In this video, I talk with author and economic analyst John Sneisen about the recent warning by Chris Flanagan, the head of securitization at Bank of America.

According to Flanagan,

"Unemployment is low, and probably headed lower, and the Fed is intent on raising rates to stave off future inflation; we've seen this movie before and it typically ends with a flat or inverted yield curve. Based on history (and gravity), we think the most likely path forward is that the 2y10y spread reaches zero or inverts sometime over the next year or so and that recession of some kind follows in 2020 or 2021."

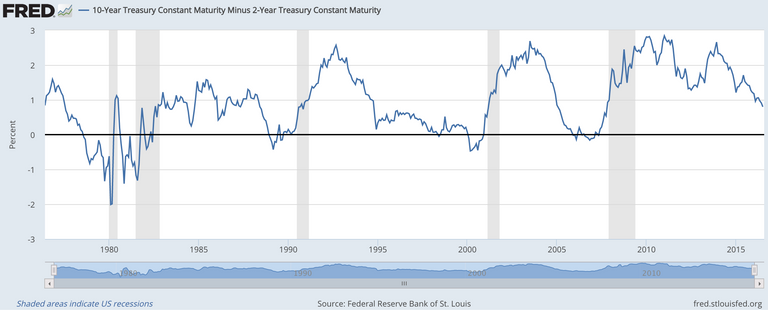

Now when one looks at the yield curve data, it seems to coincide perfectly with recession and bubble bursts throughout history, going negative in the late 70s, early 80s, late 80s, during the dotcom bubble and of course in 2008. The cliff looks incredibly volatile and risky heading forward, at a rate we haven't exactly seen before.

John Sneisen clarifies the issue in question...

"The yield curve in question is the 2 year bond which the US Treasury issues every time they get into debt and the 10 year bond which is longer term debt which you hold for a longer period of time. It's like a 25 year mortgage vs. a 30 year mortgage.

This yield curve they're talking about is when the 2 year rate is at a higher rate than the 10 year rate. In finance, the longer you borrow money for the higher interest rate you have to pay because there's more risk."

As we see bubbles pop up in real estate, bonds, the derivative induced stock market, the crumbling fiat monetary system, especially in the United States, this whole domino effect is about to start falling and the contagion is something people need to take seriously. This affects the average man or woman in the United States as it's a sign of the times to come. Hyperinflation, poverty, debt. This is why the individual must seek personal and financial responsibility and self sustainability. People must prepare themselves. You cannot have freedom without responsibility, so to understand this crucial issue is to understand the negatives and make them positives.

This video breaks down the story you won't hear on television.

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow! :)

If you like what I do, you can donate to my Bitcoin, Litecoin or Dash addresses below, especially as we're entirely demonetized for "hate speech" on YouTube!

Bitcoin:

Litecoin:

Dash:

A market correction is long overdue. Things can't just keep going up like this. Unfortunately, most people won't see it coming.

Thanks for this excellent article/video. I will be keeping an eye out for your future content

Not to mention wage growth is stagnant while unemployment is down, also not a good sign right?

And that's why they're going down. Crypto ftw!

hey there i waiting for your post..thats a good news..thanks for sharing your content..✌👌👌

The demand for Dash coins is increasing day by day.

Unfortunately, the numbers the FED is spouting as a "stable" economy are very much not in line with reality. So, it is a lie, based on a lie... which sometimes could be the truth, but more often a worse lie.

I do not think we are heading into a recession like of old... I think this will be something completely new. Something we haven't seen before.

Out of left field it will come. It will definitely be interesting.

Hello, i like your post as you share the general public about american economic. Wish to see more of your post

And the safe heaven is in cryptos.

The entire economy is held up on fraudulent and unsustainable information. That's why these cryptos are so important, it's a way out. It's a way to be okay when the big crash happens.

Yeah this is ridiculous,

Bank of America will quickly give you a loan to buy real estate but won’t give you a loan to invest in shares of their stock . Thank you for this content!

I don't think we will see anything until 2022 if not 2023. It took many many years of neglect to get the housing recession. The dot com boom happened after about 5-7 year run up to the crash. If anything as UBS said the crypto currency crash will be the crash to watch out for but that wont happen for prob another 5 years. If it does crash it will recover cause the Tech behind Cryto is incredible. Just like during the dot com bubble the tech stayed the companies disappeared.

Latest news, awesome video. Thanks for sharing

Posting very nice I love you all,

Sorry if I take to sell my blog,for my educational needs

want to sell my blog, very pure, msih, can you guys check link

Www.nutritionvitaminhelath.com

Www.chevroletnewcar.com

Interested please comment, I am selling because I need the money, only a fellow steemit who can help me. Party steemit also please help me.

Real time:

We price match

#Thank you very many users I respect

Good information to know. A lot of what we hear on mainstream news outlets do not add up. We are on shaky ground!