This agreement is being uploaded to the HIVE blockchain as proof of evidence.

LOAN AGREEMENT dated on the day of 13th Feb 2022

BETWEEN:

.

[@bearbonds] (“the Lender”)

and

[@username] (“the Borrower”)

.

.

Loan and repayment details:

| Loan Amount | Term | Interest % | Collateral | Repayment Due | Repayment Date |

|---|---|---|---|---|---|

| $100 HBD | 3 months | 2.5% (10% annual) | SPI tokens | 102.5 B tokens | 12th May 2022 |

Loans

- Loans will be issued when the borrower has provided the required collateral and signed this agreement in the comments below.

- All loans are issued as Bearbond (B) tokens to the borrowers hive-engine wallet. Bearbonds are pegged to 1 HBD and redeemable by transferring to @bearbonds

- Bearbonds will provide loans from a minimum of 25 HBD to a maximum of 200 HBD during this trial period.

- Each user/person can have a maximum of 2 opens loans during this trial period provided they use 2 different forms of collateral. Eg, LEO and HIVE, OK. LEO and LEO, not OK.

Terms

- Loan length terms are measured in calendar months ranging from 1-6 months during this trial period.

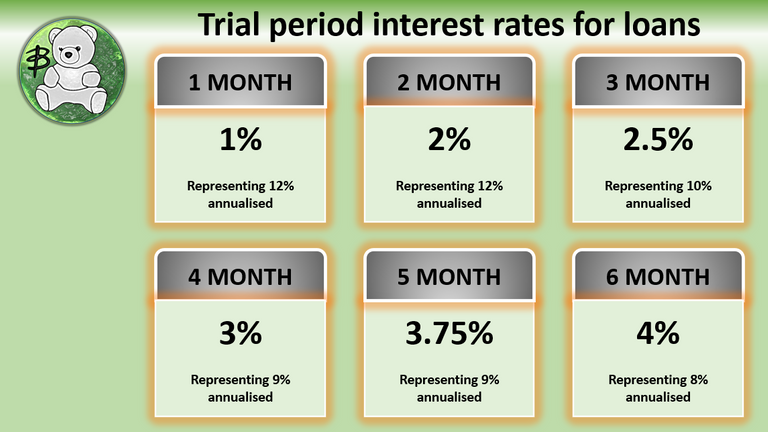

Interest rates

- Interest rates charged are shown as 2 figures

. 1/ Interest charged for the loan amount

. 2/ (Interest shown as an annual percentage) - Interest rates charged are dependent on the length of your loan term

. 1-2 months = 12% annualized

. 3 months = 10% annualized

. 4-5 months = 9% annualized

. 6 months = 8% annualized

Collateral

- Bearbonds will currently accept 3 forms of collateral

. HIVE

. LEO

. SPI - All loans are based on a 200% LTV (loan to value) valuation

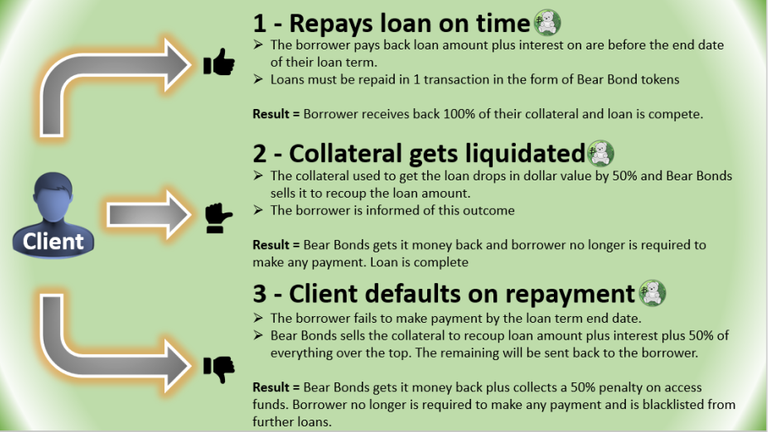

- Provided collateral is subject to liquidation if its value based in HBD falls to 50% of the loan amount secured against it.

- Borrowers can top up collateral to avoid liquidation but no notifications will be provided by bearbonds.

- If a borrowers collateral is liquidated, they will be informed and the loan will be marked as completed.

- Collateral will be held in the @bhold account.

. Any airdrops obtained during a loan term to a borrowers collateral depending on conditions will be forwarded to the borrower 6-24 hours after issue.

. Bearsbonds at its discretion can stake are power-up collateral subject to the loan term.

. All collateral held from borrowers is backed and guaranteed by @spinvest during this trial period.

Repayment Amount

- The repayment amount shown above "Loan and repayment details:" is the total of the loan amount plus total interest for loan term.

- Repayments must be made in 1 transaction in the form of bearbonds (B) tokens

- Send all loan repayments to @bhold

Repayment date

- The borrower promises to repay the loan amount plus interest by the date shown in the "Loan and repayment details:" section above.

- Early repayment is accepted but no discounts are offered and no penalty is enforced.

- Upon receiving repayment, Bearbonds will release borrowers collateral and loan status will be updated to complete.

- Failing to meet this date will result in

. The borrowers collateral being liquidated to recoup the loan amount plus interest.

. A 50% penalty on outstanding collateral will be enforced due to time-wasting

. The remaining 50% of the outstanding collateral after liquidation will be returned to the borrower

. Loan status will be updated to defaulted and the borrower will be blocked from further loans. - Grace periods may be granted with good reason if contact is made at least 48 hours in advance of the final repayment date.

Amendments

- Bearbonds can change and amend any of the above if both borrower and lender agree.

- Amendments are likely during the transition from trial and full launch service

- Any amendments made will only affect new loans and not loans already signed for.

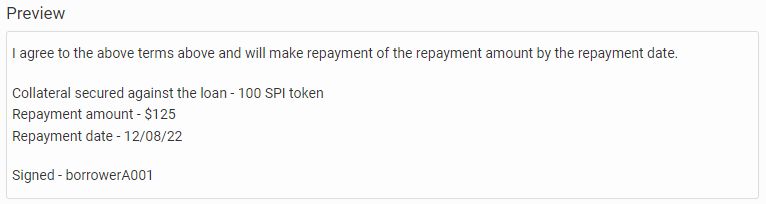

Borrower copy/paste and complete in the comments below

^^^^^^^^^^^^^^^^^^^^^^^^^^^COPY/PASTE BELOW THIS LINE^^^^^^^^^^^^^^^^^^^^^^^^^^^

.

.

I agree to the above terms above and will make repayment of the repayment amount by the repayment date.

Collateral secured against loan -

Repayment amount - $

Repayment date - dd/mm/yy

Signed - borrowerA001

.

.

