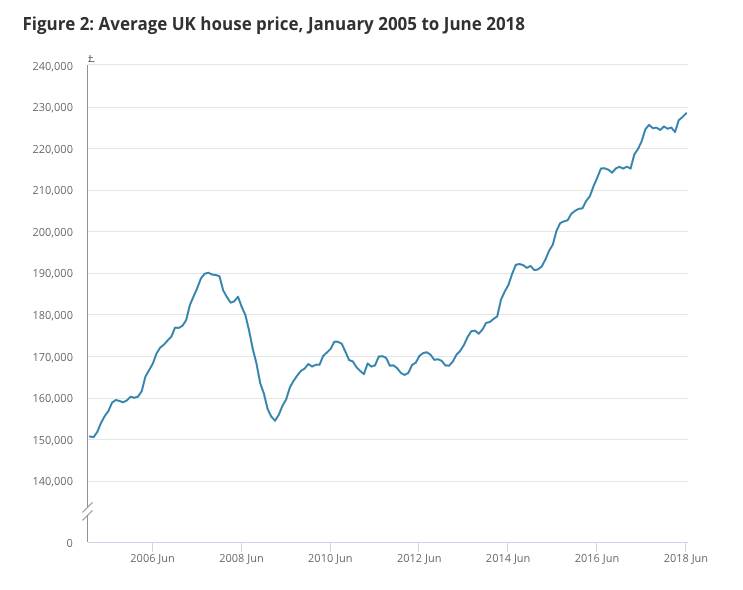

Average house prices in the U.K. have increased by 2.5 times in real terms (adjusted for inflation) in the last 40 years.

This means that the average person will now pay at least 2.5 times on their mortgage every month compared to their parents or grand-parents in 1979, which is very significant given that housing is the single largest item of spending in most people’s budgets. (Also, these are average figures, the situation in London is more dramatic!)

According to Josh Ryan-Collins in his recent book ‘Why can’t you afford a house’? this radical increase in the cost of housing is essentially down to a combination of three things

- A social and political preference for home ownership

- The increasing availability of cheap mortgages, or loans specifically to buy land and housing since the 1980s

- The fact that there is a limited supply of land, especially desirable land in big cities such as London.

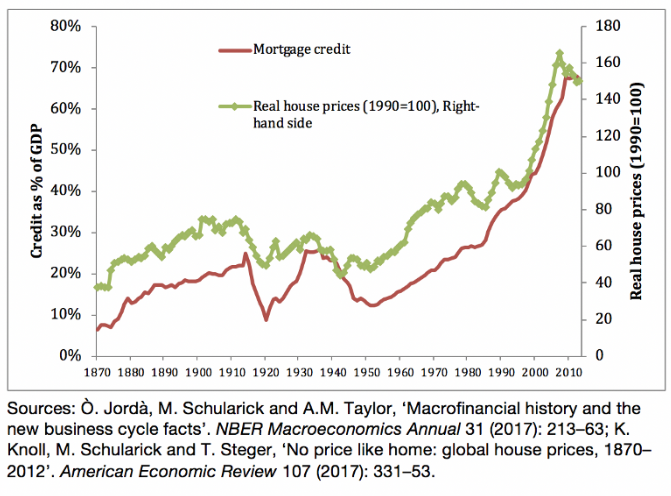

Josh Ryan-Collins theory is very simple – when you have a country such as the U.K. where people want to own their own homes, then when banks are given the freedom to make more money available in the form of loans (mortgages), this increases the demand for land and houses, which pushes the prices up, which then means that the next set of buyers have to apply for larger mortgages and so on.

As potential first-time buyers and investors alike see land and house prices going up, this further increases demand for housing and adds to the demand for higher mortgages, which adds to this inflationary price-cycle.

Behind all of this is a process known as financialisation (link to podcast here, thanks @shanibeer for putting me on to this) – in which financial services (become more central to the economy than producing tangible products.

Financial services include such things as investment and insurance services, but also loans – of which domestic mortgages are a huge part. Essentially when a bank gives someone a mortgage, they create a new asset (they basically create money), which has a ‘value’ over and above the amount initially lent because the borrower agrees to pay back much more than that original sum – typically 2-4% per annum on the figure over 25 years.

Over the last 40 years, there has been a significant deregulation of the mortgage market in the UK, and even with the 2008 financial crash, banks still have significant freedom to effectively create new financial assets (mortgages) – and there has been a trend towards allowing people to pay them off over longer and longer terms (from 25 to 35 years) which increases the number of people eligible to apply.

