2008

After nearly crashing the stock market and the entire world economy in 2008 through the toxic mortgages and loans schemes, the "too big to fail" banks were handsomely rewarded with government bailouts.

Many so-called "financial experts" still maintain that the TARP (Troubled Assets Relief Program) program to prop up a failing economy in 2008 was only $700 billion in immediate relief to the the banks, a small price to pay for saving the entire economy.

However, what's often ignored in this calculation is that the TARP program only includes immediate loans made to the banks which makes up a very small percentage of the total government and Federal Reserve relief programs. An array of Federal Reserve lending programs designed to assist Wall Street financial institutions have received ongoing funding since the fulfillment of the TARP relief program.

All things considered, the true figure of the 2008 government bailout of the banks is estimated to be upwards of $10 trillion and even as high as $23 trillion.

Let that sink in, the total annual GDP of the United States is roughly $13 trillion.

Sources - 1,2,3,4

These are staggering figures.

More so, it highlights an astonishing theft from US taxpayers by the very same people who caused the financial crisis.

Not only did the banks escape the 2008 crisis unscathed, to a large extent Wall Streets largest institutions grew even more powerful as a result of larger concentrations of wealth in the hands of a few power elite.

All Time High Stock Market

Prior to the COVID-19 pandemic, the stock market was on-fire breaking all time high records on a regular basis. This phenomena has largely been a continuation of a process set in motion since the 2008 bailout.

Over the last decade, the richest companies have concentrated enormous amounts of wealth while average Americans have struggled to regain their footing since the financial crisis. For the vast majority, wages have been stagnant for decades, job insecurity is a growing concern and the gap in income inequality continues to widen.

