Gold and war

There is much to be said about the run to gold during a war, the mentality of both civilians and soldiers during war and how they react to gold but let’s put this to one side for now and look at how gold behaves in the run up to a war. Whilst it may seem there are too many wars, there are also several ‘run-ups’ to them before anything, if at all, happens.

Rumours of military action

Of course, at the moment all we have is talk of a war. This has happened many times before, and often with no outcome.

As rumours of a war with Iran peaked at the beginning of November 2007, gold soared to reach a 27-year high touching $806/oz. This was 5-months after the US government issued a warning to all US citizens not to travel to Iran and just a month or so after the first batch of US sanctions were placed on the country. Again, it seemed gold ‘smelt’ war.

The red line indicates when gold soared, it then fell to levels not seen since the previous month before climbing and falling over the next couple of months. It wasn’t until the beginning of January when the gold price pushed above the highs seen in November.

Of the three wars we use as examples in this article, the jump in the gold price following talk of war is the most acute. However, like the other examples gold returns to levels seen prior to the outbreak of war, following the jump.

Unlike the next two examples the gold price returned to levels lower than seen before any talk of war or during the military action.

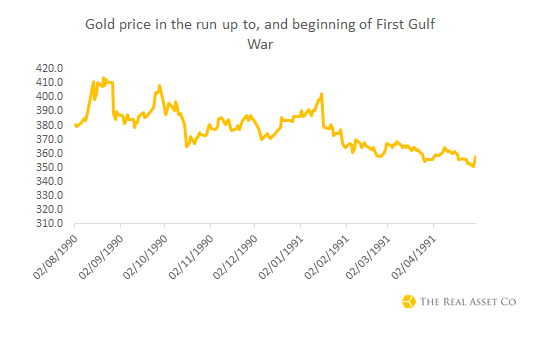

It was on the 2nd August 1990 that Iraq invaded Kuwait, here the jump in the gold price is clear to see and is similar to the current movement in the price of the yellow metal. As talk of war went on, the gold price returned to pre Kuwait-invasion levels – again, this is a similar pattern to today.

The initial bombardment on Iraq happened on the 17th Januray 1991. The graph clearly shows gold peaking, but it is not able to return to those highs seen in the previous August. As the war ends, gold finishes lower than pre-war.

The Iraq War

In the run up to the war some analysts wrote that gold could ‘smell war’.

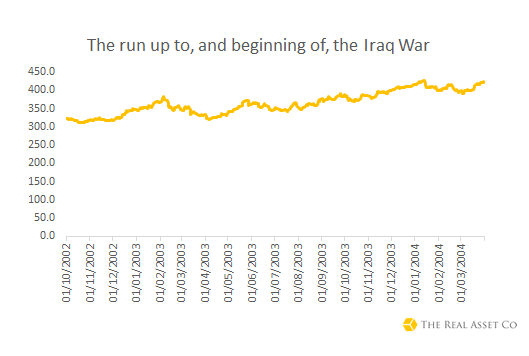

In October 2002 new inspections of weapons production facilities began, something which George W. Bush reluctantly agreed to. It is whilst these inspections are going on that we see the gold price remain relatively steady.

However as dialogue regarding an invasion of Iraq continued the gold price is seen rising, particularly ahead of the first invasion in March 2003. It then returns to pre-invasion levels as profit-taking begins. It then climbs and this time it is more sustainable than the pre-war panic seen previously.

Syria and gold

On the other side of the gold equation we have of course seen evidence of gold being used as a defence weapon in this war against Syria. In February 2012 sanctions on Syria, from both Western and Arab nations proved too much. The country resorted to selling some of their 25.8 tonnes of gold reserves ‘at rock bottom prices’ to try and raise revenue.

Previously the country had traded in gold, as well as other precious metals, until February 2012 when the European Union prohibited trade in precious metals with Syrian state institutions.

Internally, the gold market is not a booming one. Since 2009 the import of manufactured gold jewellery has been banned, whilst other gold objects above 0.5kg are also banned from being imported.

When the war broke out and sanctions took hold citizens rushed to sell their gold, however few were looking to buy as cash became king in a country where there was little money to be made anywhere.

Since 2000 it is estimated that the number of gold workshops has fallen from around 600 to just 200. There is yet little evidence that those caught in the middle of the conflict are turning to gold as a safe-haven. However data for smuggling is not yet available, we would also hypothesise that many of those escaping the conflict have taken whatever precious metals they own, recognising it as a faceless currency.

Does war affect the gold price?

Talk of war and the act of war clearly affects the gold price. The price of the yellow metal obviously continued to climb after each of the three examples we provide. But in truth very little happens when the talk of war turns into action.

This brief look at a small selection of wars suggests that the gold price peaks prior to and at the beginning of military action, before returning to levels seen not long before. It then, of course goes on to extend its bull run. But how much of it was to do with wars that happen in the Middle East?

We believe very little, whilst geopolitical instability clearly is a driver for the gold price, it does not obviously have a long-term impact on the price of bullion. It may be interesting however to look at how the economic impact of wars go on to affect the price.

For instance, what many appear to forget when they discuss Syria, tapering and gold in the same breath, is that a war means money printing will have to happen regardless of what you call it.

About the Author

Jan Skoyles is Head of Research at The Real Asset Company, a platform for secure and efficient gold investment. Jan first became interested in precious metals and sound money when she met Ned Naylor-Leyland whilst working alongside him in the summer of 2010. Jan then went on to write her undergraduate dissertation on the use of precious metals in the monetary system. After graduating from Aston University in 2011 Jan joined The Real Asset Co research desk. Her work and views are now featured on a range of media including BBC, Reuters, Wall Street Journal, Mail on Sunday, Forbes and The Telegraph. She has appeared on news channels including Russia Today to discuss the gold price and gold investing.

https://steemit.com/steemit/@supernovaone/gold-surges-to-10-month-high-after-n-korea-s-aggressive-missile-test

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://therealasset.co.uk/war-syria-gold-price/

Congratulations @supernovaone! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP