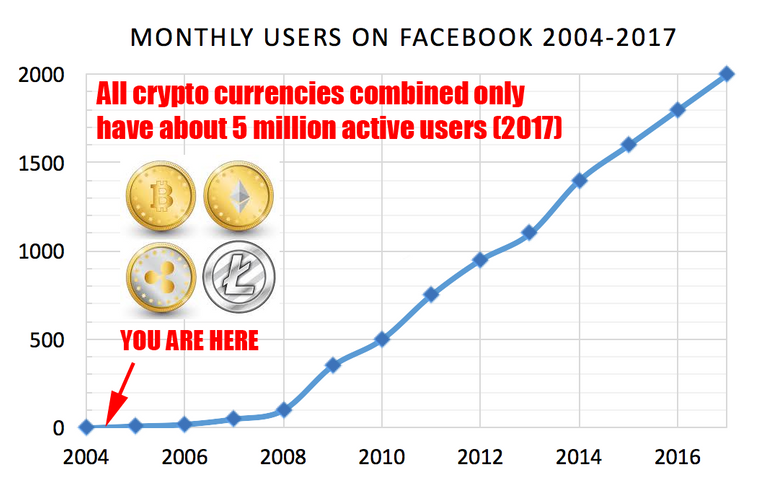

Investing in crypto is becoming a safer bet each year as Bitcoin and altcoins get older, improved and better established. We are still in the very early days of crypto and the opportunity to strike it rich is well within reach of most people, provided they have access to the internet, modern banking and a little disposable income. However, for most new investors coming into the crypto space deciding which coins to invest in and how much is a very complicated issue.

There’s so many of them, so much information, high tech jargon and amazing promises that sound more like lies uttered by politicians than from the nerdy developers that are pitching them. Every new coin is hyped, packaged and sold like the next Amazon... However, despite all the hype and noise, we can now say with a high degree of certainty that some of them will make it big in the future, but which one(s)?

Interesting fact: All users of crypto currencies today represent less than 1% of the number of current Facebook users. More details

The reality is, no one knows, whoever tells you they do, they are flat out lying, fooling you and themselves. This market looks very much like the early car industry in the United States. Thousands of car brands appeared everywhere, a lot of them were very promising (remember the DeLorean?), but most eventually went bankrupt, only a few succeeded in the long run.

So, how do I know which coins will succeed?

The simple answer is you DON’T. Trying to pick winners is very dangerous game that most people lose, those who don’t are demonstrably just plain lucky and end up losing everything the next time they bet big. The strategy that I’m introducing guarantees the winners come to you, rather than you pick them up.

How much money should I put in each?

This is a huge conundrum for most investors. With so many coins available and limited disposable income to invest it’s hard to distribute the funds in a sensible way.

Introducing the Millionth of Supply Passive Indexing strategy:

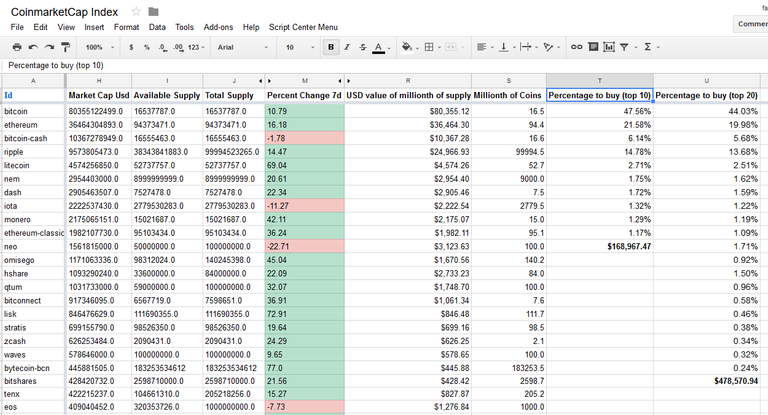

The following spreadsheet feeds from Coinmarketcap’s API and lists (or indexes) the top coins by market cap and daily trading volume. The coins at the top give you a pretty good idea of the current coins being favored by the market as of the day of publication of this post.

Download spreadsheet image showing USD value of millionth of supply and percentages to invest to own the top coins by market cap. Follow me @CryptoEagle for updates.

The goal of this strategy is to own a millionth of the supply of each of the top coins by market cap . This way you guarantee that if any of them succeeds in the future you will be part of the elite, the top 0.1 percenters and millionaires of the future. If any of the coins (or some of them) succeed(s) and become(s) a widely used reserve currency you will be guaranteed to own a millionth of its supply .

In columns T and U of the spreadsheet you'll find the percentage of funds you should invest based on market cap and the USD value of the millionth of supply of the coin. This is calculated by dividing the USD value of the millionth of supply by the total amount you should invest to own the top 10 or 20 coins.

