The massive debt load that is happening around the world is stifling the global economy. This is something that has been taking place the last few decades with no end in sight.

Many people have ideas about why this is the case. However, for the most part, they tend to miss the most basic element.

Debt is the same at every level. It really doesn't matter whether it is a government, corporation, or individual household. When they accumulate debt, the consequences are the same.

Of course, governments have a few different options in some situations, especially when it is the US Government. Since it is the reserve currency, there are something things it can do that other countries cannot. This allows it to keep operating long past the time when consequences would normally be felt. Whether this continues in the future is something we will have to watch.

Source

The challenge with debt comes down to servicing it. As long as the payments can be made, things are not a problem. This is something that we all know. Have a mortgage and a car payment? No problem as long as the job is in place, bringing in the money needed to make the monthly bill.

From a government perspective, it is unlikely the US Government will default. Everyone else is not so lucky. Defaults take place and, actually, are natural. It is a clearing out process. This is one of the challenges we have right now with the insistence on keeping things "propped" up. It is deterring the natural cleansing mechanism that markets have. Hence why we have so many "zombie" corporations.

What ends up happening is that the cost to service debt keeps increasing as more is taken on. This starts to direct large sums of capital to what amounts to non-productive purposes.

Again, we can look at our personal income statements for this idea. As we take on more debt, say a car loan, if our incomes are the same, we have less money to spend elsewhere. At the personal level, productive spending can be termed "investing". So if we were investing $1,000 a month, then take on a $500 car payment, now our investment fund is only receiving $500. It was cut in half.

We can see how this will have a long term impact upon our finances.

From the standpoint of an economy, the situation gets that much worse. As more debt is taken on, the cost of servicing the debt keeps rising. There are times when certain actions can help offsetting it, like rolling debt over from a higher interest rate bond and replacing it with a lower interest rate.

Nevertheless, we find the governments of the world were amassing debt for so long that many of the bonds that are out now are very low. There really isn't much to be garnered with that tactic anymore.

Here we see, from an economic standpoint, that as the debt load grows, the amount to service the debt expands, leaving less money to put into productive purposes. This really gets difficult since the only way to offset this is with growth, which is stifled by the misallocation of capital in terms of productivity purposes.

Hence we see the downward spiral that took place across the planet for the past couple decades.

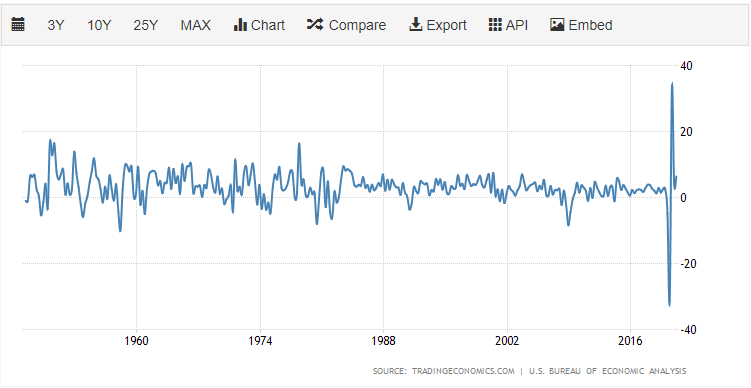

As we can see from this chart, the growth rate of the US Economy has slowed the last couple decades. Each one is a bit lower in terms of the higher points, meaning we just are not seeing the growth we need.

Source

Ultimately, the cause of this is not enough money is heading into productive areas. Instead, we have larges sums being extorted from the economy in the form of unproductive payments. This is a big problem going forward. We see this situation only getting worse as more debt is added to the balance sheets of most major countries.

Therefore, the raw number really doesn't matter since these balances are not going to be paid back by governments. What is vital is the amount that is money that is going to service the huge numbers, something that is only growing.

This is why anemic growth is becoming the norm for the global economy. We see China even starting to be bogged down by what they did the last 10 years.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

This is how the rich poor gap hurdles around like a earthquake resulting in a wider division.

Add to the fire, the pandemic. Relief funds have been tossed around like gifts on an Oprah set. Don’t get me wrong, people needed help fast- it was necessary. But, here in Canada the first few waves of Gov funding was given on a trust system. People in poverty, who didn’t qualify for the assistance, applied and received the help. Of course they did! Humans will do what they need to survive.

Now, with the various financial relief aids, Canada has falling into a deep deficit again.

The poor are still poor. Poorer now, with having to pay the money back.

The rich are still rich. Richer now, with the truckloads of money they made from the poor who were given chunks of money and were forced To stay inside with nothing to do but shop online.

But wait! Let’s not forget that debt of a country is the debt of the poor. So, the blue collar working person will pay back the big man while the rich companies avoid taxes with the plethora of tactics employed.

The gap widens.

I don't know about in other countries, but, in the US, the decision has been made that current spending is more important that any issues that may arise from the debt load. The current argument is to spend 1 trillion from the conservatives or 1.7 trillion from the liberals on infrastructure. This is above normal spending. I don't care how many educated economists state otherwise, that type of spending leads to hyper-inflation and economic crashes.

Posted Using LeoFinance Beta

Dont by the hyper-inflation discussion that those same educated economist promote. Keep in mind it is those with PHDs at Harvard and Yale who are espousing the money printing leads to hyperinflation.

Forty years of deficit spending proves otherwise. You statement about economic crashes sums it up: that is deflationary.

So if the Fed wrecks the economy, which they will, you will see inflation fears plummet.

