Today I am talking about of probably one of the best dividend companies, General Electric. GE has paid a dividend for over 100 years, and has increased its dividend annually since 2011. Due to do financial crisis GE had to cut its dividend from 1.24 USD to 0.42 USD in 2010, currently it offers a dividend of 0.96 USD. But let's have a look if General Electric is currently worth an investment.

Company Overview

General Electric Company (GE) is a diversified technology and financial services company. The company offers many products and services including aircraft engines, power generation, water processing, household appliances, medical imaging, business and consumer financing, and industrial products. GE has a presence in over 100 countries. Segments of the company include Energy Infrastructure, Aviation, Healthcare, Transportation, Home & Business Solutions and GE Capital. General Electric was founded in 1892.

Stock analysis

Currently GE is priced at 24.28 USD per share, which is 24.6% below its 5 year high of 32.20 USD in August last year. I think you can easily see in the drop of the share that the company was and still is in a restructuring phase, but I also think the drop is a overreaction of the market. Based on the current key ratios,

Price/Earning: 27.9

Price/Book: 2.8

Price/Sales:1.8

Price/Cashflow: 42.4

it is hard to say that GE is a buy currently especially when you also look at the payout ratio of more than 100%, every analyst would say no. But due to the fact that GE is at the end of its transition phase and when looking at the forward valuation I would say GE would be good investment at its current price. The forward P/E ratio according to morningstar is at 15.4, which is way below the 5 year average and also in line with the P/E ratio before the financial crisis.

But there is not only the fact that GE is able to improve their earnings, what is even more impressive during their transition phase there were ableto reduce their debt level significantly. In the last 5 years the company was able to cut their liabilities in half. So GE is one of the few companies which decreased their debt level instead of increasing it.

So for me GE is currently a good investment, but let's have a look at their future and the possible dividend income for the next 8 years.

How much income would I generate with GE?

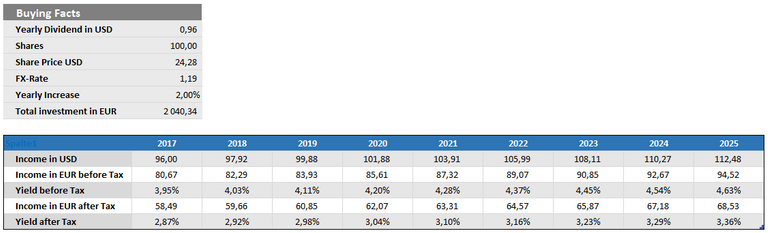

Let's have a look how much additional dividend income I get if I will buy 100 shares of GE.

As you can see I am planning to buy 100 shares of GE, which will give me and additional dividend income of 58.50 EUR after tax, with a yield of 2.87%. Concerning the dividend growth I assumed a very moderate one of 2.00%. So I am not really buying GE for its growth, no I am buying it because it is one of the few companies which are currently fairly valued, at least to me, and I honestly missed to buy to GE 3 years and I don't want to miss it again. The good thing the situation of GE is now much better than it was 3 years ago.

Conclusion

I think the latest decline of the share price is a good opportunity to buy GE at its current price level. What is also a reason for me to buy US stocks is the currently strong EUR, the exchange is currently almost 1.20 USD which is not really reasonable. It is mostly affected by the mistrust in Mr. Trump and I think will not be permanently. So all in all I plan to buy 100 shares of GE in the next couple of days.

What do you think about GE? Would you buy it at its current price or do you even have it already in your portfolio?

Disclosure: Long GE

I do not recommend any decision to the reader or any user, please consult your own research. Thank you for your understanding!

Here is a list of ETFs with exposure to GE

8.03% GE INDF iShares Edge MSCI Multifactor Industrials ETF

7.87% GE FIDU Fidelity MSCI Industrials Index ETF

7.58% GE VIS Vanguard Industrial ETF

6.84% GE XLI Industrial Select Sector SPDR Fund