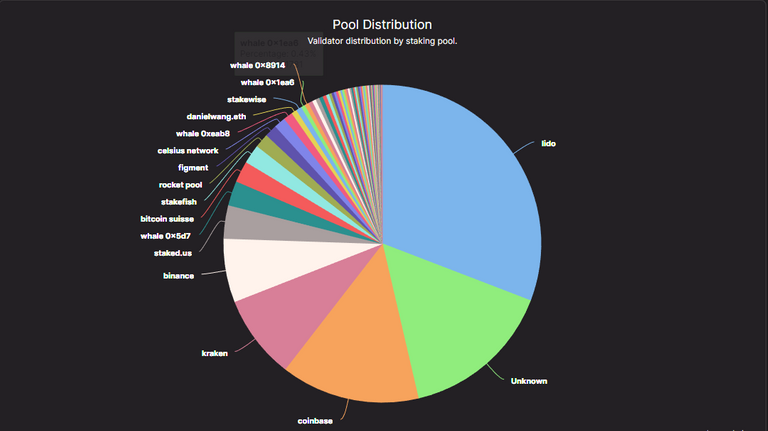

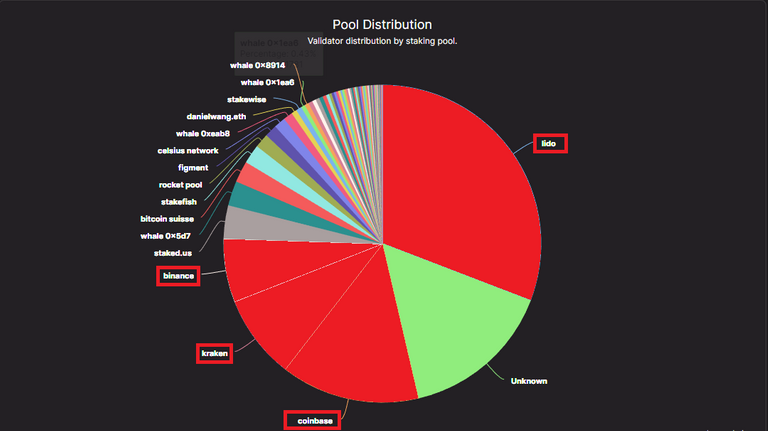

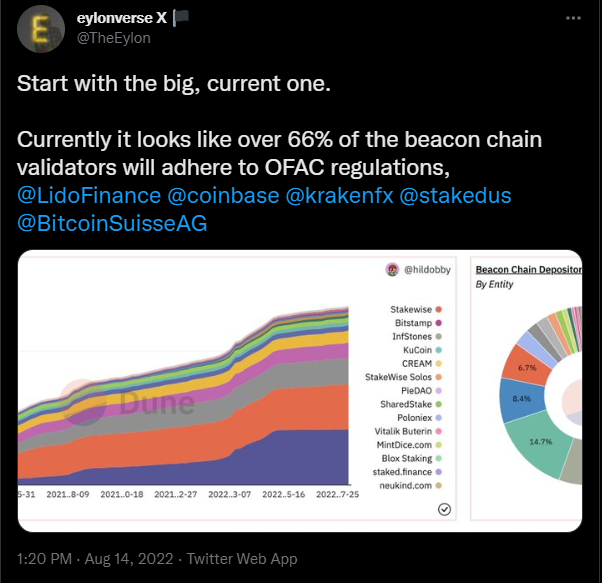

First of all, we have Ethereum 2.0 Beacon Chain Chart which is not that appealing. As you can clearly see below, the bulk of tokens staked belongs to a handful of big entities. More specifically, Lidofinance alone accounts for over 30% 0f the staking pool, then come Coinbase, Kraken, and Binance with 14%, 8,5%, and 6.5% consecutively. This is no fun because Coinbase, Kraken, and Binance are centralized regulated exchanges which effectively makes them subject to law changes in the jurisdictions in which they operate. What would happen if (hypothetically) regulators asked those exchanges to censor the Ethereum protocol?

And while Lido Finance (the largest staking provider) is theoretically a decentralized protocol, which implies that decisions like censoring would come down to a governance vote of the Lido DAO, it’s worth considering that Lido token distribution doesn't look any better...

It's also worth mentioning that all of the above must adhere to the United States Department of the Treasury's Office of Foreign Assets Control (OFAC) regulations.. In other words, they must obey whatever regulators ask!

