No unregulated cryptocurrency is safe from the Central Bank, and it never was - not as a alternative currency at least. This may seem like bold statement, especially to most self-proclaimed anarcho-capitalists and die hard crypto-currency fanatics, but you should be warned that there are several ways in which the big banks can take everything down, including your profits. I created this post to illustrate signs and tactics which may signify the end, but as an investor, I sincerely hope that none come to fruition.

To understand this article, one must view Bitcoin & altcoins as a commodity, like gold, rather than a currency. This is probably easy for most since their evaluation depends very highly on their market acceptance, and some (like Ethereum) hold intrinsic value.

In the beginning, bitcoin was used almost exclusively by the tech-savvy and capable entrepreneurs whom became savvy after seeing it’s potential. As more and more people begin to believe in the value behind bitcoin and other alt-coins, demand is increased and profits are realized. Herein lies the core of the problem. It has been argued that, like gold, most the crypto market consists of speculators whom believe that they are sitting on a commodity which could potentially represent a large source of wealth. As soon as a large enough portion the population (I would estimate roughly 25-30%) of perceives something of the same (in an unregulated commodity, no less) they have gained the attention of their local government and have entered a commodity war, for which the main objective of the defensive party(government) is to maintain its control of their citizens via faith in their fiat currency.

Like most commodities, the United States Federal government has a lot of influence over these markets in ways that average consumers may not understand, and thus, the ability to drive down acceptance of these commodities which in turn, devaluates the crypto’s all together.

Media outage

As demonstrated during the 2016 US Presidential election, 2017 Netherlands & French elections, as well as state emergencies in Sweden, United Kingdom, Venezuela – and pretty much any time – governments can censor content which does not agree with their agendas, with very little or no effort. Lately, they’ve even taken it a step further by creating a malicious ‘boogie man’ type character, known as fake news, to justify their censorship. Though this process starts with social media outlets like Facebook, Twitter & reddit silencing or banning both content and users, enough internet buzz eventually catches the attention of televised media outlets, whom do their best to ridicule the opposing party – sometimes, in person.

The reason that we have only seen half-witted attempts by the mainstream media to ridicule crypto-currencies (like this November 2013 interview with Jeff Berwick on Fox Business) is because there hasn’t been high enough volumes of acceptance in the mainstream market. That said, I suspect that we will see higher levels broadcasted opposition as value, demand and acceptance increase.

BTW Great interview, Jeff @dollarvigilante

In USSA, people are accountable to government.

As evaluations soar, exchanges increase user volumes and use cases (exchange for material goods etc.) stories of bitcoin billionaires (and millionaires) will start flooding the internet. This is where the news will begin to step up their opposition, and we will (as we already have) start to see large government officials meet, and smaller governments (in terms of GDP) begin to accept bitcoin as legal tender. As I mentioned, this has already happened to some extent. In Venezuela, people we using Bitcoin to buy food and clean drinking water while Malta, Australia and Japan decided to embrace BTC as legal tender. The United State congress began to hold several meetings on the topic as well.

Though it is unclear to me which of the following will happen first, both are inevitable if the US and Central bank decide not to accept unregulated cryptocurrencies as legal tender.

F*dCoin

I was going to see if I could write a full article without dropping an F-Bomb, but it had to be done. FEDcoin is coming, and it will probably have the logo “Keep calm, carry on”. Personally, I like to observe other western countries in policy, tax, and political agenda for use as a litmus test in what may come the United States. From what I’ve heard, Australia, Norway, Sweden, Belgium, France and the UK are already =/>90% cashless. They’ve even gone so far as calling the pro-cash citizens “activist”. While some sources claim that the US is roughly 60% cashless, there are a lot of economic reasons that the federal government may choose to make the switch. These include tax collection, P2P exchange tax, oversight, regulation and, yes – control of where citizens can spend their money. Being that ‘terrorism’ is the new ‘communism’ of the 50’s, they will probably use that as justification as well.

Like most Austrian Economics students, I could go on all day about the problems associated with a cashless society, but as relevant to bitcoin and other unregulated cryptocurrencies, a cashless society will allow the government to track every single purchase made from its citizens, as well as ban those which are in that shade of gray - instantly. Although they won’t ban these currencies immediately, they may choose to limit the crypto/fiat exchange volumes – like Coinbase.

State Mobile OS

In-Q-Tel claims to be a non-profit strategic investor[firm], that accelerates the development and delivery of cutting-edge technologies to U.S. government agencies with the goal of keeping the US safe. While I will not begin to argue about the distance between their definition of ‘safe’ and morality, I will mention that it is widely known that IQT was one of 4 investors of Googles initial funding in 1998, and again in 1999 when Google announced a $25 million round.