Posted Using LeoFinance Beta

Speaking of defaults. I was having a nice conversation with my friend this weekend who is in the Title business. We were talking about how busy she has been with the housing market going crazy and she was pretty candid about her belief that the bubble is going to burst soon. Too many houses selling for much more than they are actually worth. People are going to be hurting.

Posted Using LeoFinance Beta

Mortgage applications declines each week for the past 3 or 4 weeks.

It is worth watching to see if that trend continues. It is on both the new mortgage and ReFi sides.

Many are projecting that housing is going to have issues starting the second half of 2021.

Posted Using LeoFinance Beta

I know she has been slammed lately. She manages three offices and they have been averaging 20+ closings per day per office for the past six months or more. She was telling me about a house that was valued at $50k and was selling for $90k. The fact that places are giving out loans for more than the appraised value is very concerning.

Posted Using LeoFinance Beta

the experiment goes on

The US can keep printing money without it losing as much value (relative to other countries printing at the same rate) because they bully the whole world into using their currency for exchanges. Crypto can circumvent that

That is an interesting view. One I would completely disagree with.

Have you noticed what China, the EU and Japan are doing with their money. The ECB is even outpacing the Fed in this area.

And none of them have near the economy the US does.

Posted Using LeoFinance Beta

It is interesting if you like world economy, I will try to be unbiased, but keep in mind it is impossible, so take with as much salt as you want:

I have been studying chinese(Mandarim) language, thus chinese economy and society by proxy, for over 6 years already. I don't know about the EU, but I know Japan has a purposefully inflationary currency, that is, they actively try to devalue their currency so that they can export at cheap and have a competitive price.

China calls themselves a "scientific socialist society in early stage of developement", which translates to this:

They are willing to use market mechanics to make their economy grow, despite agreeing that markets generate equality (they have increasing equity and equality of citizens ecnomy as goals for the next 29 years), so they have learned form Japan, they are a huge exporter of many goods (made in China everywhere). When a country exports a lot, their currency tends to increase in value, but that in turns makes it less interesting for people to buy, because stuff gets more expensive, so they are in a privileged position where they can, and should (to boost local industry) print money to avoid deflation, so that they can keep being attractive for foreigners trying to buy their stuff.

The US citizens might not notice, there is a term in sociology called "american exceptionalism", that says americans, because of heavy government propaganda, can not view their country unbiasedly. The international consensus, which I agree with, is that the US also uses this strategy, it is not interesting for them to have a currency that jumps in value from one day to another, because it makes international business hard, and most of the international trade is in USD Dollars, so ithey have to keep printing to avoid deflation.

US printed over 50% of the dollar supply last year (something like that), and yet, the currency did not devalue by that much in regards to most other currencies, that is because it was a calculated move.

Of course, citizens that import, instead of exporting, that is, the majority of people, would prefer their currency to go up in value, to import and consume more, but to the national industry that is not good, unless they have a huge leverage, like patents or monopolies, so that foreigners don't have a choice but to pay increasingly higher prices.

Debt is strange. If you are a mortgage holder, a bank will not negotiate with you if you are having trouble making payments. You have a contract, and they want their money, like in the deal.

Yet, banks are willing to sell a nonperforming note at a discount to get it off their books. You could buy a note that's a few months behind for a good discount. Often, note buyers can renegotiate with the borrower and get a good yield. There is an industry for nonperforming notes.

There are debt collectors who buy bad debts and are able to harass enough people to make a decent return.

Debt can be traded. Dollars are simply notes that are always at full maturity. Bonds are notes that are discounted. Both represent debt, not actual assets as we are no longer on the gold standard.

The point is, debt isn't something that is hard coded into fiat. There is room for negotiation and for packaging debts and selling them at a discount, if governments are willing to get creative. Much of it relies on the ability to discount a debt for fast cash. The US could say, 'Kerplakistan owes us $300 billion. We'll sell you the note for $150 billion in cash." This gives the buyer some wiggle room to lower the debt by say 20% and still make a decent return on the refinance.

Of course, unlike mortgages that have underlying collateral. Government debt doesn't get you anything other than more printed fiat. It's not like one can go take away some acreage or foreclose on a government property.

Posted Using LeoFinance Beta

That is true. However, a good case could be made that currencies are backed by the productivity of their economies (i.e. populations).

Of course, debt is exploding yet economic growth rates are going down so that highlights the problem of the current situation. The productivity backing these currencies, overall, is waning.

Posted Using LeoFinance Beta

It's essentially the problem of good vs bad debt. Anything that will help society or the economy grow is good but things like propping up declining companies is bad debt. In our society and how the targeting is working, most of it is not going towards good debt.

Posted Using LeoFinance Beta

I guess you are saying debt that is used for productive versus non productive purposes. That is true to a degree yet both require servicing. Even good debt has payments tied to it. One could make the case that good debt is profitable but that isnt always the case. What people term good debt does not always lead to more economic output.

In fact, bad debt, like credit cards, can increase economic productivity. The problem is the future payments will suck more out than it puts in.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

A lot of economies around the world are dying. Some faster than others, but seeing the US go through such a slow growth or decline affects everyone.

Posted Using LeoFinance Beta

Yep. And the world was propped up by China's absurd growth rates for decades.

That country is slowing and seeing their numbers drop. This is going to be a global problem going forward.

Posted Using LeoFinance Beta

that depends if the debt is bad or good

that depends if the debt is bad or good