I love technical analysis and firmly believe that a thorough technician can use it to gain an edge over the market beyond gut and discretion.

Besides, when it comes to the forex market, it's actually almost all you have to work with.

There's of course fundamentals such as interest rate and inflation expectations, GDP and trade data etc, but the market will often run contrary to fundamental sensibilities for months at a time, so in the short term, techs are all you have to go off.

This is because the forex market is simultaneously decentralised and opaque - a few brokers are semi-transparent with their orderbooks and positioning data - but most aren't.

Conversely, stock exchanges are inherently centralised, but relatively transparent - stock and index traders have a lot more internal data to work with and successful systems traders can leverage this data to improve their technical systems.

How does this relate to blockchains and Hive?

Well, though Hive and blockchains in general are decentralised like the forex market, unlike the forex market they are incredibly transparent - there is a treasure trove of data readily available to anyone with the technical know-how to query the chain.

Even if you wouldn't know an API from the DMV, there's an abundance of people who do have that knowledge and share data and insights publicly.

In the case of Hive we have @Penguinpablo who has been publishing valuable stats about the blockchain since the days of Steem.

Hodlers and Pumpers

Broadly speaking, there are two distinct groups of people who drive price higher - stakeholders and short-term traders.

The latter group are inherently fickle, they have no to very little interest in a project, they are buying only to capitalise on short term opportunities.

As such, the long term success of a project in terms of price comes down to the first group of people, the stakeholders.

Net Powerdown

So what are the stakeholders doing?

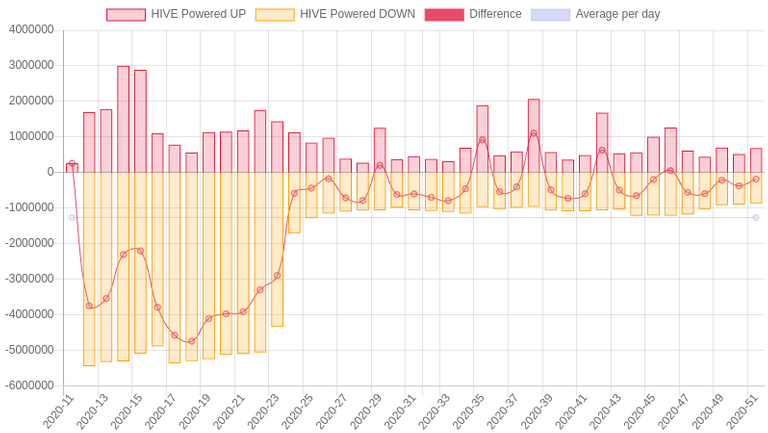

Let's take a look at a chart from our Antarctic friend's latest weekly stats post:

(Credit: @penguinpablo)

This chart shows the amount of Hive powered up and down, week by week, as well as the net result or "Difference" (red line) - this difference is what we're interested in.

As you can see, since network inception, the vast majority of weeks have resulted in a net powerdown. Over 40 weeks of data, we only see a net powerup on 6 occasions.

Where there's smoke, there's a net dumpster fire

Now the above phenomenon in isolation doesn't necessarily mean there's more money leaving the network than coming in eg stakeholders burnt by 13 week powerdowns in the past could be opting to hold the more nimble liquid Hive, or they could be using liquid Hive to make markets on HBD, Steem Engine etc

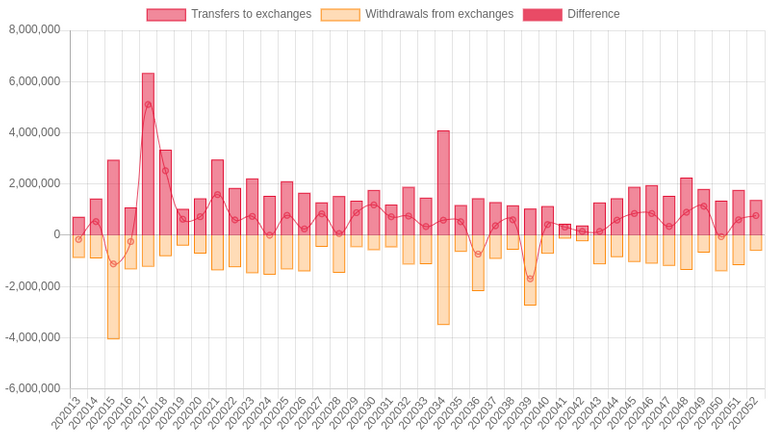

Let's take a look at another one of Pablo's charts:

(Credit: @penguinpablo)

This chart shows net transfers to and from exchanges, and once again, the difference between the two, represented by the red line.

