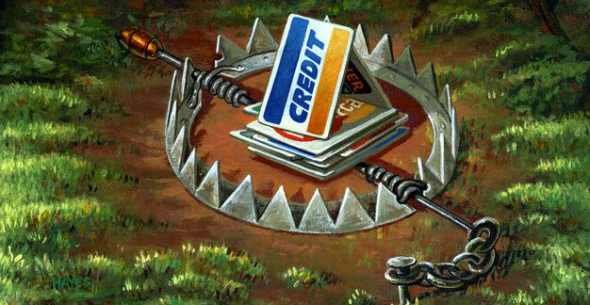

Debt sucks, but we knew that right?

Image Source

This is the question we are considering as we work through P.T. Barnum’s book The Art of Money Getting.

This book was originally published in 1880 and is therefore no longer subject to nor protected by U.S. copyright law because the copyrights have expired.

Therefore, this book is found freely available online and the reuse of it here is permitted and may trigger content detection on the excerpts that are included for discussion.

The plan is to include excerpts and discussion through a series of posts, so there will be new content provided by me that include my thoughts on the reading to promote discussion in the comments.

Index of related Barnum Book Review posts:

Image Source

We will pick up this session with AVOID DEBT:

THE ART OF MONEY GETTING or GOLDEN RULES FOR MAKING MONEY

By P.T. Barnum

AVOID DEBT:

Young men starting in life should avoid running into debt. There is scarcely anything that drags a person down like debt. It is a slavish position to get in, yet we find many a young man, hardly out of his "teens," running in debt. He meets a chum and says, "Look at this: I have got trusted for a new suit of clothes." He seems to look upon the clothes as so much given to him; well, it frequently is so, but, if he succeeds in paying and then gets trusted again, he is adopting a habit which will keep him in poverty through life. Debt robs a man of his self-respect, and makes him almost despise himself. Grunting and groaning and working for what he has eaten up or worn out, and now when he is called upon to pay up, he has nothing to show for his money; this is properly termed "working for a dead horse." I do not speak of merchants buying and selling on credit, or of those who buy on credit in order to turn the purchase to a profit. The old Quaker said to his farmer son, "John, never get trusted; but if thee gets trusted for anything, let it be for 'manure,' because that will help thee pay it back again."

Mr. Beecher advised young men to get in debt if they could to a small amount in the purchase of land, in the country districts. "If a young man," he says, "will only get in debt for some land and then get married, these two things will keep him straight, or nothing will." This may be safe to a limited extent, but getting in debt for what you eat and drink and wear is to be avoided. Some families have a foolish habit of getting credit at "the stores," and thus frequently purchase many things which might have been dispensed with.

It is all very well to say; "I have got trusted for sixty days, and if I don't have the money the creditor will think nothing about it." There is no class of people in the world, who have such good memories as creditors. When the sixty days run out, you will have to pay. If you do not pay, you will break your promise, and probably resort to a falsehood. You may make some excuse or get in debt elsewhere to pay it, but that only involves you the deeper.

A good-looking, lazy young fellow, was the apprentice boy, Horatio. His employer said, "Horatio, did you ever see a snail?" "I--think--I--have," he drawled out. "You must have met him then, for I am sure you never overtook one," said the "boss." Your creditor will meet you or overtake you and say, "Now, my young friend, you agreed to pay me; you have not done it, you must give me your note." You give the note on interest and it commences working against you; "it is a dead horse." The creditor goes to bed at night and wakes up in the morning better off than when he retired to bed, because his interest has increased during the night, but you grow poorer while you are sleeping, for the interest is accumulating against you.

Money is in some respects like fire; it is a very excellent servant but a terrible master. When you have it mastering you; when interest is constantly piling up against you, it will keep you down in the worst kind of slavery. But let money work for you, and you have the most devoted servant in the world. It is no "eye-servant." There is nothing animate or inanimate that will work so faithfully as money when placed at interest, well secured. It works night and day, and in wet or dry weather.

I was born in the blue-law State of Connecticut, where the old Puritans had laws so rigid that it was said, "they fined a man for kissing his wife on Sunday." Yet these rich old Puritans would have thousands of dollars at interest, and on Saturday night would be worth a certain amount; on Sunday they would go to church and perform all the duties of a Christian. On waking up on Monday morning, they would find themselves considerably richer than the Saturday night previous, simply because their money placed at interest had worked faithfully for them all day Sunday, according to law!

Do not let it work against you; if you do there is no chance for success in life so far as money is concerned. John Randolph, the eccentric Virginian, once exclaimed in Congress, "Mr. Speaker, I have discovered the philosopher's stone: pay as you go." This is, indeed, nearer to the philosopher's stone than any alchemist has ever yet arrived.

PERSEVERE

When a man is in the right path, he must persevere. I speak of this because there are some persons who are "born tired;" naturally lazy and possessing no self-reliance and no perseverance. But they can cultivate these qualities, as Davy Crockett said:

"This thing remember, when I am dead: Be sure you are right, then go ahead."

It is this go-aheaditiveness, this determination not to let the "horrors" or the "blues" take possession of you, so as to make you relax your energies in the struggle for independence, which you must cultivate.

How many have almost reached the goal of their ambition, but, losing faith in themselves, have relaxed their energies, and the golden prize has been lost forever.

It is, no doubt, often true, as Shakespeare says:

"There is a tide in the affairs of men, Which, taken at the flood, leads on to fortune."