It doesn’t matter if you invest $100 dollars every month or $100,000 at once, your goal will be to own the millionth of the supply of the top coins as soon as possible without spending any income that's not disposable to you . So, if for example, all you had is $100 dollars to invest monthly, you would invest this amount in each top coin according to the percentages shown, no more, no less. At the bottom of the columns is the total amount in USD you would invest to do this for the top 10 and 20 coins.

How rich will you be if you follow this strategy?

There are currently an estimated 10.5 trillion dollars in existence. If you owned a millionth of the supply of US dollars right now you would own about ten million five hundred thousand dollars!

In the United States alone, at end of 2016, there were 10.8 million millionaires, according to a study from Spectrem Group's Market Insights Report 2017.

Credit Suisse estimates there are about 35 million millionaires in the world (including all financial and nonfinancial wealth, such as assets, collectibles, and homes). If we compare this number to 21 million, the total number of Bitcoins that will ever exist, we can see that there won’t ever be enough Bitcoins in the world for every millionaire to even hold just one!

Also, this doesn’t account for the disruption of other industries such as remittances, Gold as a store of value and many other new uses of crypto currencies that we can’t even dream of today. As an example, if Bitcoin overtook just 5% of the market cap of Gold, a single bitcoin would be worth approximately $24,000 USD.

But, “introduce any crazy coin name here” is so great, the technology is amazing, so exciting. It’s the future, my guts tells me!

Yeah right, the market doesn’t care about your hunches, white paper promises, or all those great technologies that people sell as the best thing since Coca Cola. Nope, only market cap, volume and related network effect can tell you what coin will end up being favored by the market.

You must re-balance every once in a while

About every 3-6 months you should take a look at this index and re-balance it. Follow me for updates to this post. If any coins dropped in market cap sell them and re-invest the money on the top coins until you own the millionth of their supply. If there are new coins in the list you should invest in them until you reach the goal as well, no more (over invest), no less (under invest). If you don’t do this you are risking missing the upcoming coins and keep investing in the long term losers.

Don’t invest on coins that only briefly come to the top

(Especial thanks to @famunger for contributing to this point)

Even though the spreadsheet gives a pretty good idea of the top 4-5 coins, as you go down the list you will see, every once in a while, some temporarily overhyped coins that come up but can’t sustain their ranking and eventually crash. Only invest in coins that manage to maintain their ranking on the list for at least 3 months or more. Don’t fall victim to the Fear of Missing Out (FOMO) so typical in this world. Think of these coins as if they were the hot chick from high school that got away but later you find out she became an ugly fat blob...

Advantages of this strategy:

You will be almost 99% guaranteed to become a multimillionaire by owning the top coins the market finally ends up favoring. You will certainly sleep like a baby!

You can start investing with very limited funds and continue investing periodically. Even if you don't get to own the millionth supply of every top coin you'll be certain you did as best as you could with your limited resources.

You won't over or under-invest in any particular coin and thus keep risks at a minimum.

You’ll skip all the typical drama of investing in cryto. The Fear of Missing Out (FOMO), the Fear, Uncertainty and Doubt (FUD), the daily crashes, the pumps and dumps etc. will not rattle your nerves and send shivers down your spine every time they happen.

Disadvantages:

This is a boring, long term, no feelings involved, passive strategy, you will not have the adrenaline rushes and enjoy or suffer all the crypto drama. Picking winners is reduced to a simple to follow probabilities game.

There may be coins that gain 1000 percent in a few weeks that won’t show up in the index until their market cap grows to the top and which you will miss but, on the bright side, you’ll also miss the big losers, the suicide inducing and family wrecking crashes.

There’s still the slight possibility (the 1% chance) that the entire crypto world is a huge bubble that will never work, the Internet could come crashing down after an EMP attack or a meteorite could strike earth... In which case we are all screwed anyways and should worry more about food and bullets to fight the zombies...

CHECK OUT MY PREVIOUS POSTS:

SEE THE CHARTS! Segwit progressing slow but already helping ease congestion in the Bitcoin network

Bitcoin is mooning! Find out what’s causing this increase in price

Tell me what you think of this strategy in the comments below. This is not professional investment advise. I'm not your financial advisor. Only invest money you can afford to lose!

Follow me for updates to the spreadsheet.

Happy crypto investing!

Bitcoin, food, water and weapons!

and clothes^^..

Daily Learn some new from your post. Love to read it.

Top post! Very good quality. Keep-up the good work.

Thanks vlemon! Following you too, loved the exchanges traffic analysis. tip: try SimilarWeb.com, much better than Alexa in my opinion. I used it for my recent post comparing Facebook to Crypto users https://steemit.com/bitcoin/@cryptoeagle/cryptocurrency-wallet-users-vs-facebook-users-where-are-we-now-making-the-case-for-the-million-dollar-coin best regards!

I would, I did use it for this analysis of thé Steemit community https://steemit.com/steemit/@vlemon/steemit-traffic-data-engagement-and-other-metrics-monthly-update .

Talk to you soon.