Note the way this one has been laid out is a little different to the previous chart, as the behaviour pattern that is bad for the network is represented as a positive number rather than a negative.

This chart confirms what we inferred already from the previous chart, overwhelmingly there is more Hive being sent to exchanges than there is coming in from exchanges.

I saw a comment in the stats post along the lines of people are holding it on exchanges waiting to sell a rally - given 3s TX times and the bearish trend, I don't put much stock in that - this is Hive being net dumped by the community, week in, week out.

Wen moon?

As long as the above trends continue, Hive can't possibly moon.

Sure it may get pumped by short term traders every now and then, but as long as stakeholders are behaving more like traders, with a focus on short term gains rather than the long term health and wealth of the network, the trend in price is obviously going to be down.

The bright side

The good news is net powerdowns are no where near as large as they once were, the difference in the last week of data was 180 000 HP, roughly $20 000 USD.

If the community had powered up 30% more liquid Hive, we would of had a net powerup.

If the community had powered down just 25% less HP - net powerup.

The difference in net exchange transfers was substantially larger at 780 000 HP, roughly 80K USD and a substantial sum of money, but not huge in the bigger scheme of things.

If the community had bought twice as much Hive we would have had net inflows.

If the community had sold 60% less Hive - net inflows.

Food for thought

If all stakeholders; witnesses, investors, authors, devs etc just took a little bit less from the network each week, gave a little more where possible, we would be positioning the network for serious long term success.

Just 4 new investors buying 20K USD worth of Hive each and powering up would of led to net inflows and powerups too, but can we really expect new stakeholders to come in when we are actively sabotaging our own existing stake?

Posted Using LeoFinance Beta

HIVE (and SteemIt) have suffered this problem from the beginning.

The platform has been dominated by people seeking to pull money out with a vain hope that somehow it would pull enough new investors in to keep the currency stable.

IMHO, for HIVE to thrive, there has to be some compelling reason for people to buy HIVE ... other than a vain hope that newbies will someday join the ranks of people pulling money out of the system.

Posted Using LeoFinance Beta

Exactly, there's a term for an investment that's success relies solely on new money paying out old.

I once uttered a word with the meaning "there's a term for an investment that's success relies solely on new money paying out old" and I discovered that HIVE is not immune to cancel culture.

It is a word that should not be uttered.

I really like this post because I learned a lot. I've never looked at things this way before mainly because I don't how to interperate data. But what you said at the end about everyone having a little more conern for the network seems to be what happens in the Leo community. But it still scares me that I've converted my hive for leo because my leo stake is so small. It seemed like I had a nice chunck of hive when it was sitting in my wallet lol

Posted Using LeoFinance Beta

Thanks bud.

Yes I didn't want to make the comparison in the post to avoid the Hive vs Leo debate, plus didn't have comparable data for Leo, but you look at how much Leo is either staked or tied up in Uniswap liquidity, and it's clear why Leo is out performing.

There are other issues though too eg. HBD not listed on Binance, this means authors are selling HBD for Hive here and then dumping the Hive on Binance. Liquid HBD rewards are a really important feature of the network's tokenomics, designed to keep author selling pressure away from the platform token, but HBD needs exchange listings for this to work.

I hadn't even considered that point about HBD

Posted Using LeoFinance Beta

A terrific piece of work, thank you.

The encouraging part from all this is that the numbers are not real large. It will not take a ton to turn the ship. There is a lot of extracting going on presently but that could change with just a few sinks that start to suck up HIVE as opposed to it getting pushed to exchanges.

Posted Using LeoFinance Beta

Thanks bud, appreciate it.

Yeah spot on, I think that's the key take away here - we only need a small shift to start moving mountains. The HP chart suggests a lot of the big powerdowns already happened at network launch.

Posted Using LeoFinance Beta

That makes sense since there was a lot of powering up going on before the split. Plus the airdrop went to many who were on the "Sunny Side".

I would think a lot of them powered down, including exchanges, and sold out.

Posted Using LeoFinance Beta

Exactly, I feel with short term gainers we might just continue seeing the downward trend for hive for a really long time. Irrespective if we have more holders we might salvage the hive price situation. I enjoyed reading this.

