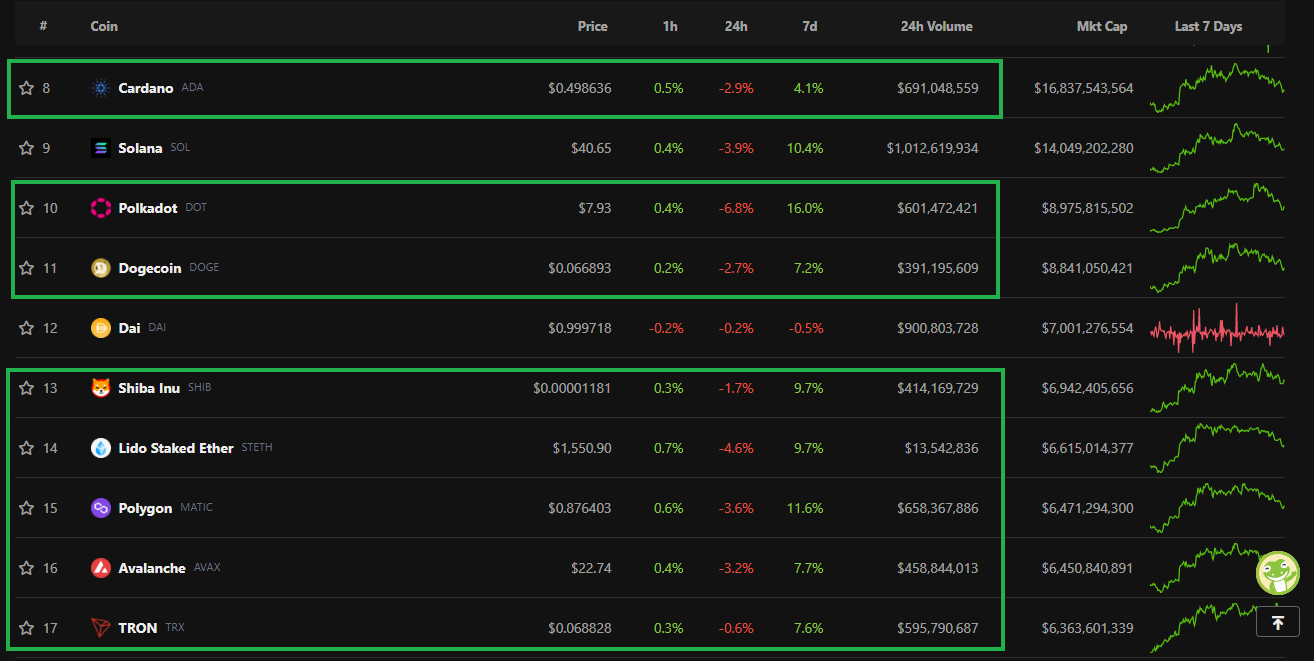

While replying to @dalz under his post on HIVE inflation (deflation) for July I pointed out that HIVE has been having some incredible trading volume (2.5 times of what Cardano is having while being #8 in marketcap). In fact, HIVE was beating around half of the Top 100 cryptocurrencies by trading volume. I have not been following trends or market sentiments around HIVE. I know that I am in for the long run. I'm not going to obsess over some small time movements of a cryptocurrency that could go up 200X.