Good stuff

Thanks

you have no idea how good it feels to wake up every morning knowing you are mine and I am yours."" Good Morning, my best friend"

That is a very solid strategy. I wasn't aware of it, so thanks for sharing @cryptoeagle

Really good article and thanks for the links. We were just having this conversation last night about the best currencies to get into. Your insights made a lot of sense.

Great article. thanks for sharing . I invest in BTC and Doge . And now i am thinking about Litecoin

It is surprising that England is second to none.

@cryptoeagle got you a $2.92 @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more!

Good post@cryptoeagle

Nice.

https://steemit.com/life/@marthunis227/rekaman-hidup-live-recording-201792t193227273z

Great article. thanks for sharing!

Excellent article :)

I will have to study this more deeply and see if it's worth the time and effort, but thanks for the info.

The idea with passive indexing is to not devote too much time and effort. You should re-balance your portfolio sparingly. Thanks for stopping by and commenting! Some people prefer the rush of active investing, not for me. Hope this information is useful to you. regards

I don't need to be a multi-millionaire. More peaceful world, without corruption is good enough. Alright, one million is ok :)

Bless!

I'm already a trillionaire, well I have so much money I can't even count it :) Take a look, can you add these amounts?

haha, nice one. and the neo meme never gets old :-D

Yes, yes Brother!

I remember your point :) And I agree in 100% It's about paradigm change in mentality. I mean 1 BTC is worth 1 BTC, not 10000000000 fiat paper.

Bless :)

Im so happy :) I'm in LTC right now, and LTC is skyrocketing. Thank You :)

I tried this out after I read your last post in this series. I started six days ago and I am up 8.50%. So far so good.

Thanks for this post @cryptoeagle! I was just thinking of this exact question as a newbie to cryptocurrency. I don't make a lot of money, but figured I could easily invest about $200-$300 a month in something. Better than nothing, I guess. Again, thanks!

I get this question all the time. Don't feel bad or alone, most people are like you, they don't have 100K to invest but still want to have a chance in the new revolution of trust and would rather invest their play money in crypto than expensive coffee and chinese crap at walmart. Glad to hear you are taking up investing step by step. Two more pieces of advise, don't ever panic sell, dumps are normal and happen often and don't go into debt. Think long term and build a strong portfolio with time, no rush.

I started back when Bitcoin was $250 and, just like you I put into it whatever I could every month, living within my means. I could never dream of the returns I've gotten with crypto! regards

Good post!..Merci pour l'info!

De rien, merci mon ami

Nice story. Thanks for sharing. Following, voted and resteemed. Have a nice day.

Reading this makes me wonder why STOCKS 101 isn't mandatory for the high- school curriculum grades 9-12. Could it be that college and massive student-loan debt would become obsolete?

Thanks @cryptoeagle for sharing this.

Peace.

That's exactly why, financially educated people are much harder to control. I'll make sure my kids read Ben Graham before Harry Potter :) Thanks for commenting

Smart move @cryptoeagle. The Harry Potter thing is still a mixed bag for me, two decades removed. On the one hand I was so glad to see my young teen enthralled with reading; and, on the other, exposure to the occult at such a tender age was a bit disconcerting... Glad to say, she seems quite well-adjusted, and walking in the Light; so, I suppose it goes the way of teaching fact from fiction. As parents, this is especially important with the video craze; which, we know can get very dark.

I guess it's safe to say that all after-school programs are not alike....all summer camps aren't generic...While the financially educated are difficult to control, I seriously wonder what percentage of them have taken to the streets in recent protests in defense of the left? If you look carefully, many of them appear to be of an elite background. Somehow, I think there is a difference between the financially smart and the financially privileged in rebellion....just food for thought...

Peace!

Very sensible, thank you. I'm trying to diversify a long term HODL outlook in multiple coins, but in all the researching to pick good ones (and I have ;) I feel the lure of day trading coming on. Probably not wise, haha. This makes great sense.

I'm loving this Crypto revolution

I will inveat 80% on Bitcoin and 20% on etherum . Nice post thanks for sharing.

Two pieces of advise:

Congratulations @cryptoeagle! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGreat article , interesting information .Bitcoin rules , cheers!

Quark isn't on the spread sheet. Why?

Quark is currently number 266 in Coinmarketcap's index because it has very low volume. My list only goes up to the top 20.

@cryptoeagle

Thank you for responding to my question about Quark. I am new to the crypto world but recently joined a Meet-up in my City for fellow Bitcoin and Ethereum enthusiast.

Your fellow humble steemian

theprettysoul

BITCOIN IS CRASHING SELL SELL SELL !!

This article was informative, well researched and written and gave me a total new outlook on my investing strategy. Thanks for the info! UFRing! Cheers

Great information! Gives me a whole lot of perspectives. Thank you.

Great post, i like it the your post, thanks

My friend good morning

Thanks for this amazing post!! Not often to get sensible and steady advice about investing. Now I guess it is time to actually learn how to do said investing (like how does one buy and sell these currencies??) Time to step up. Any advice on step by step how to set up an investment account?

well done

Nice work

good post..