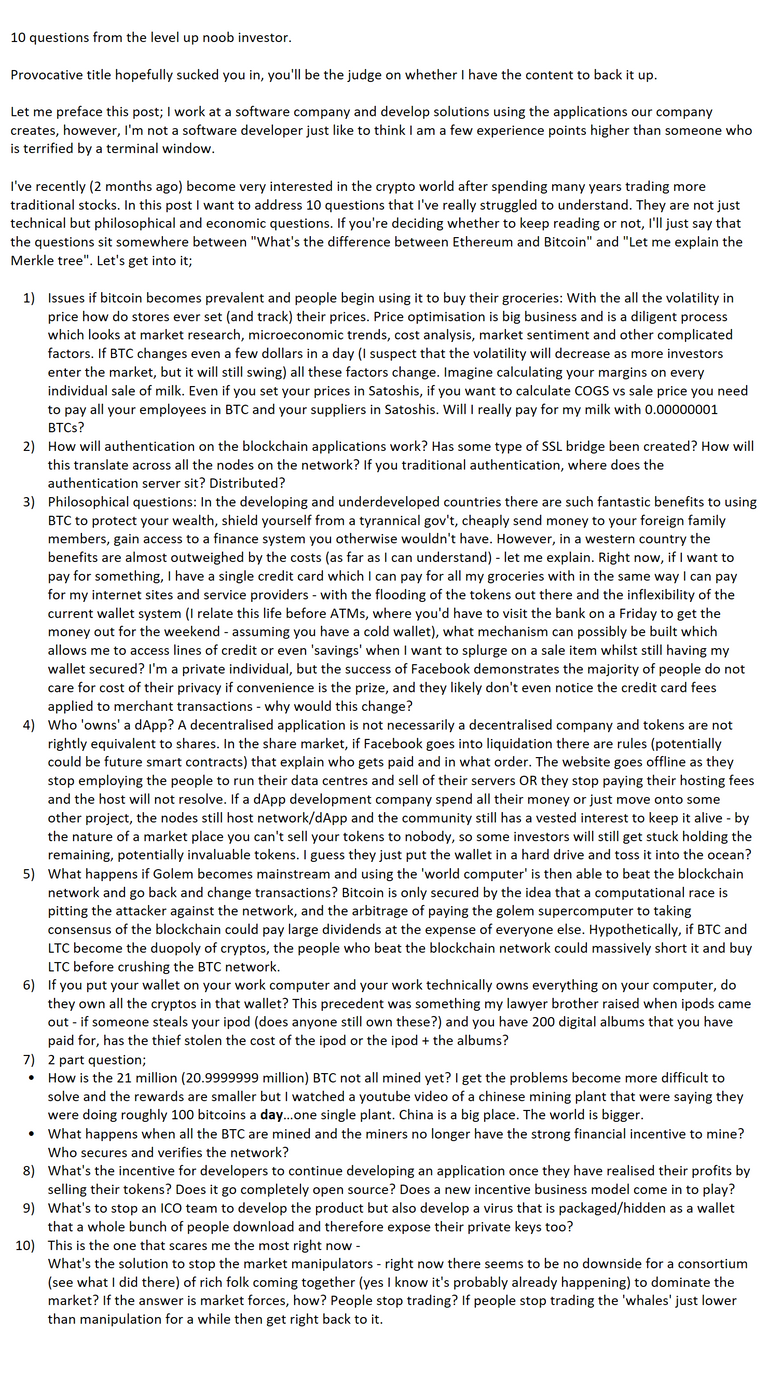

Provocative title hopefully sucked you in, you'll be the judge on whether I have the content to back it up.

Provocative title hopefully sucked you in, you'll be the judge on whether I have the content to back it up.

Let me preface this post; I work at a software company and develop solutions using the applications our company creates, however, I'm not a software developer just like to think I am a few experience points higher than someone who is terrified by a terminal window.

I've recently (2 months ago) become very interested in the crypto world after spending many years trading more traditional stocks. In this post I want to address 10 questions that I've really struggled to understand. They are not just technical but philosophical and economic questions. If you're deciding whether to keep reading or not, I'll just say that the questions sit somewhere between "What's the difference between Ethereum and Bitcoin" and "Let me explain the Merkle tree". Let's get into it;

1) Issues if bitcoin becomes prevalent and people begin using it to buy their groceries: With the all the volatility in price how do stores ever set (and track) their prices. Price optimisation is big business and is a diligent process which looks at market research, microeconomic trends, cost analysis, market sentiment and other complicated factors. If BTC changes even a few dollars in a day (I suspect that the volatility will decrease as more investors enter the market, but it will still swing) all these factors change. Imagine calculating your margins on every individual sale of milk. Even if you set your prices in Satoshis, if you want to calculate COGS vs sale price you need to pay all your employees in BTC and your suppliers in Satoshis. Will I really pay for my milk with 0.00000001 BTCs?

2) How will authentication on the blockchain applications work? Has some type of SSL bridge been created? How will this translate across all the nodes on the network? If you traditional authentication, where does the authentication server sit? Distributed?

3) Philosophical questions: In the developing and underdeveloped countries there are such fantastic benefits to using BTC to protect your wealth, shield yourself from a tyrannical gov't, cheaply send money to your foreign family members, gain access to a finance system you otherwise wouldn't have. However, in a western country the benefits are almost outweighed by the costs (as far as I can understand) - let me explain. Right now, if I want to pay for something, I have a single credit card which I can pay for all my groceries with in the same way I can pay for my internet sites and service providers - with the flooding of the tokens out there and the inflexibility of the current wallet system (I relate this life before ATMs, where you'd have to visit the bank on a Friday to get the money out for the weekend - assuming you have a cold wallet), what mechanism can possibly be built which allows me to access lines of credit or even 'savings' when I want to splurge on a sale item whilst still having my wallet secured? I'm a private individual, but the success of Facebook demonstrates the majority of people do not care for cost of their privacy if convenience is the prize, and they likely don't even notice the credit card fees applied to merchant transactions - why would this change?

4) Who 'owns' a dApp? A decentralised application is not necessarily a decentralised company and tokens are not rightly equivalent to shares. In the share market, if Facebook goes into liquidation there are rules (potentially could be future smart contracts) that explain who gets paid and in what order. The website goes offline as they stop employing the people to run their data centres and sell of their servers OR they stop paying their hosting fees and the host will not resolve. If a dApp development company spend all their money or just move onto some other project, the nodes still host network/dApp and the community still has a vested interest to keep it alive - by the nature of a market place you can't sell your tokens to nobody, so some investors will still get stuck holding the remaining, potentially invaluable tokens. I guess they just put the wallet in a hard drive and toss it into the ocean?

5) What happens if Golem becomes mainstream and using the 'world computer' is then able to beat the blockchain network and go back and change transactions? Bitcoin is only secured by the idea that a computational race is pitting the attacker against the network, and the arbitrage of paying the golem supercomputer to taking consensus of the blockchain could pay large dividends at the expense of everyone else. Hypothetically, if BTC and LTC become the duopoly of cryptos, the people who beat the blockchain network could massively short it and buy LTC before crushing the BTC network.

6) If you put your wallet on your work computer and your work technically owns everything on your computer, do they own all the cryptos in that wallet? This precedent was something my lawyer brother raised when ipods came out - if someone steals your ipod (does anyone still own these?) and you have 200 digital albums that you have paid for, has the thief stolen the cost of the ipod or the ipod + the albums?

7) 2 part question;

• How is the 21 million (20.9999999 million) BTC not all mined yet? I get the problems become more difficult to solve and the rewards are smaller but I watched a youtube video of a chinese mining plant that were saying they were doing roughly 100 bitcoins a day…one single plant. China is a big place. The world is bigger.

• What happens when all the BTC are mined and the miners no longer have the strong financial incentive to mine? Who secures and verifies the network?

8) What's the incentive for developers to continue developing an application once they have realised their profits by selling their tokens? Does it go completely open source? Does a new incentive business model come in to play?

9) What's to stop an ICO team to develop the product but also develop a virus that is packaged/hidden as a wallet that a whole bunch of people download and therefore expose their private keys too?

10) This is the one that scares me the most right now -

What's the solution to stop the market manipulators - right now there seems to be no downside for a consortium (see what I did there) of rich folk coming together (yes I know it's probably already happening) to dominate the market? If the answer is market forces, how? People stop trading? If people stop trading the 'whales' just lower than manipulation for a while then get right back to it.

I'm not qualified nor do I have the time to answer all of these, but to take on a few of them:

With the mass adoption of crypto, market caps will increase, volume will increase and Bitcoin (to use that as an example) will be much less volatile. The prices will stabilize at a given point, much like forex does, although even there prices vary a lot. You'll have to rewire your brain to stop comparing BTC's price to fiat; you'll have to think that 1 BTC = 1 BTC. Once you do that, you'll come to realize that its fluctuation really doesn't matter unless it's significant, much like you won't think about the USD's fluctuations on a daily basis.

Technically the company owns it, I suppose, but to avoid this issue altogether, just don't store your wallet on your work computer. Store it cold or online, in that case.

Part 1: Did you somehow verify the amount of BTC this plant mines? When exactly were they interviewed - could it have been years ago? Was it one of the largest plants in the world? You just have to trust the maths on this one. No one can actually lie about this as you can look it up yourself.

Part 2: There are probably creative ways to solve this, but they will probably be rewarded by fees.

The developer's ambition of making a change. Currently this is actually an issue, as a lot of ICOs raise enough money for the devs to stop caring about their project, and also why a lot of ICOs are scams.

Once the market starts reaching the trillions, even the richest people in the world won't really make a difference in the pricing (obviously depends on what coin they invest in), and even if they do bother to invest billions into a smaller coin, they risk the market going against them, especially if their participation is big enough to make a coin more volatile. You don't see billionaires controlling the forex markets to any significant degree, and neither will they do crypto once it reaches its point of equilibrium. If the trading volume for BTC in 5 years is $1 trillion a day, $100 billion will only skew the market so much, and the other $900 billion that day will react to that movement like they would any other.

You weren’t kidding about the formatting! Here’s my attempt at some responses:

Fiat currencies initially garnered stable valuations from “pegging” their value against a physical asset like gold or the value of other stable currencies (like the Dirham against the Dollar or the Indian Rupee against a basket of currencies). Look up “USDT” as an example in attempts to get a stable peg for cryptos that is tradeable. Until that happens, only a fringe to moderate section of society will use cryptos to buy their groceries. After all you don’t want to be that guy who paid for his pizza with BTC when it was sub 100 bucks a coin.

Not sure how recent this information is but block rewards halve every 4 years on btc. Some estimates say the last coin wont be mined till 2140.

• What happens when all the BTC are mined and the miners no longer have the strong financial incentive to mine? Who secures and verifies the network?

Some of this is similar to how the dollar was pegged to gold to begin with to give it its value. Then we started to create more complex financial instruments that don’t have a physical asset tag anymore. Also, miners will still be paid transaction fees which is incentive for securing the network, but there are some counter theories to this as well.