Volume Can Bring Attention

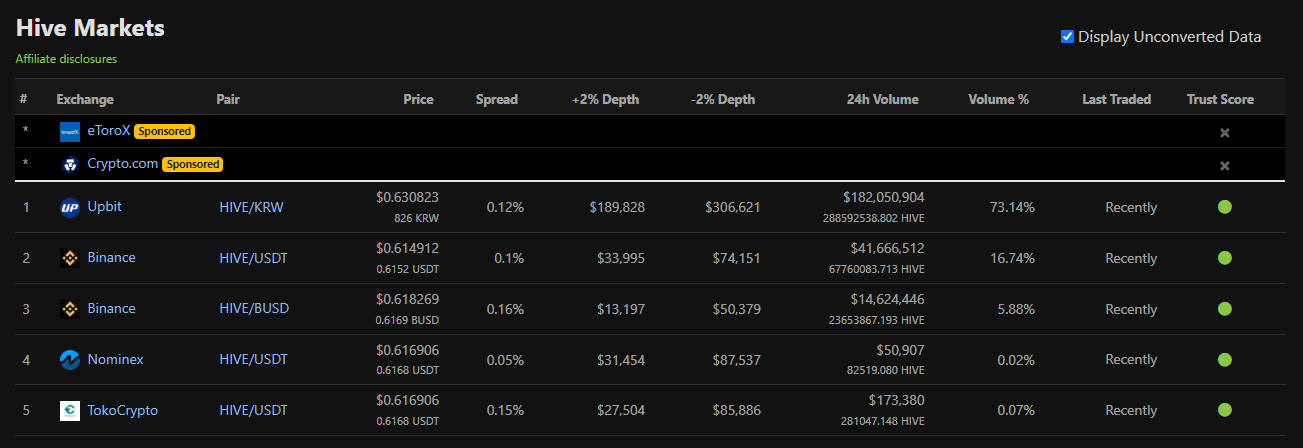

I did not take enough screenshots yesterday. The picture we can see today does mostly represent how things were going at the time. Over 70 of the volume is coming from South Korean won pair.

You can compare these numbers with some of the biggest and most talked about names in Cryptosphere including the meme coins.

THORChain Integration Would Be Amazing

We are already on Binance. When other exchanges see these volumes, it is likely that we would be able to convince them to list HIVE. In fact this is one of the best times for HIVE whales and community representatives to start talking about more exchange listings. We even have HiveFest⁷ coming into the picture. We better utilize this to gain the best of results.

I don't see HIVE much around DEX space. I have a special love towards what THORChain is trying to do with integrating native assets instead of some wrapped asset. We already have wrapped versions of HIVE available on Polygon and BNB Chain courtesy of @leofinance team. You can try it out here. As an investor of POLYCUB and CUB, fees you pay for these services will benefit me albeit in tiny amounts.

