There is a fair bit of discussion of late about the Hive Backed Dollar (HBD). This is a currency that caused a great deal of confusion to people. In fact, it was so overlooked throughout the years that many feel it should be done away with.

What is the HBD?

Basically, it is an attempt at providing Hive with a stablecoin. The idea is that 1 HBD is always worth $1 worth of HIVE. That is how it is programmed into the blockchain.

However, the markets seem to tell a different story. The peg simply has not worked over the years. Even now, 1 HBD is worth a great deal more than $1 on the open markets. This can tilt things in an entirely new direction.

Because of this, efforts are being made to fix this. One of the key moves is to put a "cap" on the price in the next Hard Fork. While this could end up covering the high side, there is still the opening for a downside move.

Either way, HBD is now getting a lot of attention.

The benefits of having a stablecoin on Hive are enormous. One of the first things that comes to mind is the ability to engage in commerce. Merchants do not want to deal with a currency that is fluctuating all over the place. Imagine selling an item online, while you were asleep, only to realize the price of the token crashed 20%. There went your entire profit margin.

If one want to learn more about this, in greater detail, @edicted and @blocktrades wrote a number of posts that offer insight.

A pegged HBD would be a game changer for Hive. It would provide an essential element to the DeFi on the Hive ecosystem at the base level. This would be a big step forward, not only in cryptocurrency but also finance in general.

Why is this such a game changer?

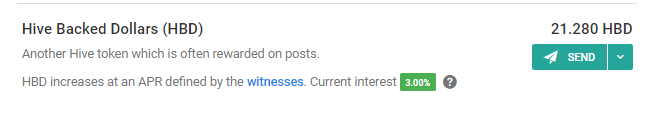

If we look in the wallet, we see something very interesting.

Hive Backed Dollar now earns 3% interest on any that are held. This is an important point.

Of course, for it to be effective, the peg has to hold. Receiving 3% if the price is going to collapse 40% is not a very good deal. We need to be able to switch from speculation to income earning.

Turning HBD into a fixed income asset would really alter things a great deal.

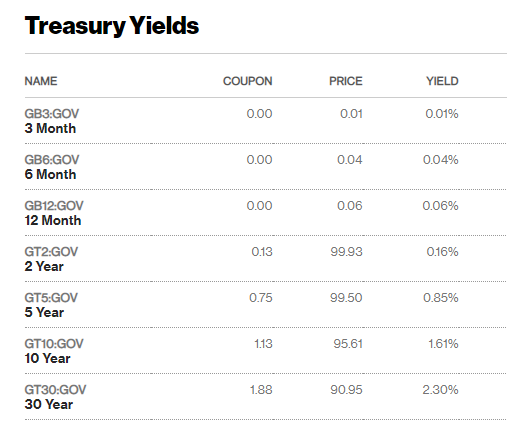

Looking at the present rates for Treasuries from Bloomberg, this is what we see.

Even the 3% that HBD generates, in terms of return, is significantly better than what Treasuries are offering. We will not even look up what local banks are paying on CDs. It will be a lot lower.

Naturally, for all this to work, the price of HBD has to be pegged. However, if that is pulled off, an entirely new world opens to Hive.

The 3% rate is set by the witnesses. We know that yield farming is the trend right now with some insane returns. Let's ignore the mania for a moment to deal with some realistic numbers.

If the rate for HBD can be set to be competitive with traditional markets, then we could start to see a transition from the absurd to sensible.

We know that the low-interest rate environment established by the central banks is absurd. Equally so are the yields some many DeFi platforms are putting out there. Hence, we should look somewhere in the middle.

According to Investopedia, we see this:

The S&P 500 Index originally began in 1926 as the "composite index" comprised of only 90 stocks. According to historical records, the average annual return since its inception in 1926 through 2018 is approximately 10%–11%. The average annual return since adopting 500 stocks into the index in 1957 through 2018 is roughly 8%.

Here we can see how it can be established. If the payout on HBD matches the historical return of the S&P, between 8%-10%, then we will rival one of the largest markets in the world. And this is something determined by the witnesses.

Again, we need to forget about Lambos, McMansions, and mooning. When dealing with the traditional world of finance, offering something that they can comprehend, with little risk, is appealing.

If this was the return, in addition to being able to engage in commerce with products and services prices in HBD, we could also see a lot of people holding their savings in this currency. Why would someone put money in a bank paying near nothing when one can match the historical returns of the stock market without the risk? Outside of liquid funds to pay current obligations, it would make little sense.

Consider all the money in bonds, certificates of deposit, and interest bearing savings accounts that is earning next to nothing. The hunt for yield is on. Forgetting the insanity of present DeFi, this is a step towards a more reserved approach.

Will this be a long-term hold for most people? Probably not. HBD will basically become a parking spot for money. If one sells out of a particular asset, the money might be moved into HBD until it finds another home. This is what people are doing with stablecoins like Tether.