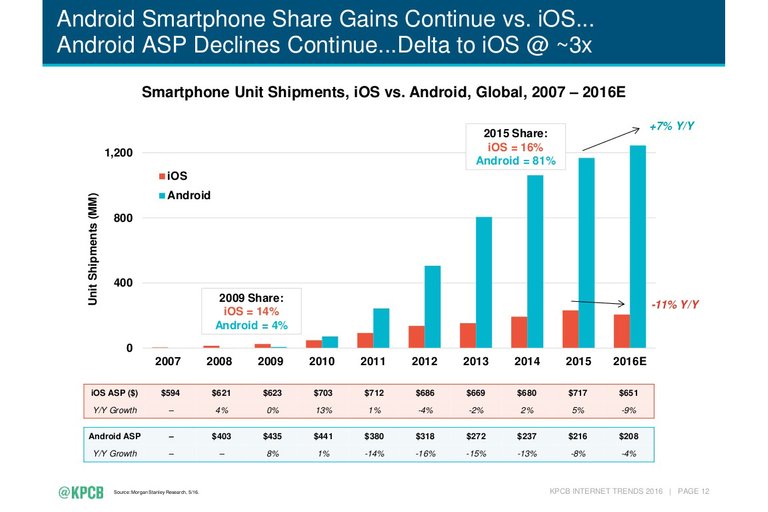

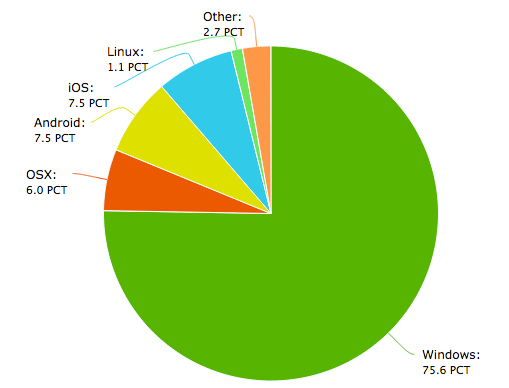

Why is this important? Because google owns and maintains the android operating system (which makes up 81% of the global users as per data released in 2016 by Morgan Stanley Research) as well as the google play store. If the west decides to treat bitcoin and other altcoins as illegal contraband in effort to restore faith in the USD & EUR, they can very easily ban all applications from the play store, and flag all software wallet applications for removal as the updates roll out. From there, it is likely that they will use the excuse that they’ve discovered numerous bugs in the OS, and roll out updates several times over the course of 90 – 180 days, defeating the will of the die hard users.

Apple is no exception when it comes to state influence, and although they consistently perform media stunts to earn their consumer’s trust, most can see their ‘disputes’ with the CIA and FBI as choreographed plays, much like WWE wrestling. Like Google, they are likely to follow the laws (whether right or wrong) and ban all software wallets from us in iTunes.

Microsoft is another massive software provider whom consistently works with the federal government. The difference between MSFT and AAPL, however, is the massive revenue streams generated for Microsoft via large US govt contracts, as well as total private users. Unwilling to lose these, it is likely that Microsoft will assist your local government in banning these products. Below image utilizes data conducted by Morgan Stanley 2016

The main threat that this section presents is that it will drive up the level of proficiency required to partake in cryptocurrency markets and exchanges, forcing the common retail investors out of the picture. Additionally, many investors may simply choose not to partake based on the perception that they might be doing something illegal.

Conclusion

So can you keep your coins? Sure, you can grab yourself a copy of Ubuntu, Mint, or several other open source operating systems which and trade away. But without mass acceptance and severely limited liquidity back to accepted cryptos, there is no real value behind them. As the central bank makes moves to push the masses out of the crypto markets, we may see the sad day that bit coin is valued at $200 again.

So, all of this is for nothing?! No, actually. Like the dotcom crash of the late 90’s, there will be few investors whom get out with their skin (and hair). Those will be millionaires while the rest will suffer massive losses. Again like the dotcom crash, we gain a massive step forward in technological advancement: the blockchain. Evolution hurts the masses but is great for overall advancement.

When will this happen? Well, that depends, but I would guess that it would happen slowly over the next 4 or 5 years for the following reasons:

- US Debt:GDP ratio rising, (Debt rising:GDP falling) and we’ve just voted to raise the ceiling.

- 68% of US treasury bonds (from 2008 housing bubble) mature in 2019.

- Many of the BRIC countries (whom have been stock piling gold as the US spends it) have already accepted Bitcoin and other decentralized currencies (or expect to). This would offer an avenue of crypto to fiat liquidity outside of the dollar.

- EU GDP will be absolutely devastated by cultural enrichment policies.

I plan to write articles on all of the above points over the coming months, but each could build pressure on the World Bank and US Government to take steps which help preserve it’s supremacy in the financial markets (which they call democracy).