If you hesitate, some bolder hand will stretch out before you and get the prize. Remember the proverb of Solomon: "He becometh poor that dealeth with a slack hand; but the hand of the diligent maketh rich."

Perseverance is sometimes but another word for self-reliance. Many persons naturally look on the dark side of life, and borrow trouble. They are born so. Then they ask for advice, and they will be governed by one wind and blown by another, and cannot rely upon themselves. Until you can get so that you can rely upon yourself, you need not expect to succeed.

I have known men, personally, who have met with pecuniary reverses, and absolutely committed suicide, because they thought they could never overcome their misfortune. But I have known others who have met more serious financial difficulties, and have bridged them over by simple perseverance, aided by a firm belief that they were doing justly, and that Providence would "overcome evil with good." You will see this illustrated in any sphere of life.

Take two generals; both understand military tactics, both educated at West Point, if you please, both equally gifted; yet one, having this principle of perseverance, and the other lacking it, the former will succeed in his profession, while the latter will fail. One may hear the cry, "the enemy are coming, and they have got cannon."

"Got cannon?" says the hesitating general.

"Yes."

"Then halt every man."

He wants time to reflect; his hesitation is his ruin; the enemy passes unmolested, or overwhelms him; while on the other hand, the general of pluck, perseverance and self-reliance, goes into battle with a will, and, amid the clash of arms, the booming of cannon, the shrieks of the wounded, and the moans of the dying, you will see this man persevering, going on, cutting and slashing his way through with unwavering determination, inspiring his soldiers to deeds of fortitude, valor, and triumph.

My Thoughts:

“There is scarcely anything that drags a person down like debt.”

How I wish I didn’t know this from personal experience!

I have been steadily working my way out of debt almost as long as I had moved at of my parents home around the age of 18.

It has been a long and hard road and thankfully it looks like steemit is going to have role to play in destroying my debt once in for all!

This platform was my introduction into cryptocurrencies and has provided a way to earn in a way that I could turn it around and put it into other cryptos without having to directly give some of my hard earned paycheck.

Instead, I just had to create a quality content post, like this one, to be able to get steem and then use that for my other picks on the BitShares Decentralized Exchange.

Anyways, there isn’t a day that goes by that I haven’t had some thought about my debt and how to work my way out of it.

P.T. Barnum rails against personal debt but sees no problem with the use of debt for business. This is something I can get on board with given that the way businesses operate and need certain cash flows, there is a place for “merchants buying and selling on credit, or of those who buy on credit in order to turn the purchase to a profit.”

This passes my “financial brains” filter for b.s. because some people outright declare all forms of debt as bad or evil and don’t understand the value of its proper usage.

It seems Mr. Barnum was savvy enough to know when it was a good idea to use debt.

But do you?

P.T. warns of the now obvious need to avoid using credit cards to pay for things that are perishable goods. This theory is economically sound, yet when real life happens and you need food to eat or have nothing to sustain your life, then, well, out comes the credit card.

The dire circumstances make more dire use of credit from time to time, but what you do next can make all the difference in the world.

Do you let that balance linger?

Barnum points out what many other “financial gurus” have said in as many ways that “Money is… a very excellent servant but a terrible master. When you have it mastering you; when interest is constantly piling up on you, it will keep you down in the worst kind of slavery.”

The use of money, especially interest, against you can be devastating, however, to turn the tables and have your dollars earn dollars themselves must be a glorious thing.

The hard part is getting to a point where that can be your case and requires much perseverance.

Speaking of which, let us learn what P.T. has to say about how to PERSEVERE.

“Perseverance is sometimes but another word for self-reliance.”

This idea strikes me as something to take to heart and know that it comes down to making the choice to continue on, whether in debt or not, and work or produce things on your own.

I think this creates value and meaning for your own life as well as for others.

“Until you can get so that you can rely on yourself, you need not expect to succeed.”

The admonition to persevere and push forward is great and can gain you much in life, but must you do it at all costs?

We will look at this next time when we discuss the internet’s buzzword “hustle”.

What do you think? Let me know in the comments below!

Next time we will pick up with and continue on with WHATEVER YOU DO, DO IT WITH ALL YOUR MIGHT.

Stay tuned.

Stay interesting.

Stay Strange.

Join me on the BitShares Decentralized Exchange

Image Source

Debt does stink. But I've come to believe beating myself up about it is worse. I'm working on that.

Resteemed!

Agree. I gave up letting it shame me or make me feel bad or powerless.

I manage it now and still have debt I am climbing out of, but no longer do I care about it in the same way as I did in the past.

I have no proof of this, but I honestly feel like the only people without debt are the super rich or the homeless.

I'm not going to be superrich and I don't want to be homeless.

yeah, it seems as much.

I guess we will persist and seek another way!

My favorite post of yours in this series! I love this quote about buying property for revenue ` "John, never get trusted; but if thee gets trusted for anything, let it be for 'manure,' because that will help thee pay it back again."

lol, yeah that gave me a chuckle too.

glad you are enjoying the series and stay tuned!

Exactly.

yup

really you post so great subject,,,,,,,,,,,and your presentation ............too good......i just speech less......how could you do this........i appreciate you...you are so creative person.....keep it up ...all the best......

that's great you are trying to apply these lessons.

I too am doing the best I can!

How different from today! I'm sure P.T. Barnum, were he brought back from the grave, would be shocked at how many people were in debt and to what extent. Like yourself, I had to learn about this one through personal experience.

Yes, the easy credit was too easy and has caused much stress and anguish!

I am getting closer, but not quite out of debt yet...

Same here.