Do you want to read something intriguing?

If I will quote them: “Across protocol is a novel bridging method that combines an optimistic oracle, bonded relayers and single-sided liquidity pools to provide decentralized instant transactions from rollup chains to ETH Mainnet.” Not enough? I will share with you my own experience.

If someone will ask me why I would prefer Across Protocol Bridge over the other ETH Layer 1 – Layer 2 bridges that I used in the past, my answer is ready, and I can prove it, point by point. I like to use Across Protocol because it is secure, it is fast, has enough liquidity available even for a serious transaction (don’t you have it when you try to move couple of thousand dollars and it will take half a day because there is not enough liquidity for the transaction that you need, just because it is some niche Layer 2?), and on top of that, it is fast, very fast. Not to mention with the first reason that I should have mentioned, the fees. I am monitoring what is happening around the cryptoverse, I can notice quite often tweets about random people being surprised about how much they can save in terms of fees using Across Bridge.

Let me prove this to you, talking about each reason to use this bridge, at least to know that I share this with you, some of my favourite people. Everybody is winning if we can prove that ETH blockchain is usable and not just living from their enormous transaction fees

Premise number 1: Across Protocol bridge is secure.

There are two essential parts regarding the security of the bridge, tested smart contract and UMA’s Optimistic Oracle. UMA has a history working on smart contracts security, has never been hacked and it is providing solutions focused on decentralization. It is in the name – Universal Market Access. Risk Labs, the team behind UMA and Across, has also been audited by Open Zeppelin (if you are like me, you may like to read all about the audit in here). The Optimistic Oracle can be used to resolve markets and bring all types of data on-chain, and unlike other Oracles, it is not limited to UMA Protocol, as any DEFI protocol can use it, given the right conditions.

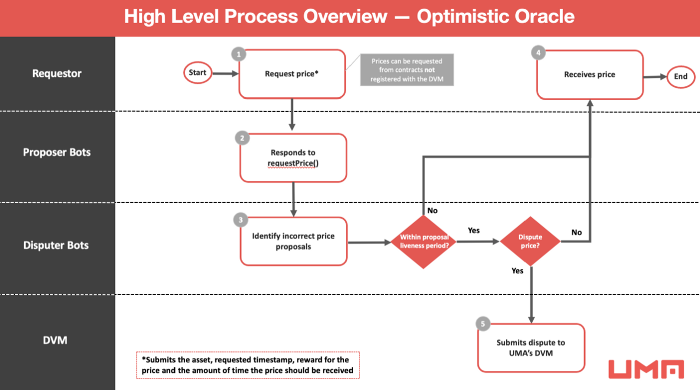

The Optimistic Oracle operates optimistically, as most of the time you will get an answer very quick. Anyone can provide an answer on-chain, and it will generate a dispute only if it is wrong. This way it will decrease the gas usage, reducing the costs. We got 3 main actors for any transaction, the requester, asking for a price and specifying the dispute period, and the proposer, posting a bond and offering a price. If the dispute period finishes and nobody disputed the price, the transaction is finalized and the proposer is getting back his bond. If the requester disagrees with the proposed price, can post a bond equal with the proposer’s one, and the dispute is escalated to UMA’s Data Verification Mechanism (DVM), where UMA token holders will vote to resolve the dispute in the next 48 hours. Here is the interesting part: if the disputer is correct, it will get the proposer bond as reward, and vice versa. So, this reason is enough to not try to be dishonest, as you lose your own funds if you try, and in the past year we had only 5 legitimate disputes, so the optimistic system is working very well, in this case. Each use of the DVM costs money, so the flood event is highly unlikely. And the UMA token holders are incentivised to vote correctly, as this is the only case when they are rewarded (if you vote wrong you get no rewards, and UMA value may drop), so the ‘’skin in the game’’ is a real-life concept when you use UMA’s Optimistic Oracle. (If you want to read more about the Optimistic Oracle, find about it here.)

Premise number 2: Across fees are lower than any other bridge solution from the market right now.

There are three types of fees used on this bridge:

- Liquidity provider fees (set by the protocol)

- Slow relay fees (set by the user)

- Instant relay fees (set by the user)

In order to start to talk a bit about each, I will begin mentioning that Across as a bridge will provide incentives to relayers to offer short-term loans to users on L1. These loans are repaid to the relayer within two hours, from liquidity pools on L1. The pool is refreshed once funds from the canonical L2 transfer settle. The user initiating the transfer will pay the fees, and those fees will be used to compensate the relayers and the liquidity providers. Right now, Across users can bridge USDC, ETH, WETH, WBTC and UMA from L2 Arbitrum, Optimist or Boba to L1 Ethereum. (You can be a liquidity provider also, getting some decent rewards doing it.)

Premise number 3: Across Protocol is fast, almost instant (I remember the times when transferring across layer 1 – layer 2 was taking days). There are Liquidity pools on ETH Mainnet, created to facilitate fast withdrawals of tokens from Layer 2 networks like Arbitum, Optimism or Boba. When someone is using the bridge, it is paid instantly, most of the times, and few hours later when the deposits from Layer 2 are sent to the ETH Mainnet, the liquidity provides are rewarded, and the pool is reimbursed. It is a short dated loan of some sorts, on ETH Mainnet, secured by Layer 2 deposits.

Premise number 4: There is always enough liquidity for every transaction, even if you are a whale. Just a quick look, at the moment we have in the liquidity pools:

- 6,108.3578 ETH (37% used),

- 17,763,356.7885 USDC (53% used),

- 30,446.6090 UMA (0.7% used),

- 1109 WBTC (30% used),

- 6,108.3578 WETH (37% used),

- 250,000.1468 BOBA (0.12% used),

- 20,413.8923 BADGER (29% used).

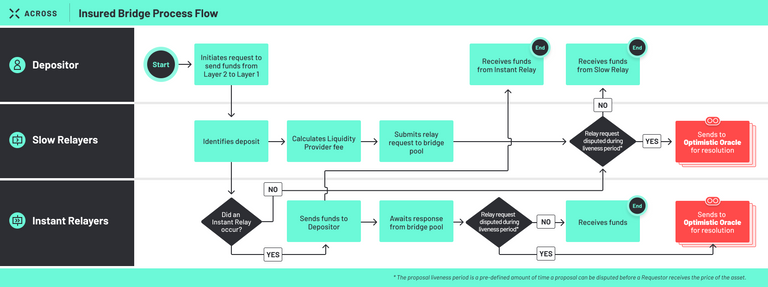

I feel the need to add few words about few possible paths a deposit can take. I will start with a statement underlying that depositors will not lose funds in any of these scenarios.

- Instant relay, not disputed – Being the most common scenario when the instant relayer sees a deposit on L2 and immediately advances the amount of the deposit (minus LP and relayer fees) to the recipient address, while making a claim to the bridge pool. Two hours later, when the dispute window ended, the bridge pool compensates the instant relayer with the deposit amount minus LP fees.

- Instant relay, disputed - When the instant relayer sees a deposit on L2 and immediately advances the amount of the deposit (minus LP and relayer fees) to the recipient address, while making a claim to the bridge pool. This time somebody will raise a dispute in the 2 hours window, the dispute will go to UMA’s OO, and it will take 2-4 days to be voted by the token holders.

- Slow relay, not disputed - No instant relayer is available to accelerate the transfer, so a slow relayer sees a deposit on L2 and immediately advances the amount of the deposit (minus LP and relayer fees) to the recipient address. Two hours later, when the dispute window ended, the bridge pool compensates the slow relayer with the deposit amount minus LP fees and slow relay fees to the recipient address.

- Slow relay, disputed - - No instant relayer is available to accelerate the transfer, so a slow relayer sees a deposit on L2 and immediately advances the amount of the deposit (minus LP and relayer fees) to the recipient address. This time somebody will raise a dispute in the 2 hours window, the dispute will go to UMA’s OO, and it will take 2-4 days to be voted by the token holders.

- Slow relay, accelerated to instant relay – A slow relayer sees a deposit on L2 and immediately advances the amount of the deposit (minus LP and relayer fees) to the recipient address. An instant relayer comes along to accelerate the transfer. Then the pathway is identical with A or B case, the only difference being that the instant relayer will receive both slow and instant relay fees.

- No relay – If the relay fees for the Layer 2 deposit are too low, the depositor may need to relay the deposit himself/herself, or to have somebody else to do it on their behalf without fees (maybe for an out-of-band payment).

With these being said, I am just pointing out to another opportunity, if you are a white hat hacker or a bounty hunter. Across Protocol has a generous bounty program, paying a $250 for a low severity bug, 1000 for a medium severity bug, 10.000 for a high severity bug and 10% of the funds at risk for a critical one found on any of the Across smart contracts or interactions.

In conclusion, if you are looking for a bridge that is secure, fast, has enough liquidity and a low level of fees, than Across Protocol bridge may be an obvious choice. Use it now, thanks me later.

All the best,

George

Why not...

...have fun and win rewards on my favourite blockchain games (Splinterlands- Hearthstone-like card game) (Mobox_ - GamiFI NFT platform) and (Rising Star - Music creators game)._

__...get the higher rewards for your investments using Blockfi, __Hodlnaut __and __Celsius.network. __Get crypto while writing on Publish0x blog, using Presearch search engine to maximize your income with PRE tokens. Use Torum instead of Twitter . I am also writing for crypto on __Read.cash _and Hive.

Congratulations @heruvim1978! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!