NB – There are 11.1 million mortgages in the UK, and the total value of those mortgages is £1.3 trillion, equivalent to more than 30% of our GDP. Mortgages in the UK are a very serious business.

The rub is that it’s those easily available mortgages have pushed up house prices, ultimately meaning that the average person now has to pay double what they would have done to buy a house in the 1970s.

To restate the situations again – when a financial product (a mortgage) is used to buy a limited good (land is ultimately limited in the UK), it just pushes up the price of that good (land and housing), and that is precisely what has happened here in the U.K.

If you’re not convinced of this, then check out this graph which shows the correlation between increasing mortgage credit and increasing house prices!

A few thoughts…

My lefty bias wants to buy this argument, but I can’t help thinking that the move towards single person households and restrictive planning laws have also contributed towards increasing house prices. It can’t just be the increasing availability of cheap credit.

Having said this I do buy the argument that it’s a major factor: land, ultimately is limited, especially desirable plots in London, and it’s places like this where the true tragedy of financialisation has affected housing: where people are more likely to see houses as assets with a potentially rising value, which means even relatively high income earners cannot afford to live in the South East as the price pressure pushes out from London. I moved 200 miles west as a result of this.

It’s also tragic that this has had the effect of encouraging people to see their homes as assets, when in reality they are basic human needs! Nothing wrong with wanting some kind of security of ownership over housing IMO, but having to pay 2.5 times as much now as compared to the 1970s is, well, harsh!

This trend of increasing house prices looks like it might be coming to an end anyway: home ownership is already down for people in their 30s, suggesting that there simply aren’t enough people able to afford mortgages to keep house prices increasing.

Sources, including pic sources

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/june2018

https://www.allagents.co.uk/house-prices-adjusted/

https://www.housepricecrash.co.uk/indices-nationwide-national-inflation.php (pic 1)

https://medium.com/iipp-blog/why-cant-you-afford-a-home-9c5cf009be21 (pic 2)

Couple of points:

Good post, thank you.

To keep it focussed on housing. it's an interesting point that the system forces us to pay for an asset rather than a need!

I agree, I don't need my house to be 'worth' £200K, I'd rather it was valued at £50K and paid off 5 years ago so I could work a day or two less!

I need to find out more about that 90 + mortgage.

We defo need more social housing. I think something like £23 billion is paid annually out of benefits to private landlords.

Have to have a think about blockchains as money printers.

Are you planning on mortgage at 90+?

It is people investing in realestate, pure and simple.

I don't care where they live or wjat nationality they may be, it affects those who want to live in homes.

Solutions:

Posted using Partiko Android

I agree that there has to be a political/ social solution to this. Simply allowing the rentier class to be free to use housing as a speculation is a great social harm!

Another factor is foreign investors (in any major global city). They don't just buy houses and apartments and rent them out to locals, which would at least keep them on the housing market and take some pressure off the home sales prices. They buy them and keep them empty, waiting ONLY for profit from resale. That not only pushes up prices directly, but also means there is a greater housing shortage than just land area constrains.

I think there's a proposal in London to start taxing empty units. Not sure of the particulars. Wouldn't want to be taxing someone who's just having trouble finding renters, but how you determine that genuinely vs making outrageous demands to dissuade applicants, I don't know.

I commented about this in response to a previous post: as well as taking properties out of the housing market, it's removing spend on retail, restaurants and services in the local economy. In the Royal Borough of Kensington and Chelsea, England's richest borough, over a third of the properties are unoccupied with corresponding damage to local jobs and businesses.

I hadn't thought about that. Great point!

Often a lot more non foreign investors do it. Persoannly I don't care about their nationality.

Posted using Partiko Android

I agree, but there are different tax regulations for UK and foreign nationals. Both need to be tackled.

Very fair point, I'm not sure how significant such speculators are compared to ordinary house buyers, but it certainly does push prices up!

Council tax has been increased on empty properties since 2013. However, a £4,250 Council Tax bill on a £2.1m average price property isn't having much impact. Foreign nationals are also happy to pay £218,000pa in tax rather than declare which mega-properties they own.

Number of empty homes in England - May 2018

I think this is part of the future - more empty homes, more people homeless. Neoliberalism - polarises!

I remember doing a hand-out for a sociology lesson many years ago, and at that time the number of empty homes perfectly matched the number of homeless. I know the later can vary depending on definition, but at least one of those matched almost exactly!