Posted Using LeoFinance Beta

Yep, there will of course be external pumps, but where you land after the dump comes down to strength in the internal economy.

Thank you! I also love technical analysis, and this was very informative!

Posted Using LeoFinance Beta

Most welcome, glad you enjoyed!

Loving these reports and the education I am getting.

100 percent upvote, reblogged and tweeted.

Beadley

Posted Using LeoFinance Beta

Thanks Brad, appreciate the feedback!

Have to go back to my day job come Monday, but will try to get out at least a couple posts a week.

Posted Using LeoFinance Beta

I always wondered how much pressure the hive engine tokens dragged down the price, I guess it's small compared to what's sent to the exchanges.

Posted Using LeoFinance Beta

Yeah that's a tough one, there wouldn't be a direct effect other than perhaps token issuers dumping HIVE they got from issuing tokens. I'd say overall a project like LEO is a big net positive for Hive eco system --> price, but yeah no data to back that up!

Posted Using LeoFinance Beta

Personally I think the best way to run a hive account when gaining author rewards and such is to keep all the HP from the 50/50 hive/hbd split and then convert the hbd and just withdraw that. That way you both grow your account and also get something out of it too.

An incentive to power up other than governance, curation rewards etc would be nice too. Maybe a game that doesn't use it's own token but hive only. who knows.

Posted Using LeoFinance Beta

Yeah when Steem blogging used to pay a wage that was my approach, as things stand I'll just be powering up everything!

Posted Using LeoFinance Beta

Nice analysis - this is why I don't support Devs or witnesses who don't hold a significant stake in the network.

Of all of those i find the support for Dcity the most bewildering - one look at the rate Gerber is sending Hive to the exchanges should be enough to put any one off buying into that.

I also unvoted anyx as a witness recently, he has a tiny stake.

I'd much rather support people that invest in the network.

Posted Using LeoFinance Beta

Thanks bud.

This post wasn't intended to throw shade on anyone in particular - as the data shows the problem is much wider than any one person / subset of people. The majority of the network (in terms of stake, if not users) is extracting value.

Posted Using LeoFinance Beta

Yes fair point.

You could say that we're all killing this thing together!

Posted Using LeoFinance Beta

What puzzles me more is why do users support other users who are selling hive at the exchanges. Surely supporting users who power up and stake is the only way as otherwise they are sabotaging everything we are working to build.

Posted Using LeoFinance Beta

It's tricky, you should be able to sell your stake as you wish, the problem is, there's too many people doing it. You'd think at price levels like this, people would be accumulating for a rainy day, but it seems a lot have no interest anymore and are just heading for the doors.

Posted Using LeoFinance Beta

I believe that was their intention from the beginning and had no thought about 5 years from now and will just take what they can get. They will be lost at some point as having stake will mean something.

Posted Using LeoFinance Beta

It looks bad but steem was lower few years ago if you factor in inflation.

Posted Using LeoFinance Beta

STEEM is in just as bad shape for the exact same reasons though. The amount of wealth created and destroyed on that network is astounding.

Posted Using LeoFinance Beta

Congratulations @tradewatchblog! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

I would add something but your analysis and the comments are pretty spot on so just gave my biggest upvote and a thumbs up emoji 👍

Posted Using LeoFinance Beta

Thanks Nicky 👍

Loved your insights. It was obvious I had to follow you after reading the post. Thanks :)

Posted Using LeoFinance Beta

Thanks for feedback and follow :)

Posted Using LeoFinance Beta

Thanks for the awesome content :)

Posted Using LeoFinance Beta

You can read this and think or come to the conclusion that I'm a short term interested person and as long as it stays that way we don't move forward And the truth is that just like me there are thousands of people who make life in this community they have to put strict measures like st that they forced people to set up the posts to receive rewards completely in steem power so that people don't take out the money and so the value goes up

Translated with www.DeepL.com/Translator (free version)

Posted Using LeoFinance Beta

Thanks Fabian, as I mentioned above to CFCclosers I think the problem regarding author rewards is a lack of exchange listings for HBD. The system was designed so that authors dumped HBD, not HIVE, but if HBD isn't listed at the author's favourite exchange, they are going to sell HIVE there instead, putting downwards pressure on HIVEBTC.

Posted Using LeoFinance Beta

How did I not find a post like this earlier? Thanks for sharing.

Posted Using LeoFinance Beta