As a dividend income investor you probably ask yourself the question if the dividend is safe, before you are taking any investment. By being safe I mean in this case, is the company able to pay and to increase the dividend for the next decades. Considering the companies in my portfolio I am convinced that this is the case for all the companies, otherwise I would not have invested in those.

But as an dividend income investor outside the US and if you are holding any other foreign companies, safe means also something different. As you know I am mostly invested in american companies which are traded in USD and one of my weaknesses still is to have a relatively small portion in european companies. Actually my portfolio consists 81.32% of stocks traded in USD and 18.68% of stocks traded in EUR (this includes the one ETF I have).

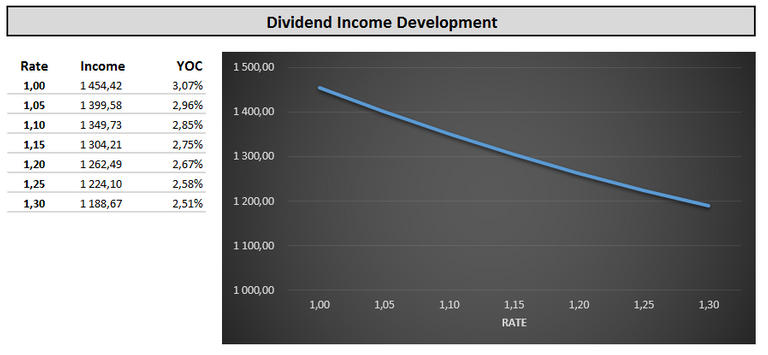

Currently my projected dividend income is at 1 322.66 EUR, based on current exchange rate of 1.1292 USD. This just means that even though I added in May 100 shares of Uniqa my projected dividend income is currently lower than at the April.

What does a further decline of USD mean for my dividend income?

A further decline of the USD compared to the EUR means of course a further decline of my annual dividend income and my YOC.

As you can see above, I simulated my current dividend income with the changes in the exchange rate. Of course the stronger the USD the higher is my annual dividend income and also the better are my Yield on Costs. Nevertheless the current weakness of the USD shows me that my portfolio consists of too many USD Stocks and too less EUR stocks. This is definitely a point I have to change and where I will focus on in the future as well.

What option do I have to reduce the currency risk?

Well as I already mentioned I do have the option the increase my total share of EUR traded stocks, in order not to rely so heavily on the USD stocks. The weak point is, there are a couple of good dividend payers in Europe (I mentioned them at the beginning of the article), but the majority of the dividend heavyweights are based in the US. In this case I will mainly increase my EUR positions by investing in ETF's, for me it is much cheaper than investing in companies throughout Europe (the conditions of my broker for US Stocks are much better) and I do not have that much work when it comes to tax refunding.

The second option would be of course averaging down, the EUR purchase price. Yes besides the drop of the share price I can also use a drop in the exchange rate to average down my cost basis. But this would make more sense when the USD comes to closer to the rates it had about 3 years ago.

The third option would be hedging, but for me this does not make much sense as it would reduce my yield, so this something I am not considering.

Conclusion

As foreign investor you should also keep an eye on exchange effects, as it can effect your dividend income in a positive and negative way. But nevertheless you should not overreact on currency changes. As you could see in the graph, the dividends would still come no matter if the USD is at a rate of 1.00 or 1.30 compared to the EUR. A side effect of a weaker USD could be also that it is better for the american companies, which can lead to higher dividend increases. That is a fact I did not include in my calculations above. Nevertheless it is important to have a well balanced portfolio when it comes to currencies. But at the same time it is proven that through constant investing throughout the years the exchange effect will be not that big.

So again learning is: Invest constantly in high quality stocks, keep an eye on the balance between EUR, USD, GBP and other currencies, but don't get crazy if your dividend income declines because of a weakening USD. Focus on your goals and invest regularly this will keep this effects automatically very small :).

What do you guys think? How do handle the currency risk?

I do not recommend any decision to the reader or any user, please consult your own research. Thank you for your understanding.

i liked it its nyc and i upvote you

follow me at @zazaibot i will follow you back upvote me restreem my posts i will do yours to become both rich :D

thanks

just did :)