I Barely Had Any Liquid HIVE

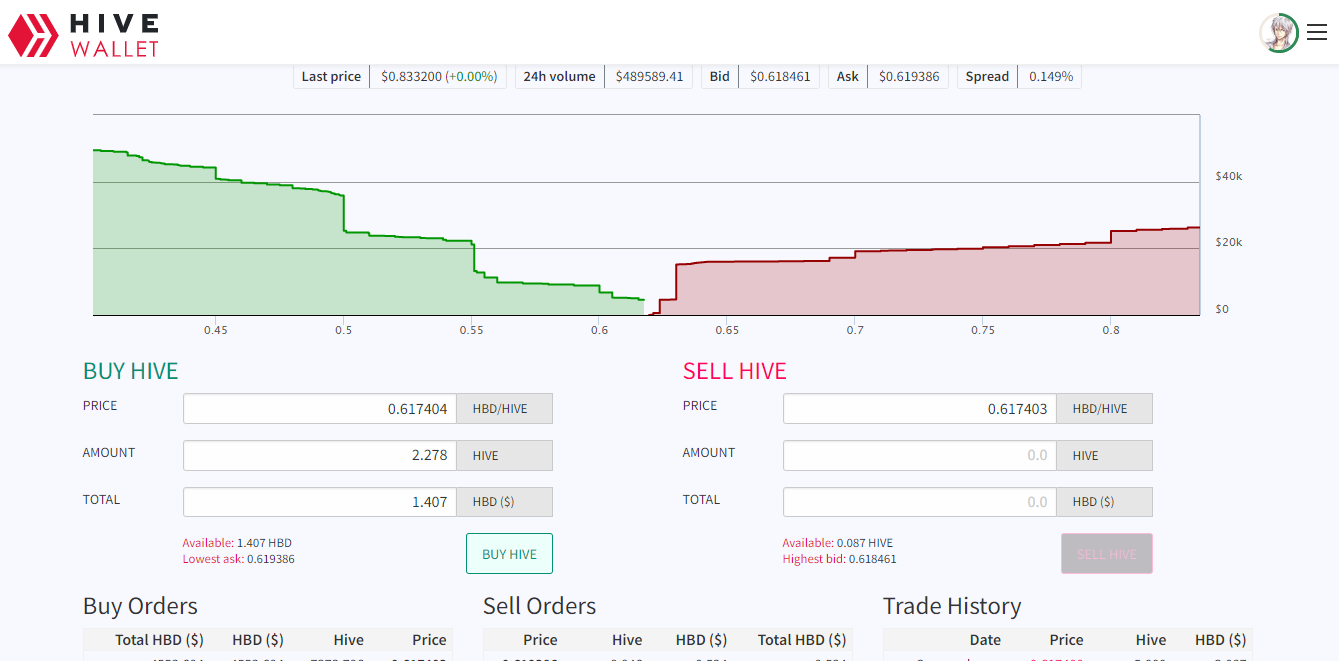

I sold what I had while HIVE was trading above 80 cents expecting to buy back on the next day. The next day is here and the markets are bahaving more or less the way I expected it to behave.

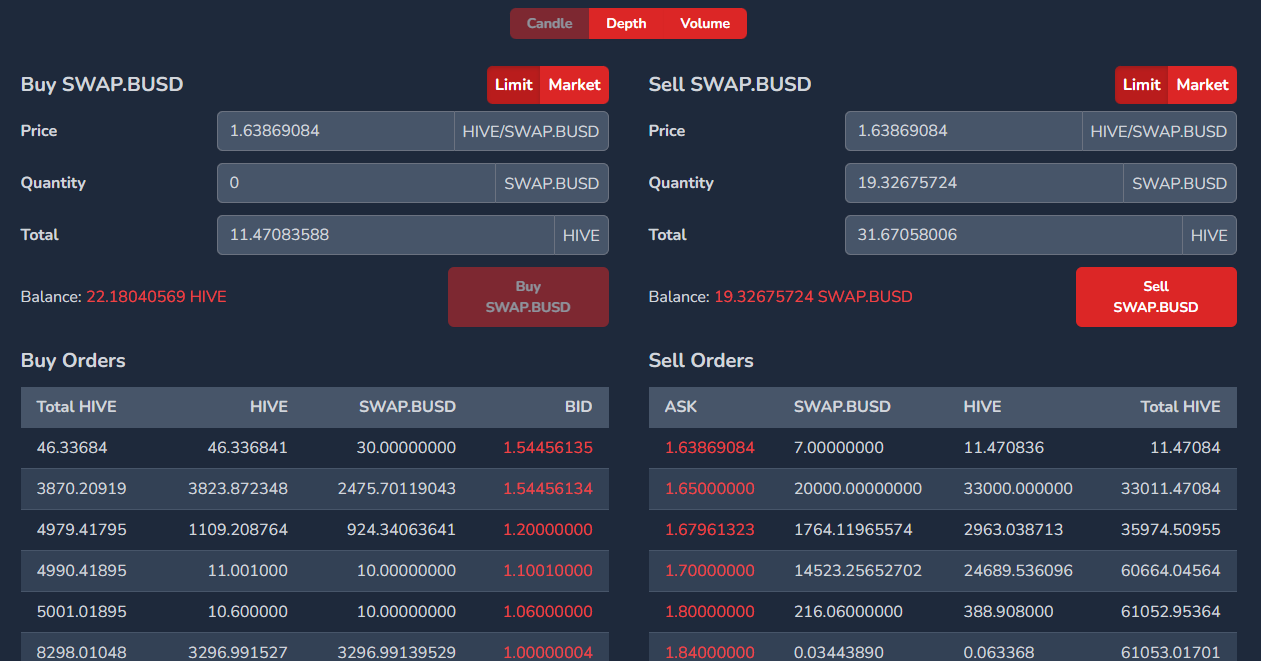

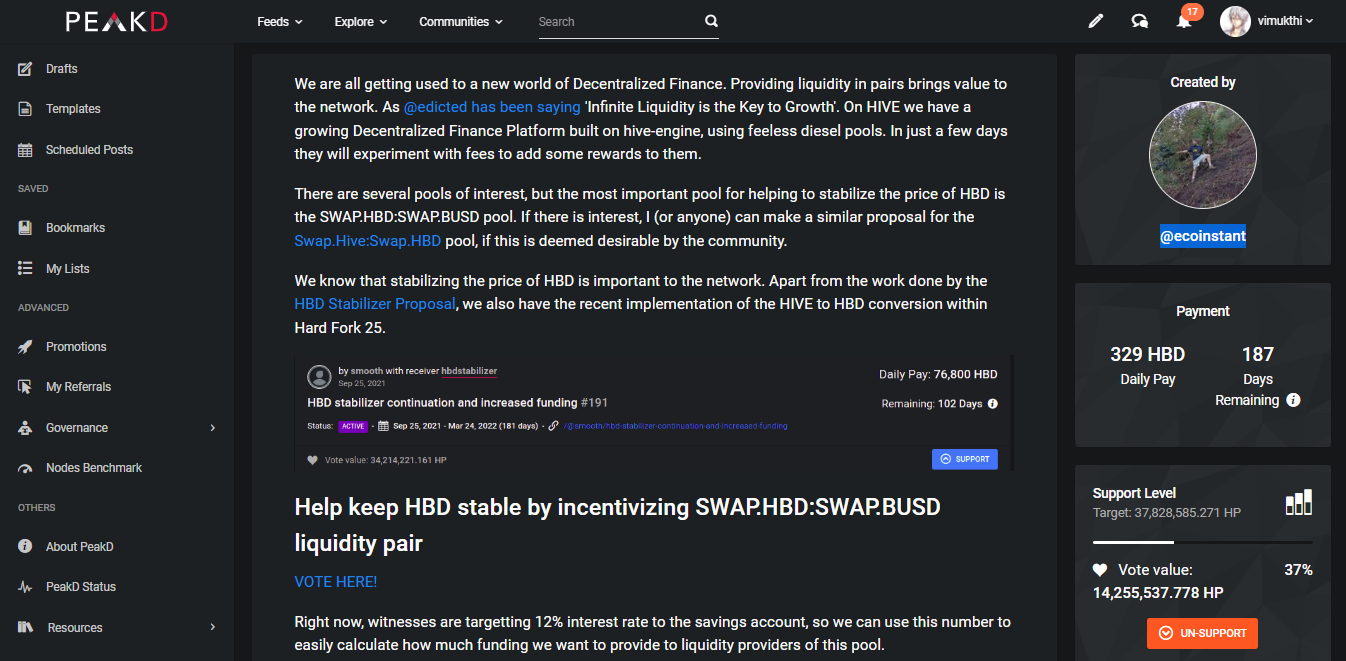

I sold some of the HIVE I had for HBD on HIVE DEX. The prices and volume did not seem that good on SWAP.HBD; hence the use of SWAP.BUSD. Now that we have come to talk about stablecoins on HIVE-Engine, I must bring your attention to my favorite unfunded DHF Proposal by one of the best community members of HIVE; @ecoinstant

No Trading Fees Were Paid in The Making of This Article

That is one of the greatest things about HIVE and HIVE-Engine. We simply don't pay fees for transactions or trades. There were some fees for the Diesel Pools. Even those could be changed over time if there were sufficient other incentives to provide liquidity to these assets.

HIVE is one of the greatest projects in cryptosphere. What makes it even more amazing is the community we have built. HIVE has very little presence on social media. It is not surprising because HIVE is the better social media.