I agree. Depressing.

Ha ha, well all I can say is that the likelihood of me ever affording a house is pretty much zero. Unless I win the lottery or get lucky with a best selling novel.

I'll probably be renting until I die. But I am lucky to be with a social landlord. Maybe my steem and BTC/LTC holdings will save the day and I can buy a little place in Thailand or Indonesia where the diving is good 😉

Ahhh daydreams

Posted using Partiko Android

Glad you're with a good social landlord at least!

I would like a little place abroad.... Malaysia's also worth considering, don't know about the diving there though.

Cheers man. Yep, being with a soc landlord in this new place is a weight off my mind as I try to clear debts etc.

Yep, there are some amazing dive spots in Malaysia also.

Check out this place Sipadan Island Malaysia:

Really any of those south east Asian countries and the Philippines as well are amazing dive destinations as well as being super cheap to live. I think Thailand is the only one that is reasonably easy to get residency in though unless you're bringing a business or guaranteed job skill.

Ha ha, I'm proper living in daydream world where BTC hits $100000 and I can just buy a little beach front place, write an article/day on steem and live from crypto profits eating coconuts and scuba diving every day 😆

Maybe when I'm 60 at this rate lol

That really is the dream!

Posted using Partiko Android

But everyone has to live somewhere, which means that even if fewer people want to be homeowners in the future someone will still need to own their homes. Rents are outrageously high in big cities in the UK, too.

Reduced demand should lead to lower prices of course, whether that results in lower rents i don't know!

If fewer people want to buy, then more people will want to rent. The rentals will have to be bought by someone.

Posted using Partiko Android

Yeah... Rub it in. I've been looking for a house for ages now. It's just not affordable. Extensive calculations say that it IS still waaaaay more economical long-term to buy vs rent though. Ugh. I really don't like the idea of buying, but in the end of the month I would have more cash available for other stuff :-)

You should buy if you can afford it. I was lucky to get in on a government assisted part-buy scheme, then lucky enough to get out last year before they hiked the service charge to £4500 ($6000) a year, or so I've heard!

I like being a house owner, I don't like paying off a large mortgage that is only so large because of financial engineering.

It's all such a systemic trap.

Yes, it will probably happen. But I feel like I'm buying 'top of the market' now - but can I wait and hope for lower prices 'soon'? It's a huge gamble.

Yes, it's a systemic trap - I'm now looking into options where I buy a house and rent half of it to a student for example :-) That would be the dream. #passiveincome

It's a difficult call whether to wait or buy! No point rushing into anything unless you find somewhere you really want.

Part-renting defo sounds like a good plan!

If I only had read something like this 15 years ago but instead halfway through a 30 year mortgage which when added up shows I have ready paid the price two time over; I realize how right this is. The herd mentality in addition to consumerism has blinded most to continue to inflate the real bubble which is credit. As markets can continue to be irrational, especially when everyone is benefiting, there is no telling when it will all end!

Posted using Partiko iOS

It's a really good example of a market system benefitting the few and harming the many!

Posted using Partiko Android

Congratulations @revisesociology! You received a personal award!

Thank you for taking part in the early access of Drugwars.

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Can I use from a laptop Partiko, as I currently do not have an Android

Hello! Thank you for your message! Partiko is mainly for mobile devices, that being said, we do have a website partiko.app and we are adding features to it! Let us know if you have any other questions! We are always happy to help!

Posted using Partiko Android

I think it's just mobile - for both android and iphone

Posted using Partiko Android

Hi, @revisesociology!

You just got a 1.63% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

You got a 30.68% upvote from @ocdb courtesy of @revisesociology! :)

@ocdb is a non-profit bidbot for whitelisted Steemians, current max bid is 60 SBD and the equivalent amount in STEEM.

Check our website https://thegoodwhales.io/ for the whitelist, queue and delegation info. Join our Discord channel for more information.

If you like what @ocd does, consider voting for ocd-witness through SteemConnect or on the Steemit Witnesses page. :)

Hi @revisesociology!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.566 which ranks you at #1878 across all Steem accounts.

Your rank has improved 1 places in the last three days (old rank 1879).

In our last Algorithmic Curation Round, consisting of 354 contributions, your post is ranked at #31.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

I just started today!! Already earning and getting results from this free Telegram Bitcoin tool!

link: https://t.me/BTC_Hourly_freebot?start=743166107