So for now, be safe with your investments, do you own diligence and stay cognizant of anything that may threaten your freedom. This is probably the most interesting time to be alive in man kinds brief history.

Also, let me know what you thought in the comments below. This is only my 4th article so please excuse the formatting errors, and I hope you enjoyed the read.

Donations

100% of Steem generated by my account will be donated responsibly to a cause which is committed toward empowerment of impoverished areas, tangible improvements to Human Development and the betterment of all mankind. For each donation, I will generate a full write up of the reasons why I selected a particular organization, stated mission, and what our STEEM has purchased. These write ups will be complete with receipts and pictures when possible.

In my commitment to support the currencies and the blockchain space, all funds will be used to purchase material goods directly, or converted into other currencies (such as ETH) which ensure contract completion and mitigate exposure to fraud.

Interesting article. Makes me think about Ripple which some say is not a real crypto but rather something created by big banks. Also wonder where Steem will be, in this kind of future world.

I am feeling good about being heavily involved with the VIVA project because they work well with existing fiat currency, seeking to improve rather than replace. Maybe you could analyse VIVA at some point!

https://s3.amazonaws.com/vivacoin/viva-white-paper-v-2-0.pdf

Many steemians have already written on VIVA (https://steemit.com/created/viva) but I like your perspective and think you can add to the discussion.

with you on VIVA kenny, its interesting to see how it will operate.

why didn't my response post to your comment?

I don't know! Did it show up somewhere else? I'm interested to see your response.

Very interesting article. Decision on the entry point is only yours but even decentralization by nature looks possible it is unacceptable to happen. Regulations will come one day. Agree on your points. Software is the first detector of your activity. I am expecting some untrasable OS to appear from the thin air.

It is not a question of if but when will the financial system be depleted.

Absolutely right. In other articles, I will discuss why the US will soon loose the grasp it's created over the past few decades, but the same holds for the de-centralized, non-regulated crypto's. I hope that this serves as a call to wake up from the bliss we've all been experiencing, especially over the past 2 months.

I agree. But, I think for most of the middleclass, they are satisified with the situation, and the safe system with devaluating, as it gives the impression of accumulating wealth with just owning stuff like houses.

you can now consider me your biggest fan. thanks for the article.

Glad to have you on board @kaeptnkook! If you have a topic that you would like to hear about, please let me know. My planned posts over the 14 days include:

Really like the points mentioned above @lennartbedrage

Glad that you enjoyed the post @absna. I have a few more coming that are of this nature.

Very informative, thanks for the post man!

The point you made about the censorship based on government agendas, I've been noticing that more and more as I slowly become more aware of what actually goes on.

It's has been getting pretty bad. Generally speaking, I think that people are waking up and starting to distrust the 'authorities'. Even scientific discovery changes based on who is in office - which is impossible given that it should be based on discovery of facts.

Noo.

I dont want this to happen

I hope that it doesn't happen either, but I have a feeling that it will. The thing is that most organizations (govt or otherwise) have a completely different gratification model from citizens or private consumers. Where citizens are more worried about instant or 90 day pay offs, organizations may be looking at the 5 - 10 year range, making it difficult for citizens or less organized groups to combat.

To what extend would the EU and USA be shooting themselves in the foot by outlawing cryptocurrencies while (or if) the rest of the world embraces it?

First, I don't think that they will be outlawing cryptos all together, but I they most certainly will push to outlaw unregulated currencies, due to the lack of control that they will be able to impose. Remember, currency and credit are about control of a population rather than financial freedom. Due to their unregulated nature, cryptos like Bitcoin, Litecoin, Monero and others are very difficult for governments to track, and almost impossible to tax unless records are kept at the exchange. From a game theory standpoint, they stand only to gain by shutting them down.

Second, they will not likely ban Etheruem(ETH), Ripple(XRP), and potentially many others. I describe why in my analysis of Etheruem and in my analysis of Ripple.

Thanks for the great reply! That's a lot to think about. There are so many future scenario's for cryptocurrencies. I guess the key is to diversify your holdings, and keep an eye out for the signs you described in your post.

edit: By the way, I loved you analysis of Ripple and Ethereum posts!

Glad to hear it! I will be covering some ICO's that may be interesting, exchanges that will help you get them first, and of course, the markets as they change - like my Litecoin(LTC) article, which unfortunately only gave my followers a 12 hour window to invest prior the price jumps.

Nice article with strong arguments. I think that if banks or governments were planning to destroy cryptos they will have started the 'war' a long time ago. At the present time I read news and articles about how banks adopt cryptos and blockchain's technology . I think that they will support and promote centralized cryptos like ripple. No one can stop new technology.

Great content, your articles. Followed! Also, ancap +1

Good article, I agree with most of your points but one thing you seem to forget is that the world does not only revolve around the USSA (to quote you ;) and this is a worldwide global market we are dealing with.