In the Latest Steem Release 0.14.0 there was an interesting update concerning Steem Dollar Stability. A few questions later from users like @elyaque (who also posted here, I have decided to post on this topic, and provide my thoughts on how this could impact the Steem Economic System moving forward…

As I have done in many of my previous posts, I am going to begin by consulting the Steem Whitepaper - Page 12/13. Where there is Change, it is always worth considering the Origins of where we have come from, and where we are Suppose to be going. The Whitepaper allows us to do both.

Sustainable Debt to Ownership Ratio

If a token is viewed as ownership in the whole supply of tokens, then a token-convertible-dollar can be viewed as debt. If the debt to ownership ratio gets too high the entire currency can become unstable.

Debt conversions can dramatically increase the token supply, which in turn is sold on the market suppressing the price. Subsequent conversions require the issuance of even more tokens. Left unchecked the system can collapse leaving worthless ownership backing a mountain of debt. The higher the debt to ownership ratio becomes the less willing new investors are to bring capital to the table.

For every SMD Steem creates, $19.00 of STEEM is also created and converted to SP. This means that the highest possible debt-to-ownership in a stable market is 1:19 or about 5%. If Steem falls in value by 50% then the ratio could increase to 10%. An 88% fall in value of STEEM could cause the debt-to-ownership ratio to reach 40%. Assuming the value of STEEM eventually stabilizes, the debt-to-ownership ratio will naturally move back toward 5%.

The idea behind having a conservative 5% debt to ownership ratio is that even if all debt were converted and sold there should be ample buyers and the effective dilution of the token holders remains relatively small.

A rapid change in the value of STEEM can dramatically change the debt-to-ownership ratio. The percentage floors used to compute STEEM creation are based on the supply including the STEEM value of all outstanding SMD and SP (as determined by the current rate / feed).

What is apparent from reading this extract of the White Paper is that the founders already had this mechanism of their radar. The key sentence for me is; Left unchecked the system can collapse leaving worthless ownership backing a mountain of debt.

Why the change?

Something the founders couldn’t necessarily have planned for was the almighty demand for Steem at such an early point in the project.

The price rally in the week after the 4th July was around 1,000%

This was great for Steem investors who profited handsomely from this rally. It was also great for Content Curators and Creators…

Why?

Curation and Creation rewards are paid out as a percentage of Steem Market Cap (~10% per annum). So, if the price of Steem is High, the Market Cap is High, and so are the Curation and Creation rewards.

Here is the Key Point

These rewards are split as follows;

- Curator: 25% of the Rewards: Paid in Steem Power

- Creators: 75% of the Rewards: Paid 50:50 in Steem Power and Steem Dollars

This means that, currently 37.5% of these Rewards are paid out in Steem Dollar, which is Essential Debt in the Steem Economy. This debt is priced in $Dollars, and thus does not change in value with the Price of Steem.

- If the Price of Steem goes up, the Market Cap rises, and the % of Debt in the system Falls.

- If the Price of Steem goes down, the Market cap falls, and the % of debt in the system Increases.

At any given point in time, the amount of new debt created (Steem Dollar rewards) is a small fraction of the overall value of the Steem Economy. So, during normal trading conditions, there is nothing to concern ourselves over. We could however encounter problems If/When the price of Steem Falls, Just like it has done over the past month.

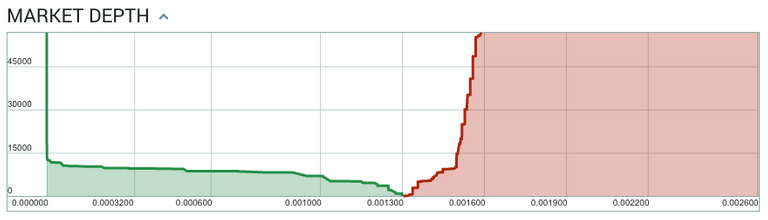

When the price of Steem started to fall, the Steem Dollar to Steem Market Cap ratio was well below <1%. In the space of 1 month, we are now hitting ~2%. Without having a mechanism in place to cap Steem Dollar Production, every price fall in the future would result in a increase in Steem Dollars to Steem Market Cap (Essential Debt to Ownership Ratio would balloon). Imagine we had started out around 5% a month ago, we could have been pushing towards 20% Debt to Ownership Ratio. This could have been enough to put the Steem system under severe pressure, considering all this debt is convertible to Steem over a one week lead time.