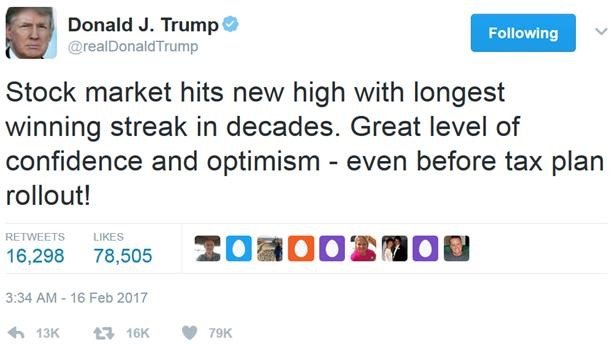

2017

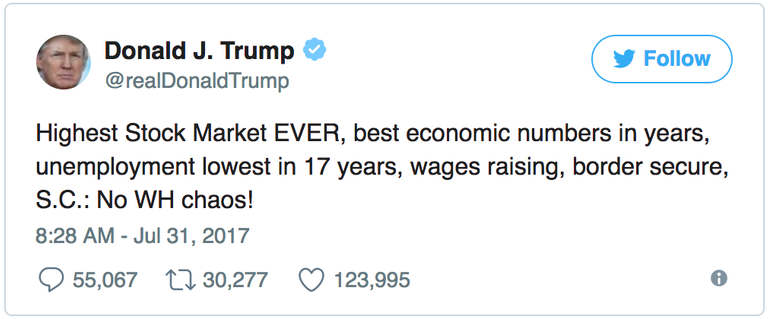

2018

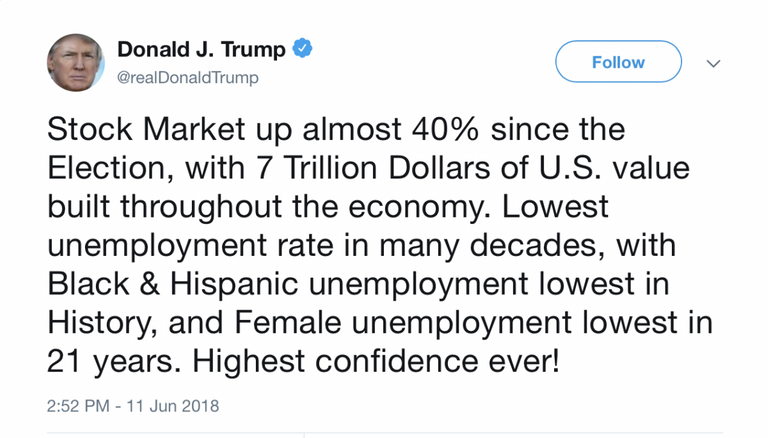

2019

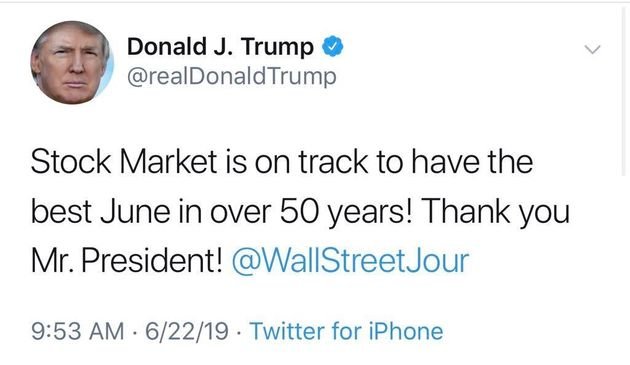

2020

twitter.com/@realdonaldtrump

US president Donald Trump never missed an opportunity to point to the stock market as proof of a healthy and resurgent economy, all thanks to Trump of course. At the same time, the American public scratched their collective heads in wonder. Apparently, the economy was booming.

The truth is - Main Street never recovered, while Wall Street prospered.

Then how is it that the NYSE, the NASDAQ and the S&P 500 were experiencing a modern day gold rush?

Part of the answer lies in stock buybacks.

Trump Tax Cut for the Wealthy

As a result of Trump's 2017 Tax Cuts and Jobs Act (TCJA), the richest 400 Americans in the country pay a lower-tax rate than any other group.

It’s never been more clear that our country’s tax code is built to serve only those who have the most money. While hedge fund managers, private equity executives and venture capitalists benefit from the carried interest tax loophole, everyday Americans barely get a deduction for their student loan interest payments

forbes

The significance of the 2017 (TCJA) for the biggest corporations is that the vast majority of companies who benefitted from the tax break simply used the money to buy back even more of their own stock to inflate the share price.

This is in stark contrast to how the 2017 tax cut bill was sold to the American people. The argument made at the time is that if US corporations paid less taxes they would have more money to reinvest in workers and hire more Americans.

money.com

Stock Buyback Bonanza

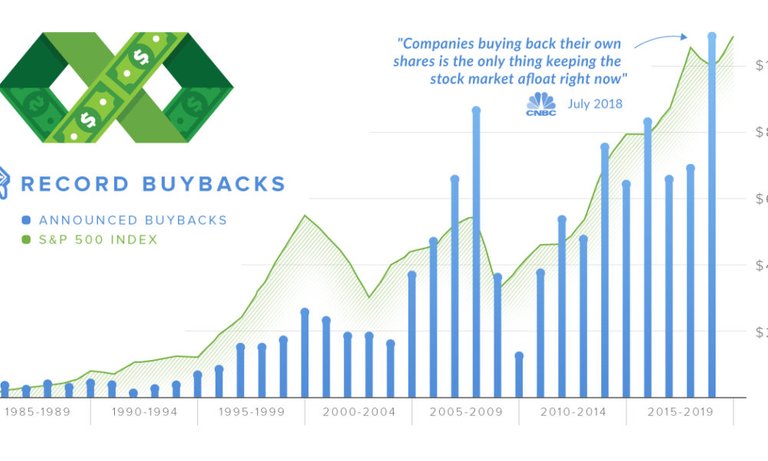

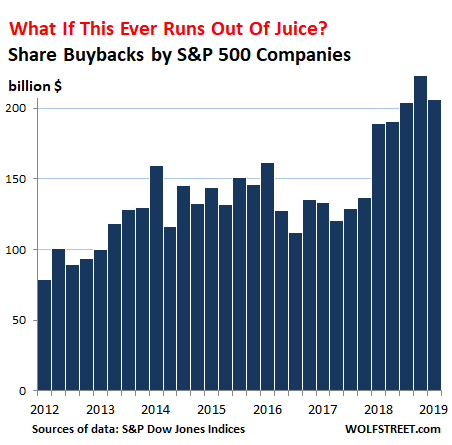

Since 2008, stock buybacks have been a driving force in consistently pushing the stock market to never before seen all time highs. Companies looking to increase their bottom line have found that repurchasing shares in their own company is a quick and efficient way to achieve results with little effort.

A significant factor that makes the practice so appealing boils down to the short-term benefit of repurchasing shares. Since CEO pay has been closely tied to stock performance, it seems natural that CEOs regularly gravitate towards buybacks. It has quickly become the instrument of choice for many CEOs as it keeps shareholders content in cases where a CEOs performance, and actual company growth, has been uninspiring.

There's no question the big winners in buybacks are the shareholders and the top executives at the company. Of course, unsurprisingly, the top executives are most often the largest shareholders in the companies to begin with. At the same time, top executives and CEOs are often paid in a combination of cash and stock options which only further incentivizes stock buybacks.

