My main shares fund, Fundsmith, established in 2010 by Terry Smith turned 10 years old this week.

I bought in from the very start of the fund - by taking advantage of their regular direct debit pay-in offer and since October 2010 I've been paying in from between £100 to £200 every month since.

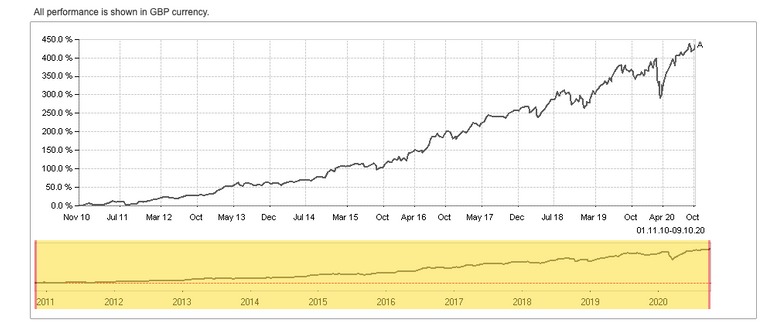

Had you bought a lump sum in 2010, your investment would have quintupled over the last ten years, but I estimate that with my gradual buy-ins I've seen about a 300% return over that period, which I'm very happy with!

I've cashed out some along the way, mainly to fund my house-move a couple of years ago, and from this account because the returns have been so good that my portfolio was looking a little too shares-heavy (it's not the only shares fund I have!).

I'm actually surprised the Fund has done as well as it has, it's weathered covid amazingly well - I cashed out another few grand a couple of weeks ago to kick start my land purchase fund here in Portugal and the Fund was up yet another 20% in just six months, even during the Pandemic!

The philosophy behind Fundsmith is remarkable simple: They buy

A small number of high quality, resilient, global growth companies that are good value and which we intend to hold for a long time, and in which we invest our own money.

Their Fund Factsheet also summarises their approach has having three simple principles:

- Buy good companies

- Don’t overpay

- Do nothing

And that's precisely what they've done. The fund has holdings in around 30 global companies, and its top three holdings (sorry Crypto peops!) are

- Microsoft

- PayPal

- Facebook (ouch)

(But at least I'm profiting out of Facebook!)

Room for more Growth?

I'm not sure if the Fund can continue growing at the rate it has done as there simply may not be that many 'already winning' companies that have the capacity for significant growth, so more risk-taking might be required in the future.

I'm probably going to keep paying in £100 a month, the performance of the fund over the last six months has suggest that their investments are relatively crisis-resilient, although this might be moot for me as I've got most of what I've got left in it earmarked for a land purchase anyway, which is the MOST crisis resilient asset you can own!

Find out More

This article in IT Investor offers a great summary of the last 10 years of Fundsmith and some thoughts on weather it's still a good buy!

Posted Using LeoFinance Beta

Great stuff :)

I bought in not long after 2010, not here though sadly!

How do you mean, bought in to shares?