May 9 Investment moves

- Today markets (US equity) - 11 am EST.

- May 9 Options Trades

- Everything Bubble

- Case-Shiller Home Price Index

- Credit Card Charge off

- US Election Cycle and bailout coming?

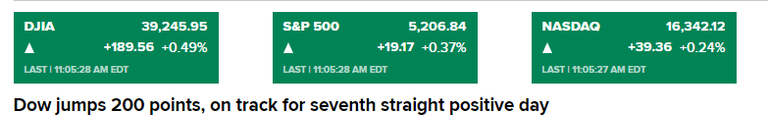

Today markets (US equity) 11:00 AM - EST.

Markets started slow, but now it has moved up strong. SP500 was down yesterday, but the general direction has been GREEN.

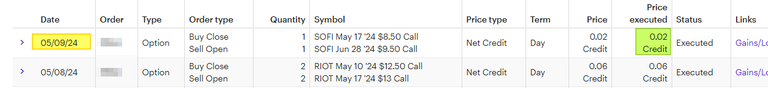

May 9 Options Trades

Here is my only trade for today (May 9, 2024).

I roll my SOFI-covered call up and out for $2 premium.

Everything Bubble?

Are assets in trouble and overvalued? According to this, most asset are bubbles and it will crash in 2024!

Read this post from Business Insider

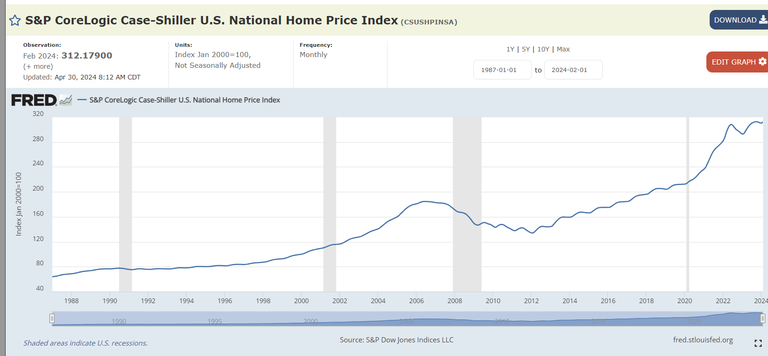

Case-Shiller Home Price Index

If you compare it to income, I can tell you home prices are expensive today. I understand the "Supply vs Demand Curve" and I know there hasn't been enough supply since 2013. When I did not think we would ever see a crash like 2008-2009, I'm starting to think we will see something different, but it coming.

https://fred.stlouisfed.org/series/csushpinsa

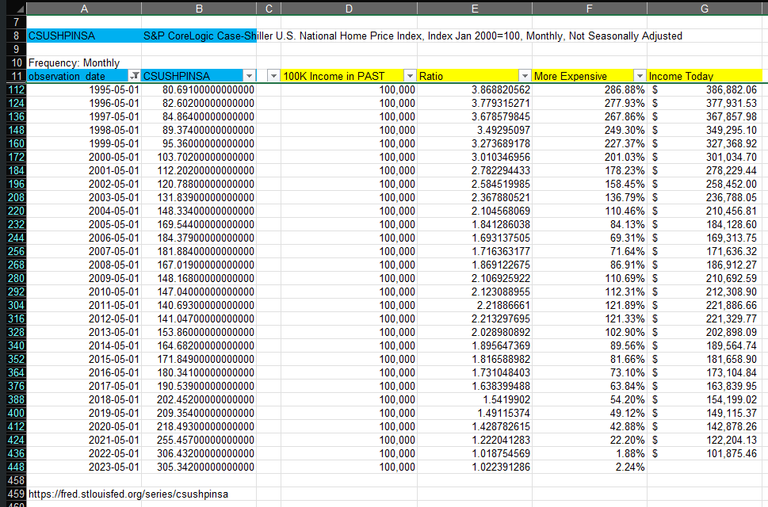

I added the change in Index value from Past to now.

Used 100K as a benchmark in the PAST.

Added filter on MAY only.

Here is what I got:

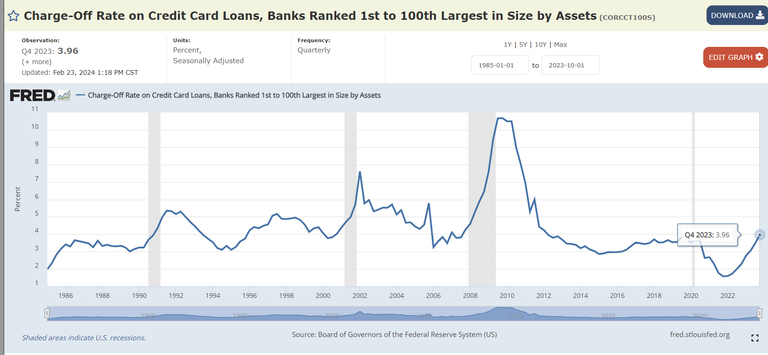

Credit Card Charge Off

This data is about 4 months old (Q4 2023).

BAC - April 2024 Earnings:

Provision for credit losses was $1.32B, up from $1.10B in the prior quarter and $931M a year ago.

JPM - April 2024 Earnings:

The bank card services net charge-off rate is projected to be less than 3.50% vs. its previous guidance of 3.50%. Provision for credit losses was $1.88B, vs. the Visible Alpha consensus of $2.74B and compared with $2.76B in Q4 and $2.28B in Q1 2023.

Before a recession, the charge-off rate goes up. The general pattern is it HITS its peak after the recession is HERE. Can we avoid a RECESSION (soft-landing) or are we entering ONE?

US Election Cycle and Bail Out coming?

The US economy is at a crossroads and the election year makes it worse.

Do we lower the interest rate? Or do we leave high interest rates to slow down the economy? The consumer makes up 70% of the GDP, and when the consumers don't spend, we enter a recession. The problem is we avoid the "pain" for so long and we use CHEAP money to help everyone FEEL rich.

Election year and/or newly elected officials like to hand out "free" money (via bailout). Is this the year that FIAT money gets exposed and people realize that governments are the problem in the giant shell game?

There are a lot of technicalities for me here, but it sounds interesting. I hope to learn more and more as time goes on. I am new.

Welcome.

I don't expect the average person to trade options.

I think that is only suitable for less than 10% of folks.

But the cool stuff is when I give an opinion on different topics. I write about various topics on money, personal finance, investing, insurance, and any other related money topic.

In the USA, I wanted to share how Housing Prices have moved in the last 10-15 years and why most people's income has not kept up fast enough. Prices in Texas/Florida have moved up because of folk from out of state (geolocation arbitrage), which in turn hurt local who want to become homeowners or those who want to upsize their primary homes.

In Orlando, AirBnB investment is one area to keep an eye on. I think the market was pushed up by all the out-of-state investors.

I study actuarial science. I recently wrote a post on insurance. I would love to see your comment on the post if you could.

I hope to learn plenty from you as time goes on

Cool.

I like to look at life insurance and how to use life insurance in different ways (like hedging).

There are different ways to use life insurance.

I am new to using life insurance to hedge. I would like to know more