The Update

Under the 0.14.0 update there will be a 2% cap in Steem Dollars to Market Cap. This means that, if this threshold is ever reached, Author Rewards will paid in Steem and Steem Power, instead of Steem Dollars and Steem Power. This will naturally keep control of the Debt to Ownership Ratio, rather than letting it runaway by itself.

This is a slight more aggressive control than the original 5% ratio referred to in the White Paper, and shows how serious the founders consider this metric.

Is this Good or Bad?

Overall, It think this is a good idea.

This protects the Steem Economy from large falls in the price of Steem which could send Debt to Ownership ratio to breaking point. Steem would need to become pretty much worthless for this to happen under the 2% Cap implemented in the latest update. If this point was ever reached, it at least won’t be the Debt to Ownership level (which we can control..) which would cause Steem’s demised.

I have considered the fact that, if we go beyond the 2% cap, more Steem would be created which could create extra sell side pressure on the system. On balance, I feel this is much better than increasing Steem Dollar Circulation. Steem Dollars essential represent Steem anyway. This update, to me, seems like the only reasonable way to control this moving forward…

Yesterday the Debt to Ownership Ratio was at 1.92%...

Interested to hear your thoughts…

Finally I've got thing about SBD as a Debt. Now I understand why Promote feature will be good for Steem currency.

Thanks!

Because promoting a post burns SBD, so it burns or reduces the debt.

Yes, I find this feature to be incredibly beneficial. Now people or corporations can promote a post and reduce debt at the same time. It can be viewed as non intrusive optional advertising since you never have to click on the promoted posts feed if you don't want to.

We have some great minds working behind the scenes

It is an ingenious system. Also I think there are talks of making it optional in people's account if they just want to get paid 100% in Steem Power. That seems like it could help as well. If there was an option where they could pick to be paid 100% in Steem Power or even do 75% in Steem Power and only get 25% in SBD instead of 50% of the Payout. Giving that choice to people who were already going to power up anyway could help if I understand it properly.

Yes that makes sense, but it seems a small step between taking that 50% sbd and trading on the internal market for steem power.

But it would speed up the process you are absolutely right.

Exactly @neoxian

Good 4U, I still don't understand the way this all works.

Thanks for mention me here, and Thank you VERY MUCH for the desired answer !!! Upvote 100% :)

No problem @elyaque Your request kept me out of trouble on a 4hr Train journey this afternoon. Don't hesitate to ask further questions moving forward.

It is mandatory that there are adjustments to the system as time passes relative to the base concepts outlined in the White Paper due to the fact that until real users were on the platform, it was impossible to predict or measure user behavior.

Now that there are a reasonable number of real users it is possible to start making meaningful technical adjustments to the platform.

However, there is another issue I see that may have even more impact on the platform than anything I have seen you or anyone else acknowledge so far.

That is the perception of a sufficiently large portion of the user base that the opportunity to earn cryptocurrency from posts does not in fact function in a manner that is consistent with the marketing messages used to attract them to the platform. Please note that I used the word "perception" here as a context for looking at this issue.

It is not a matter of whether the system is fair or not or that there are valid and sound reasons for the way the platform functions.

It is the perception that it is rigged, unfair, overly complicated by design, or any of the other suggestions I see posted more often than not which concerns me as an observer of the contents I see posted.

I am quite sure that no system regardless of how fair and reasonable will please everyone since we are dealing with human beings. However, that not withstanding, the platform must be perceived as being attainable relative to the possibility of reward versus quality efforts in order for there to be any significant movement from other social media platforms to Steemit.

Recent posts by Dan and Ned plus actual feature enhancements executed lately certainly are most encouraging in terms of transparency.

