The budget is next week, and there have been hints that there is some room for tax cuts.

The Inland Revenue reports that

Total HM Revenue and Customs (HMRC) receipts for April 2023 to September 2023 are £392.5 billion, which is £23.1 billion higher than the same period last year.

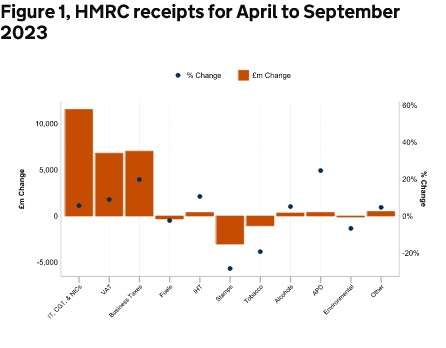

Here is the graph showing which taxes brought in increased revenue:

Income Tax, Capital Gains Tax, National Insurance contributions and corporation tax all provided a surge of revenue. We're at full employment, and people have been getting payrises higher than inflation. Combined with the freezing of tax thresholds, this has hauled in a good bit of money.

However stamp duty was down by £3 bn (28%), which reflects the frozen housing market where people are reluctant to move until interest rates come down again.

The government desperately needs inflation to get back to 2% so that interest rates can be cut. Not just to get the housing market going again, but to decrease the amount of interest being paid on the national debt.

So yes, the govt is in a better position than last year, but there is not that much wriggle room.