The latest discussion, as shown in this post by Blocktrades, centers around the idea of paying a return to HBD put in the savings account. This makes a lot of sense since then it would negate all the HBD held by exchanges. If one wants to be liquid for instantaneous moves, then he or she simply forgoes the return. However, if one is going to "park" for a while, put it in the saving account and earn some on it.

With the savings account, the unstake time is 3 days.

People are looking to cryptocurrency to fix real world problems. One of the biggest problems in the financial arena is the fixed income markets went to crap. The moves by the central banks destroyed the returns. This is causing people to hunt for yield, taking on more risk than they probably should. It is a situation that will likely not end well for many.

A pegged HBD paying a return of around 10% can go a long way to providing a solution to this problem. It will give people the opportunity to earn a steady return without having to deal with junk bonds (or worse, non-rated bonds) to get the payout.

This would certainly be a big step to positioning Hive in a much different place.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Getting HBD in a very stable state just like USDT is would be a very perfect way to bring in investors who are just here to play it safe.

It’ll also gives you peace of mind when asleep that your assets is intact even if there might be an inflation, it’s going to be in a very little amount.

It’s a very welcome idea to stabilize it(HBD).

Yes, agreed if HBD can offer a stable value and 10% interest, it would be a very unique place in the crypto world to store and stake value without much risk. That is the biggest problem for the crypto world is the massive risk.

As much as I love the price of HBD being so high right now to give me a better conversion to Hive, I really think it needs to be capped. Knowing that it is supposed to be right around $1 and seeing it between $1.50 and $2.00 gets me a little on edge. I think the points you laid out here make a lot of sense. Having a stable place to store funds even if temporarily would be a great thing. It would also drive a lot of people here to Hive (hopefully).

Posted Using LeoFinance Beta

The advantages far outweigh the issues we are presently experiencing. It will take work to get there but it seems like some of the ideas are doing well.

We could see the next hard fork really take a step forward for HBD. I look forward to more discussions out there about it.

Posted Using LeoFinance Beta

I always get a little nervous when hard forks come around, but this one has me pretty excited. It sounds like they have a lot of good stuff in the works.

Posted Using LeoFinance Beta

yeah, this is one of the "small" things on Hive that can really make a difference. Seems like we are still in the discovery phase and are only slowly discovering Hive's true potential

It is going to take some toying around. The first step is to get it closer to $1. It appears the move in the next hard fork will cap the upside.

We might have to see more work done after this. It is going to be a process.

Posted Using LeoFinance Beta

I can fully understand why having HBD pegged is great for Hive ecosystem, but this is flawed method if we want to decentralize from fiat currency. In the fiat world a country that wants to peg to the dollar rely on trading with US to earn USD dominant. The countries also hold a lot of USD/ US treasuries. The mechanism to control the peg is the country's central bank. If USD weakens, the country sells local treasuries to flood more of their debt into the economy while a stronger USD the country buys up local treasuries to take out local currency from circulation. In short to peg the HBD will require a central group controlling the supply. The HBD Stabilization initiative appears to want to have the authority to do this. I am hopeful that they will succeed, but irony of this is we will have a centralized system pegging the HBD as we are not allowing free market to set a value to HBD.

I would be willing to park a larger sum in HBD for that return.

Posted Using LeoFinance Beta

I think a lot of people would.

It only makes sense if people can get 8% or 10% on their money in a fairly simple manner.

We will see how it all pans out.

Posted Using LeoFinance Beta

I've never been a HBD or a SBD fan. It's to confusing.. it's never worth $1.. it's not like there isn't other stable coins out there.. I would vote for eliminating it completely... if a business losses money because the token crashes so what.. they make up fot it when the token price rises. HBD is currently $1.61.... SBD is $9.73... neither one of those seem very "stable" in fact those tokens are cutting into the HIVE/STEEM market cap. Eliminate them and the token price goes up. Everybody wins. Bottom line a stable coin that isn't stable is actually a shit coin.

Posted Using LeoFinance Beta

I dont see how eliminating HBD will send the price of Hive up.

Posted Using LeoFinance Beta

Really? Maybe I'm stupid.. but if HIVE has a market cap of say $200M and HBD has a cap of say $8M to eliminate HBD one would have to "buy" all the HBD with HIVE giving HIVE a market cap of $208M. If someone bought $8M of HIVE I'm betting the price would go up.. isn't that how market caps work?

It could be done using the existing Hive that is out there and converting it so I am not sure it would have much of an impact.

I dont think you would see the situation where $8 million worth of new money was coming in and adding to the market cap.

It basically would be existing tokens out there being swapped.

But hey, there are people a lot smarter than me working on the problem.

Posted Using LeoFinance Beta

I'm already building a HBD savings pot ready of HF 25. It also makes sense for me since I want to build a easy withdrawable pot of crypto that doesn't fluctuate wildly in price and my banks savings account has a lovely APR of 0.05% :D

Communities I run: Gridcoin (GRC)(PeakD) / Gridcoin (GRC) (hive.blog)| Fish Keepers (PeakD) / Fish Keepers (hive.blog)

Check out my gaming stream on VIMM.TV | Vote for me as a witness!

From what I understand the hard fork will just cap the price of the token (I think at $1.05). So it severely limits the upside range.

The APR is decided by the witnesses. They started at 3% and we will see if they change it. For now, I think the intention is to just get something out there.

In the future, I hope they look to increase it to make it more attractive as a fixed income asset class.

Posted Using LeoFinance Beta

From my understanding is it becomes profitable to convert HIVE->HBD if HBD is above $1.05 effectively cause people to flood the market to sell when it does break that price point, effectively acting like a cap of sorts. More like a soft cap imo.

It's going to be good changes all round that's for sure, personally I think 5-8% APR is a good competitive interest rate for HBD

Communities I run: Gridcoin (GRC)(PeakD) / Gridcoin (GRC) (hive.blog)| Fish Keepers (PeakD) / Fish Keepers (hive.blog)

Check out my gaming stream on VIMM.TV | Vote for me as a witness!

0.05 ?! Mine is making a 0.1%. And that is terrible to see that there is still banks giving lower interests 😅

Posted Using LeoFinance Beta

I don't remember but somebody raised an interesting point on this particular change in HF25:

If we make APRs too lucrative, people might buy Hive and power up but put their stake in HBD to get the interest. That might affect manual curation if the APR is set to be more than 10%. As far as I understand, we cannot predict the user behavior without actually doing this expt. Let's give it a try.

I still do not understand how this will solve the peg problem or is there anything I am missing?

Posted Using LeoFinance Beta

The APR and the peg are two different issues. The peg is coming from a capping of the hard fork. Blocktrades posts do a much better job at detailing that than I could (edicted might have covered it too).

As for the manual curation, I am not sure how that is affected. Curation is based upon the total HP and the percent a person has when upvoting. Thus I am not sure whatever money in HBD affects it.

The total HP that is voting is the total HP voting and splitting up the reward pool. It doesnt matter if it is 10 million HP or 200 million HP.

Obviously the lower the number, the more each of our votes are worth.

Posted Using LeoFinance Beta

I think that the HBD with an annual interest rate of 10% is very good, since it could encourage users to save money.

But there is also the problem that it is not stable at all, since a few months ago it was trading below the dollar, and right now it is at 1.67. So instead of doing good, it can be a tool for speculators and pump and dumpers, as I think is happening with the SBD.

So if it is eliminated I think it would be of more benefit to the HIVE, and we could finally see it at 1 dollar or more.

Posted Using LeoFinance Beta

Its so complicated and I think it might be worth giving it a try. At worst it would just mean HBD can't be pegged if it blows up. Because there would be a huge amount of HBD being bought at a low price, I think it would be even harder to peg in the future. So there are both pros and cons towards the approach.

Posted Using LeoFinance Beta

I think they have the top side covered so we will not see the $1.50 or $2 HBD.

I am not sure we have a solution yet that prevents it from going to 80 cents. But one thing at a time. If that becomes a problem, then we can address it.

Posted Using LeoFinance Beta

I don't think there will that much of an issue if it goes to 80 cents. It would just mean its better to have fully liquid HIVE instead of HBD from rewards because you get 20% more rewards that way.

Posted Using LeoFinance Beta

I have seen in one of the recent posts that interest on HBD will be increased. if HB price stays stable to 1$ and offers a good amount of interest then I would love to hold all my HBD for long. It will work like USDT for me on Hive.

Posted Using LeoFinance Beta

Exactly.

It also will pay better than bank accounts or move government bonds.

How attractive would that be?

Posted Using LeoFinance Beta

The "parking spot for money" part is very important in crypto and would generate a lot of benefits for the blockchain because many people would convert Hive to HBD ( or whatever the hive stable will be called ) when hive moons and then buy Hive when the price is cheap, thus we shouldn't scrape the bottom of the barrel again like we did until January

Posted Using LeoFinance Beta

This is really informative! It helps a newcomer like me understand HBD in detail. Thank you for sharing this.

There's definitely benefits to having a stablecoin in the ecosystem. First things first, is the development group here capable of making one that works as intended. From what I can gather algorithmic stablecoins are pretty challenging to get right.

Posted Using LeoFinance Beta

We shall see. They just started to address the issue, something that was overlooked by Steemit Inc for so long.

The hard fork will address the upside runs. If that can get into place, then we will have least be half way there.

Plus, with HBD, we are dealing with something truly decentralized since it is run by the witnesses (the blockchain) and not tied to USD. It is rather pegged to $1 worth of Hive.

No need to back it with USD like some claim to be doing.

Posted Using LeoFinance Beta

I was still having 1000€ on a bank account which was giving a 1.75% APY (the biggest possible, capped at 1600€ max on the account). That was not really hard to withdraw it to buy a computer with it. That only makes 17.5€ per year. I even get more just with curation rewards on hive, and I only have 1700.

If having a $1 HBD can help the token to be usable directly without needing to sell it before on a market would really be huge. Maybe Hivepay should become something big !

Posted Using LeoFinance Beta

The central banks killed the fixed income markets.

They are cooked for a long time.

Posted Using LeoFinance Beta

Sometimes I wonder why we can’t fund DHF with HIVE ?

People who work to improve Hive ecosystem should have more alignment with the other stakeholders who wants $HIVE network growth

Posted Using LeoFinance Beta

As bad as HBD is with volatility, Hive is even worse.

When looking for payments, having something that can drop 30% in a matter of a couple days is not healthy. I think the idea was to use HBD and strengthen that.

So far, we just got the DHF, not an improved HBD.

Posted Using LeoFinance Beta

Talking about the topic, I've, as a "half" noob, got a question. Is it then always better to power up on every post, obviously seen at all of your posts. Logically, I've understood that it should everything be in Hive and slowly we'll get the progression we all actually want? By your example, my last posts, and most likely every one after that one is going to be powered up 100%.

There was always discussion about that and when to do it.

I tend to power up all my posts since that is where I want to grow my accounts. Is it the best payout?

Hopefully someone who worked the numbers more than I did could chime in.

Posted Using LeoFinance Beta

If we could get HBD to a stable 8-10% I'd tell my 401K broker to eat dirt.

there is also bbd

Posted Using LeoFinance Beta

i think so i can or leo can

I just learned about the 3% on HBD. Meanwhile, if HBD will be at the price it is purposed for, do you think it can help Hive as a coin to have a higher price?

Posted Using LeoFinance Beta

Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Honest question, wouldn't it me more worth to have HBD pegged at $1 USD like most stable coins and not trying to get it to $1 worth of HIVE?

I feel like use cases for $1 USD peg are far greater and better known and understood.

Well HBD is not going to be backed by a dollar and will not be redeemed for dollars. It is paid in Hive.

So a peg to a dollar via Hive is still I think near the same.

Posted Using LeoFinance Beta

I'm really not understanding the benefits of that for some reason. It seems overly complicated with no real benefits? What makes pegging it that way more beneficial than $1 USD?

Would be really interesting to see how this unfolds. I'm sure a real stablecoin will open a ton of new opportunities. And with high interest paid on it, it sure gets interesting. My only concern is whether this will disincentivize people from holding Hive Power. The network can become weaker if this happens. But it is good that the witnesses can adjust the APR parameter, so if we see a lot of HP being powered down and moved to HBD savings, then witnesses can hopefully act to lower the APR or take some other measure.

Posted Using LeoFinance Beta

Why would there be less incentive to hold HP?

A few people have mentioned that and I dont get it. Hive can appreciate in value, can generate a return, and provides governance. So, if there is a 8% return on HBD, for example, I still am not sure there is an incentive to opt for that over HP. Of course, it depends upon what the use case is. If one is simply an investor, then maybe so. But anyone who is active, I think the HBD will be a benefit and pull in some new money as opposed to just taking from what is here.

Posted Using LeoFinance Beta

My guess is many people lean towards passive income. Increasing your HP requires participation. It also seems more complex - less certainty about your ROI. Whereas if you have a clear APR set, then you can park the money and not do anything - it just grows. So maybe there is more certainty and more passivity (less action required) when you hold HBD in savings as opposed to holding HP.

Another thing I'm wondering about is the compounding. Will HBD compound every 3 seconds? Does HP compound every 3 seconds? I'm not sure about this but if it does, then it seems extraordinary and the compounded interest (APY) would be far greater than the APR.

Posted Using LeoFinance Beta

There's definitely benefits to having a stablecoin in the ecosystem

Posted Using LeoFinance Beta

I would be happy to see a stable coin on Hive as it makes a laughing stock out of our system right now being at nearly 3x 1 with Hive at $1.54. HBD should never be an investment coin as it was never intended to move off $1 so not knowing what we have brings uncertainty and even more confusion to users and investors we are hoping to attract.

Posted Using LeoFinance Beta

Someone posted that SBD is over $9, so we are better in that regard.

Posted Using LeoFinance Beta

Didn't SBD go over $14 or $20 a few years ago?

3% is adequate. 10% is too much IMO. Plus what of HBD held on exchanges? Would the exchanges just pocket the interest themselves?

Posted Using LeoFinance Beta