$MDLZ or $HSY cocoa companies?

First of all, I confess that I have bought both companies in their respective falls, however, I have to say that HERSHEY has given me better feelings and I have bought its shares heavily, whereas in MONDELEZ I have only bought a lower position...

Why?

Well, basically both companies are very good for a DGI portfolio but there is something that makes me lean more towards HERSHEY and that is its DEBT vs Free-Cash-Flow ratio.

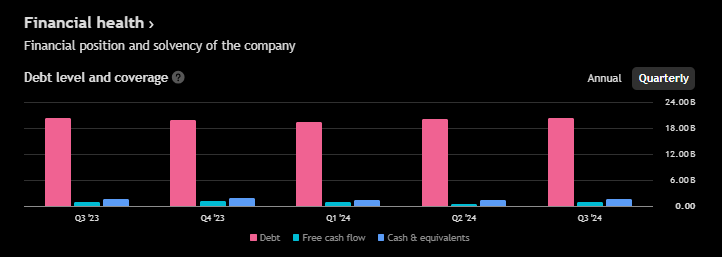

MDLZ Debt and FCF

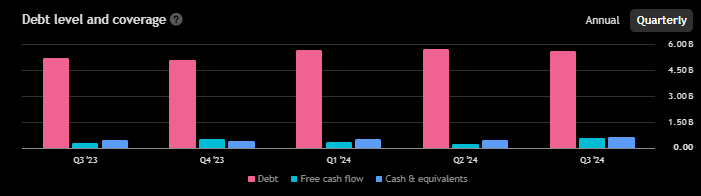

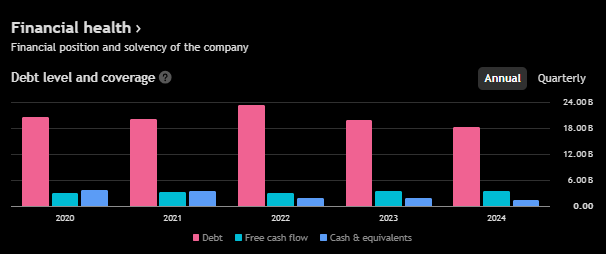

HSY Debt and FCF

As you can see in the charts above, MONDELEZ has a debt of 20 Billion with a FCF of just 1 Billion... does that mean that if it maintains that cash flow it would take 20 years to pay off the debt?... Not really but almost, it does indicate a higher debt compared to HERSHEY which has a debt of 5.64 Billion and a FCF of 0.567 Billion, that is, a Ratio of 10...

MONDELEZ's position seems more dangerous than HERSHEY's, it would not be unusual for it to cut dividends...

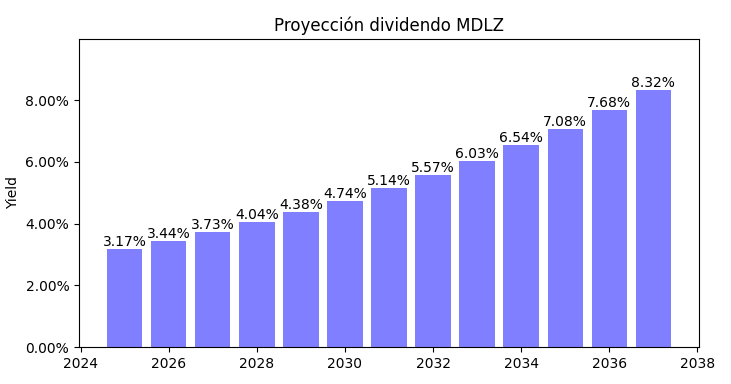

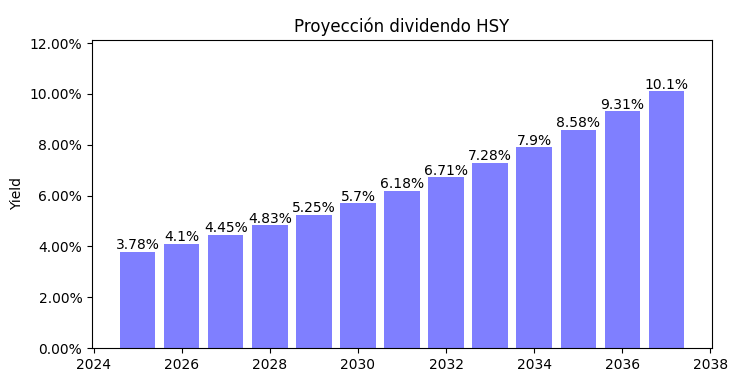

Also, you only have to look at its expected dividend increase projection, if everything were sustainable, it would be much more advantageous to buy $HSY today than to buy $MDLZ...

I don't know why so many people only look at how big a company is to buy its shares, parameters such as debt are key to predict its sustainability... in fact, I think it is the main parameter IMO.

What do you think?

In any case, both companies are very good acquisitions in a long-term DGI portfolio...with the permission of the Cocoa price, of course...

I would prefer MDLZ slightly over HSY because they have a more diversified product Portfolio.

But one question: Where did you find that MDLZ FCF number of 1B? I think you just took only the quarterly number, Eddie. No? They reported a Free Cashflow of 3,5B in 2024 yesterday (See link below) 🤔

But fully agree that the recovery and results depend a lot on the cocoa Price which is still high.

kspnr0_gcl_auMTIyNDY4Nzg0Mi4xNzM4MTQ0MzQy_gaMTkxNTk0MjIxNS4xNzM4MTQ0MzIz_ga_EPKQQDGNK5MTczODc3OTU3MC4xMC4xLjE3Mzg3Nzk1NzIuMC4wLjkyOTE0NzM1Mg.._fplc*VHRBJTJGQVg5eG4za1hFTnhydGNNQzRKcHBIN2hNOHFGZExYYXE2TmxHYzdSSTFXSFNlS0olMkJ3c1pUaHRGQWFFeU1wUGt1d2JDbXJhcE5vdE9HWUw5a25WZVU3d1UlMkJITlR1Z21wRjltbm1MJTJCaVdTQlNRNlliTnkxQ25KQVZYVmclM0QlM0Q.https://ir.mondelezinternational.com/news-releases/news-release-details/mondelez-international-reports-q4-and-fy-2024-results?_gl=1

You are fully right, my mistake

This is MDLZ annual:

RATIO: 5.15

And here HSY:

RATIO: 3.3

so, still seems HSY in better situation, but not as dramatic as I had thought

😅👍🏻

I think both companies are good and despite the debt situation, I don't think either will go down anytime soon. People will still be buying their products. I think that MDLZ is my preferred option. Maybe because of its track record

hsy seems better for me too even tough im no expert there

In the beginning when we buy things, we are a little nervous to see our money sink, but if there are good projects, they definitely give us profit.