CBDCs, IMF's New Bretton Woods, WEF's Great Reset - Where is it all headed? (Part 2)

Image source

This is a continuation from Part 1

This 2-part post is structured as follows:

- CBDCs (Central Bank Digital Currencies)

- IMF (International Monetary Fund) & IMF's New Bretton Woods

- BIS (Bank for International Settlements)

- Regional & Country-specific Notes of Interest

PART 2: (this post)

- Thoughts and Predictions on this Global Monetary Reset

- Final Thoughts

Thoughts and Predictions on this Global Monetary Reset

To better organize my thoughts and predictions, I will segregate them as follows:

- Major Aspects Central Banks won't give up

- Undetermined Issues and Risks

- Major Threats Central Banks will face

- Concessions Central Banks will likely have to make

- New Power Grabs

- Wildcards

Also, I will refer to all banks (including commercial/retail) as CBs (Central Banks) here for simplicity sake. Commercial/retail banks could become redundant in the future as financial innovation warp speeds ahead and their need or use in the traditional sense might fade; they will likely still be around at least for a transitionary period.

Major Aspects Central Banks won't give up

Without a doubt the issuance of debt to governments, companies, and citizens is something I just don't think central banks will be willing to give up. This is their bread & butter, their cash cow. This is how they've pludered the masses for over a century making them rich beyond belief. Greed is completely hardwired in their DNA and I just don't see them giving it up, for I doubt any other viable looting alternative exists in the new digital 2.0 economy.

Another thing I don't see them giving up is their ability to increase the supply of currency units. We all know that this is another plundering mechanism - theft through inflation. Year-by-year over the past century they have employed this method to steal from us all. Accordingly, I don't see how they can promise (unless they lie) that they will issue a fixed set of CBDC tokens like is the case with Bitcoin.

Undetermined Issues and Risks

One of the key issues to be determined that will have a tremendous impact on the implementation of CBDCs is who will process the payments.

When fund holders (companies, citizens) decide to convert their deposits to a digital Euro (or their country's respective currency) they will become the bank's liability. Similar to now, if you withdraw funds from your bank account (which are merely digital entries and not actual cash) and get cash notes, they are now in your possession and not the bank's. The same thing will arise when they switch to CBDC mode. People and companies will wish to "take out" their funds to make purchases, transfers, etc. But, the concern for the banks will be that withdrawn funds are not in their coffers, so this could have a severe impact their solvency (should the volume of withdrawn funds be high), creating possible instability issues.

Another issue that could destabilize the central banks has to do with how entities will want to switch between one nation's (or block's) digital currency in favor of another. There are all kinds of issues (political turmoil, natural disasters, etc.) that could make people or entities seek or dump certain digital currencies. Collectively, the CBs know this and I am sure they are seeking ways to mitigate this kind of issue, most likely with cross-currency limitations or restrictions. This is another reason why they despise stablecoins, for these could bypass such limitations or restrictions.

Major Threats Central Banks will face

I see 5 majors threats:

- 1. Taking Too Long to Implement CBDCs

If they take too many years before rolling out (at least running it in parallel or alongside to the traditional cash based system) the digital currency they run the risk of not being able to catch up to the private sector players (exchanges, DEXs, cryptos, & other digital asset providers) who are already moving at lightning speed. Second, the current banking sector is extremely vulnerable (i.e., bank deposits requirements are practically nil) and there is huge systemic risk - just look at all the $100 billion+ daily REPO operations and QE bailouts by the Fed ($trillions alone from the past 6 months) & covert shenanigans (off-book ESF/PPT ops) currently going on just to keep the system afloat. Time is not on their side. Not at all.

- 2. Stablecoins

Stablecoins, as I mentioned earlier in this post when covering the European Union, poses a huge threat to the viability of issuing CBDCs. In a way, stablecoins represent the monkey wrench in the cogs of the financial wheel they want to set in motion. Don't believe me? Just look at today's news from Cointelegraph (China's central bank lays regulatory foundation for CBDC). A few excerpts from the article:

China’s central bank, the People’s Bank of China (PBOC), published a draft law this Friday that aims to provide regulatory framework and legitimacy for a forthcoming central bank digital currency (CBDC), the digital yuan.