Catastrophic Scenario:

Before going into my gloomy scenario, I'd like to point out again that I'm damn bullish on the upcoming transition to proof of stake and what it will bring to the Ethereum network. However, I think we should contain our enthusiasm sometimes and have a broader view of the situation. I'm no a FUD peddler, and I hate to be so, but being in crypto for several years now has taught me that only those who can ask hard questions will survive in the crypto market when others don't. Being critical and skeptical doesn't mean spreading FUD but it means looking at facts with objective eyes, right?

Well, the gloomy scenario I'm imagining is that regulators ask larger staking providers to impose new rules on the Ethereum blockchain. What's scary is that those validators who collectively control over 60% Ethereum staking pool are all regulated entities, and if they were to work together, they could easily censor the entire blockchain i.e reversing transactions, freezing wallets, or even deleting decentralized applications from the network! If such scenario were to happen, it would make Ethereum no different or even worse than the current financial system...Now, to be fair, Ethereum validators would never do this voluntarily as it would do devastating damage to Ethereum, and thus, their stake in the process. However, this would be less than a trivial consequence for governments and regulators who are willing to do whatever damage it takes to see their laws enforced.

As a reassuring sign, CoinBase has had the courage to answer that hard question as the CEO, Brain Armstrong, said they would prefer to stop staking than censor. But, it would be interesting to hear what the other large staking providers have to say!

And if you think it is a bit far-fetched scenario, allow me to remind you of what happened with the Tornado Cash protocol where regulators went as far as sanctioning an entire open-source protocol just because there are some using it for "illicit purposes". They even went further to arrest the developers of TC just because they wrote up some codes! Can't you believe it? Me neither, but this is what really happened. And the fact that most TC users are law-abiding people and are using it for valid reasons didn't help either!

A solution is coming soon?

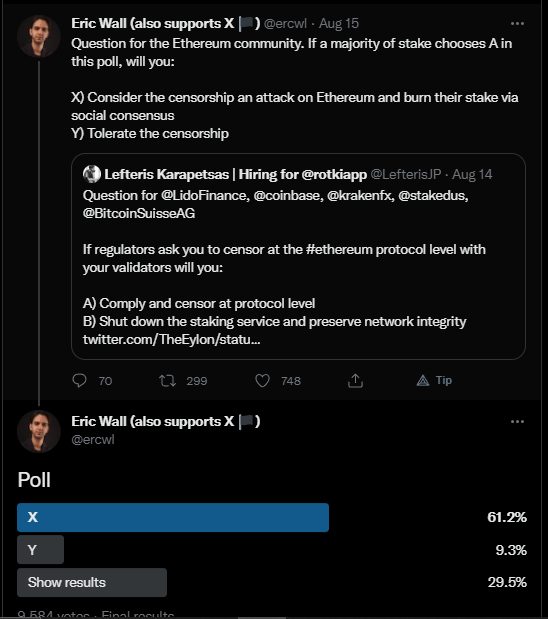

As you've seen, the centralization and censorship-resistance issues are a huge risk for Ethereum and its future, but we shouldn't forget that we're talking about the second largest cryptocurrency on the market which has an enormous community of innovative great minds. This is why I believe a solution will eventually emerge as there are many working hard at it. For what it's worth, though, there seems to be a proposal by one of the ETH community to ensure the censorship-resistance nature of the network until the issue of centralization is addressed. The proposal is quite straightforward and that is considering any attempt to censor as an attack on the entire network and thus slash and burn its stake via social consensus. And as draconian as this might appear, it seems to have gotten the blessing of most of the Ethereum community including Vitalik Buterin himself.

Will this measure be applied soon? Hard to tell at the moment but it seems the only solution until more validators come in and share larger slices of the staking pool pie.

What do you guys think about the ETH 2.0 centralization censorship-resistance issues? I'm keen to read your opinions and thoughts...

The rewards earned on this comment will go directly to the people( @qsyal ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I hope that they would rather stop staking than allow their platforms to be censored or regulated. Cos those law enforcers will definitely look for something to use to make sure their laws are enforced.

Posted Using LeoFinance Beta

Coinbase has pledged to do that but we have yet to hear from the others (Binance, Kraken, and Lido)

Congratulations @qsyal! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 19000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: