The Solana chain has gone through a roller coaster ride. It has been one of the main stars of the bull run since 2021, reaching the top 5 in token valuation and close to 100 billons market cap. Then it went through a massive depression phase with the price going down more than 95%, and in the last year it has emerged strong again. The market cap and the price of the token have increased as well.

Let’s see how the network activities are doing under the current market conditions.

Solana has some unique tech. It is a sort of hybrid between Proof of Stake (PoS) and a novel concept that they call Proof of History. There is a lot to say about the proof of history concept, but in short here we will just mention that it is a concept that checks all the transactions in the right order/sequence. The Solana blockchain works with slots for periods of time, in which the chosen validators confirm the transactions.

Solana has a reputation for being one of the fastest blockchains, with a theoretical possible 65k transactions per second. Solana also has a controversial reputation over its decentralization since it has been put under maintenance and stopped operating a few times in the past.

We will be looking at:

- Total Value Locked TVL

- Active addresses

- Daily transactions

- Fees

- Staking and voting Rewards

- Inflation and supply

- Market cap

The period that we are looking into is 2021 to 2025.

The data for the analysis are taken from Defi Lama and Dune Analytics.

Total Value Locked

This is one of the most used metric for chains and apps representing the mount of value that is stored and handled by the chain. At the moment the chart for Solana looks like this.

Quite the ride.

Going from zero to 10B in the previous bull run, a drop to 300M in 2023. A growth in 2024 reaching a new ATH of 12B and a drop again in March 2025 to 6B, and a growth since then to above 10B where we are now.

Active Addresses

One of the key metrics for a blockchain is the number of active wallets. Here is the chart.

A massive spike at the end of 2024 with a new ATH for the number of daily active wallets, reaching 8M DAUs. The Solana chain now far outpaces the previous numbers in 2021 when there was around 500k DAUs at the top.

IN 2025 there has been a drop in the DAUs, but much smaller compared to the previous levels.

There is a drop in the last period and the DAUs are now in the range of 3M to 4M.

The one thing that has been driving massive activity on the Solana chain has been the hyperproduction of meme coins on platforms like Pump.fun, with millions of meme tokens launched there. Even Trump launched a meme coin on Solana back in November 2024.

For comparison the number of active wallets on ETH is somewhere around 500k, so the 4M on Solana is quite a lot. Still not sure how many of these are unique users and how many bots, my guess is that there are a lot of bots, but still the activity is high.

On a monthly basis the chart for active wallets looks like this:

Here again we can notice the spike in the last month with an amazing130 MAUs in November 2024! Again not sure how many of these are bots. In the last months this number has been in the range of 70M to 100M. Still a huge number.

.

Daily Transactions

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

The number of transactions is where Solana shines. It probably holds the record for a number of daily active transactions.

In the last period the number of transactions has increased furthermore and reached a new ATH at the end of July 2025 with close to 100M transactions per day.

Compared to ETH where there is just above 1M transactions per day, Solana is leading by a lot.

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

A massive spike in the beginning of 2024 and later in the year again, when fees reached more than 0.1 USD, or 10 cents. This is still quite a low number compared to the ETH fees, when cheap fees are usually around five dollars but can go more than 50 USD in some periods.

For most of the time transactions fees on Solana are around one cent, or just a few cents.

Solana is one of the cheapest blockchain to transact on. Because of the very cheap fees we have seen a lot of botting on the chain, but it still manages the traffic. The thing is the validators need a lot of resources to maintain the speed and the numbers of transactions. Half of the fees are burned and half goes to validators.

Staking and Voting Rewards

Fees are just one aspect that the Solana validator receives as rewards. There are also staking rewards and voting rewards.

Here are the charts.

The staking rewards are at the bottom of the chart, while the voting is at the top. Cumulative these two types of rewards account for around 50k SOL daily now and continue to go down.

The staking and voting rewards have been quite constant in the period, with a slow downtrend.

The daily SOL for staking rewards is around 35k, while the voting rewards are at 15k.

Inflation and Supply

Inflation and supply are on of the most important metrics for a blockchain. Here are the charts from the official Solana docs.