The draft law also appears to take aim at third-party efforts at yuan-backed digital currencies, stating that individuals and institutions are prohibited from making and issuing a currency designed to “replace” digital yuan circulation. This move would presumably criminalize all non-state-sanctioned yuan-backed stablecoins.

You see, the Chinese central bank would criminalize non-state sanctioned (i.e., not state approved) stablecoins that would represent the digital yuan.

Thought I'm not sure how they could crack down on these outside the country and on DEXs, that's a bit besides the point. The point here, is they are very adamant about it. To wit:

The punitive measures against violators of this proposed law are harsh: most notably confiscating all profits, destroying all tokens, and imposing a fine of not less than five times the illegal amount created, in addition to the possibility of criminal prosecution and imprisonment.

Does this sound like they are not worried about stablecoins?

The Chinese who have been studying the issuance of the digital Yuan have surely contemplated the negative effects stablecoins would have on their digital currency.

Enough said.

- 3. DeFi (Decentralized Finance)

Though this crypto sector has really just started picking up steam since this past summer, things are moving at lightning speed. A boatload of projects, platforms, stablecoins, financial derivatives, and other digital assets have been introduced and are being tested and fine-tuned. Moreover, things such as yield-farming (parking one's crypto as collateral to earn 5% interest) are blossoming to the tune of hundreds of billions of dollars. The sector is growing at an exponential rate. They are competing with traditional investment banks; and they are much more accessible to the commoner, much cheaper, much faster, and a heck of a lot more private. So much can be said about DeFi, but I will leave it at that for now. If you want to learn more, you can check out my previous post - How DeFi is Defying Traditional Finance & Banking.

- 4. Privacy Coins

As traditional banks have become more and more intrusive towards their customers (individual & corporate) in the last years/decades, people have not only been turned off by it, but are also sick and tired of having every aspect of their financial lives being scrutinized and continuously checked. Privacy is all but dead in the realm of traditional banking.

That has not only lead to the advent of Bitcoin, but has also prompted the creation and issuance of privacy coins such as Monero, Dash, Zcash, Zcoin, among others. Though these privacy coins vary from one another in terms of security and privacy features, they offer a means by which parties can transact privately or anonymously without fear of being tracked and traced by other parties. As people are increasingly valuing their privacy and financial freedom, these coins aren't going away anytime soon. Though regulators in the US have tried to crack down on some of these privacy coins, solid projects such as Monero seem to always be one step ahead of them and more and more users are turning to them. I expect the demand for these coins is going to skyrocket in the next few years. Think mass adoption.

- 5. Digital Run on the Banks

I've briefly touched upon this issue earlier in this post, so I won't say too much about it. But this is of grave concern to banks that would issue a CBDC, for if the masses were to withdraw their digital currency tokens/units from their depository accounts en masse, that could spell a whole lot of trouble for the banks, as they wouldn't be able to account for them as assets. It could destabilize their capacity for lending and required reserve thresholds. Oops...

Concessions Central Banks will likely have to make

There's no doubt that CBs will have to substantially lower cross-border remittance and other fees, as the new decentralized financial realm commands it and users as well. Charging $14 or so to send $100 cross-border just won't cut it anymore.

Though I'm sure CBs and the IMF, BIS, et al. would love to wipe out cryptocurrency exchanges and DEXs (decentralized exchange platforms), realistically they just won't be able to do it. They might regulate the hell out of them (at least the non-decentralized ones). But, these platforms, projects, and cryptocurrencies (including stablecoins in my opinion) are here to stay. So, they'll have to play alongside each other in the same sandbox. And this might actually be beneficial to the traditional banking sector, as they will have to innovate, lest they roll over and die.

New Power Grabs

Well on the "positive" side for Central Banks, there would be a lot of benefits that a CBDC or digital currency could provide them with. What follows are merely some of them and if you don't notice that they are all power based, then your certainly missing the point of why they are still salivating at the thought of issuing these digital babies:

Every single transaction you make will be recorded on a centralized blockchain.

Every single transaction you make can be taxed directly on-the-spot. (If you currently work for the IRS or any tax authority, best be updating your resume.)

Authorities tied to the CB (such as governments, financial regulators, law enforcement, etc.) can easily order that dissidents be "unpluged" from the system. Pouf, you're gone!

Synchronization with centralized national health authorities/databases - Didn't get the latest vaccine? Then you may be blocked/frozen from using your digital wallet and no travel health pass for you! Similarly, your employer may not let you back to work.

Bypassing governments in order to commandeer Fiscal Policy. Usually, central banks have a say in Monetary policy and government legislatures have command over Fiscal policy. This was briefly mentioned above when talking about the Fed and its chair Powell (see some of the linked articles above for more on this).

Wildcards

Here are a few that come to mind, though I am sure there are many more (leave your thoughts in the comments section if I have forgotten some obvious ones):

Some countries may start holding Bitcoin in their currency reserves. Should one country do this, it would create a precedent and possible copycat effect. And think about it, countries won't buy just a few bitcoins, they'll likely buy billions of dollars worth.

Some large Pension Funds may start adding Bitcoin to their portfolios. Some pension funds already include gold as a more stable store of value. As Bitcoin is becoming more and more of a store of value (and appears to slowly become less volatile), it will certainly be a viable addition to pension funds that are currently holding much [arguably] riskier assets such as bonds (that may be defaulted on) and extremely over-priced equities, CLOs, and other questionable assets.

Gold. I think that one significant way that CBs can really sell the idea of CBDCs would be to back them with gold. This is not far-fetched at all and is actually quite likely. Let me explain. At the beginning of prior monetary systems, currencies were indeed backed by gold (or silver). For instance, this was the case with the original Bretton Woods system whereby the US dollar was backed by gold (until 1971 - when Nixon axed it). The CBs can easily onboard the masses with a gold-backed CBDCs and simply gradually decrease or remove it altogether at a later period. Once the masses have already been sucked into the system, it will be a hell of a lot more difficult for them to exit it. So, how can this not currently be an option envisaged by the CBs? We also should consider the following 2 facts:

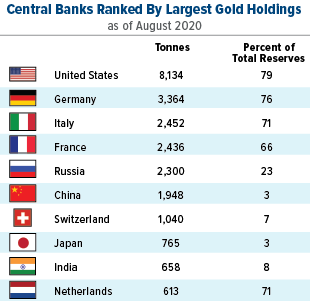

1. Look at the following chart 'Central Banks Ranked By Largest Gold Holdings':

Image source

As you can see from this list of Top 10 Gold Reserves in Central Banks, there are 7 countries that figure from the big block I mentioned earlier for which the BIS appears to be coordinated with. Hence, it's not that difficult to see how they could pool these reserves that would amount to at least 20,000 tons. Now, that amount could back a lot of currency!

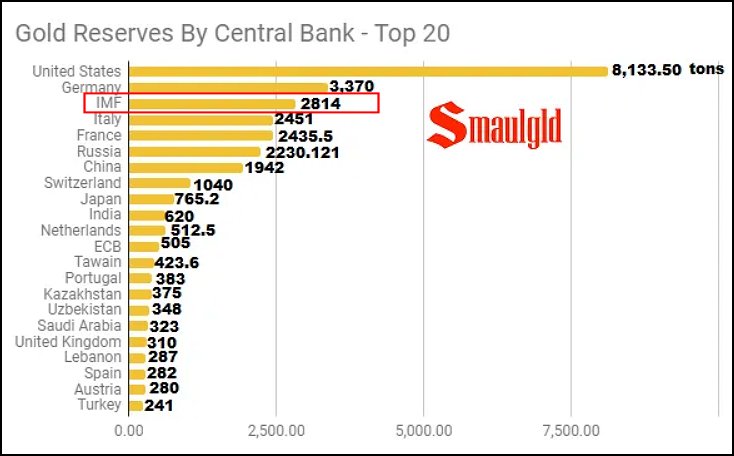

- 2. And it gets better, this is not even counting the gold reserves held by the IMF:

Image source

The IMF holds nearly 3,000 tons and would figure in 3rd place just behind Germany should it be considered a country. That tonnage in the vaults of the IMF is not really doing much and could be put to much better use.