Compared to this, other projects I have mentioned have 20 times or even more followers. For an example:

- Cardano - 850.6K Followers

- Polkadot - 1.3M Followers

- Avalanche - 721.6K Followers

- Polygon - 1.5M Followers

- Tron - 1.4M Followers

HIVE does not get that many times to shine in the mainstream. We are basically a major threat to the way things are usually done in cryptosphere. We should not waste these chances we get in the bear market.

Happy Investing! Happy Marketing!

Posted Using LeoFinance Beta

There is a withdraw/deposit fee for moving over from and to Hive/Hive-Engine. The only way I know to avoid the fees is to provide liquidity to the opposite side of the trade at the hiveupme bridge. If it doesn't require liquidity, then there is a 0.1% transfer fee.

Posted Using LeoFinance Beta

This is the cheapest option I have come across so far. Thank you very much!

!PIZZA

I wonder if the attention is good attention. Won't outsiders be looking and saying that it is just a pump and dump?

Posted using LeoFinance Mobile

They do say that. I've gotten DMs from people about "how long do these pumps usually last?"

I would still insist that such DMs are better than people completely ignoring HIVE. We should take the opportunities to tell more people about features and DAPPs of HIVE and get them to make and account and power of few dollars worth HIVE. We should treat this as part of a marketing funnel. Once you get few people to make an account and install Keychain, they can discover rest of the ecosystem at their own preferred speed.

!PIZZA

Lol account creation is atrocious around here.

People thing everything related to cryptocurrency is a scam. There is always some people who would speak ill of a project. Even saints have their detractors. What matters to us is the free marketing we get. As I have shown in the later parts of the article, HIVE has barely any social media marketing going on for it. I would say the pros of attention we are getting far outweigh the cons.

!PIZZA

Pumps do that.

Posted Using LeoFinance Beta

Good job with SEO. Today I checked LeoPedia on Similarweb and the numbers did not look that great. I think LeoPedia deserve some love and attention. It could be greatly helpful for newcomers to the cryptosphere.

!PIZZA

You''re wrong about one thing. You do pay a fee of a fraction of a percent to move from native Hive to Hive-Engine Hive but that's very small compared to the spread between the best buy price and the best sell price in many trading pairs. If you want to buy BUSD you can go to Ionomy and buy 10 BUSD for HBD. I'm keeping the spread at 2% for the end user. So, 10.1 HBD buys 10 BUSD approximately on Ionomy. So far keeping liquidity has been more profitable than not doing anything with it but a lot less profitable than simply leaving it in Savings and collecting interest.

That is not a trading fee. It is a deposit/withdrawal fee. The lowest I know comes from HivePay](https://hivepay.io/swap) which is 0.2%

I have most of my cryptocurrency earning some form of a yield. The tiny bits I have liquid becomes useful when I want to have some flexibility with my finances.

!PIZZA

I hope the pump won't make hive get wrong attention

Posted Using LeoFinance Beta

There is always going to be some level of wrong attention. At least bear markets tend to wash out many of the scammers and other bad actors.

!PIZZA

That is a very good point

Posted using LeoFinance Mobile

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

PIZZA Holders sent $PIZZA tips in this post's comments:

vimukthi tipped taskmaster4450le (x1)

@vimukthi(5/5) tipped @leprechaun (x1)

vimukthi tipped dwayne16 (x1)

vimukthi tipped zooropa84 (x1)

Join us in Discord!

This was likely a domino effect. I have seen this happen with several cryptocurrencies being a trader for 5 years. Some initial pump can get viral attention sometimes making more people trading it creating many opportunities for professional traders and whales to do quick day trades. I would consider this similar to a viral social media post. Sometimes things align to create a very favorable market for an asset. After some pump, some people are going to take their profits and get out and that creates a fall in price. We should simply expect more of similar events going forward.

!PIZZA

Take a look at a chart like this one on TradingView. The price goes up and down a lot and this volatility goes up during steep rises and falls in price. Day traders don't simply buy once and sell near the top. Some do that while others (especially trading bots) buy and sell many times every hour to maximize gains. More volatility leads to more opportunity to make profits day trading.