.jpeg)

Cryptocurrency prices turned lower in trading Wednesday (25/8/2021) morning Indonesian time, after more than a week of scoring a fairly promising rally.

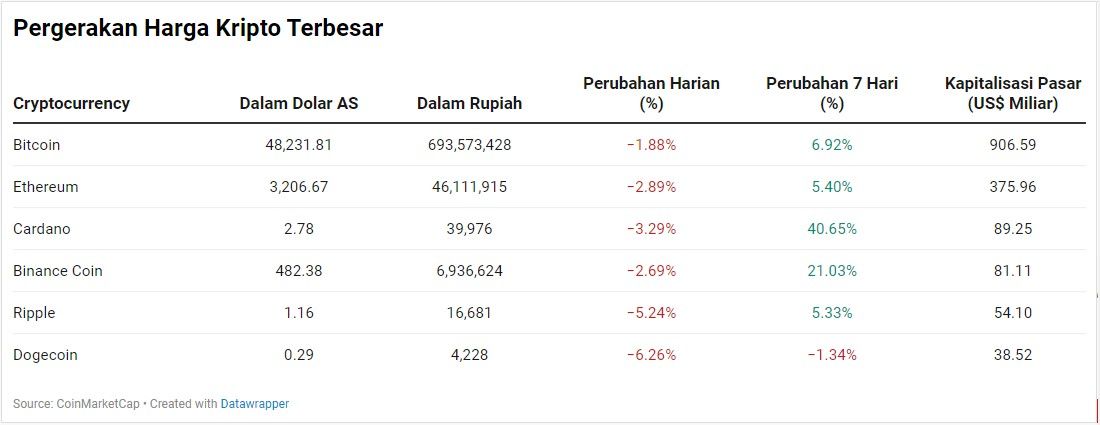

Based on data from CoinMarketCap at 09:15 WIB, the six largest non-stablecoin cryptocurrencies were trading in the red this morning.

Bitcoin weakened 1.88% to a price level of US$ 48,231.81/coin or equivalent to Rp. 693,573,428/koin (assuming today's exchange rate is Rp. 14,380/US$), ethereum slumped 2.89% to a level of US$ 3,206.67 /coin (Rp 46,111,915/koin), cardano dropped 3.29% to US$ 2.78/coin (Rp 39,976/coin).

Furthermore, binance coin corrected 2.69% to US$ 482.38/coin or Rp 6,936,624/koin, ripple fell 5.24% to US$ 1.16/coin (Rp 16,681/coin), and Dogecoin fell 6 .26% to US$ 0.294/coin (Rp 4,228/coin).

The majority of cryptocurrencies weakened again after a period of bullish sentiment that occurred in the past week, making investors realize their profits again.

After breaking above $50,000 earlier this week for the first time in three months, bitcoin slipped and traded around $48,000 this morning.

Some analysts expressed caution after bitcoin failed to break above the $50,000 level.

“The upside comes with some moderation, and we don’t expect a more exponential upside breakout like we saw in late 2020 to early 2021,” crypto trading firm QCP Capital said in its Telegram chat, quoted by CoinDesk.

On the other hand, according to Arcane Research, the level of 'greed' in bitcoin tends to increase over the past week.

"Investors' fears are starting to dissipate for now, and the market is currently optimistic, maybe even very, very optimistic," Arcane Research wrote in its newsletter Tuesday (08/24/2021), reported by CoinDesk.

Bitcoin's rise to $50,000 has sent the "Fear and Greed" index in crypto into "extreme greed" territory this week.