All this considered, though I have put this as a "wildcard", I see as a definite possibility.

Oh, and I almost forgot one additional note:

We should also consider that even though China only has less than 2,000 tons "officially" stated in their holdings, readily available data on the internet easily revises this figure to over 20,000 tons (through the domestic gold production of the past several decades (which never leaves China) and all the tonnage that has been imported via Hong Kong, or the fine assessment rendered by Jim Rickards as of late). So, just picture a gold-backed digital Yuan for a second; can you imagine what kind of clout such a currency could carry? They would definitely be able to compete with the Western kids on the block for this one.

- Facebook's Libra

Over a year ago when Facebook announced it might issue a stablecoin called Libra, it scared the bejeezus out of CBs - particularly the Chinese CB who immediately recognized it as a huge threat to their CBDC project. After the news, the PBOC openly stated that they needed to accelerate the development and issuance of the digital Yuan.

Though a lot remains to be seen how this Libra project will advance and be rolled out remains to be seen. Nevertheless, it can be a huge wildcard for CBs.

Final Thoughts

Sorry for the long post guys, there was just too damn much to cover!

Though everything is moving so fast and there is still a lot to be determined with this new Monetary Reset and the issuance of CBDCs, my general sentiment is that the BIS, IMF, and Central Banks will move too slowly and won't be able to catch up with the financial innovation taking place in the 'crypto/DeFi' sphere.

Sure, they will try. But they are at a huge disadvantage because so many things still need to be properly designed, tested, approved by governments, trial-runned, tweaked, regulated, etc., etc. Pure madness.

So, my thinking is that it is good for all of us to get a 360 degree or bird's eye view, a bigger picture of all of this. I have done my best to present you with such an overview in this post.

I also invite you to watch the following video entitled The Bitcoin Life Raft: The End of Monetary & Fiscal Policy As We Know It from Raoul Pal from Real Vision Finance who touches upon these exact same issues and articulates them very well. The video has over 200,000 views, so his message is resonating with a huge crowd.

He is extremely knowleagable in the fields of finance and banking and has worked as a Hedge Fund manager in London and elsewhere including Goldman Sachs. He knows the ins and outs of traditional finance and banking with and all its ugly shortcomings.

Moreover, he has been in the crypto space for several years now and sees tremendous opportunities for who he calls "the little guy" (the you and me that aren't in the Big Club, as George Carlin use to put it).

I think he is generous in sharing this tremendous wealth of knowlege and insight for us to benefit from.

Simon Dixon is another person of the same caliber who I highly recommend you follow.

But back to Raoul and his must-watch video.

Screenshot of the video The Bitcoin Life Raft: The End of Monetary & Fiscal Policy As We Know It, URL: https://www.youtube.com/watch?v=qL2LfVRl3J0

What do you think?

Where is this all headed?

Who are going to be the winners and losers?

How much will Central Banks accomplish and get away with in the new digital Monetary Reset?

Will humanity take back the reigns of financial freedom and sovereignty?

Please leave your comments below.

Peace and Prosperity.

God bless.

UPDATE (Nov. 15, 2020)

A video worth checking out regarding which CBDC the UNITED STATES may use, issue, or base its future Fedcoin on:

Coinbureau - FED, USDC & Stellar: ULTIMATE Stablecoin Conspiracy!

Given the connections he makes between the current top two stablecoins (USDT/Tether & USDC), the IMF, the WEF, I think he is on to something...At least we should keep an eye on this.

Congratulations @libertyacademy! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: