Topics for Indianapolis DNOWS Trading Group:

Bob Shenberger - Markets Trend

Ken Yamasaki - BPI and RSI

https://www.zerohedge.com/news/2019-04-08/jpmorgan-morgan-stanley-and-now-goldman-all-warn-its-time-hedge-fomo-euphoria

George Crawford - Market Musing, 10-30 Put Calendar, EOS Trading

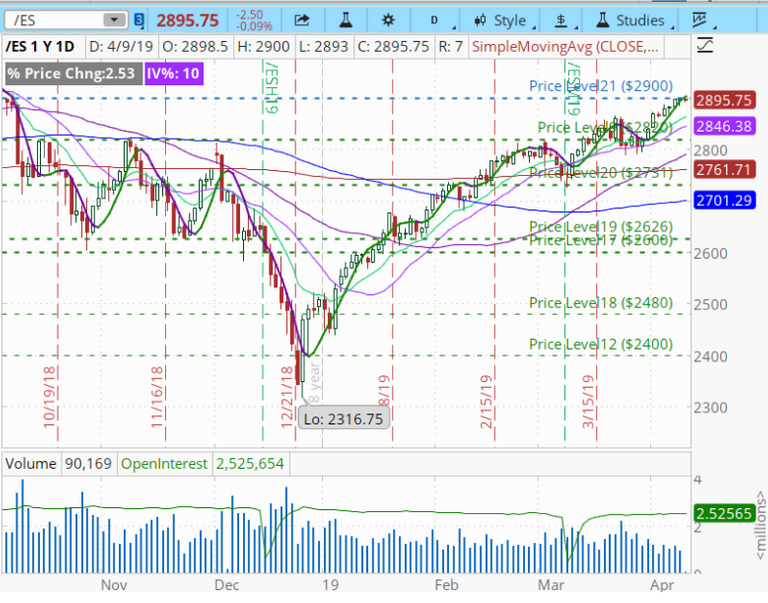

Low Volatility: VIX < 14. /ES Futures are potentially headed to new all time highs in 2019. On Monday, the US Markets increased in spite of Boeing (BA) significant price drop. Overnight /ES finally retested 2900. With the Fed Reserve hinting at Rate Cut and Trump wanting QE4, expect market to continue to rise.. The economic date in US is week and global growth is slowing. Now is the time to start hedging or at least taking profits.. Risk Twisted Spreads, Atomic Hedges and 10-30 Put Calendars are good hedging strategies. Antipin, Jade Lizards, Put Credit Spreads, Call Diagonals and 10-30 Day Put Calendars trades are still working.

E-currencies vs US Dollar:

Bitcoin is rising above $5000/Coin and EOS is around $5.50/Coin. US Dollar is still range bound between $95-$97.5 trading range since October 2018.. Euro still has challenges including Brexit, French riots and Banking Problems in Germany and Italy which should keep US Dollar elevated at these levels.

http://www.openmarketcap.com/

Cherry Picks Newsletters:

TastyTrade Researchers publish an awesome weekly newsletter every Tuesday.

https://s3.amazonaws.com/cherry-picks-s3-bucket-newsletter/live/19_04_09_tastytrade_Research.pdf?mc_cid=b8d0bbecde&mc_eid=e9e24bad07

If you are new to options or this blog sound like gibberish, please tryout Tasty Trades New 2019 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

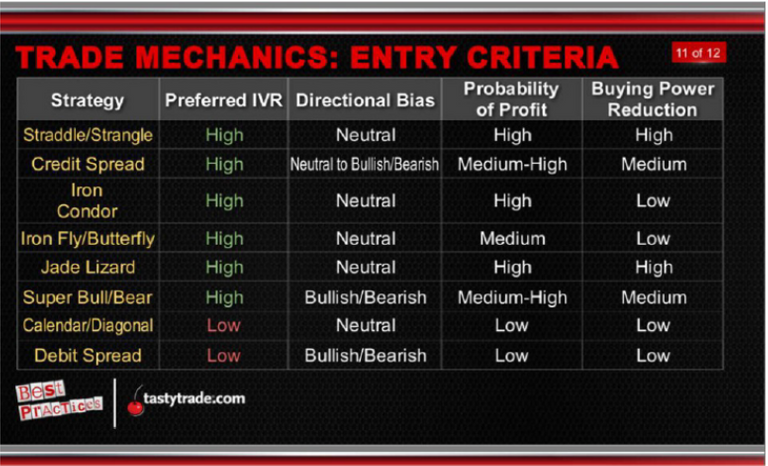

https://tastytrade.thinkific.com/courses/beginner-options-courseTRADE Log: VIX < 14

- Credit Spread, Iron Condors

- Broken Wing Butterflies, Put Condors

- Jade Lizards

- 10-30 Day Calendars

- Weekly Antipin Butterflies

- Risk Twisted Spread for June

Videos:

Theotrade: What Will Upcoming Earnings Reveal?

Dan Sheridan: 2- Tip of the Morning 4-5-19: A Calendar with VIX at 12

https://www.tastytrade.com/tt/daily_recaps/2019-04-08/episodes/managing-ratio-spreads-04-08-2019

10-30 Day Put Calendar Recipe:

Setup

Underlying is range bound after a runup. But definitely range bound

High Liquidity

Low IV Rank (less than 10 if possible)

No earnings for next 10 days

Find support to confirm the underlying is range bound

Set strikes at 30 to 40 delta

Entry

10 to 17 Days Short Put and 30-38 Days Long Put

Ask for improved pricing (by looking at nearby strike pricing)

Consider adding a little more time to the trade to get improved pricing

Exit/Adjustment

Profit Target: 10-20% of Debit Paid for Trade

If your short strike gets hit, get out by closing the trade

If price stays the same, close the trade before the short expiration

If price runs up roll the short put up and out for a credit. Now it's a diagonal or credit spread instead of a calendar

Congratulations @traderdad! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!