Good day, Friends, crypto enthusiasts and just good people!

In our last review on Ethereum, we promised not to forget about the "brothers of our elders" of the crypto market - Bitcoin and Ether. And if the creation of Vitalik Buterin we have disassembled into atoms and particles here: https://ru.tradingview.com/chart/ETHUSD/YgHNQFfM-ehfirium-otkazyvaetsya-ot-majninga-horoshie-urovni-dlya-pokupki /

, then the "first guy of the digital village" was left without due attention.

THE FUNDAMENTAL.

Today it's his turn - especially since tomorrow, May 4, the key event of all financial markets will take place -

the meeting of the American banking regulator - the Fed. In America, however, as well as all over the world, inflation is off the scale and rampant. Consumer prices are rising by leaps and bounds, storming all new highs. There is nowhere to retreat further, and the Fed on Wednesday plans to take tough monetary measures to somehow slow down the inflationary flywheel and calm the inner beast. The main tools for this are the reduction of the regulator's budget and an increase in the interest rate on deposits. Moreover, they plan to raise the rate by 2 steps at once - this is "indicated" by the forecast of the CME group website, 98.7% of analysts prefer this step. The main question is: WHAT CAN THIS LEAD TO in THE CRYPTO MARKET in general and, in particular, BITCOIN? Usually, an increase in interest rates leads to a rise in the price of the national currency - in this case, the dollar - because it becomes more profitable to keep money on deposits and in government bonds.

However, if we look at the last meeting of the US Central Bank on March 16, where the rate was raised for the first time in the last few pandemic years, we will see that in the first week BTC, on the contrary, strengthened against the dollar (from 41k to 48k). But there are 2 factors worth noting here. The first is the well-known postulate of the market: "buy on rumors and sell on facts." That is, the major participants have long taken this event into account and on its completion acts in the opposite direction. The second factor is that at the March meeting, most of the market participants were waiting for a sharper rate hike, by 2 steps at once, and not by one, as, as a result, the regulator did. In other words, the market was disappointed in the Fed's rather soft, dovish position, despite the rapid rise in prices within the country.

So the KEY POINT now is whether the Fed will not turn on the "reverse gear" at the very last moment and raise the rate again by only 1 step, by 0.25% - then it is almost unambiguous (given that there are no unambiguities and 100% rules in the financial markets) SELL, SELL THE dollar and THE GROWTH OF BITCOIN. Plus, how will the market react if the Fed does not "wag its tail" and raises the rate, as everyone expects, by 0.5%? Here the short positions no longer look so unambiguous. It is better to follow the reaction of the market and the formation of a CLEAR trading pattern for a day or two. Also, do not forget that after rising to 48k, Mr. BTC lost all advantage and went below the initial growth point - up to 38k. Such a scenario may well happen again now.

TECHNICAL ANALYSIS.

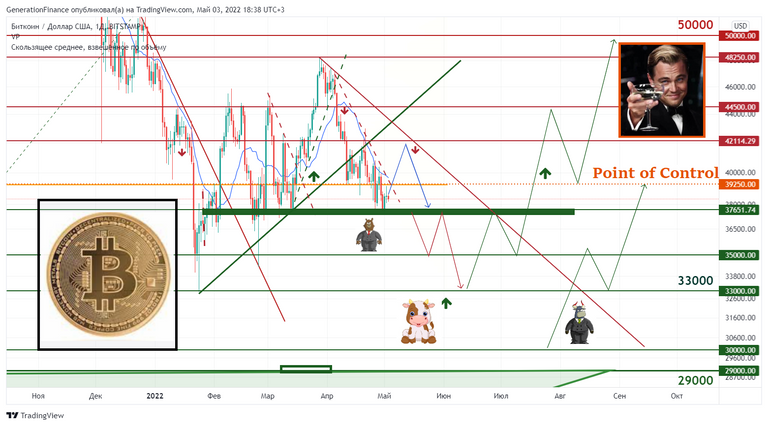

At the moment, the price is moving within the framework of a downward accelerating trend and has come close to a powerful support zone of ~ 37500.

If we consider the scenario outlined in the fundamental part of the analysis - the growth of the token after the announcement of a rate increase, and then a systematic decline with the complete absorption of the upward momentum movement, then important price levels here will be:

The RESISTANCE ZONE at 42,000 is where the current trend resistance line and a good historical level pass. It can act as a target for the initial growth impulse and from there the price will continue its "route to the SOUTH", will begin to decline.

Next, the current SUPPORT ZONE - 37500 - will act as an important boundary.

If the price manages to break through it and gain a foothold below (through the pattern DOUBLE ZIGZAG*), then the goals for salting and selling will be 33,000 and 29,000.

When the price approaches 33k, it makes sense to fix part of the SELL position and activate NO LOSE option. 29 figure acts as a bonus for bears.

The same zones 33 and 29k are good support levels, from where cryptobulls will be able to cheer up and break the bearish trend (we are waiting for the formation of the mentioned pattern *), go on the offensive.

The benchmarks for this "offensive" (bullish trend) are 40, 45 and 50k for one token.

*- Learn more about the DOUBLE ZIGZAG in this video:

https://ru.tradingview.com/streams/gRrpeN1oB_3SU9m_uWrKl/

Good hunting to all, Friends, I will be glad to discuss the idea in the comments!

Congratulations @kalmanovich1985! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!