Welcome to the future, where saving is done effortlessly by computers. No longer do you have to worry about how much you can save and whether you are putting away too much or too little.

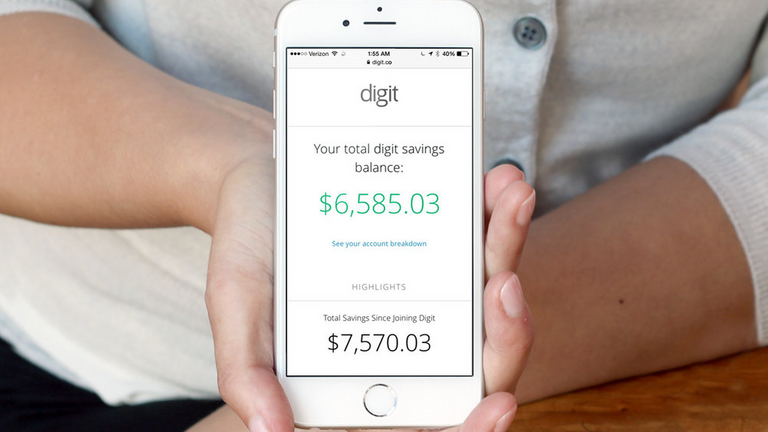

Instead, just use Digit, a smart phone app designed to do all the nitty-gritty of calculating your savings for you. Whether you are a star in financial planning or a complete novice, this app will lead you to your full financial potential.

Getting started is easy. After signing up, you will need to connect your checking account. From there, Digit will calculate how much money can be safely set aside based on your income and spending. For security purposes, Digit uses a 128-bit bank-level security and does not store your bank login.

Digit works daily to move extra money from your checking account to your Digit account. With a no-overdraft guarantee, they promise to never transfer more than what you can afford. Additionally, whenever you need to access the money in your Digit account, you just need to send Digit a text message. They will then transfer the money you need back to your checking account the next business day.

Unlike many money-saving and investing apps, Digit is supremely flexible. They allow unlimited transfers and have no account minimums. That means you can start saving now with any amount and access it whenever you want.

“Digit believes anyone can start saving regardless of income,” says CEO Ethan Bloch. “While everyone understands the importance of saving, it’s hard to get started. Digit’s goal is to make saving as easy, stress-free, and automatic as possible.”

The four main variables used by Digit are checking balance, upcoming income, upcoming bills and recent spending patterns. They then take out a relatively small amount that you will not notice and add it to your Digit savings.

The cost of the account is $2.99 a month. Digit will also give you a 1% savings bonus every few months. Savings are FDIC insured up to $250,000.

Digit automates saving, making it extremely easy for people to begin building their wealth and saving habits. With that money saved, you can go on a vacation, invest it, or use it towards an emergency fund. Just sit back, relax, and let Digit do all the work.

click here!This post received a 2.1% upvote from @randowhale thanks to @hollyjb! For more information,

I think I need to install it ASAP , so I can save money for travel .

Hey I am new here can you just check my Introduction Posts

https://steemit.com/introducemyself/@nihal-pathan/starting-a-new-journey-with-steemit-introducingmyself