It's estimated that since the bank bailouts of 2008, that companies have invested almost $4 trillion into buybacks.

It’s the “shock” market rally — cash-rich US companies have plunged nearly $4 trillion of their cash into buying back their stock since 2008, which is why all the stock indexes are hovering near record territory.

How Buybacks Work

The practice of stock repurchasing is quite straight forward. Buying back stock removes shares from the market, concentrates shares into a fewer number of stakeholders, and the stock price rises as the number of available shares is reduce.

A stock buyback, also known as a share repurchase, occurs when a company buys back its shares from the marketplace with its accumulated cash. A stock buyback is a way for a company to re-invest in itself. The repurchased shares are absorbed by the company, and the number of outstanding shares on the market is reduced. Because there are fewer shares on the market, the relative ownership stake of each investor increases.

investopedia

So what's the problem with buybacks, it's a win-win, right?

The problem with buybacks is that they mask the true value of the company and, at a larger scale, obscure attempts to measure the resilience of actual economic conditions. Furthermore, the practice only exasperates the chasm between the ultra-rich and the poorest of our citizens.

As a 2015 Reuters article on buybacks notes;

These financial maneuvers, they argue, cannibalize innovation, slow growth, worsen income inequality and harm U.S. competitiveness.

reuters

Despite the risks to future viability and financial longevity posed by short sighted share repurchasing, major corporations have become captivated by the process and addicted to quick profits.

Buybacks or Bust

Some analysts suggest stock buybacks are the only thing propping up the stock market.

Visual Capitalist

Wolf Street

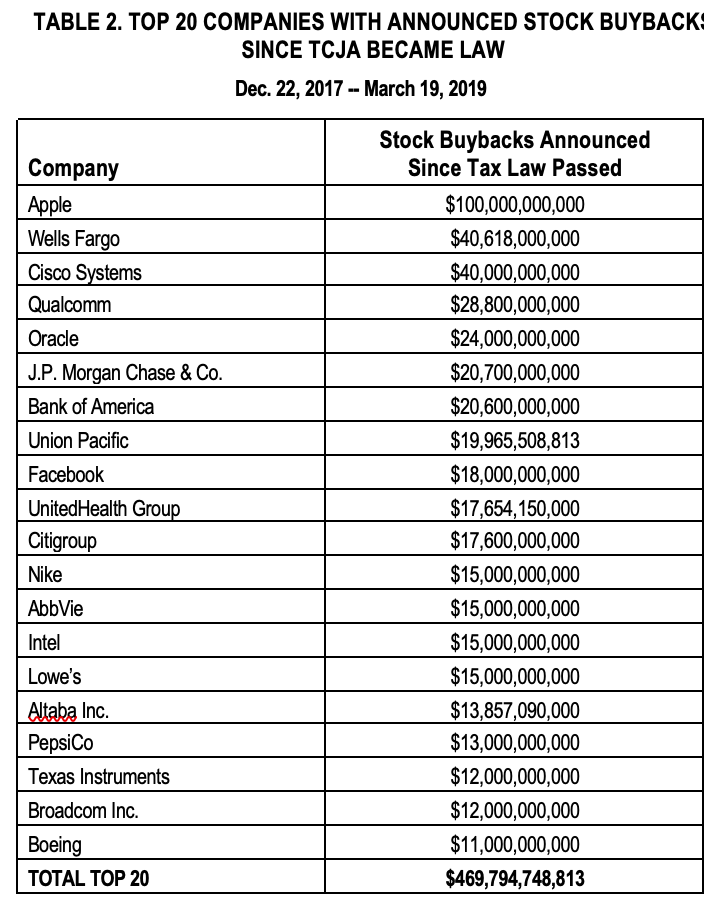

Leading up to the COVID-19 pandemic, the stock market was regularly seeing record numbers. From IT to banking, major corporations such as Apple, Wells Fargo, IBM, Oracle, JP Morgan, Bank of America, Facebook, Citigroup, Nike, Intel, Pepsi, Boeing,... the list goes on, were heavily committed to stock repurchasing programs.

americans for tax fairness

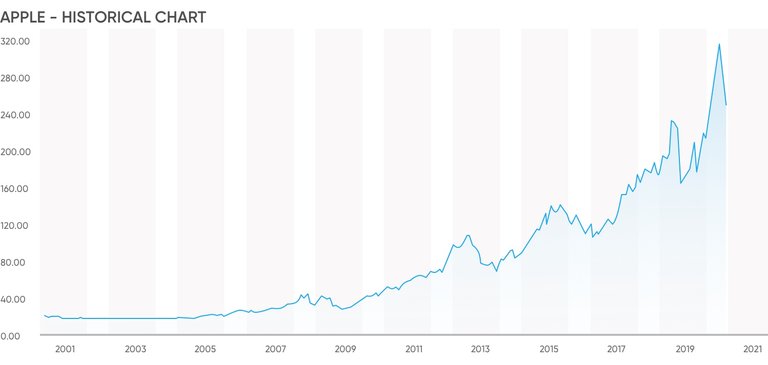

Leading the way was Apple, a company that keeps over $250 billion in cash in overseas tax havens and does whatever it can to avoid paying US income tax on it's revenue, has been repurchasing it's company's own stock for over a decade. The company bought back more than $100 billion between 2017 and 2019.

As a result, Apple's share price has skyrocketed coinciding with the rise in popularity and increasing interest in stock repurchasing programs throughout the private sector.

CapitalOne

It wasn't until Trump's Tax plan was officially signed into law, which lowered the corporate tax rate from 35% to 21%, that Apple decided to finally re-invest $30 billion in the United States and announced their intention to create thousands of new tech jobs for Americans.

Regardless of their announced intentions, critics maintain that Apple executives rake in obscene profits while their workforce, many of who work in Chinese sweatshops, toil away under oppressive conditions.

Even with all the advantages of lower income tax rates, the highest stock valuation on the market, record profits, and hundreds of billions in cash stockpiles, there's no thought of sharing a modicum of prosperity with the workers who make their products overseas.

Long time advocate and activist, Ralph Nader, argues that even a very modest amount of 1-to-2 precent of the $100 billion the tech giant spent on buybacks would make a monumental difference in the quality of life for FoxConn workers in China.

“For less than 2 percent of your $100 billion buyback, or $2 billion, you could award a full year’s pay bonus to the 350,000 Foxconn workers who build your iPhones,” Nader wrote. “Think of the economic relief and happiness that gesture would produce. These workers sweat for your immense wealth in difficult workplace conditions, unable to afford the Apple phones they manufacture for your company’s massive profits.”

[FoxConn Factory] Saturday Herald

Apple is far from being the only company engaged in stock buybacks, many of the countries most famous brands have been aggressively committed to the practice since the Trump tax cuts took effect.

A string of companies, including Boeing and Honeywell, have announced close to $90bn worth of share buyback programmes since the reforms were agreed in December. Bank of America Merrill Lynch estimates that of $1.2tn parked overseas, perhaps half of the post-tax total, or around $450bn, could be devoted to share buybacks.

Boeing, still reeling from the 737 MAX disaster, has been trying to keep its shareholders happy by increasingly relying on buybacks to appease exasperated investors upset with the management of the scandal by the company.

The airline industry in particular is up to their ears in buybacks, investing an incredible 96% of their cash flows into the practice. United airlines spent 80% of it's cash on repurchases, while American Airlines took out loans to cover their buybacks to the tune of 12.7 billion dollars.

A Stock Market Disconnected from Reality

Clearly, the practice of stock buybacks has been a major contributor to an artificially inflated stock valuations. As a result, we have a stock market with very little relation to reality:

"It has massively manipulated the market,” said Richard Bowen, the former Citi executive who blew the whistle on the bank during the subprime mortgage crisis, and noted how these share buybacks in the open market were once deemed illegal. The Securities and Exchange Commission eased the rules in the early ’80s.

To make matters worse, many of the companies took advantage of low-interest loans in order to increase the amount of stock buybacks further blurring the already opaque economic waters.

Let's be honest, the practice of buying back stock is not illegal. Yet, the process has lead to a grotesque overly inflated economic system that is nothing more than a grand illusion.

It was only a matter of time before the fake stock market crashed. COVID-19 is a convenient scapegoat but the truth is it was a house of cards to begin with.

As the overreaction to COVID-19 continues to decimate the US economy, large corporations who refused to reinvest in their employees, save money for when times are thin and spent enormous amounts on stock buybacks are now asking for even more government assistants.

Why should companies who fail to put aside profits in case of difficult periods on the horizon and operating with very low-liquidity now be first in line to receive government assistance?!

These are the titans of industry, the richest companies on the planet!

When average Americans mismanage their money or speculate on future earnings or fail to save for unexpected expenses.

There are no bailouts.

Tough luck, they're told.

You done fucked up.

Game over. You lose.

When corporate America fucks up,

there's no end to the charity, assistance and free loans.

They're perpetually bailed-out.

They lose nothing, they only gain.

Well written, good piece Vap. At the end of the day it's all about profits and investments. Blue collar workers are replaceable whereas investors are not. The pursuit of the almighty dollar, above everything else, is the reality we live in.

Corporate cronyism at it's best. Government knows how to fuck with the "natural laws" of correction in a free market and save the big boys from getting wiped out so that they can continue to rig and game the economy in their favor. Rich get richer and poor get poorer. These bubbles need to pop out of the fantasy sky they float in, and drop hard onto the ground of reality. This correction to reality is never happening, and we keep sailing higher into the fantasy clouds to increase the severity of the impact when it actually does hit ground. We keep going higher and higher, ensuring greater and greater hardship when the house of cards can't be built any higher and it all falls down.

Greed know no bounds. I can only imagine how those that spend all of their waking hours on Wall Street get caught up in a sort of bloodlust for even greater profits though they have more money than they will ever need. It's little wonder that some even call themselves "the masters of the universe".

We are facing a massive depression, and a collapse of empire, indeed dark days on the horizon. However, we have an opportunity here to seize the narrative and move society in a new direction if we demand it.

Yeah, forget just a greater recession, it's gonna get to a depression level most likely. The economic collapse has had writing on the wall for decades... at some point the illusion will shatter. Indeed, chaos/negative teachers. That's unfortunately the catalyst many require to wake up and see what's going on, to ask themselves "how" and "why", and finally realize they've been lied to and awaken the desire to inquire and ask questions by thinking for themselves and going to get the information outside the mainstream.

People I know kept saying "the economy is great! the stock market is hitting epic high's right now!!!!11" but wouldn't listen to me when I told them that the stock market was an absolute joke. The stock market no longer represents the health of the 'economy' (which is hardly a word we can use to describe much anymore) but is rather just a reflection of the mega companies getting even more rich. Fell on deaf ears though and now they are crying that the market is crashing to "attack Trump" as if he has anything to do with it. Comical and unfortunate how brainwashed some are.

Bang on with buybacks analysis my friend. Following the Covid fallout .. erm excuse, we're at a point where there is no economy and there is no stock market .. there is simply a FED who is keeping the entire shitshow afloat .. and an institution with that level of power should give us all sleepless nights.

well written article that sums it up nicely.

I have just a small thing to add which might sound a bit controversial.

The companies that did the buybacks were right to do so.

but not in the amount they did it

Its the job of the CEO to make money for the shareholder.

They can do that through augmentation of share value or through dividends. Sadly the tax rules made it more advantageous to use buybacks and they made it so their wage was linked to stock price through stock options.

What they did do was way to much and without regard for R&D and sustainable growth.

As usual greed got in the way of common sense

It is not just buy backs though is it, take a look at Japan, the central bank owns more than 75% of all the stock, quantitative easing, such a cute name for what was and still is, central banks buying stocks and pumping the market, for their own benefit. Take a look at who the EU invests in via quantitative easing, and you will find it to be all the usual suspects companies.

Unethical to say the very least.

For sure, it would be an oversimplification to say that buybacks are the only factor here, but I chose to focus on this as it's one of the easier aspects that most people can wrap their heads round. Ever tried to explain derivatives? It can turn into a hot mess real quick. Yes, QE and austerity programs prescribed by IMF /World Bank / EU - for so many economies certainly plays a role in the widespread economic disfunction and disintegration across the globe.

I can understand your point of view yes, as most people have no idea how it all works.

Unfortunately I don't think this will change anytime soon. We've seen the play book and "it works", which means they will keep doing it and doing it until they aren't able to anymore. When that point is, I'm not entirely sure, but I have a feeling we aren't there yet... The FED has shown time and time again they will do whatever it takes to keep stock prices going up. If they let it drop more than 20%, people can't retire and 'they' have a whole other mess on their hands. So, the game goes on...

Yes, in many ways the cycle perpetuates itself and we're in essence trapped on a runaway train. I don't think this is going to end well as you say if the train slows down there will be major repercussions throughout society. You are correct, it's not a question of if anymore it's a question of when! Its worrying because up until recently most people preferred to be blissfully ignorant of what was/is coming down the tracks.

DUMP IT

@tipu curate

Upvoted 👌 (Mana: 0/10)

Keep working, stop paying.

Only the banksters will get mad.

Nicely written @v4vapid in a manner which allows for easy comprehension by us lay people :>)

Thanks for reading! I'm also a lay person in many ways, but even lay people can see that the economy is rigged.

Yes...with a little attention given to it and research, the obvious comes into the light :>)

Very thorough analysis. Buybacks is what inflated the Markets, not the earnings, now that there will be a lot less buy backs, the Markets will have a hard time of repeating the last 10 yrs.

Posted Using LeoFinance

upvoted :)

Congratulations @v4vapid! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Vote for us as a witness to get one more badge and upvotes from us with more power!