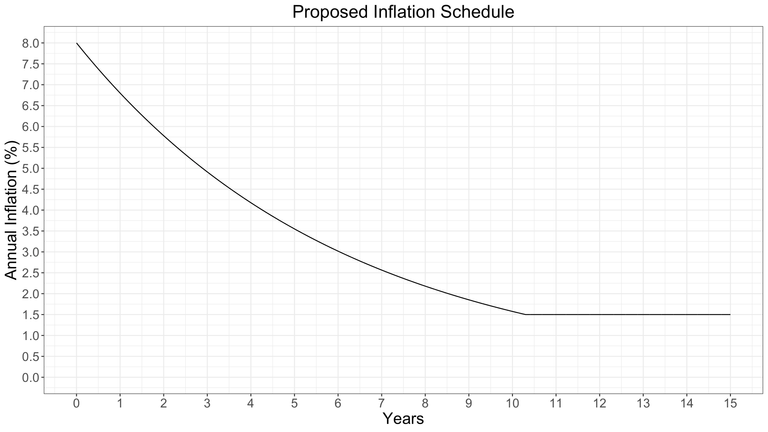

The inflation rate for Solana starts at 8% per year and drops each year, reaching 1.5% after 10 years and stays at that level for the future years.

The supply looks like this.

The current supply of Solana is close to 540M. From the inflation schedule it is projected to reach more than 700M in 10 years’ time. After that the inflation should slow down to 1.5% per year, and the supply should increase more slowly.

Market Cap

At the end the chart for the market cap.

Solana has reached a new ATH in terms of market cap. While in terms of price it is still bellow prior to its past ATH. This is because there were new tokens added in the last years since 2021, more than 200M and this has pushed the market cap.

At the peak Solana reached an amazing 120B market cap, higher than the 2021 levels of 80B. At the moment the Solana market cap is around 100B. In terms of price it is now around 180 USD per token.

All the best

@dalz

Fascinating look at the on chain data! I have personally avoided SOL because it seemed like hype, and when it crashed and got re-funded it definitely seemed scammy. Then all the memecoin madness, pump and dumps, and obvious schemes, make me feel like using it is just a way to burn money. Like Eth. However there must be some utility... like as a way for influencers to rugpull their fanbase. Not for me!! Hive is enough, I just like writing some <a href 's and <img srcs into posts haha.

Thanks for these Details. Makes me quite comfy when my 3 Seeker Phones arrive :) Will write an Article too.

i was wondering if a Bridge between Hive and SOL could happen, like account creation, do snaps with seeker Phone(solana wallet) and transmit it to the Hive Blockchain and earn "HIVE/SOL" with it.

Thanks!

Any type of integration is positive for Hive! It can provide what it does best and take what it needs from other networks

Any reason, why Hive does not have similar publicity like Solana ? What are we lacking ?

Solana is heavily supported by a top VCs companies from the US. It is the major competitor of ETH and literlay has people in the top goverment and corparate structures. With all this said, still nothing is guaranited, and it success is not without risks. Hive is just a community project with few top devs in the US...

It is interesting to see how low fees influence user engagement. I think it is truly a game changer for both traders and developers.

The data and analysis I have provided on Solana confirm that innovation is a key factor in maintaining the relevance of blockchain, even after massive downturns.

It's almost no surprise that Solana outperforms ETH in number of active wallets or users and number of transactions. Solana's popularity is fueled by the memecoin-trading craze. It seems to me that memecoin-trading can never be popular on any other blockchain as it is on Solana. Solana is surely destined to reach hundreds of billions of dollars in market cap. Thanks for the info.

This post has been shared on Reddit by @acidyo through the HivePosh initiative.

$WINE

Excellent.

Great overview which shows that the fundamentals like DAU or TVL support the rise in market cap.

Thank you for sharing this 🙏🏾

It would be great if you could do a post on the downvoters on Hive and the top downvoted author's on Hive 🤔

I used to think it was weird that @lasseehlers hasn't been promoting all of the Solana crypto scams.

But then I remembered @lasseehlers does fuck all research other than maybe listening to a YouTube video's audio for a few seconds as he copy-pastes the URL for a low quality shitpost. So @lasseehlers probably hasn't randomly ripped off a Solana crypto scam video yet.