Believe me when I say that I wish I were smart enough to present a workable solution here instead of this overly long "rant".

I think that you probably already have many people who are creative enough and smart enough to tackle this issue.

I only bring it up because I sincerely believe that Steemit is an amazing opportunity and has the potential to blow away every other social media platform existent today.

In my opinion, that potential will be realized by a bunch of "little" things that are meaningful to non-technical ordinary people rather than fully enlightened crypto wizards!!

" a reasonable number of real users";"we are dealing with human beings."

What really is steem? A laboratory to study human and A.I. interactions?

Although it may very well serve as a use case for study, I do not think that is the primary intention of the developers. I use "real users" to set the context to human beings as opposed to bots...!

Which raises the question: How many are human beings and how many are bots?

Well that raises a whole lot of new questions that only the insiders have answers for. It also points to why the voting issue raises so many questions. @hisnameisolllie is trying his best to make some sense of it but it is very complicated so he has an uphill battle with not much of an upside I can see.

Nice bit of analysis here. I agree with this change; the 2% cap should help to keep things in check during times of rapid price movement. And as a user & writer, I don't particularly care if I'm rewarded with Steem or Steem Dollars. If I get Steem, I'll just power it up. If I get Steem Dollars, I'll just hold on to them, maybe spend a little on promoted content to see if that's worth doing. I don't plan to cash any out anytime soon. I'm happy to see the founders taking a proactive stance on the evolution of the system, making little tweaks here and there in response to changing conditions as we go along. All of this is encouraging, and I remain optimistic on the future of the platform.

While I still have no idea how the Steem economy works, my intuition tells me to keep steeming on because it's the first time I've ever seen a platform tied to any kind of currency (without relying on Ad(non)sense) and keeping an eye on the health of supply and demand to keep us going for a long time. I feel pretty confident that my time here is not wasted :)

Cool!

Steem on!

@hisnameisolllie

Well, it would be a good idea if people from outside were investing in Steem and/or signin up in the platform. So far is just massive whale cash out and it doesn't look really optimistic. Whales even fight each other with flags just to get an edge on the exit door. If this trend continues with the same pace, the top trending post by December will be $50 tops.

You can screenshot this for future reference.

I never quite understood the curator thing, does that mean it goes to up-voters? Do whales get a higher percentage or how is the curation reward spread?

Hello @vegeta You pretty much right on you points.

Crudely:

Curators (Up-voters) get a share in the rewards. If you have more voting power, you get a bigger share in the rewards. Voting power is inextricably linked to the amount of Steem Power you hold.

"If you have more voting power, you get a bigger share in the rewards." Which means that the rewards will concentrate towards the whales. The distribution of wealth needs to be spreaded out better if Steem wants to hit critical mass.

I have posted on this a number of times, if you interested check this out. It's all relative remember...

Thxs. I read it. It's just gonna have to take time, growing pains.

Loved this, The timing was perfect with the collapse of the SDB today.

i wouldnt call 0,83 $ a collapse :)

It's a low enough price to bring back up the value of Steem.

I would like to see steemit.com to become profitable even if it meant ads on the site.

Yea,

Facebook is into ADs 4 sure

If You can't beat em, join em!!

Actually the new promotion feature is a kind of advertisment area.

How did you calculate this percentage, where are you get the latest figures from?

I publish this number every week here

If you want to work it out for yourself. Go to https://steemd.com (right hand side of home page) for figures on Total Steem Circulation and Steem Dollar Circulation. Get a $price for Steem and multiply this by the number of Steem in Circulation. Divide Total Steem Dollars by Steem Market Cap..

Thank you for this interesting article.

Great explanation. This allows the debt to be more manageable and permit rewards to content creators and curators without devaluing the currency of the Steem platform as a whole.

Thanks! Take care. Peace.

Great explanation. Thank you.

You said stability? It's 80 cents now.

That wasn't what this post was about...

This post has been linked to from another place on Steem.

About linkback bot. Please upvote if you like the bot and want to support its development.