^^^^^^^^^^^^^^^^^^^^^^^^^^^COPY/PASTE ABOVE THIS LINE^^^^^^^^^^^^^^^^^^^^^^^^^^^

Get in contact

on HIVE - Use the comments below

on Discord - silverstackeruk#3236

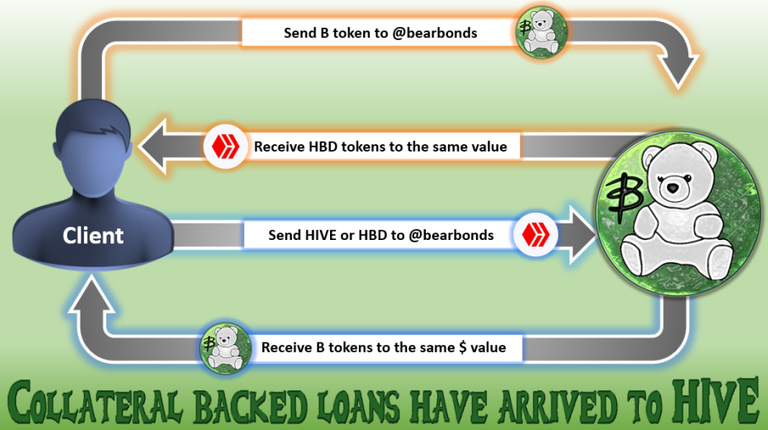

BearBonds Loaning and Repayment process

How bearbonds (B) tokens interact with your HIVE and hive-engine wallet

3 outcomes for each loan

Current loan terms and interest rates

Huh

Posted Using LeoFinance Beta

Can you give me a scenario where someone would want to do this? How does the borrower benefit? Sorry, this is a new concept for me and I don't understand it.

You need a short term loan of $100 for something but you do not wanna sell off your HIVE because you think the price will increase in the short term. You use your HIVE as collateral for a $100 loan. Now you have the $100 you needed and you still own your HIVE. When you pay the loan back, you get your collateral back.

That would be the jest of it. It's a standard model for crypto lending used by platforms like Nexo, crypto.com, Celsuis, etc. I'm trying to introduce it to HIVE 😃

What I don't understand is the fiat transfer. I put the HBD as collateral, but how do I end up with $100 Fiat?

We dont accept HBD as collateral, we issue loans in B tokens which can be converted to HBD in your HIVE wallet.

We dont transfer fiat. If you look at the "BearBonds Loaning and Repayment process" and "How bearbonds (B) tokens interact with your HIVE and hive-engine wallet" pictures from above.

I'm sorry, I still don't understand. I have $100 worth of Hive. I send it to you. You send me $100 of Bear Bonds. How do I turn the Bear Bonds into fiat? Then once I have fiat, I pay that back later by converting it to Hive or HBD and send that to you?

You have $100 worth of Hive, SPI or Leo. You send that to @bearbonds, that sends you $100 worth of Bear Bonds - these represent the loan.

You send the Bear Bonds to @bearbonds which releases $100 worth of HBD to you. You have many choices now:

At the end of the loan period, assuming your original tokens have held their value, you buy sufficient Bear Bonds to repay the loan and send them to @bearbonds to release you Hive, SPI or Leo.

You can also buy Bear Bonds weekly during the loan period using the recurring payment mechanism on Hive, so you are gradually putting aside the amount to repay the loan.

Thank you! What was tripping me up was what happens to the Bear Bond tokens. I thought I held them, but I understand that those go back to you in exchange for the HBD. Then I can buy new Bear Bonds when the the term is up, send those to you, and have the Hive returned to me. I appreciate you taking the time to review it with me. While you hold 2 times in collateral, a big market downturn could be a loss for you, correct? Assuming, that the borrower chose not to repay.

Congratulations @bearbonds! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 200 upvotes.

Your next target is to reach 50 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

We looked into doing something like this before but never went with it. Have you heard of the Hive escrow functions? That would be a great use for it, although not sure how it would or could work with #hive-engine tokens

Heard of it but never looked into it. Thanks for sharing :)

First I wondered, why it's below 12 % as you could just put your HBD into the savings. But I'm sure you have thought about that.

What I'm still not sure: Why does it say different percentages in the last picture?

It's different in numbers and concept ( longer time = higher annualised interest rate).

Did I get something wrong?

No, i got something wrong. I had a few slides made for this and used the wrong one. Thanks for highlighting that buddy.

cool concept! maybe down the road you can make a dividend token to raise capital to lend, and payout the earnings to token holders.

!PIZZA

!LUV

!LOLZ

@forsakensushi(5/5) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

lolztoken.com

Because he conditioned it.

Credit: reddit

@bearbonds, I sent you an $LOLZ on behalf of @forsakensushi

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (5/10)

PIZZA Holders sent $PIZZA tips in this post's comments:

@forsakensushi(5/10) tipped @bearbonds (x1)

Join us in Discord!

Interesting thanks for the shout out

Posted Using LeoFinance Beta