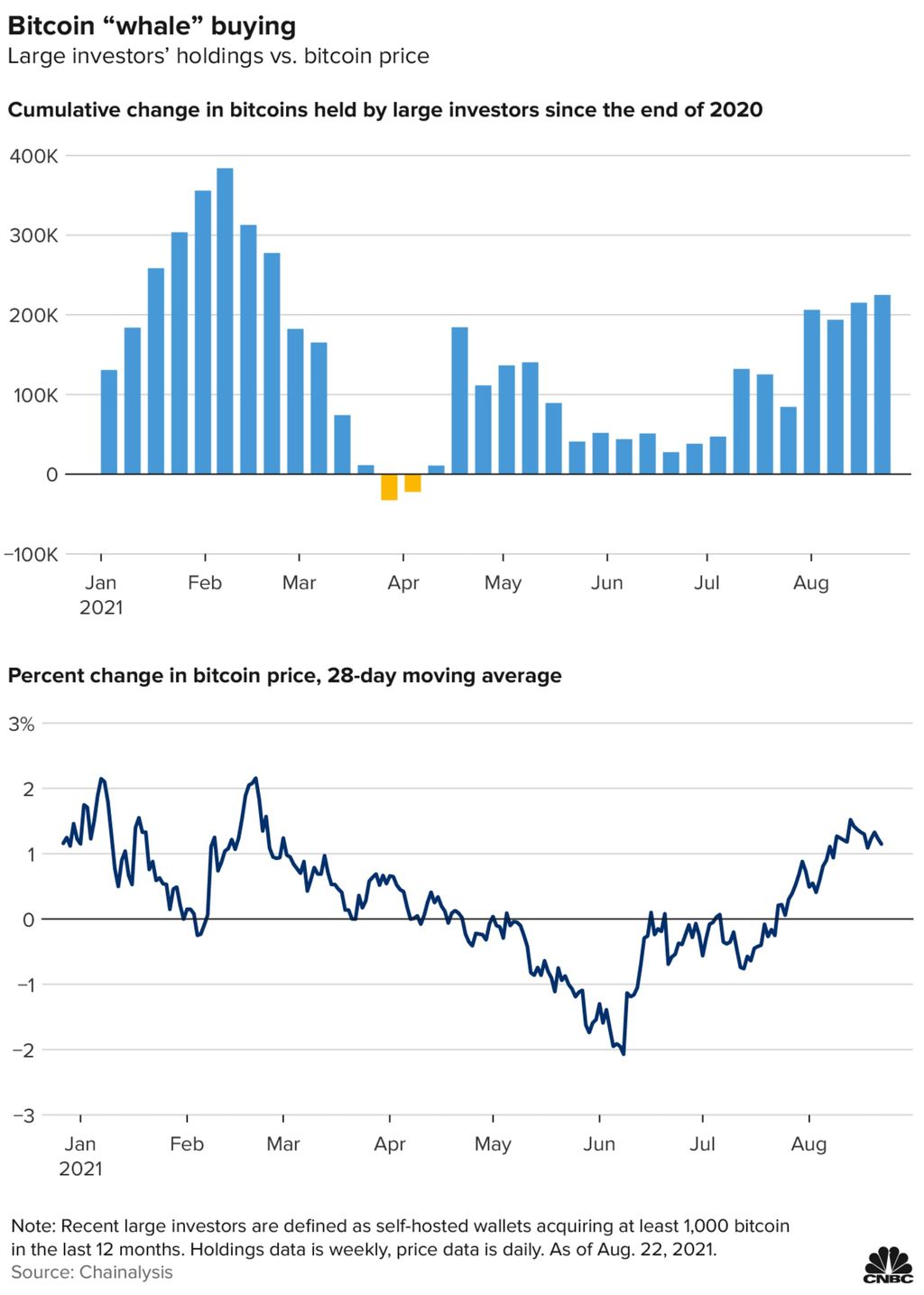

Meanwhile, the number of investors who have large enough holdings and funds or the term whales has increased in recent weeks. The whales seem to be starting to increase their holdings when the bitcoin price is indicated to be recovering.

The activity of the bitcoin whales has been linked to the price reaction this year. The whales can move prices in the market until the end of February.

“When whales acquire more digital assets, prices typically go up for 28 days. When they sell, prices go down,” Chainalysis said, quoted by CNBC International.

Whale activity has fluctuated along with the volatility of digital assets. While they were strong buyers to start the year, the whales started selling bitcoins in March to a bitcoin record peak last April.

From late June to August 22, the whales earned the equivalent of nearly $10 billion at Tuesday's trading price.

Those larger investors also tend to be long-term holders (Hodlers). Whales as measured by Chainalysis tend to retain at least 75% of the bitcoins they buy.

.jpeg)

Source of plagiarism

Direct translation without giving credit to the original author is Plagiarism. Repeated plagiarism is considered fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

Guide: Why and How People Abuse and Plagiarise

Please note that direct translations including attribution or source with no original content are considered spam.

If you believe this comment is in error, please contact us in #appeals in Discord.