When you have a centralized monetary system, fiat money controlled by a government, you have a single point of failure. You also have a set of risks: for lack of a better term, "sovereign risks."

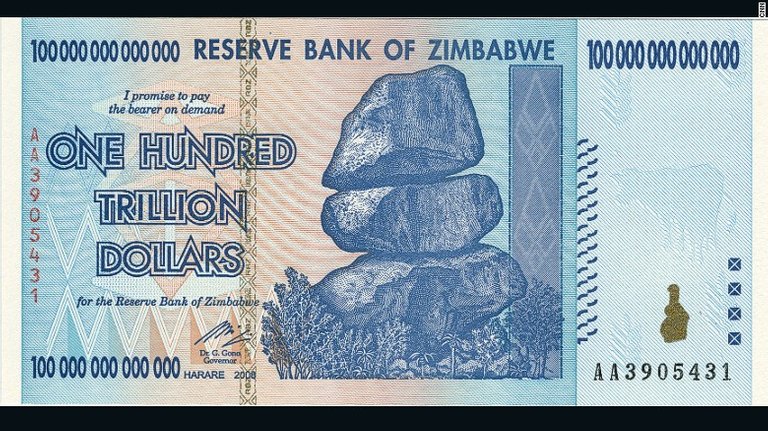

The most-discussed sovereign risk of fiat currency is inflation. We all know what happened to the legendary Zimbabwe dollar:

A one hundred trillion Z$ note gives you a good enough idea of how much a mere million was worth. (Image from here.)

But there's another sovereign risk of fiat currency: demonetization.

Earlier today, the Liberal government of Canada announced that it's putting forth legislation to demonetize the $1,000 bill.

Budget says some paper currency will no longer be legal tender

The $1000 bank note will no longer be legal tender, pending the introduction of legislative changes. The Bank of Canada will still accept the bills for an exchange. (CBC/Bank of Canada)

The Liberal government announced Tuesday — in an item buried deep in its 367-page 2018 budget document — that some paper currency will no longer be accepted as legal tender.

While the Bank of Canada stopped printing the $1,000 note in 2000, there are still about 700,000 of those bills still in circulation across the country.

As part of a plan to crack down on counterfeiting, money laundering and tax evasion, the government will no longer allow those bills to be used to pay for goods and services. The budget does not say when those bills will cease to be legal tender.

The $1,000 note has long been a favourite of organized crime because it makes transporting money easier. But it's not the only bill headed for the dustbin of history. The $500, $25, $2 and $1 bills — none of which are currently being printed by the Bank of Canada and are rarely seen — also will no longer be usable...

https://ca.news.yahoo.com/budget-says-paper-currency-no-090000512.html

It's not as bad as it sounds: people holding those notes will be able to deposit them into an account at a chartered bank or get still-monetized notes in exchange. The bank will forward them to the Bank of Canada, who'll credit its account with easily-traceable electronic money and then destroy the notes.

But this story is a wake-up reminder that governments can demonetize their own money simply by passing a law or issuing an edict. Sovereign risk is real, and the above item shows why.

The virtue of cryptocurrency is it has no sovereign risk. True, crypto prices are volatile. But the inflation is baked into the code cake, therefore predictable, and so long as there's an active network crypto cannot be demonetized.

One quantity of Bitcoin, or STEEM, etc., will always be good as another of equal quantity no matter what denomination. As the demonetization announcement shows, the same is not true for fiat money.

It may just be a good idea to hold some gold and silver as well as crypto. Also I'm going to keep my 2 dollar bill-it already can't buy very much...

I was thinking about that! And I'm sure I'm not alone: lots of crypto enthusiasts came here through the gold-to-Bitcoin pipeline. I wonder how many of the new-rich have sold some of their crypto for a nice haunch of gold...

So are lots of others, I'm sure. Heck: it was a 'think' to buy those uncut sheets of $2 bills around the time it was being withdrawn.

The Bank of Canada sure was willing to sell them...

(Image from here.)

P.S.: A quick look at eBay's listings shows $1000s being sold at pretty much the same price they've always been sold at.

Woow, i like this post.

Thanks for sharing.

great your steem post

Algo asi nos va pasar en Venezuela!...

No, I don't want to go there. ;)

Do not miss out on anything good.

So, am I zimbabwean trillionaire?

Not any more: all the old Zim dollars have been demonetized.